Yes, any money you contribute to your 401(k) is an asset and is included in your net worth. Retirement accounts are considered assets and count towards net worth. The full value of pretax retirement accounts is included in net worth calculations.

| Characteristics | Values |

|---|---|

| Retirement accounts | Yes |

| Market value of investment accounts | Balances of brokerage accounts, 401(k) and IRA |

| Early withdrawal penalty | 10% penalty + ordinary income tax on gains/dividends based on income tax bracket |

| Taxes | Depends on where you are from |

| US | 10% early withdrawal penalty + ordinary income tax on gains/dividends based on income tax bracket |

What You'll Learn

Retirement accounts included in net worth

Retirement accounts are included in net worth. Any money you contribute to your 401(k) is an asset and is included in your net worth. The balances of your brokerage accounts, as well as your 401(k) and IRA, are considered the market value of your investment accounts.

If you want to be really nit-picky, you can discount retirement accounts to account for any applicable federal & state income tax and/or early withdrawal penalty. Nevertheless, they are still an asset at the end of the day no matter what. I count it in net worth, even if I can’t touch it for years. It’s still my money and is saved for a purpose.

In the US, it’s typically a 10% early withdrawal penalty + ordinary income tax on gains/dividends based on your income tax bracket. Plenty of ways to not pay the penalty if you are before the standard retirement age. If you are American, consider opening a Roth as there is much more flexibility on taking out contributions penalty-free if you need to.

Retirement money is included in net worth but it’s money you don’t ever plan on touching so you don’t look into the withdrawal penalty. That’s a big financial no-no unless you’re on the streets tomorrow.

Before you start investing, it's a good idea to speak to a financial planner or brokerage professional. That way, you can ensure you’re building a safe and well-diversified portfolio.

Peer-to-Peer Investing: Navigating the Risks and Rewards

You may want to see also

Market value of investment accounts

The market value of your investment accounts is the sum of the balances of your brokerage accounts, as well as your 401(k) and IRA. You can find information about the current market value of some of the assets you own, such as collectibles, by looking on eBay, and using Edmunds or Kelley Blue Book to determine the current value of your vehicles.

Liabilities represent what you owe to others. You should add these up and subtract them from your assets. Mortgages: Outstanding balances on all your property loans, including what you owe on the mortgage of your primary residence, home equity loans and what you owe on rental properties.

Any money you contribute to your 401(k) is an asset and is included in your net worth. If you want to be really nit-picky, you can discount them to account for any applicable federal & state income tax and/or early withdrawal penalty. Nevertheless, they are still an asset at the end of the day no matter what.

Plenty of ways to not pay the penalty if you are before the standard retirement age. If you are American, consider opening a Roth as there is much more flexibility on taking out contributions penalty-free if you need to.

I include the full value of my pretax retirement accounts in my net worth. I include my retirement money into my net worth but it’s money I don’t ever plan on touching so I don’t look into the withdrawal penalty. That’s a big financial no-no unless you’re on the streets tomorrow.

Hiring an Investment Manager: Key Considerations for Success

You may want to see also

401(k) included in net worth

Yes, any money you contribute to your 401(k) is an asset and is included in your net worth.

K)s are retirement accounts and any money you contribute to them is considered an asset. This means that the full value of your pretax retirement accounts, including your 401(k), should be included in your net worth.

When calculating your net worth, you should add up all your assets and subtract your liabilities. Market value of your investment accounts, including your 401(k) and IRA, can be found by looking at the balances of your brokerage accounts.

If you want to be really nit-picky, you can discount your 401(k) to account for any applicable federal and state income tax and/or early withdrawal penalty. However, no matter what, your 401(k) is still an asset at the end of the day.

If you are American, consider opening a Roth 401(k) as there is much more flexibility on taking out contributions penalty-free if you need to.

Rebalancing Investment Portfolios: Yearly Refresh for Optimal Returns

You may want to see also

Early withdrawal penalty on 401(k)

Withdrawing from a 401(k) before age 59 1/2 usually results in a 10% penalty. For example, taking out $20,000 will cost you $2,000. Time is your money’s greatest ally. But when you withdraw from your future savings, you’re denying your money the chance to earn valuable interest. Because it’s taxable income, not only could a withdrawal increase your tax bill, but it can potentially move you into a higher income bracket requiring even more taxes.

Hardship withdrawals usually don't qualify for an exception to the 10% penalty. This is true unless the employee is age 59 1/2 or older or qualifies for one of the exceptions listed above. Starting in 2024, the Secure 2.0 Act added cases where money can be withdrawn. These cases include: financial emergencies - one withdrawal per year up to $1,000 · victims of domestic abuse - within the past 12 months can withdraw up to the lesser of $10,000 or 50% of their account · federally declared natural disaster areas - withdraw up to $22,000 · terminal illness allows withdrawal. You can take any amount if diagnosed with an illness that will likely cause death within seven years.

