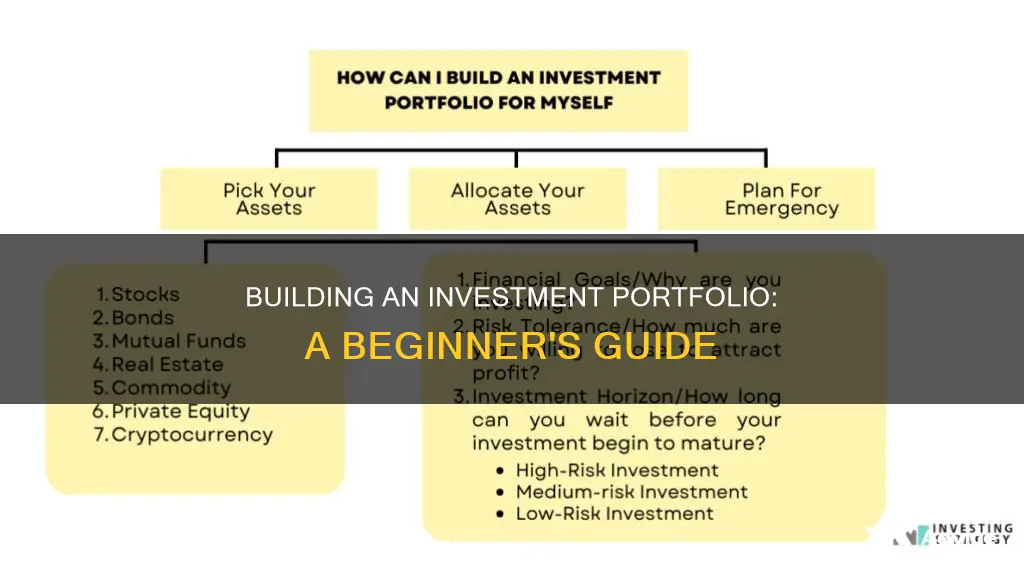

Setting up an investment portfolio can be a challenging task, but it's a crucial step towards achieving your financial goals. The process involves several steps, from defining your investment goals and risk tolerance to selecting the right mix of assets and regularly monitoring and rebalancing your portfolio.

Here's an overview of the key steps to help you get started:

1. Define your investment goals and risk tolerance: Understand your financial objectives, whether it's saving for retirement, your child's education, or a major purchase. Assess your comfort with investment risk and be honest about how you handle market volatility.

2. Determine your investment time horizon: Consider when you'll need the money for each goal. Short-term goals are those within a year, medium-term goals take 1-5 years, and long-term goals are over 5 years.

3. Choose an account type: Select an investment account that aligns with your goals. Tax-advantaged accounts like IRAs and 401(k)s are suitable for long-term retirement goals, while taxable brokerage accounts are better for mid- to long-term goals.

4. Select your investments: Choose from various options such as stocks, bonds, mutual funds, exchange-traded funds (ETFs), or alternative investments like real estate or cryptocurrencies. Diversify your portfolio across different asset classes.

5. Create your asset allocation: Decide on the percentage of each asset class in your portfolio based on your risk tolerance. A common rule of thumb is subtracting your age from 100 or 110 to determine the stock allocation.

6. Monitor and rebalance: Regularly review your portfolio to ensure it aligns with your goals and risk tolerance. Rebalance by buying or selling assets to maintain your desired asset allocation.

| Characteristics | Values |

|---|---|

| First step | Determine your investment goals and risk tolerance |

| Second step | Pick the individual assets for your portfolio |

| Third step | Monitor the diversification of your portfolio |

| Fourth step | Make adjustments when necessary |

What You'll Learn

Identify your investing goals

Setting up an investment portfolio begins with identifying your investing goals. This involves understanding your motivations, values, and financial aspirations. It is crucial to consider what matters most to you and ensure that your portfolio aligns with your unique objectives.

- Define your short-term and long-term goals: Determine your financial aspirations for the next 12 months, 1-5 years, and beyond. Examples of short-term goals include saving for a new car or a down payment on a home, while long-term goals may include retirement planning or saving for a child's education.

- Prioritize your goals: If you have multiple goals, prioritize them based on their importance to you and their respective timelines. This will help you allocate your resources effectively.

- Understand your risk tolerance: Assess how much risk you are comfortable taking to achieve your goals. Are you willing to tolerate market volatility and potential short-term losses in pursuit of higher returns? Your risk tolerance will influence the types of investments you choose.

- Evaluate your time horizon: Consider when you will need the money for each goal. A longer time horizon may allow for a more aggressive investment strategy, while a shorter time horizon may require a more conservative approach to ensure capital preservation.

- Determine your financial resources: Evaluate your current financial situation, including your income, savings, and any existing investments. Be realistic about how much you can invest and how long it will take to achieve your goals.

