Retirement and investment expenses can be part of the standard deduction, but it depends on the type of expense and the individual's tax situation. The standard deduction is a fixed amount that reduces the taxable income, and it includes a basic standard deduction and any additional amounts for age or blindness. Taxpayers can choose between the standard deduction and itemized deductions, which include various expenses such as mortgage interest, charitable contributions, medical expenses, and certain business expenses. While retirement and investment expenses may fall under these categories, it's important to review the specific guidelines provided by the Internal Revenue Service (IRS) to determine eligibility and applicable deductions.

What You'll Learn

Standard deduction for retirees

The standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed. Your standard deduction consists of the sum of the basic standard deduction and any additional standard deduction amounts for age and/or blindness.

If you're over 65, the standard deduction increases. The specific amount depends on your filing status and changes each year. For example, for the 2022 tax year, seniors filing single or married filing separately got a standard deduction of $14,700. For those who were married and filing jointly, the standard deduction for those 65 and older was $25,900. The standard deduction for a widow over 65 was also $25,900 if they qualified.

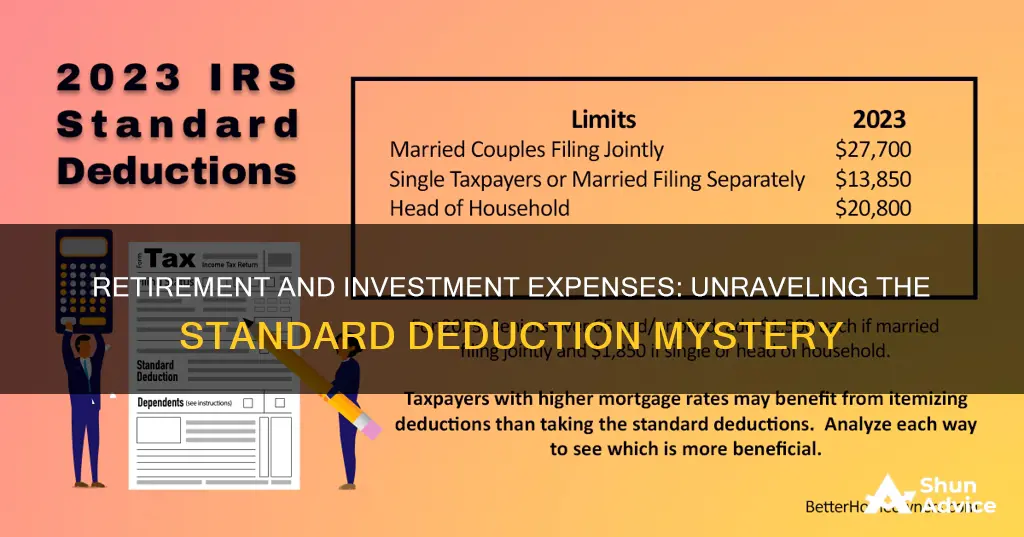

The standard deduction for 2023 is $13,850 for those filing single or married filing separately, $27,700 for qualifying widows or married filing jointly, and $20,800 for a head of household. If you are blind, you can increase your standard deduction by $1,500 (or $1,850 if single or filing as head of household).

For the 2024 tax year, the standard deduction for single or married filing separately is $14,600. For those who are married and filing jointly, the standard deduction for those 65 and older is $29,200.

The standard deduction is adjusted each year for inflation and varies according to your filing status, whether you're 65 or older, and/or blind, and whether another taxpayer can claim you as a dependent.

You can't take the standard deduction if you itemize your deductions. You should take the standard deduction if your personal deductions (primarily home mortgage interest, real estate taxes, charitable contributions, and medical expenses) are less than the applicable standard deduction.

Investment Calls: Why You?

You may want to see also

Itemized deductions

If you itemize your deductions, you must keep receipts to substantiate your expenses. You need to keep records of all your expenses and file a Schedule A with your tax return. To claim itemized deductions, you must file your income taxes using Form 1040 and list your itemized deductions on Schedule A.

