In today's complex financial landscape, investors are increasingly turning to alternative investment solutions as a means to diversify their portfolios and potentially achieve higher returns. However, the question of safety remains a significant concern for many. This paragraph aims to explore the safety aspects of alternative investments, examining the various factors that contribute to their risk profile and the strategies investors can employ to mitigate potential risks. By understanding the nuances of these investments, investors can make informed decisions and navigate the world of alternative investments with greater confidence.

What You'll Learn

- Risk Assessment: Understanding the risks of alternative investments, such as real estate or private equity

- Regulation and Oversight: Exploring the regulatory environment for alternative investments and its impact on safety

- Diversification Benefits: How alternative investments can enhance portfolio diversification and reduce overall risk

- Historical Performance: Analyzing the historical performance of alternative investments to gauge their safety over time

- Expert Opinion: Insights from financial experts on the safety and suitability of alternative investment options

Risk Assessment: Understanding the risks of alternative investments, such as real estate or private equity

When considering alternative investments, it's crucial to conduct a thorough risk assessment to understand the potential pitfalls and challenges associated with these non-traditional asset classes. Alternative investments, such as real estate, private equity, and commodities, offer diversification benefits but also come with unique risks that investors should carefully evaluate.

One of the primary risks in alternative investments is illiquidity. Unlike stocks and bonds, which can be easily bought or sold on a public exchange, alternative investments often have limited liquidity. Real estate, for instance, can take months or even years to buy or sell, and private equity investments may have lock-up periods that restrict access to capital. This lack of liquidity can make it challenging for investors to enter or exit positions when they need to, potentially leading to missed opportunities or forced sales at inopportune times.

Another significant risk is the high initial investment required for many alternative investments. Real estate, for example, often demands substantial capital upfront, including down payments, closing costs, and potential renovation expenses. Private equity funds typically require large minimum investments, making them accessible only to accredited investors or high-net-worth individuals. This high barrier to entry can limit investment opportunities for those with smaller portfolios or less financial resources.

Market volatility is also a concern in alternative investments. Real estate values can fluctuate based on economic cycles, local market conditions, and property-specific factors. Private equity investments are subject to the performance of the underlying companies, which can be influenced by various market and industry-specific risks. Additionally, alternative investments may not be as closely correlated with traditional asset classes, such as stocks and bonds, which can make portfolio diversification more complex.

Furthermore, the lack of transparency and regulatory oversight in some alternative investment markets can introduce additional risks. Private equity funds, for instance, may provide less detailed financial reporting compared to publicly traded companies, making it more challenging for investors to assess performance and risks. Real estate investments, especially in the secondary market, may have limited access to accurate and up-to-date information, increasing the potential for misjudgment.

In summary, while alternative investments offer diversification and the potential for higher returns, they also come with distinct risks. Investors should carefully assess their risk tolerance, conduct thorough research, and consider the liquidity, investment size, market volatility, and transparency of these investments before allocating capital. A comprehensive risk assessment is essential to ensure that alternative investments align with an investor's financial goals and risk profile.

Unit Trust of India: A Guide to Investing

You may want to see also

Regulation and Oversight: Exploring the regulatory environment for alternative investments and its impact on safety

The regulatory environment for alternative investments is a critical aspect of ensuring safety and stability in the financial markets. Alternative investments, such as private equity, real estate, and hedge funds, often operate outside the traditional asset classes and may pose unique risks to investors. As such, regulatory bodies worldwide have implemented various frameworks to oversee and regulate these markets, aiming to protect investors and maintain market integrity.

One of the primary goals of regulation in this sector is to establish transparency and disclosure standards. Alternative investment vehicles often deal with complex structures and limited information availability. Regulatory measures mandate that these investments provide comprehensive documentation, including detailed financial reports, management agreements, and risk assessments. This transparency allows investors to make informed decisions and assess the potential risks and rewards associated with these investments. For instance, the European Union's Alternative Investment Fund Managers Directive (AIFMD) requires alternative fund managers to disclose key information, such as valuation methods, liquidity provisions, and potential conflicts of interest, to ensure a more level playing field for investors.

Regulatory oversight also focuses on investor protection and the prevention of fraudulent activities. Given the often high-risk nature of alternative investments, regulators employ various tools to safeguard investors' interests. These include setting minimum investor qualifications, such as the net worth or income requirements, to ensure that investors can bear the risks associated with these investments. Additionally, regulations may mandate the use of independent auditors to verify financial statements and provide an additional layer of assurance to investors. For example, the United States' Investment Company Act of 1940 requires registered investment companies to disclose their holdings and provide regular financial reports, ensuring investors have access to critical information.

Furthermore, the regulatory environment for alternative investments often involves collaboration between national and international authorities. Given the global nature of many alternative investment funds, cross-border cooperation is essential to ensure consistent standards and oversight. International organizations, such as the International Organization of Securities Commissions (IOSCO), provide guidelines and best practices for regulating alternative investments, fostering a more harmonized approach. This global regulatory framework helps in mitigating risks associated with cross-border transactions and promotes fair competition among market participants.

