Determining investment opportunities requires a careful assessment of various factors, including risk tolerance, financial goals, market trends, and diversification strategies. Here are some key considerations for identifying potential investment opportunities:

- Define your criteria: Establish clear investment criteria by evaluating factors such as budget, risk tolerance, and expected returns.

- Research the market: Stay informed about trends, opportunities, and challenges in industries, sectors, and regions of interest. Utilize financial websites, newsletters, and market analysis tools.

- Evaluate performance and risk: Assess the historical and expected performance of potential investments using metrics like ROI, NPV, and IRR. Also, consider the impact of market volatility, economic cycles, and competition on your investments.

- Diversify your portfolio: Spread your investments across different assets, industries, and sectors to mitigate risk and enhance returns.

- Monitor and review: Regularly assess the performance of your investments against benchmarks and peer comparisons.

- Consider emerging markets: Explore investment opportunities beyond traditional options by looking into emerging or alternative markets, such as investing in top Chinese CRO companies.

- Chart analysis: Develop skills to analyze price movement charts and identify investment opportunities or red flags.

- Seek advice: Learn from experienced investors with a proven track record of successful investing.

- Stay informed: Keep up with global financial news and market trends to identify potential opportunities or risks.

| Characteristics | Values |

|---|---|

| Risk tolerance | Determine how much risk you are willing to take and choose investments that match your risk tolerance. |

| Financial goals | Define your financial goals and create a plan to achieve them. |

| Time horizon | Consider how long you are willing to invest for and choose investments with a suitable time frame. |

| Knowledge | Understand the investments you are making and conduct thorough research. |

| Diversification | Diversify your portfolio to reduce risk and increase potential returns. |

| Emergency fund | Build an emergency fund to cover unexpected expenses. |

| Investment analysis | Analyze charts, financial ratios, and other data to identify good investment opportunities. |

| Expert advice | Seek advice from experienced investors or financial professionals. |

| News and trends | Stay informed about global financial news, trends, and emerging markets. |

What You'll Learn

- Define your criteria: How much can you afford to invest How long are you willing to wait for returns How much risk are you comfortable with

- Research the market: Stay updated on the trends, opportunities, and challenges that affect your potential investments

- Evaluate the performance: Assess the profitability, liquidity, solvency, efficiency, and growth of your potential investments

- Assess the risk: Measure the impact of market volatility, economic cycles, competition, and regulation on your potential investments

- Diversify your portfolio: Spread your risk across different investments, industries, sectors, and regions

Define your criteria: How much can you afford to invest? How long are you willing to wait for returns? How much risk are you comfortable with?

When determining investment opportunities, it is crucial to define your criteria and assess your financial situation, risk tolerance, and investment goals. Here are some key factors to consider:

The first step is to evaluate your finances and determine how much money you can comfortably invest. This involves reviewing your income sources, establishing an emergency fund, paying off high-interest debts, and creating a budget. It is important to invest only what you can afford to lose and not endanger your financial stability.

Your investment timeline depends on your financial goals and objectives. Do you have short-term goals, such as saving for a vacation or a down payment on a house? Or are you investing for the long term, such as retirement or a child's education? Longer time horizons often allow for more aggressive investment strategies, while shorter timelines may require a more conservative approach.