Some common itemized deductions include:

- Mortgage interest on up to two homes

- State and local income or sales taxes

- Medical and dental expenses exceeding 7.5% of your adjusted gross income

- Charitable donations

Salary and Investment: A Correlation

You may want to see also

Tax liability during retirement

Retirement is a time when many people consider giving back to their community by making charitable contributions. You can donate cash or property to a qualified charitable organization and claim a deduction. If you donate property, you can generally deduct the property's fair market value. However, if you donate a car, boat, or airplane, your deduction is limited to the gross proceeds from its sale by the charitable organization.

During retirement, you may also sell your house and move into a smaller place or a retirement community. If you've lived in your home for at least two of the five years before you sell, you may have substantial equity and earn a large profit on the sale. Fortunately, you might not have to pay any tax on your profit. As long as you live in your home for at least two of the five years before you sell, the profit you make on the sale—up to $250,000 for single taxpayers and $500,000 for married taxpayers filing jointly—is not taxable.

If you're still working during retirement, you can continue to make tax-deductible contributions to retirement plans such as IRAs. Those over 50 have higher contribution limits for traditional IRAs, Roth IRAs, and 401(k)s. With a Roth IRA, you'll pay taxes on the income you contribute now, but the withdrawals upon retirement are tax-free. So, no tax must be paid on the interest or other income earned by your Roth IRA investments.

During retirement, you may also have income from investments. If you sell an asset like a stock, mutual fund, or piece of art, you'll owe a capital gains tax on the profit. The IRS will tax the profit at the more favorable long-term capital gain tax rate if you owned the asset for more than a year. If you sell the asset within a year of purchasing it, the sale is considered a short-term capital gain and gets taxed as ordinary income.

Your tax liability during retirement depends on your retirement income sources and the tax bracket you fall into. Distributions from 401(k) and traditional IRA accounts are generally taxable, while distributions from Roth IRAs are tax-free. Up to 85% of your Social Security benefits may be taxable, depending on your total income and filing status.

To reduce your tax liability during retirement, consider the following strategies:

- Withdraw money from your retirement accounts, such as traditional 401(k)s and IRAs, by the time you turn 73 to avoid a 25% penalty on the minimum distribution.

- Understand your tax bracket and try to remain in a lower tax bracket by withdrawing a little less from your taxable accounts.

- Make withdrawals from your retirement accounts during your 60s to spread your tax liability over more years and reduce your tax bill over your lifetime.

- Invest in tax-free bonds, such as federal, state, or municipal bonds, to avoid paying state or local taxes on the profits.

- Invest for the long term instead of the short term to take advantage of the more favorable long-term capital gain tax rate.

- Consider moving to a state with lower taxes, such as Alaska, Montana, Oregon, New Hampshire, or Delaware, which have no sales tax.

Young Investors: Excited or Apprehensive?

You may want to see also

Retirement income sources

Social Security

Social Security benefits are the primary source of retirement income for many people. These benefits are guaranteed to keep up with inflation, with adjustments made each January. The amount received depends on when you start receiving benefits; you can take reduced benefits at 62, wait until you're eligible for full benefits, or postpone for larger payments. Many financial professionals recommend waiting until you are eligible for full benefits, or longer if possible.

Pension Plans

Pensions are another significant source of retirement income, though they are becoming less common. They are typically based on how long you worked, what you earned, and your age when you stopped working. Some pensions are insured by the Pension Benefit Guaranty Corporation (PBGC), a government agency that protects pensions even if an employer goes out of business. Government pensions and military retired pay are also adjusted for inflation.

Employer-Sponsored Retirement Plans

Qualified employer-sponsored retirement plans, such as 401(k)s, 403(b)s, and governmental 457(b)s, offer both investment freedom and growth opportunities. These plans allow you to defer part of your current income and, in most cases, choose how your money is invested.