- Be specific and measurable: Use the SMART framework to set clear, specific, measurable, achievable, relevant, and time-based goals. This will help you stay focused and track your progress effectively.

- Regularly review and adjust: Investment goals are not set in stone. Life events, changing market conditions, or shifts in your risk tolerance may require you to re-evaluate and adjust your goals over time.

Remember, identifying your investing goals is a personal process that should reflect your unique circumstances and aspirations. It is essential to be honest with yourself about your goals, risk tolerance, and financial situation to build an investment portfolio that aligns with your needs.

Roth Accounts: Savings or Investment?

You may want to see also

Weigh your comfort with investment risk

Weighing your comfort with investment risk is a crucial step in setting up an investment portfolio. It is important to be honest with yourself about how much risk you are willing to take. Your risk tolerance will often determine the type and amount of investment you choose to pursue.

Your risk comfort level refers to the amount of risk you can live with based on the expected return on your investment. It is a personal decision that depends on your financial objectives and how much loss you are willing to endure. Some people can accept the risk of a sudden plunge in the value of their investments, while others will balk at any hint of loss. Most people fall somewhere in between these two extremes.

It is also important to understand that risk and potential return are correlated. Generally, the greater the level of risk an investment poses, the higher the potential return. However, this also means that you have a greater risk of losing money. Therefore, it is crucial to assess your risk tolerance and investment goals to determine the appropriate level of risk for your portfolio.

Your investment timeframe will also influence the level of risk you are willing to take. If you are investing for a short period, a more cautious approach is advisable, as you will have less time to recover from potential losses. Conversely, if you are investing for a longer period, you can afford to take on more risk, as you will have more time to ride out any market volatility.

Your capacity for loss should also be considered when weighing your comfort with investment risk. If you have enough disposable income to invest and can handle potential losses, you may be more comfortable taking on riskier investments. On the other hand, if you are concerned about the impact of losses on your financial stability, a more conservative approach may be more suitable.

Finally, it is worth considering your general attitude towards risk. Some individuals are more inclined to take bigger risks for the chance of larger rewards, while others prefer to play it safe. Ultimately, you should feel comfortable and confident in your investment decisions and ensure that your risk profile aligns with your financial goals and situation.

Invest to Grow: Why Smart Investors Shun Savings Accounts

You may want to see also

Understand your investment time horizon

Understanding your investment time horizon is a critical part of setting up an investment portfolio. An investment time horizon refers to the period of time you expect to hold an investment before needing the money back. This is dictated by your investment goals and strategies. For example, saving for a house deposit in two years is a short-term time horizon, while saving for retirement is a long-term time horizon.

Your investment time horizon is important because it determines your risk tolerance and the types of investments that are suitable for your goals. Generally, the longer the time horizon, the more aggressive or riskier your portfolio can be. This is because you have more time to recover from any short-term downturns or setbacks in the market. Conversely, shorter time horizons usually require a more conservative or less risky approach to ensure you don't lose money.

When determining your investment time horizon, consider your age, financial situation, and future income needs. For example, a 22-year-old college graduate will have different investment goals and timelines compared to a 55-year-old planning for retirement in the next decade. Your personality and risk tolerance also play a role. Are you comfortable with potential losses in the short term for greater returns in the long term?

It's important to note that your investment time horizon may change over time as your financial situation, goals, and risk tolerance evolve. For instance, your retirement savings may have a long-term horizon when you're in your 20s, but as you approach retirement age, it shifts to a shorter time horizon. Therefore, it's crucial to periodically reassess and adjust your investment strategy accordingly.

Understanding your investment time horizon is key to making informed decisions about your portfolio allocation, risk tolerance, and investment choices. It ensures that your investments align with your financial goals and that you are comfortable with the level of risk you are taking.

College Savings vs Investments: Where Should Your Money Go?

You may want to see also

Decide on asset allocation

Deciding on your asset allocation is a crucial step in setting up an investment portfolio. It involves determining how to distribute your investments across different asset classes, such as stocks, bonds, cash, and other alternative investments. Here are some detailed guidelines and factors to consider when deciding on your asset allocation:

Risk Tolerance and Investment Goals:

Your risk tolerance is a key factor in deciding your asset allocation. Consider how comfortable you are with market volatility and short-term losses. If you have a high-risk tolerance, you may be willing to allocate a larger portion of your portfolio to aggressive investments like stocks. On the other hand, if you have a lower risk tolerance, you may prefer more conservative investments like bonds and cash. Your investment goals also play a role here. If you are investing for retirement, for example, you may have a longer time horizon and be willing to take on more risk.

Time Horizon:

Your time horizon refers to how long you plan to invest for each goal. For instance, saving for retirement may have a time horizon of 20-30 years, while saving for a child's college education may be 10-15 years. Generally, a longer time horizon allows for a more aggressive asset allocation, as you have more time to recover from potential short-term losses.

