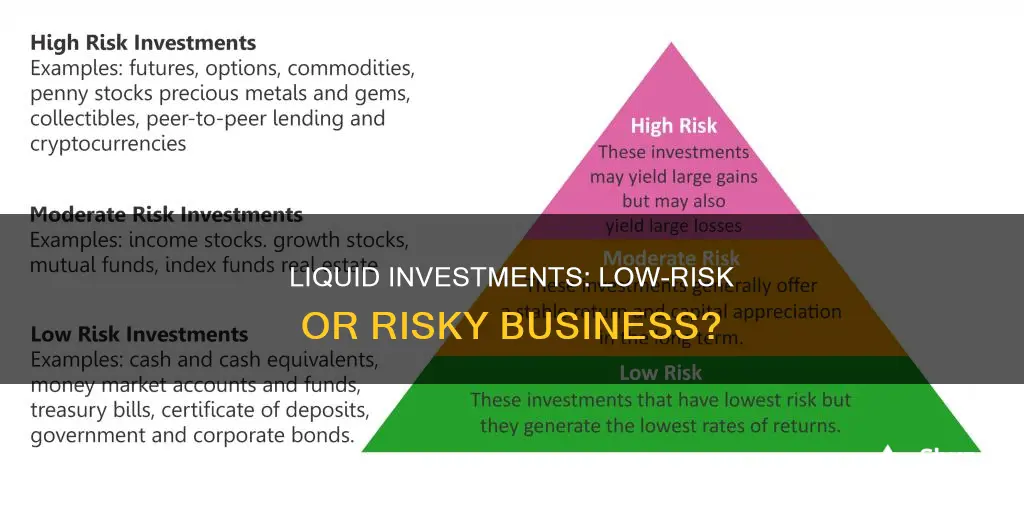

Liquidity and low risk are two important factors to consider when investing. While there is no such thing as a completely risk-free investment, some options are considered safer than others.

Liquid assets are those that can be converted into cash quickly and easily without incurring withdrawal penalties. Emergency funds, for example, should ideally be kept in liquid assets to ensure easy access in unexpected situations.

1. Money Market Accounts: These accounts are a mix between checking and savings accounts, offering check-writing privileges and higher interest rates than traditional savings accounts. They are insured by the FDIC or NCUA, protecting your money up to $250,000.

2. High-Yield Savings Accounts: These accounts offer higher interest rates than traditional savings accounts, making them attractive for emergency funds or short-term savings goals. They are easily accessible and FDIC-insured.

3. Certificates of Deposit (CDs): CDs are low-risk savings instruments with guaranteed interest rates. They are FDIC-insured and offer higher interest rates than regular savings accounts, but early withdrawal typically incurs penalties.

4. Treasury Securities: Backed by the US government, these include Treasury bills (maturing within a year), notes (up to 10 years), and bonds (20 to 30 years). They offer reliable returns but may have lower interest rates than other options.

5. Government Bonds: Issued by the US government, these are safe and low-risk investments with reliable income. The market for government bonds is highly liquid, making it easy to sell and access your money.

While these investment options are generally considered low risk, it's important to remember that all investments carry some degree of risk. It's always a good idea to diversify your portfolio and seek professional advice to make informed decisions that align with your financial goals and risk tolerance.

| Characteristics | Values |

|---|---|

| Risk | Low |

| Accessibility | High |

| Returns | Low |

| Volatility | Low |

| Liquidity | High |

| Flexibility | High |

| Safety | High |

| Inflation protection | No |

What You'll Learn

High-yield savings accounts

There are many benefits to opening a high-yield savings account. These include higher interest rates, accessibility, the ability to link to checking accounts, safety, and compound interest. However, there are also some downsides, such as variable APYs, limited withdrawals, and stricter standards.

When choosing a high-yield savings account, consider the APY, availability, fees, required deposits, and withdrawal rules. Additionally, keep in mind that some high-yield savings accounts require minimum initial deposits to open and may need you to maintain a minimum balance to avoid monthly fees or account closure.

Overall, high-yield savings accounts are a great option for those seeking a safe, low-risk investment with competitive returns. They are easily accessible and provide excellent flexibility, making them a convenient choice for short- and medium-term savings goals.

Foreign Indirect Investment: India's Global Economic Strategy

You may want to see also

Money market accounts

It is important to note that money market accounts are different from money market funds, which are a type of mutual fund that invests in short-term, highly liquid, low-risk assets. Money market funds are not insured by the FDIC and have a floating net asset value (NAV), while money market accounts have a stable NAV of $1 per share.

