The Tax Cuts and Jobs Act (TCJA) of 2017 eliminated the deductibility of financial advisor fees for tax years 2018 through 2025. As of January 2018, these fees no longer contribute to reducing tax bills. Before the TCJA, investors could deduct financial advisor fees if they exceeded 2% of their adjusted gross income (AGI) in 2017 and prior tax years. However, this was claimed as a miscellaneous itemized deduction, which provided limited relief for those with high advisory costs. While financial advisor fees are currently non-deductible, there are other strategies investors can use to save on taxes, such as capital gains losses, retirement account contributions, and lower long-term capital gains rates.

| Characteristics | Values |

|---|---|

| Are investment management fees deductible? | No, not since the Tax Cuts and Jobs Act (TCJA) of 2017 |

| When did the TCJA come into effect? | January 2018 |

| When will the changes introduced by the TCJA expire? | 2025 |

| What other fees are no longer deductible? | Rental fees for a safe deposit box, fees paid to brokers or trustees to manage IRAs and other investment accounts, fees paid for legal counsel and tax advice, and investment publication subscription costs |

| Are there any other ways to save money on investment taxes? | Yes, through capital gains losses, 401(k) and traditional IRA contributions, and taking advantage of lower long-term capital gains rates |

What You'll Learn

- Investment management fees charged by a Registered Investment Advisor (RIA) are deductible

- Investment interest expenses are deductible if they don't exceed net investment income

- Commissions linked to investment trades are deductible

- Itemized deductions can be claimed for fees paid for certain financial services

- Investment fees paid from inside a registered account aren't deductible

Investment management fees charged by a Registered Investment Advisor (RIA) are deductible

Investment management fees were previously deductible on your federal income tax return, but the Tax Cuts and Jobs Act (TCJA) of 2017 eliminated this. The Act removed the miscellaneous itemized deduction for investment fees and expenses. However, there is a possibility that this could change after 2025 when the TCJA tax cuts are currently set to expire.

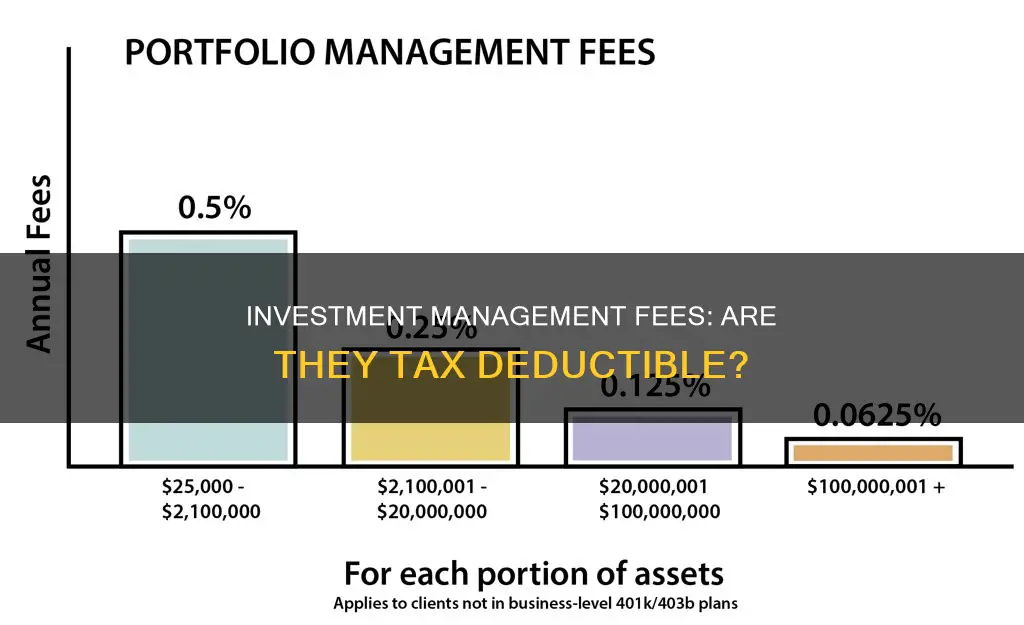

Despite this, there are still some fees that are deductible. Investment management fees charged by a Registered Investment Advisor (RIA) are deductible. This is because they are considered directly related to the production of income, according to Internal Revenue Code Section 212.

Other deductible fees include investment interest expenses, which are deductible if they don't exceed your net investment income. Additionally, if you have a traditional IRA, you can pay the account fees directly from the balance. This is essentially a tax deduction because you are paying the fees with pre-tax dollars.

It is important to stay updated on tax laws as deductions can change over time. Consulting a tax expert or financial advisor can help ensure you are taking advantage of all available deductions.

Global Investment Factors: What Doesn't Affect International Portfolios?

You may want to see also

Investment interest expenses are deductible if they don't exceed net investment income

Investment interest expenses are deductible, but there are several conditions that must be met to benefit from this deduction.

Firstly, you must itemize deductions. This means that your itemized deductions must exceed the standard deduction, which, for 2018, was $24,000 for married couples filing jointly, $18,000 for heads of households, and $12,000 for singles and married couples filing separately.

Secondly, the interest expense must not have been incurred to produce tax-exempt income. For example, if you borrow money to invest in municipal bonds, which are exempt from federal income tax, you cannot deduct the interest.