In summary, the regulatory environment for alternative investments plays a pivotal role in enhancing safety and stability. Through transparency, investor protection measures, and international cooperation, regulators strive to create a more informed and secure market for these complex investment vehicles. As the alternative investment landscape continues to evolve, the regulatory framework will likely adapt to address emerging challenges, ensuring that investors can participate in these markets with confidence and a reduced risk of fraud or mismanagement.

Diversifying Your Portfolio: Optimal Number of Investments

You may want to see also

Diversification Benefits: How alternative investments can enhance portfolio diversification and reduce overall risk

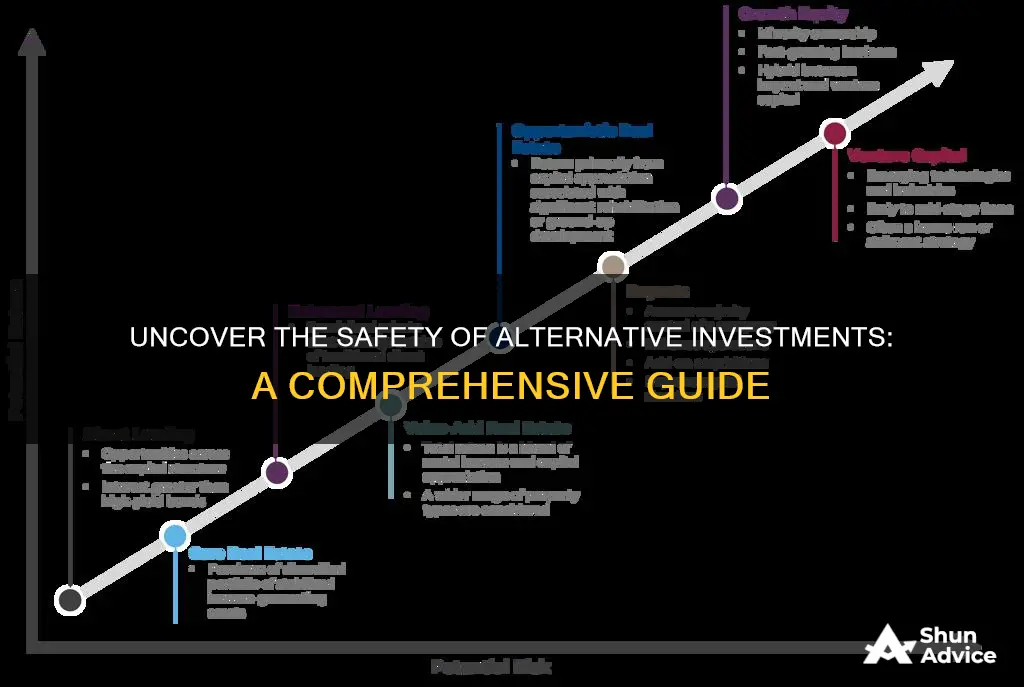

When it comes to investing, diversification is a key strategy to manage risk and potentially increase returns. Traditional investment portfolios often include a mix of stocks, bonds, and cash, but incorporating alternative investments can significantly enhance diversification and reduce overall risk. Alternative investments encompass a broad range of assets, including real estate, private equity, commodities, derivatives, and more. By including these non-traditional assets, investors can tap into new markets and asset classes that may not be well-represented in the conventional investment landscape.

One of the primary benefits of diversification through alternative investments is the ability to access different risk-return profiles. Alternative assets often have lower correlations with traditional stocks and bonds, meaning their performance is not directly tied to the fluctuations of the broader market. For instance, real estate investments can provide a steady income stream through rental payments, offering a hedge against market volatility. Similarly, commodities like gold or silver can serve as a store of value and a safe-haven asset during economic downturns, thus reducing the overall risk of a diversified portfolio.

The inclusion of alternative investments can also help investors achieve their specific financial goals. For example, private equity investments can offer high-growth potential, providing an opportunity to participate in the expansion of successful companies. Hedge funds, another alternative investment vehicle, often employ sophisticated strategies to protect capital and generate positive returns, even in challenging market conditions. By diversifying across these asset classes, investors can build a more resilient portfolio that is better equipped to weather economic cycles.

Furthermore, alternative investments can provide exposure to niche markets and specialized sectors. For instance, venture capital funds invest in early-stage startups, offering the potential for substantial returns but also carrying higher risks. Similarly, infrastructure investments can provide stable, long-term returns through the development and operation of essential facilities. By incorporating these alternative asset classes, investors can gain access to unique opportunities that may not be readily available through traditional investments.

In summary, alternative investments play a crucial role in portfolio diversification, offering a range of benefits that can reduce overall risk and enhance long-term performance. By incorporating these non-traditional assets, investors can achieve their financial goals, access new markets, and build a more resilient investment strategy. It is essential to conduct thorough research and due diligence when considering alternative investments, as each asset class has its own unique characteristics, risks, and potential rewards.

Liquid Investments: Low-Risk or Risky Business?