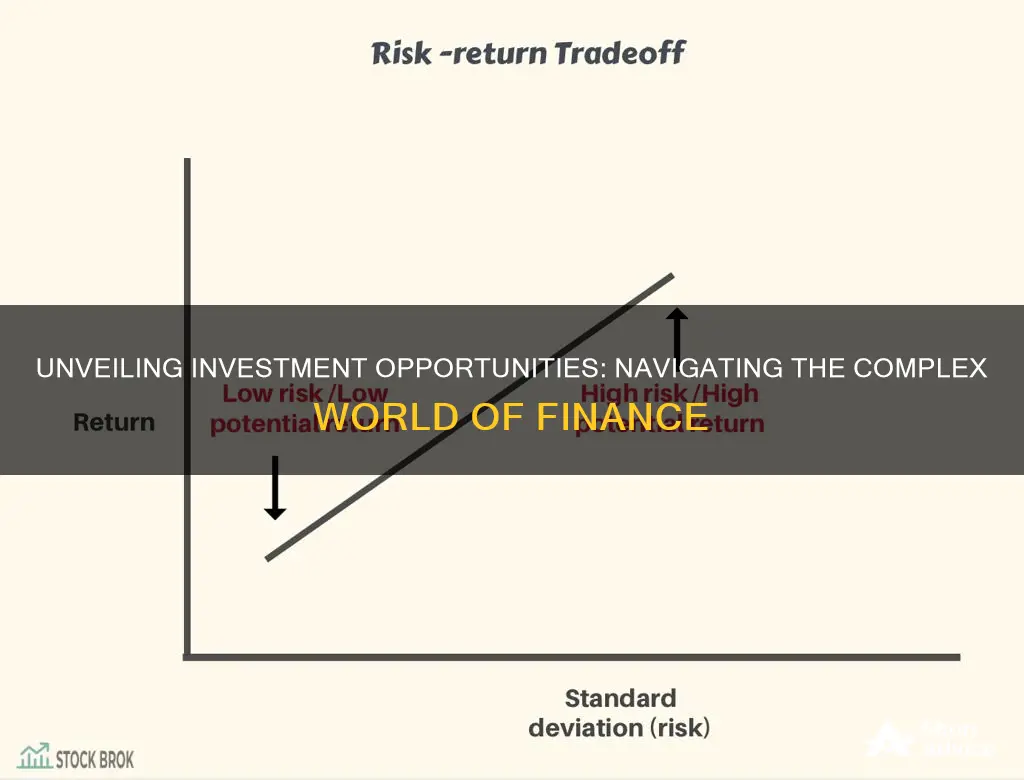

Understanding your risk tolerance is crucial in investing. You need to assess your comfort level with the inherent uncertainties and volatility of the stock market. Are you willing to take on higher risks for potentially greater returns, or do you prefer stability even if it means lower returns? Your risk tolerance will guide the types of investments you choose, ranging from low-risk assets like cash and government bonds to high-risk investments like growth stocks and sector-specific investments.

It is important to note that your risk tolerance may change over time as your financial situation and goals evolve, so it is essential to regularly reassess and adjust your investment strategy accordingly.

By carefully considering these factors and defining your criteria, you can make more informed investment decisions that align with your financial goals and comfort level.

Rich People: Investing Secrets

You may want to see also

Research the market: Stay updated on the trends, opportunities, and challenges that affect your potential investments

Researching the market and staying updated on trends, opportunities, and challenges is crucial for making informed investment decisions. Here are some strategies to stay informed and identify potential investment opportunities:

Use Reliable Sources:

Subscribe to trustworthy sources of information such as industry reports, trade journals, newsletters, podcasts, webinars, blogs, and social media accounts of experts, influencers, and organizations. Look for sources that are relevant, credible, and provide timely insights and analysis.

Monitor Market Signals:

Keep an eye on economic indicators, consumer behaviour, competitive activity, technological innovations, political events, and social trends. Use tools like Google Alerts, RSS feeds, social listening, and market research platforms to stay informed. Set up alerts to receive updates on your phone or email.

Engage with Your Network:

Connect with your contacts, clients, partners, or peers in your target market. They can provide valuable feedback, insights, referrals, and leads. Utilize online platforms like LinkedIn, Facebook, Twitter, or WhatsApp, as well as offline channels like phone calls, emails, meetings, or events, to build and expand your network.

Learn from Your Experience:

Analyze data from your sales activities, such as leads, conversions, revenue, retention, and referrals. Collect and review feedback from your customers, prospects, and colleagues. Use tools like CRM systems, surveys, analytics, or dashboards to track and measure your sales performance and identify areas for improvement.

Conduct Consumer Segmentation and Behaviour Analysis:

Divide your target audience into segments based on demographic, geographic, or behavioural variables. Demographic and geographic data help estimate the number of potential customers. Behavioural variables help pinpoint purchase motivations and tailor your marketing efforts. Monitor short- and long-term consumer shifts to understand evolving priorities.

Understand Purchase Situation:

Analyze the buyer's journey and identify factors that influence their purchasing decisions. Understand when, where, and how people make purchases. Look at distribution channels and payment methods to uncover buying patterns and determine the best places to sell your products.

Perform Direct and Indirect Competitor Analysis:

Conduct comprehensive research on your direct competitors—those offering similar products or services. Identify their unique value propositions, marketing strategies, and competitive advantages. Also, analyze indirect competitors who target a similar audience but sell different products. Understanding your competitors' performance, product portfolios, and strategic direction will help you identify growth opportunities.

Analyze Complementary Products and Services:

Monitor the performance of products and services that complement your business. This helps you understand how customers use your product alongside others, detect new opportunities and threats, and develop new offerings.