Savings and Investments

Other sources of retirement income include savings accounts, certificates of deposit (CDs), stocks, mutual funds, and annuities. These options can provide a stable income stream and help protect against inflation. However, it's important to carefully consider the risks associated with different investment types and seek professional advice when needed.

Part-Time Work

Many retirees also choose to work part-time during their retirement, which can provide additional income to cover basic necessities. This additional income may impact taxes and Social Security payments, so it's important to consider these factors when deciding to work during retirement.

Investment Advisor: Helping People Navigate Finances

You may want to see also

Tax deductions for the self-employed

Being self-employed comes with many benefits, but it also means you're responsible for your own taxes. Luckily, there are a number of tax deductions available that can help lower the amount of tax you owe. Here are some of the most common and important tax deductions for the self-employed:

Self-Employment Tax Deduction

This deduction is for the self-employment tax, which is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners. You can deduct half of your self-employment tax from your net income when calculating your income tax.

Home Office Deduction

If you work from home, you may be able to deduct a portion of your mortgage or rent, property taxes, utilities, repairs, and other related expenses. The calculation is based on the percentage of your home's square footage that you use exclusively and regularly for business.

Internet and Phone Bills Deduction

You can deduct the business portion of your phone and internet expenses, including the cost of running a website for your business or the business use percentage of your cell phone bill.

Health Insurance Premiums Deduction

If you're self-employed and pay for your own health insurance premiums, you may be able to deduct the cost of coverage for yourself, your spouse, your dependents, and your children under 27 at the end of the tax year.

Vehicle Use Deduction

You can deduct expenses for business use of your car, either by using the standard mileage rate determined by the IRS or by calculating the actual expenses, including depreciation, gas, insurance, etc.

Interest Deduction

You can deduct interest on business loans and credit card interest accrued from business expenses.

Dues and Publications Deduction

You can deduct the cost of specialized magazines, journals, and books related to your business, as well as dues for certain professional membership organizations.

Education Deduction

You can deduct the cost of continuing education related to maintaining or improving your skills for your current business, including tuition, books, supplies, transportation, and related expenses.

Business Insurance Deduction

You can deduct premiums for various types of business insurance, such as fire insurance, credit insurance, car insurance on a business vehicle, and business liability insurance.

Startup Costs Deduction

You may be able to deduct up to $5,000 in business startup costs and $5,000 in organizational costs for setting up a legal entity for your business.

Advertising Deduction

You can usually deduct advertising expenses directly related to your business, including online ads, billboards, TV commercials, and mailers.

Retirement Plan Contributions Deduction

Contributions to certain types of retirement plans, such as solo 401(k)s, SEP-IRAs, and SIMPLE IRAs, may be tax-deductible and help you build tax-deferred investment gains for the future.

Office Supplies Deduction

You can deduct the cost of office supplies and materials that are consumed and used during the tax year, such as copy paper, postage, pens, and other similar items.

Qualified Business Income (QBI) Deduction

Eligible self-employed individuals and small businesses can deduct a portion of their pass-through income (business income reported on their personal tax return) through the QBI deduction.

REITs: Recession-Proof Investment?

You may want to see also

Frequently asked questions

A standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed. The standard deduction amount depends on your filing status, age, and other criteria.

The standard deduction consists of the basic standard deduction and any additional standard deduction amounts for age (65 or older) and/or blindness.

Retirement plan contributions, such as contributions to a traditional IRA or 401(k) plan, can be claimed as a deduction. However, it is considered an above-the-line deduction, which means it reduces your taxable income even if you choose to take the standard deduction.

It depends on your specific financial situation. If your personal deductions (including home mortgage interest, real estate taxes, charitable contributions, and medical expenses) are less than the standard deduction, you should take the standard deduction. If your itemized deductions total is greater than the standard deduction, you should itemize.