Invest in Yourself: Strategies to Attract Funding and Support

You may want to see also

Certificates of deposit

CDs offer a higher interest rate than traditional savings accounts, but there is a lack of withdrawal flexibility. If you withdraw your funds early, you will be charged a penalty. This is usually a number of months' interest, but it can sometimes include a portion of your principal deposit. However, some CDs are offered with a one-time penalty-free withdrawal, or as no-penalty CDs, which allow you to withdraw funds without incurring a fee.

CDs are ideal for those seeking a lower-risk investment option, as they provide a guaranteed, predictable rate of return. They are also a good option for those who want to avoid spending temptations, as withdrawing funds early triggers a penalty. However, CDs may earn less than stocks and bonds over time, and there is a risk of inflation eating away at the value of money locked in at a fixed rate.

When considering a CD, it is important to shop around for the best rates and compare the terms of different options. Additionally, pay attention to the Fed's rate when opening a long-term CD, as increasing rates may hurt your future earnings.

Invest Wisely: Understanding Managed Futures for Beginners

You may want to see also

Treasury securities

Treasuries are also attractive due to their wide range of maturity dates, allowing investors to structure their portfolios accordingly. Additionally, interest payments on Treasuries are generally exempt from state and local income taxes, increasing their after-tax benefits. The high level of liquidity in the U.S. Treasury market further enhances the efficiency of price discovery and lowers transaction costs for investors.

While Treasuries offer lower interest rates than other riskier debt securities, they are widely recognised as the safest of all investments. This makes them particularly appealing to risk-averse investors who value capital preservation and a dependable income stream. In a diversified portfolio, Treasury securities often represent funds that investors want to protect from risk.

However, it is important to note that while Treasuries have very low credit risk, they are still subject to interest rate risk and inflation risk. As with all fixed-income securities, the underlying value of Treasuries may fluctuate depending on prevailing interest rates. Therefore, investors should carefully consider their investment goals, income needs, and risk tolerance before purchasing Treasury securities.

Savings Investment: Choosing Wisely for Your Future

You may want to see also

Bond mutual funds and exchange-traded funds

Bond mutual funds and bond exchange-traded funds (ETFs) are two investment options that pool funds into a diversified, fixed-income portfolio. However, there are some key differences between the two.

Bond Mutual Funds

Bond mutual funds are actively managed, meaning a fund manager allocates capital from investors to various fixed-income securities. They often have a minimum investment requirement and can be bought directly from fund providers, avoiding brokerage commission fees. They are bought and sold at the end of the trading day and are generally more suitable for investors seeking professional management and specific investment strategies. Bond mutual funds are also more suitable for those who are concerned about not being able to sell their ETF investments due to a lack of buyers in the market, as holdings can be sold back to the fund issuer.

Bond ETFs

Bond ETFs track an index of bonds designed to match the returns of the underlying index. They are passively managed and traded throughout the day on stock exchanges at market prices. Bond ETFs can be bought on margin and sold short, offering greater flexibility in terms of trading than bond mutual funds. They also offer greater transparency, as they disclose their underlying holdings on a daily basis. Bond ETFs are typically more tax-efficient and have lower expense ratios than bond mutual funds, making them a more cost-effective option.

Both bond mutual funds and bond ETFs can be suitable investment opportunities depending on your personal investment goals, risk tolerance, and financial strategy. If you want active management and more investment choices, bond mutual funds are preferable. On the other hand, if you plan to buy and sell frequently and value cost efficiency and operational simplicity, bond ETFs are a better choice.

Pepsico's Global Reach: Foreign Investment Destinations

You may want to see also

Frequently asked questions

Examples of liquid investments include high-yield savings accounts, money market accounts, and certificates of deposit (CDs).

Liquid investments are generally considered low risk. However, it's important to note that all investments carry some degree of risk, and even low-risk investments can result in losing some or all of your money.

Liquid investments offer stability, low risk, liquidity, and diversification. They are ideal for short-term savings and emergency funds as they provide easy access to your money without incurring penalties.

While liquid investments are considered low risk, they typically provide lower returns compared to riskier investments. Additionally, inflation can erode the purchasing power of your money over time.

You can invest in liquid investments through banks, credit unions, brokerages, or directly from the government, depending on the specific investment type. It's always recommended to do your research and consult a financial advisor before making any investment decisions.