Diversification Analysis:

If your company has reached maturity in its current market, diversification analysis helps you identify new areas for growth. Analyze sectors that could benefit from your offerings, quantify growth potential, and understand the competitive landscape. Consider factors such as market size, growth rates, unit prices, and brand positioning before making investment decisions.

Stay Adaptable:

Be willing to adapt to changes and embrace challenges and uncertainties in the market. Use the information, insights, and feedback you gather to adjust your sales approach, tactics, and goals. Experiment with new ideas, methods, and tools to increase your sales effectiveness.

Ally Invest Dividends: Unlocking the Power of Passive Income

You may want to see also

Evaluate the performance: Assess the profitability, liquidity, solvency, efficiency, and growth of your potential investments

When determining investment opportunities, it is important to evaluate the performance of potential investments. This involves assessing the profitability, liquidity, solvency, efficiency, and growth of the investment options. Here are some key considerations for each of these factors:

Profitability:

- Net Profit Margin: This measures how much of each dollar collected as revenue translates into profit. A higher net profit margin indicates better profitability.

- Gross Profit Margin: Gross profit margin compares gross profit (revenue minus cost of goods sold) to total revenue. It indicates the ability to charge a premium for products and can signal a competitive advantage.

- Operating Profit Margin: Operating profit margin measures the percentage of sales left after accounting for the cost of goods sold and normal operating expenses. It indicates how effectively a company manages its operations and keeps costs down.

- Other Profitability Ratios: Other ratios such as return on assets (ROA), return on equity (ROE), and return on invested capital (ROIC) provide additional insights into a company's profitability and its ability to generate returns for shareholders.

Liquidity:

- Current Ratio: The current ratio measures a company's ability to pay off its current liabilities with its current assets, such as cash, accounts receivable, and inventories. A higher current ratio indicates better liquidity.

- Quick Ratio: The quick ratio assesses liquidity by excluding inventories from current assets, focusing on the most liquid assets. It is considered a more conservative measure than the current ratio.

- Days Sales Outstanding (DSO): DSO refers to the average number of days it takes a company to collect payment after a sale. A high DSO indicates a company is taking too long to collect payments, tying up capital in receivables.

Solvency:

- Debt-to-Equity Ratio: This ratio measures the amount of debt capital relative to equity capital. A higher ratio indicates higher financial risk and weaker solvency.

- Interest Coverage Ratio: The interest coverage ratio measures a company's ability to meet its interest expenses relative to its earnings before interest and taxes (EBIT). A higher ratio indicates stronger solvency.

- Other Solvency Ratios: Other ratios such as the debt-to-assets ratio and fixed-charge coverage ratio also provide insights into a company's ability to meet long-term financial obligations.

Efficiency:

- Asset Turnover Ratios: These ratios measure how efficiently a company generates revenue from its assets. Examples include the fixed asset turnover ratio and total asset turnover ratio.

- Operating Expense Ratio: This ratio reflects the proportion of gross farm revenue required to cover operating expenses, excluding depreciation and interest. A lower ratio indicates more efficient operations.

- Other Efficiency Ratios: Other ratios such as the depreciation expense ratio and farm interest expense ratio provide additional insights into the efficient use of assets and financial management.

Growth:

- Revenue Growth: Evaluate the growth in revenue over time. Sustained revenue growth is a positive sign for the health and potential of the investment.

- Profit Growth: Analyze the growth in profits over time, including net income and operating income. Growing profits indicate that the company is effectively managing costs and generating increasing returns.

- Market Share: Assess the company's market share and its ability to compete in its industry. A company with a growing market share and strong competitive position is more attractive for investment.

These factors provide a comprehensive framework for evaluating the performance and potential of investment opportunities. It is important to consider multiple aspects to make an informed decision, as each of these factors contributes to the overall health and prospects of the investment.

Wellness Warriors: Who Invests in Health?

You may want to see also

Assess the risk: Measure the impact of market volatility, economic cycles, competition, and regulation on your potential investments

When determining investment opportunities, it is crucial to assess the risk by measuring the impact of market volatility, economic cycles, competition, and regulation on potential investments. Here are some key considerations:

Market Volatility

Volatility refers to the degree of fluctuation in a stock's price, with highly volatile stocks exhibiting erratic and drastic price movements. Volatility is typically measured using standard deviation, which reflects the average deviation of a stock's price from the mean over a specific period. More volatile stocks imply greater risk and potential losses. Traders also use Bollinger Bands, which consist of a simple moving average and two bands placed one standard deviation above and below it, to visualise standard deviation.

