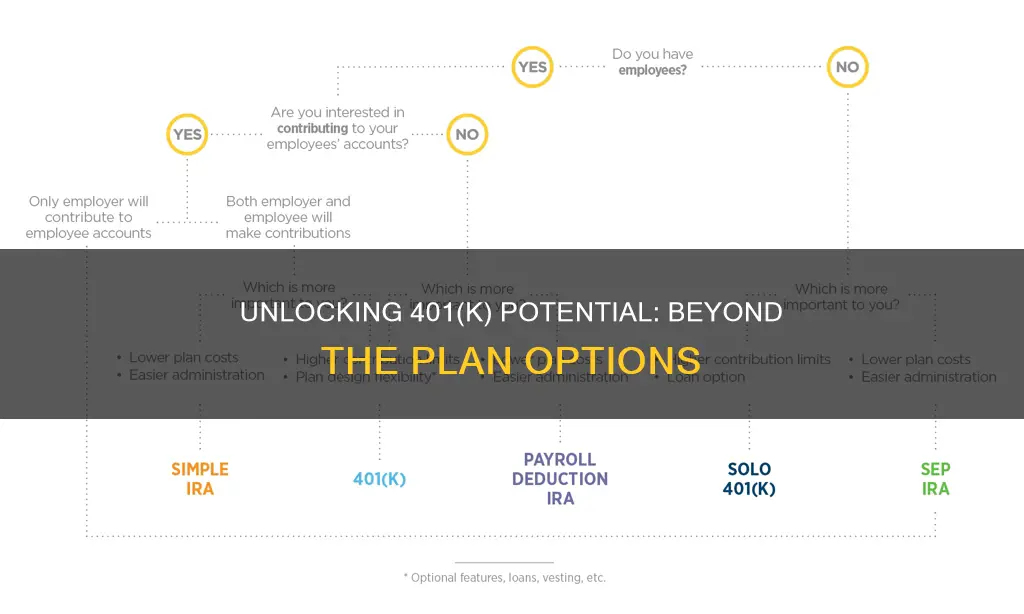

401(k) plans are retirement plans that offer a choice of investment options to employees. However, these investment options are usually limited to select funds that are managed by a financial services advisory group such as The Vanguard Group or Fidelity Investments. These funds are usually mutual funds that may include index funds, large-cap and small-cap funds, foreign funds, real estate funds, and bond funds.

| Characteristics | Values |

|---|---|

| Contribution limits | High enough to allow for adequate levels of income deferral |

| Cap | Highly paid employees can only use the first $350,000 of income when computing their maximum potential contributions in 2025 |

| Investment options | Mutual funds, index funds, large-cap and small-cap funds, foreign funds, real estate funds, and bond funds |

| Managed by | Financial services advisory group such as The Vanguard Group or Fidelity Investments |

| Drawbacks | Contribution limits for IRAs are much lower than the contribution limits for 401(k) plans |

What You'll Learn

High fees

ERISA does not bar employers from choosing high-fee funds, which is a concern for employees. Not all high-fee funds are bad, but it is important to note that employers can claim they tried to find the best funds and got unlucky, which is not a strong enough argument to win in court. It is easier to prove self-dealing or kickbacks.

One solution to this issue is to consider an individual retirement account (IRA). An IRA offers similar tax advantages to a 401(k) plan, but it provides broader investment options for employees. However, it is important to note that contribution limits for IRAs are lower than those for 401(k) plans.

In summary, high fees can be a significant issue for 401(k) plans, and employees should be aware of their investment options and consider alternative retirement savings options to ensure they are making the best financial decisions for their future.

Equity Strategies for Restaurant Investors: Maximizing Your Stake

You may want to see also

Limited contribution limits

Contribution limits on 401(k)s are high enough to allow for adequate levels of income deferral. However, there is a cap on the maximum potential contributions of highly paid employees. In 2025, the first $350,000 of income can be used when computing their maximum potential contributions.

A company that offers a 401(k) plan typically offers employees a choice of several investment options. The options are usually managed by a financial services advisory group such as The Vanguard Group or Fidelity Investments. The employee can choose one or several funds to invest in. Most of the options are mutual funds, and they may include index funds, large-cap and small-cap funds, foreign funds, real estate funds, and bond funds.

Managed funds are restricted to very large investors, which includes retirement plans. The fact that not all high-fee funds are bad means that ERISA doesn't bar employers from choosing high-fee funds. They can claim they tried to find the best funds and got unlucky, but you need more than that to win in court. It's much easier to punish self-dealing or kickbacks.