Before you start taking distributions from multiple retirement plans, it's important to note the 401(k) withdrawal rules for those 55 and older apply only to your employer at the time you leave your job. In other words, you can only take those penalty-free early 401(k) withdrawals from the plan you were contributing to at the time you separated from service. The money in other retirement plans must remain in place until you reach age 59 1/2 if you want to avoid the penalty. The rule of 55 doesn't apply if you left your job at, say, age 53. You can't start taking distributions from your 401(k) and avoid the early withdrawal penalty once you reach 55. However, you can apply the IRS rule of 55 if you're older and leave your job.

India's Investment Potential: Why You Should Invest

You may want to see also

Taxes on 401(k) withdrawal

Yes, any money you contribute to your 401(k) is an asset and is included in your net worth.

If you are American, consider opening a Roth as there is much more flexibility on taking out contributions penalty-free if you need to.

Plenty of ways to not pay the penalty if you are before the standard retirement age.

If you want to be really nit-picky, you can discount them to account for any applicable federal & state income tax and/or early withdrawal penalty.

If you are American, it’s typically a 10% early withdrawal penalty + ordinary income tax on gains/dividends based on your income tax bracket.

Assessing Downside Risk in Alternative Investments: A Guide

You may want to see also

Frequently asked questions

Yes, any money you contribute to your 401k is an asset and is included in your net worth.

Yes, retirement accounts are considered assets and should be included in your net worth.

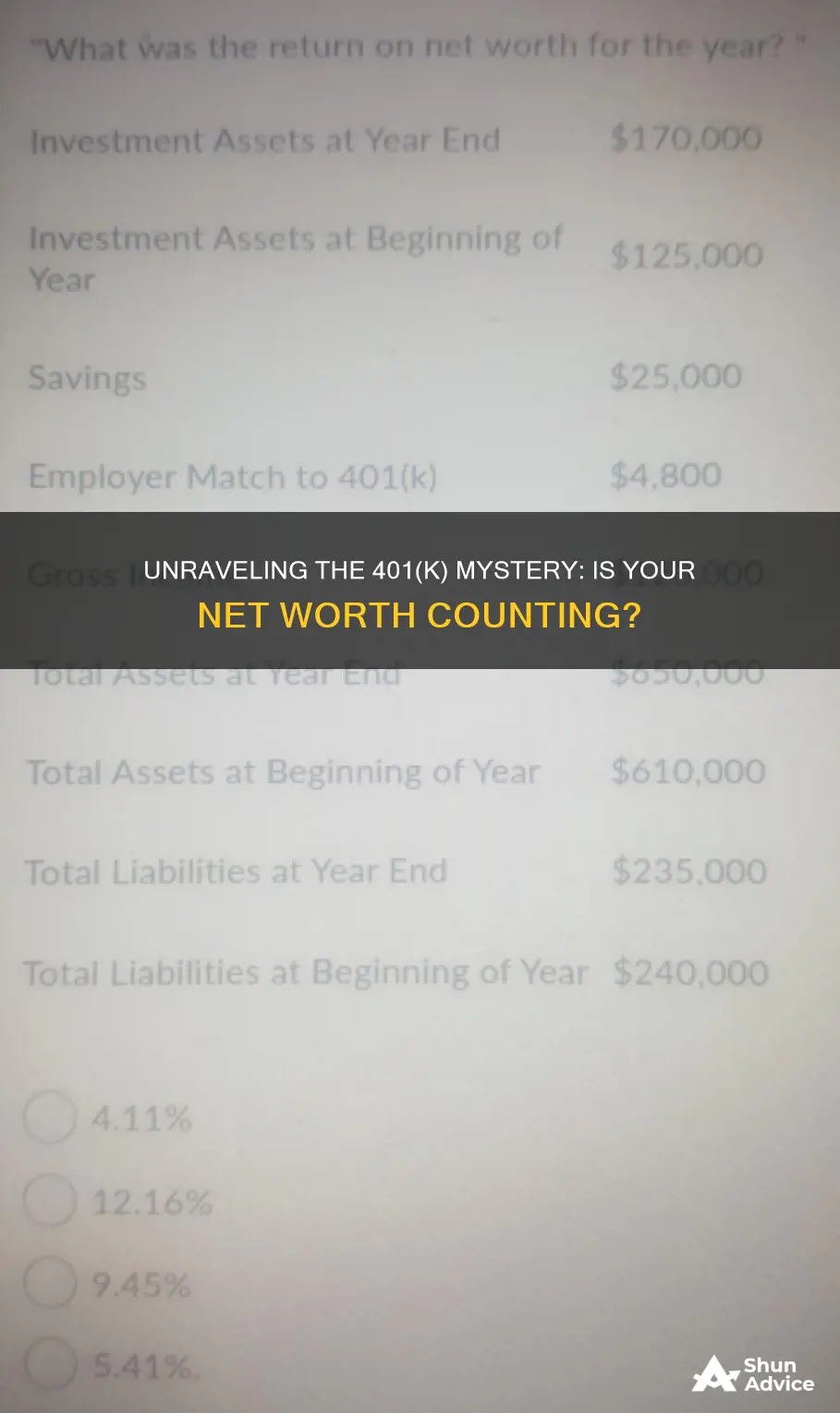

You should add up all your assets and subtract your liabilities.

Assets are the balances of your brokerage accounts, as well as your 401k and IRA.

Liabilities represent what you owe to others.