Economic Cycles

Economic cycles, or business cycles, refer to the fluctuations between periods of economic expansion and contraction. These cycles impact stocks, bonds, and corporate earnings, influencing investment decisions. The four stages of an economic cycle are expansion, peak, contraction, and trough. During expansion, the economy experiences growth, low-interest rates, and increased production. At the peak, growth reaches its maximum, and prices may stabilise before reversing. The contraction phase is marked by declining employment and prices, potentially leading to a recession. The trough is the low point of the cycle, where spending and income are negatively impacted.

Competition

Competition can be measured in various ways, such as industrial concentration, price-cost margin, and relative profit differences. It is essential to assess the level of competition within an industry, as it can impact a company's performance and financial stability. Increased competition may lead to higher interest rates and reduced lending, affecting companies' access to credit and investment opportunities.

Regulation

Government policies and interventions can significantly impact the economic cycle and, consequently, investment opportunities. During a recession, governments may employ expansionary fiscal policies, such as deficit spending, to stimulate the economy. Conversely, during economic expansion, governments may use contractionary fiscal policies, such as taxation, to prevent the economy from overheating. Central banks also play a crucial role by adjusting interest rates and implementing monetary policies to influence spending and investment.

Early Education: Worth the Investment?

You may want to see also

Diversify your portfolio: Spread your risk across different investments, industries, sectors, and regions

Diversifying your portfolio is a crucial aspect of investment strategy, and it involves spreading your investments across various assets, industries, sectors, and regions to minimise risk. Here are some detailed paragraphs on how to achieve effective diversification:

Diversification Across Asset Classes

Diversification is the process of allocating your investments across different asset classes, such as stocks, bonds, cash, commodities, real estate, and alternative investments like cryptocurrencies and precious metals. By doing so, you reduce the risk of your portfolio being heavily impacted by the poor performance of a single asset class. For example, stocks are generally more volatile and carry greater risk, especially in the short term, while bonds are considered less volatile and can act as a cushion against stock market fluctuations.

Diversification Within Each Asset Class

Diversification is not just about spreading your investments across different asset classes but also about diversifying within each class. For instance, when investing in stocks, consider investing in a range of industries, such as tech, energy, and healthcare. Additionally, look at companies of different sizes (large-cap, mid-cap, small-cap) and consider dividend stocks, growth stocks, and value stocks. This way, you reduce the risk associated with any single industry or company.

Diversification Across Geographies

Investing in companies or entities headquartered in different countries provides another layer of diversification. The performance of these securities is influenced not only by the relative value of currencies but also by the unique economic conditions of each country. For example, investing in both developed and emerging markets can offer varied opportunities and risk levels.

Diversification Through Mutual Funds and ETFs

Mutual funds and exchange-traded funds (ETFs) are excellent tools for achieving diversification. These funds typically focus on specific asset classes, such as stocks or bonds, or a mix of different classes. By investing in several mutual funds and ETFs, you gain exposure to a wide range of underlying stocks, bonds, or other securities, providing further diversification. Additionally, these funds offer a cost-effective way to diversify for investors with limited capital.

Regular Portfolio Check-ups

Diversification is not a one-time task. It requires regular check-ups and rebalancing to maintain your desired asset allocation. Over time, the performance of different investments can cause your portfolio to drift from your original allocation. Therefore, it's important to monitor your investments periodically and make adjustments to stay aligned with your investment goals and risk tolerance.

Understanding the Trade-offs

While diversification is essential for risk management, it's important to recognise the trade-offs. Diversification may lead to lower overall portfolio returns compared to concentrating your investments in a few high-performing assets. Additionally, managing a highly diversified portfolio can be cumbersome, and transaction fees and brokerage charges can add up. Thus, it's crucial to strike a balance between diversification and your investment goals, risk tolerance, and available resources.

Rwanda's Education: Invest in the Future

You may want to see also

Frequently asked questions

The first step is to define your criteria. Ask yourself: What are you looking for in an investment? How much can you afford to invest? How long are you willing to wait for returns? How much risk are you comfortable with?

You can use various methods and metrics such as return on investment (ROI), net present value (NPV), internal rate of return (IRR), payback period, and cash flow analysis.

All investments involve some degree of risk. Evaluate your comfort zone with taking on risk. Understand that you could lose some or all of your money. The reward for taking on risk is the potential for a greater investment return.

Assess your financial situation and determine how much money you can bring to an investment. If you can bring more money, it may be worthwhile to consider higher-risk, higher-return investments.

Expand your investment horizons beyond well-known routes. Look into emerging or alternative markets. Keep an eye on the global financial news each day to help you get a feel for opportunities worth investigating further.