You may want to see also

Historical Performance: Analyzing the historical performance of alternative investments to gauge their safety over time

When evaluating the safety of alternative investments, delving into their historical performance is crucial. This analysis provides valuable insights into the long-term stability and resilience of these investment strategies. By examining past trends and market conditions, investors can make more informed decisions about the potential risks and rewards associated with alternative investments.

One approach to analyzing historical performance is to study the performance of various alternative investment funds or vehicles over an extended period. This could include examining the returns of hedge funds, private equity funds, or even individual alternative investment products like real estate funds or commodity-based funds. By tracking their performance over several market cycles, investors can identify patterns and assess the consistency of returns. For instance, if a particular hedge fund has consistently generated positive returns during both bull and bear markets, it may indicate a level of stability and risk management.

Additionally, comparing the performance of alternative investments to traditional asset classes can provide a more comprehensive understanding of their safety. By analyzing how alternative investments have performed relative to stocks, bonds, or commodities, investors can gauge their diversification benefits and potential as a hedge against market volatility. For example, if real estate investment trusts (REITs) have consistently outperformed the stock market during economic downturns, it suggests that real estate could be a safer alternative investment during turbulent times.

Historical performance analysis also involves assessing the impact of various economic and market events on alternative investments. This includes studying the effects of global financial crises, recessions, or geopolitical events on these investment strategies. By understanding how alternative investments have navigated through challenging periods, investors can better prepare for potential risks and make more strategic investment choices.

Furthermore, it is essential to consider the liquidity and valuation aspects of alternative investments when analyzing historical performance. Some alternative investments may have less liquidity, making it challenging to enter or exit positions quickly. Understanding the liquidity profile of an investment is crucial for assessing its safety, especially during times of market stress. Additionally, evaluating the valuation methods and metrics used for alternative investments can provide insights into their long-term sustainability.

Private Equity: Foundation Investment Strategies and Trends

You may want to see also

Expert Opinion: Insights from financial experts on the safety and suitability of alternative investment options

The safety of alternative investment solutions is a topic of much debate and discussion within the financial industry. While traditional investments like stocks and bonds are well-regulated and offer a degree of security, alternative investments, such as private equity, real estate, and derivatives, present unique risks and considerations. Financial experts often emphasize the importance of a nuanced understanding of these risks when evaluating the safety of alternative investments.

One perspective is that alternative investments can provide diversification benefits and potentially higher returns compared to conventional assets. Private equity, for instance, offers access to exclusive investment opportunities and can provide attractive returns over the long term. However, it also carries higher risks due to limited liquidity, complex structures, and potential for significant losses. Experts advise that thorough due diligence is essential, including a comprehensive understanding of the underlying assets, the investment team's expertise, and the overall strategy.

Real estate investments, another alternative category, offer tangible assets and potential income streams. While real estate can provide stability and inflation hedging, it also involves significant risks. Market fluctuations, property-specific risks, and the potential for higher transaction costs are factors that experts highlight as considerations. Diversification within the real estate sector and a long-term investment horizon are often recommended to mitigate these risks.

Derivatives, such as options, futures, and swaps, are complex financial instruments that can be used to hedge or speculate. Financial experts warn that derivatives carry substantial risks due to their leverage and counterparty exposure. The potential for rapid and significant losses is a critical aspect that investors must carefully consider. Proper risk management and a clear understanding of the derivatives market are essential for those considering these investments.

In summary, while alternative investment solutions can offer attractive opportunities, they also present unique challenges and risks. Financial experts emphasize the need for investors to conduct thorough research, understand the underlying assets, and carefully assess their risk tolerance. Diversification and a long-term investment strategy are often recommended to navigate the complexities of alternative investments and ensure a more secure financial portfolio.

High-Risk Ventures: Exploring Dangerous Investment Opportunities

You may want to see also

Frequently asked questions

While alternative investments offer the potential for higher returns, they also come with increased risks. These investments are often less liquid and more complex, making them less accessible to the average investor. However, they can be a valuable addition to a diversified portfolio when managed properly. It's important to understand the specific risks associated with each alternative investment, such as real estate, private equity, or commodities, and to assess your risk tolerance before making any investments.

Evaluating the safety of alternative investments requires a thorough analysis. Start by researching the investment's track record, including its performance over different market cycles. Understand the underlying assets and the investment strategy. Due diligence is key; review the investment manager's expertise, reputation, and any potential conflicts of interest. Consider the investment's liquidity and the terms of exit, as some alternatives may have restrictions on selling. Diversification is also crucial; assess how this investment fits into your overall portfolio and whether it aligns with your financial goals and risk profile.

Diversification is a powerful tool to manage risk. When incorporating alternative investments, it's essential to maintain a balanced approach. Start by assessing your investment horizon and risk tolerance. Alternative investments can be more volatile, so consider allocating a smaller portion of your portfolio to these assets. Diversify across different alternative investment classes and ensure that the overall strategy aligns with your financial objectives. Regular review and rebalancing of your portfolio can help manage risk and ensure that your investments remain aligned with your goals.