The upcoming US presidential election has investors wondering about its potential impact on the markets. While the election outcome may influence specific sectors and industries, historical data suggests that elections have had little effect on the overall stock market performance in the medium to long term. Instead, market returns tend to be driven by economic and inflation trends, with rising economic growth and falling inflation associated with above-average returns.

However, elections can cause short-term market volatility as investors cope with uncertainty about the country's direction and potential policy changes. This uncertainty can lead to emotional and illogical behaviour by investors, such as panic selling or withdrawing from the market early on.

Despite the potential for short-term fluctuations, investors are advised to focus on their long-term investment goals and avoid making impulsive decisions based on election outcomes. Diversification, a long-term perspective, and a well-informed, strategic approach can help investors navigate the risks associated with election-driven market volatility.

| Characteristics | Values |

|---|---|

| Volatility | Elections can cause volatility in the market as investors cope with uncertainty. |

| Market Performance | Markets have historically risen in election years. |

| Investor Sentiment | Elections can affect investor sentiment. |

| Investor Behaviour | Elections can cause emotional and illogical investor behaviour. |

| Market Returns | Returns are typically more dependent on economic and inflation trends than election results. |

| Investor Strategies | Diversification, hedging, moving to defensive stocks, and keeping a long-term view are strategies investors can use to reduce risks. |

What You'll Learn

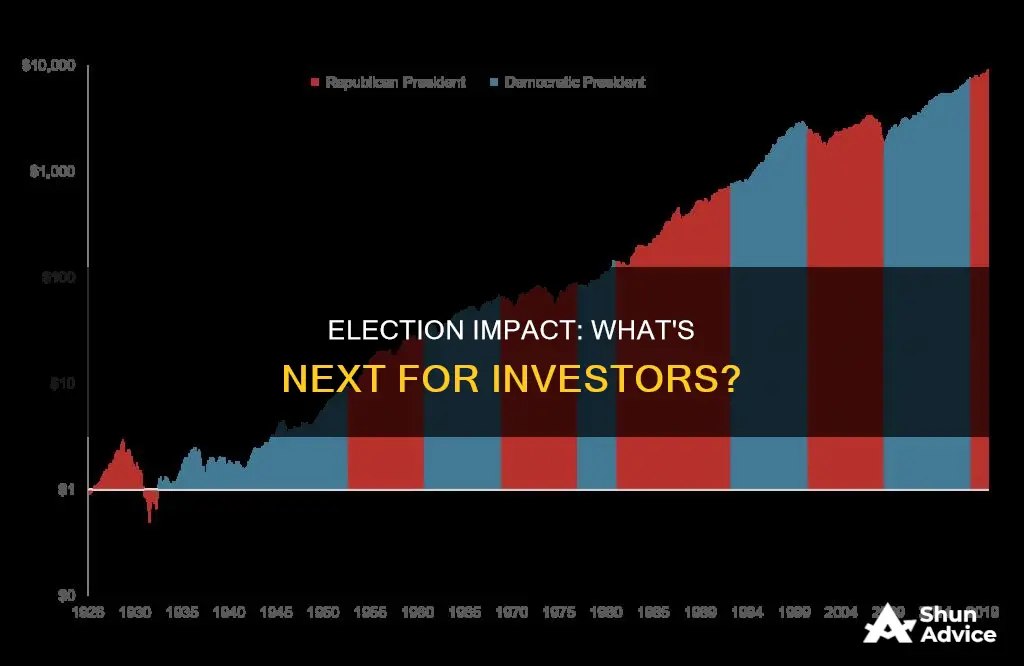

Markets are non-partisan

While the 2024 election is still in flux, it is important to remember that historically, presidential elections have had very little impact on the markets. Markets are non-partisan.

Historical Data

Although popular myths suggest that one party or the other is "better" for market returns, historical data does not support these theories. The S&P 500 has historically averaged positive returns under nearly every partisan combination. There is also some evidence that a divided government correlates with stronger market returns, perhaps because government gridlock creates less policy uncertainty.

Expert Opinion

Naveen Malwal, an institutional portfolio manager with Strategic Advisers, LLC, states:

> "It can be tempting to attribute market volatility to politics, but while political headlines may at times cause short-term ripples in the market, long-term, for stocks, bonds, and other investments, returns seem to be driven much more by the fundamentals of the underlying asset classes."