Thirdly, you must have sufficient "net investment income". Net investment income is generally defined as the excess of investment income over investment expenses. For the purposes of this deduction, net investment income typically includes taxable interest, non-qualified dividends, and net short-term capital gains, reduced by other investment expenses. Long-term capital gains and qualified dividends are not included. However, any disallowed interest can be carried forward and deducted in a later year if you have excess net investment income.

Additionally, you may elect to treat net long-term capital gains or qualified dividends as investment income to deduct more of your investment interest. However, if you do so, that portion of the long-term capital gain or dividend will be taxed at ordinary income rates.

It is important to note that the deductibility of investment interest expenses has been preserved by the Tax Cuts and Jobs Act (TCJA), while other deductions for individuals have been reduced or eliminated.

Creating Your First Investment Portfolio: A Beginner's Guide

You may want to see also

Commissions linked to investment trades are deductible

A commission paid on an investment transaction effectively reduces the taxable gain made by the investor. In other words, it decreases the investor's overall profit, thereby lowering their tax bill. Conversely, if an investor makes a loss on an investment, the commission increases that loss. This loss can then be used to offset capital gains, further reducing the amount of tax owed. For example, if an investor made a $2,000 gain on one investment but a $1,000 loss on another, they could use the loss to reduce their taxable gain to $1,000, resulting in a smaller tax bill.

It is important to note that commissions paid on the trading of stocks and exchange-traded funds (ETFs) are not deductible under the provisions for investment fees. However, commissions paid on security purchases are added to the adjusted cost base (ACB) of those securities, while commissions paid on a sale are subtracted from the proceeds received. This means that a capital gain is reduced by the associated commissions paid, while capital losses are increased.

The suspension of miscellaneous deductions under the TCJA is set to end in 2025, at which point the deductibility of financial advisor fees and other investment-related expenses may be reinstated. In the meantime, investors can continue to take advantage of commissions on investment trades as a way to lower their taxable gains or increase their losses for tax purposes.

Strategies to Promote Your New Investment Portfolio

You may want to see also

Itemized deductions can be claimed for fees paid for certain financial services

The Tax Cuts and Jobs Act (TCJA) of 2017 eliminated the deductibility of many expenses, including financial advisor fees, for tax years 2018 through 2025. This change means that, as of January 2018, these fees no longer contribute to reducing your tax bill.

However, itemized deductions can still be claimed for fees paid for certain financial services. According to Internal Revenue Code Section 212, you are permitted to deduct expenses not associated with a business provided they directly relate to the production of income. This includes investment management fees charged by a Registered Investment Advisor (RIA), tax preparation fees, and tax planning linked directly to the calculation or collection of a tax.

It is important to note that financial planning fees or fees charged by financial professionals for per-project or hourly consulting are not considered directly connected to income production or investment transactions, so they do not qualify for a deduction.

Additionally, if you own a traditional IRA, you can effectively arrange a tax break by paying the account fees directly from the IRA's balance. This is because you are using pre-tax dollars to pay the IRA fees, whereas a Roth IRA is funded with post-tax dollars. Commissions linked to investment trades can also be considered a deduction as they decrease an investor's taxable gain or increase their loss.

Building an Investment Portfolio: A Beginner's Guide

You may want to see also

Investment fees paid from inside a registered account aren't deductible

Registered investment accounts are those that are held within a registered plan, such as a TFSA, RRSP, or RRIF. Fees charged on registered assets, regardless of the type of investment, are not tax-deductible. These fees can be paid from within the registered account or from a separate taxable account.

The decision to pay registered fees from inside or outside the registered account depends on the type of account. For example, with a TFSA, where after-tax dollars can grow tax-free, paying the fee from outside the account can maximise tax-free savings as they are not directly reduced by the fee.

However, with RRSPs and RRIFs, where amounts are taxed upon withdrawal, the answer will depend on your time horizon, rate of return, and tax rate. Paying fees inside an RRSP or RRIF is done with pre-tax dollars, which reduces the value of your tax-deferred investment but also reduces the amount of tax collected by the CRA on future withdrawals.

It is important to note that if you have a traditional IRA, you can effectively arrange a tax break by paying the account fees directly from the IRA's balance. This is because you are using pre-tax dollars to pay the IRA fees, which essentially gives you a tax deduction.

While investment fees paid from inside a registered account may not be deductible, there are still ways to optimise your tax situation. It is always a good idea to stay informed about tax laws and consult with a tax expert or financial advisor to ensure you are taking advantage of all available deductions.

Savings and Investments: Your Guide to Financial Freedom

You may want to see also

Frequently asked questions

No, they are not deductible. The Tax Cuts and Jobs Act (TCJA) of 2017 eliminated the deductibility of financial advisor fees for tax years 2018 through 2025.

The TCJA eliminated most miscellaneous itemized deductions, including investment-related expenses such as financial advisor fees, rental fees for a safe deposit box, and fees paid for legal counsel and tax advice.

Investment interest expenses may be tax-deductible if they don't exceed your net investment income. Any excess can be carried forward to future years. Commissions linked to investment trades can also be considered a deduction as they decrease an investor's taxable gain.