Diversification:

Diversification is a critical component of asset allocation. It involves spreading your investments across different asset classes, sectors, industries, and geographic regions. By diversifying your portfolio, you reduce the risk associated with concentrating all your investments in one area. For example, you can allocate your stock investments across large, medium, and small companies in various sectors and industries. Similarly, you can diversify your bond investments by including a mix of government, corporate, and municipal bonds with different maturity dates and credit ratings.

Asset Allocation Models and Strategies:

There are various asset allocation models and strategies that you can consider. One common rule of thumb is to subtract your age from 100 or 110 to determine the percentage of your portfolio allocated to stocks. For example, if you're 30, this rule suggests allocating 70%-80% to stocks and the remaining to bonds. As you get older, you may want to shift towards a more conservative allocation, such as 50%-60% in stocks and 40%-50% in bonds. Additionally, you can explore different investment strategies, such as investing in mutual funds or exchange-traded funds (ETFs) that provide instant diversification by holding a collection of stocks or bonds.

Regular Monitoring and Rebalancing:

Your asset allocation should be regularly monitored and adjusted to ensure it remains aligned with your investment goals and risk tolerance. Over time, the performance of different investments can cause your original allocation to shift. Therefore, it's important to periodically rebalance your portfolio by buying or selling certain investments to return it to your desired allocation. This helps maintain the appropriate level of risk and ensures your portfolio remains consistent with your investment strategy.

Saving and Investment Economics: Core Concepts Explained

You may want to see also

Diversify your investments

Diversifying your investments is a crucial aspect of setting up an investment portfolio. Here are some detailed instructions to help you diversify your portfolio:

Spread Your Investments

Diversification is a key strategy to reduce risk and enhance returns. Avoid putting all your eggs in one basket. Invest across different industries, sectors, and asset classes. Consider a mix of stocks, bonds, commodities, exchange-traded funds (ETFs), and real estate investment trusts (REITs). Aim for a portfolio with a broad range of investments, including tech, energy, and healthcare stocks, as well as large-cap, small-cap, dividend, growth, and value stocks.

Consider Index and Bond Funds

Index funds and fixed-income funds offer long-term diversification benefits. Index funds track broad market indexes, providing exposure to a diverse range of companies with low fees. Fixed-income solutions, such as bond funds, help hedge your portfolio against market volatility and uncertainty.

Regularly Add to Your Portfolio

Consistency is vital. Consider using dollar-cost averaging, a strategy that involves investing a fixed amount regularly, regardless of market volatility. This approach smooths out peaks and valleys, reducing investment risk and allowing you to buy more shares when prices are low.

Know When to Adjust

Stay informed about your investments and overall market conditions. Be prepared to cut losses and move on when necessary. Keep an eye on the companies you invest in and their performance.

Understand Fees and Commissions

Be mindful of the fees and commissions associated with your investments. Trading certain assets, like mutual funds, illiquid stocks, and alternative investments, often incurs fees. Ensure you understand what you are paying for and whether there are more cost-effective options available.

Diversification Tips:

- Asset Allocation: Divide your investments between stocks and bonds to balance risk and returns. A common rule of thumb is to subtract your age from 100 to determine the percentage of stocks in your portfolio.

- Qualitative Risk Analysis: Assess the stability and potential of stocks before investing by evaluating parameters such as business model, management integrity, corporate governance, brand value, and compliance.

- Money Market Securities: Consider investing in money market instruments like certificates of deposit (CDs), commercial papers, and treasury bills for their liquidity and low risk.

- Mutual Funds with Systematic Cash Flow: Mutual funds with systematic withdrawal or transfer plans allow you to access your money while it's locked in a savings plan, providing regular cash flow.

- Buy-and-Hold Strategy: Avoid constant trading. Adopt a long-term perspective and allow your investments to grow, adjusting only when necessary to maintain a balanced portfolio.

- Understand Market Factors: Educate yourself about the factors influencing financial markets, such as interest rates, inflation, and central bank monetary policies.

- Global Markets: Explore investments in global markets, which offer high return potential and dynamic opportunities, but be prepared for additional complexity and monetary regulations.

- Rebalance Periodically: Regularly review your portfolio to ensure it aligns with your goals and milestones. A financial advisor can assist in this process, providing discipline and insight.

- Disciplined Investment Schemes: Consider systematic investment plans (SIPs), which allow you to invest a fixed amount in mutual funds at regular intervals, promoting discipline and taking advantage of compound interest.

- Life Insurance: Invest in life insurance, especially when young, as it offers low premium rates and safeguards your loved ones. Consider unit-linked insurance plans (ULIPs), which combine life insurance with market-linked investments.

- Be Aware of Biases: Recognize the influence of external factors, such as risk aptitude, family attitude, luck, and cultural beliefs, on your investment decisions.

S-Corp Savings: Investing for Growth and Security

You may want to see also