Investment Strategies

Despite the uncertainty surrounding the 2024 election, investors should focus on fundamentals and stick with their long-term financial plans. Market moves are more likely to be driven by market and economic fundamentals, such as corporate earnings, interest rates, and other economic factors.

Takeaways

- Historically, US markets have generally risen in election years. Since 1950, US stocks have averaged returns of 9.1% in election years.

- Betting on specific policy or sector impacts can be risky. It is difficult to predict which party will win and what sectors may benefit from their policies.

- Markets are non-partisan. Do not base your investment strategy on the outcome of elections.

- Investors should focus on fundamentals and stick with their plans. Do not try to adjust your investment strategy based on anticipated post-election swings in the market.

Apple: A Popular Investment Choice

You may want to see also

Volatility is common during election years

The year leading up to an election typically shows lower returns as investors cope with uncertainty. This uncertainty is driven by the potential impact the election outcome could have on economic policies and the country's direction. However, in the 12 months after an election, the market's performance tends to be stronger than usual, regardless of which party is in office.

Historically, US markets have generally risen in election years. Since 1950, US stocks have averaged returns of 9.1% in election years. This can be attributed to the fact that US stocks have historically risen over the long term.

It's also worth noting that the news-cycle volatility of election years has often had less impact on markets than voters might assume. Making investment decisions based on election outcomes can be risky, as there is usually not a strong relationship between election results and market performance.

- Short-term volatility: The uncertainty surrounding elections can lead to short-term volatility in the markets as investor sentiment fluctuates. However, this volatility tends to be short-lived and is not indicative of long-term market trends.

- Market fundamentals: Market performance is primarily driven by economic fundamentals such as corporate earnings, interest rates, consumer spending, economic growth, and inflation. These factors tend to have a stronger and more consistent impact on market returns than election outcomes.

- Historical perspective: Analyzing historical data can provide insights into market patterns during election years. While past performance is not a guarantee of future results, it can help identify trends and assess the potential impact of upcoming elections.

- Investor sentiment: Investor sentiment can be highly influential during election years. It's important for investors to avoid making impulsive decisions based on short-term volatility and to focus on their long-term investment goals.

- Policy implications: Elections can impact proposed policies, regulations, and global conflicts, which may have repercussions for specific sectors and industries. However, the actual impact of these policy changes on market performance can be difficult to predict.

REITs: Recession-Proof Investment?

You may want to see also

Returns are higher in the 12 months after an election

While the year leading up to an election typically shows lower returns as investors cope with uncertainty, the 12 months after an election tend to see stronger market performance, regardless of which party is in office.

Historical data and patterns

Analysts at U.S. Bank studied market data from the past 75 years and found that the stock market's performance is more muted in the 12 months leading up to the election. This is true for both the equities market and bond markets.

Equities

In the year leading up to a presidential election, equities gained an average of less than 6%. During non-election years, the average is more than 8%.

Bonds

Bonds tend to deliver returns of about 6.5% leading up to presidential elections, significantly less than the 7.5% they usually deliver.

Post-election performance

After midterm elections, the market tends to rebound quickly. However, this is not the case for presidential elections, where stock market returns tend to be lower for the first year after the election, while bonds tend to outperform their normal levels.

Impact of party change

If a new party is elected to the presidency, the stock market's returns average 5%. When the same president is re-elected or the party retains the presidency, returns were slightly higher, averaging 6.5%.

Market performance in 2024

The 2024 presidential election cycle has been an unusual one, with Democratic President Biden dropping out of the race and endorsing his vice president, Kamala Harris, to lead the ticket. Despite the uncertainty, there has been minimal impact on the markets, with key measures of the stock and bond markets moving up by less than 1% since the June 27 debate.

Market performance and economic trends

While election outcomes may be closely monitored for their potential effect on stock market performance, historical data suggests that economic and inflation trends have a stronger and more consistent relationship with market returns.

Stock market performance in midterm election years

When looking at midterm election data, the S&P 500 consistently outperformed in the year after midterms compared with non-midterm years. Again, which party controlled Congress was generally not a factor in projecting overall equity market performance.

Nonpartisan markets

Although popular myths suggest that one party is better than the other for market returns, the historical data does not support these theories. The S&P 500 has historically averaged positive returns under nearly every partisan combination. There is also some evidence that divided government has correlated with stronger market returns, possibly due to less policy uncertainty.

Focus on fundamentals

Rather than trying to predict election outcomes and their potential impact on the markets, investors should focus on economic fundamentals such as corporate earnings, interest rates, and other economic factors.