One drawback is that the contribution limits for IRAs are much lower than the contribution limits for 401(k) plans. The second option could be to fund a health savings account (HSA) if you have a high-deductible health plan. HSAs have similar tax advantages to 401(k)s and IRAs, and while the money must be used for qualified health expenses, you don't have to spend it right away and can use it to cover your health-related costs in retirement.

Public Investment Portfolio: Understanding Government's Investment Strategies

You may want to see also

Managed funds restricted to large investors

Managed funds that are better tend to be restricted to very large investors, which includes retirement plans.

The best-managed funds easily pay for their management fees. The best place to start, for most investors, will be an individual retirement account (IRA). An IRA offers similar tax advantages to a 401(k) plan, but you'll have much broader options when it comes to choosing your own investments.

One drawback is that the contribution limits for IRAs are much lower than the contribution limits for 401(k) plans. Highly paid employees can only use the first $350,000 of income when computing their maximum potential contributions in 2025.

The options are usually managed by a financial services advisory group such as The Vanguard Group or Fidelity Investments. The employee can choose one or several funds to invest in. Most of the options are mutual funds, and they may include index funds, large-cap and small-cap funds, foreign funds, real estate funds, and bond funds.

The best-managed funds easily pay for their management fees. In such a case there is zero possibility that the fat-fee class can be used when the plan is large enough to use another share class with a lower expense ratio.

Invest Wisely: Millionaires in a Decade

You may want to see also

ERISA doesn't bar employers from choosing high fee funds

ERISA (Employee Retirement Income Security Act) is a federal law that implements standards for certain employer-sponsored retirement and health plans. The law prohibits fiduciaries from misusing funds and sets standards for participation, benefit accrual, vesting, and funding of retirement plans.

ERISA violations occur when a fiduciary doesn't meet their responsibilities as outlined by ERISA. For instance, a plan administrator who doesn't provide full disclosure about fees and plan benefits may be in violation of the law. This may also be the case if a fiduciary misuses funds or fails to send updated information about the plan to participants, including statements, disclosures, and notices.

The majority of health insurance plans that are offered by employers are covered under ERISA. Plans that fall in this category include defined benefit and defined contribution plans.

The court found that participants had alternative options to choose from other than the fund that was underperforming and charging excessive record-keeping fees. The court also noted that no ERISA violation arises from using revenue sharing for plan expenses or an obligation to find the lowest cost provider. The court concluded that it did not matter that there were more expensive retail shares because the plan also offered low-cost index funds and the participants were free to choose those index funds.

Minimizing Risk: Overseas Investment Strategies for Success

You may want to see also

Stuck with high-cost funds

If you are stuck with high-cost funds in your 401(k) plan, you are not alone. Many people are limited to select funds in their 401(k) plans, even though they may have decent options to choose from. This can be frustrating, especially if you are stuck at a company long term and all of their 401(k) investment options are in high-cost funds.

One reason for this limitation is that managed funds that are better tend to be restricted to very large investors, which includes retirement plans. Additionally, not all high-fee funds are bad, so employers can claim they tried to find the best funds and got unlucky, but you need more than that to win in court. It's much easier to punish self-dealing or kickbacks.

If you are stuck with high-cost funds in your 401(k) plan, there are several options you can consider. One option is to fund a health savings account (HSA) if you have a high-deductible health plan. HSAs have similar tax advantages to 401(k)s and IRAs, and while the money must be used for qualified health expenses, you don't have to spend it right away and can use it to cover your health-related costs in retirement.

Another option is to start an individual retirement account (IRA). An IRA offers similar tax advantages to a 401(k) plan, but you'll have much broader options when it comes to choosing your own investments. However, contribution limits for IRAs are much lower than the contribution limits for 401(k) plans.

Finally, you can also consider diversifying your investments by looking for other investment options outside of your 401(k) plan. This can help you reduce the risk of being stuck with high-cost funds and give you more control over your retirement savings.

Berkshire Hathaway: Investing Guide for Indians

You may want to see also

Frequently asked questions

The managed funds that are better tend to be restricted to very large investors, which includes retirement plans. The best-managed funds easily pay for their management fees.

Yes, there is a cap on 401(k) contributions. Highly paid employees can only use the first $350,000 of income when computing their maximum potential contributions in 2025.

No, you are limited to select funds. The options are usually managed by a financial services advisory group such as The Vanguard Group or Fidelity Investments.

Yes, you can invest in a 401(k) even if you are at an income level that prevents you from also investing in an IRA.