Networking: Your Secret Weapon for Success

You may want to see also

Returns are lower in the 12 months before an election

The year leading up to an election typically shows lower returns as investors cope with uncertainty. However, in the 12 months after an election, the market's performance tends to be stronger than usual, regardless of which party is in office.

Historical Impact of Elections on the Stock Market

Elections can have significant implications for a country's direction. Therefore, it's understandable that they can also affect investor sentiment and overall market performance. To understand how elections impact the market, it's helpful to reflect on the performance of the market during past elections.

Of course, past performance is not a guarantee of future returns. There's always the possibility of the market acting differently than it has historically. However, looking at past performance can help us understand past patterns and judge whether similar conditions prevail.

Presidential Elections

Presidential elections occur every four years and can shift a nation's policies regarding foreign relations and domestic economic development. As a result, presidential elections can cause significant volatility in the market as investors cope with uncertainty about the country's direction.

Analysts with U.S. Bank found that the stock market's performance is generally more muted in the 12 months leading up to the election. This is true for both the equities market and bond markets:

- In the year leading up to a presidential election, equities gained an average of less than 6%. During non-election years, the average is more than 8%.

- Bonds tend to deliver returns of about 6.5% leading up to presidential elections, significantly less than their usual 7.5% returns.

Midterm Elections

Midterm elections primarily affect the two chambers of Congress: the U.S. Senate and House of Representatives. What happens during a midterm election can shift control of Congress and shape legislative agendas.

Analysts studied market data from the past 60 years and 15 midterm elections and found that the stock market, as defined by the S&P 500, underperformed during the 12 months leading up to midterms. On average, its return during this period was -1.1%, down from the 8.1% average for all years.

Tips for Investors During Election Season

As elections approach, whether presidential or midterm, investors may worry about how the market will be affected. Historically, the market produces lower returns in the year preceding a presidential election but typically recovers and outperforms over the following 12 months. The same is true for midterm elections, although the market tends to rebound even quicker in these cases.

Regardless of what happens and who is elected, here are some tips for investors:

- Diversify your portfolio: Building a portfolio with a mix of different securities and investments in various industries will protect your investments if the market fluctuates.

- Use dollar-cost averaging: This strategy involves investing a fixed amount of cash into an investment at regular intervals to lower investment costs and maximise returns.

- Focus on long-term investments: It's important to remember that you're investing for long-term goals, and short-term fluctuations won't have lasting effects.

- Take advantage of higher interest rates: It can be wise to move your money to a high-yield savings account or cash management account when interest rates are high.

- Meet with a financial advisor: A financial advisor can review your portfolio and provide personalised advice based on your current finances and goals.

Invest Wisely: Best Bets to Sell Now

You may want to see also

Investors should focus on fundamentals

While election years are often volatile, investors should focus on fundamentals rather than trying to adjust their investment strategy to capitalise on anticipated post-election swings in the market.

Historically, financial markets have been largely unbothered by presidential elections. Since 1950, US stocks have averaged returns of 9.1% in election years. While the 12 months preceding a presidential election have had the widest range of possible market outcomes, the average return is not substantially better or worse.

Market performance is more likely to be driven by economic fundamentals, such as corporate earnings, interest rates, and consumer spending. Therefore, investors should pay attention to interest rate levels, the job market, and business activity. For example, full warehouses might indicate slower growth.

Additionally, investors should be wary of making investment decisions based on campaign promises. There are often dramatic differences between proposals expressed on the campaign trail and the actual policy changes that take place once the candidate is in office.

Finally, investors should remember that markets are nonpartisan. The S&P 500 has historically averaged positive returns under nearly every partisan combination. There is some evidence that divided government has historically correlated with stronger market returns, perhaps because government gridlock creates less policy uncertainty.

Retirement Annuities: Your Future Financial Freedom

You may want to see also

Frequently asked questions

While elections can cause some impact on the stock market, historical data shows that presidential elections have had very little impact on the markets. The market's performance is more likely to be driven by economic fundamentals, such as corporate earnings, interest rates, and consumer spending.

Elections can have a psychological effect on investors, causing uncertainty, anxiety, and fear over possible policy changes. This can lead to emotional and illogical behaviour, such as making hurried investment decisions or withdrawing from the market early on, increasing volatility.

Diversification is one way to reduce the risks associated with election-driven market volatility. Hedging, moving to defensive stocks or sectors, adjusting tactical asset allocation, and maintaining a long-term investment view are other strategies that can help mitigate risks.