Trading securities are a type of financial asset that can be classified as either long-term or short-term investments, depending on the investor's strategy and goals. While some investors hold these securities for extended periods, aiming to benefit from long-term capital appreciation and dividend income, others engage in active trading, taking advantage of short-term price fluctuations in the market. This dynamic nature of trading securities makes them a versatile investment option, allowing investors to adapt their strategies based on market conditions and their own financial objectives.

What You'll Learn

- Tax Implications: Long-term capital gains taxes may be lower for holding securities

- Risk Management: Diversification and long-term holding can reduce investment risk

- Market Volatility: Securities can experience significant price swings over time

- Dividend Reinvestment: Long-term investors may benefit from compound dividend growth

- Historical Performance: Past performance is not indicative of future long-term returns

Tax Implications: Long-term capital gains taxes may be lower for holding securities

When it comes to investing in securities, the duration of your investment can significantly impact your tax obligations. One of the key advantages of holding securities for the long term is the potential for reduced tax rates on capital gains. This is a crucial consideration for investors, as it can directly affect the overall profitability of their investment strategy.

In many jurisdictions, long-term capital gains are taxed at a lower rate compared to short-term gains. This is often a result of tax policies designed to encourage long-term investment and provide an incentive for investors to adopt a buy-and-hold strategy. For example, in the United States, long-term capital gains are typically taxed at 0%, 15%, or 20%, depending on the investor's income level, whereas short-term gains are taxed as ordinary income, which can be significantly higher. This tax differential can be substantial, especially for high-income investors.

The lower tax rates on long-term capital gains are a significant benefit for investors who plan to hold their securities for an extended period. By recognizing the potential for reduced tax liabilities, investors can make more informed decisions about their investment timelines. Holding securities for the long term not only allows investors to benefit from potential price appreciation but also provides a tax advantage, which can enhance the overall returns on their investments.

Additionally, the long-term holding strategy can be particularly advantageous for investors who are subject to other forms of taxation, such as income tax. By minimizing the frequency of taxable events, investors can reduce their overall tax burden, ensuring that a larger portion of their investment returns goes directly into their pockets. This is especially relevant for investors who are in higher tax brackets or those who are looking to optimize their investment portfolios for long-term wealth accumulation.

In summary, the tax implications of holding securities for the long term can be highly beneficial. Lower capital gains tax rates provide an incentive for investors to adopt a long-term investment strategy, potentially increasing their overall returns. Understanding these tax advantages is essential for investors to make strategic decisions and optimize their investment portfolios accordingly.

Securities: Cash Equivalent or Long-Term Investment?

You may want to see also

Risk Management: Diversification and long-term holding can reduce investment risk

When it comes to managing investment risk, two key strategies that often come up are diversification and long-term holding. These strategies are fundamental to building a robust investment portfolio and can significantly reduce the impact of market volatility.

Diversification: The Art of Spreading Risk

Diversification is a risk management technique that involves spreading your investments across various asset classes, sectors, and geographic regions. The core idea is to minimize the impact of any single investment on your overall portfolio. By diversifying, you reduce the concentration risk, which is the risk associated with a particular investment or sector underperforming. For example, if you invest solely in technology stocks, a downturn in the tech sector could significantly affect your portfolio. However, by diversifying into other sectors like healthcare, consumer goods, or even international markets, you create a more balanced portfolio. This approach ensures that your investments are not all moving in the same direction, thus reducing the overall volatility.

Long-Term Holding: Riding Out the Storm

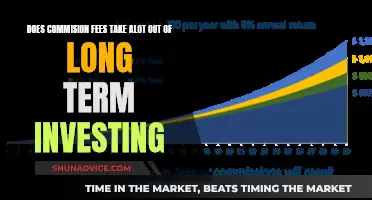

Long-term holding is a strategy that emphasizes patience and a long-term perspective. Instead of frequently buying and selling securities, investors hold their positions for an extended period, often years or even decades. This approach is particularly effective in reducing short-term market noise and emotional decision-making. By holding securities for the long term, investors can benefit from the power of compounding, where their investments grow over time through reinvested dividends and capital gains. Historically, markets have trended upwards over the long term, and by staying invested, investors can weather short-term market fluctuations. This strategy is especially useful during economic downturns or periods of high market volatility, as it allows investors to avoid the temptation of selling at the wrong time.

Combining Diversification and Long-Term Holding

The beauty of these two strategies lies in their synergy. Diversification provides a safety net by reducing the impact of individual stock or sector performance, while long-term holding ensures that short-term market swings do not disrupt the overall growth of the portfolio. When you combine these approaches, you create a robust investment strategy that is both risk-averse and forward-thinking. For instance, a well-diversified portfolio might include a mix of large-cap stocks, bonds, real estate investment trusts (REITs), and alternative investments. Holding these securities for the long term allows investors to benefit from the potential growth of each asset class while minimizing the risk associated with any single component.

In summary, diversification and long-term holding are powerful tools in an investor's arsenal for managing risk. Diversification spreads risk across various assets, while long-term holding minimizes the impact of short-term market fluctuations. Together, they provide a comprehensive approach to building a resilient investment portfolio, ensuring that investors can navigate market challenges with confidence.

Understanding the Essentials of Long-Term Investment Strategies

You may want to see also

Market Volatility: Securities can experience significant price swings over time

Market volatility refers to the rapid and significant price fluctuations that securities can undergo in the financial markets. This volatility is an inherent characteristic of the investment landscape and can be influenced by various factors, including economic conditions, geopolitical events, company-specific news, and overall market sentiment. Understanding and managing market volatility is crucial for investors, as it directly impacts the performance of their long-term investments.

Securities, such as stocks, bonds, and derivatives, are subject to price changes due to the dynamic nature of the markets. When market conditions are favorable, prices tend to rise, creating opportunities for investors to gain. Conversely, during periods of market stress or economic downturns, prices can drop sharply, potentially leading to losses. This price volatility can be both a blessing and a challenge for investors, as it presents both risks and opportunities.

Long-term investors often aim to ride out the short-term market fluctuations and focus on the underlying fundamentals of the securities they hold. This strategy involves a buy-and-hold approach, where investors purchase securities with the expectation that their value will increase over an extended period. By maintaining a long-term perspective, investors can benefit from the potential for capital appreciation and dividend growth, even during volatile market phases. However, it is essential to recognize that market volatility can still impact long-term investments, especially in the short term.

During periods of high market volatility, investors may experience increased uncertainty and emotional distress. This is because price swings can lead to rapid changes in the value of their investments, causing anxiety and potentially prompting impulsive decision-making. To navigate this challenge, investors should develop a well-defined investment strategy that aligns with their financial goals and risk tolerance. Diversification is a key tool in managing market volatility, as it involves spreading investments across various asset classes, sectors, and geographic regions to reduce the impact of any single security's performance.

Additionally, investors can consider implementing risk management techniques such as setting stop-loss orders, regularly reviewing and rebalancing their portfolios, and staying informed about market trends and news. By adopting a disciplined approach, investors can make more rational decisions during volatile market conditions, ensuring that their long-term investment strategy remains on track. In summary, market volatility is an inevitable aspect of the investment journey, and understanding its impact on securities is essential for making informed decisions and building wealth over the long term.

Understanding Short-Term Debt Investments: Are They Current Assets?

You may want to see also

Dividend Reinvestment: Long-term investors may benefit from compound dividend growth

Dividend Reinvestment is a strategy that allows long-term investors to benefit from the power of compound growth. When an investor receives dividends from their holdings, they have the option to reinvest those dividends back into the same security or use them to purchase additional shares. This practice is particularly advantageous for long-term investors as it enables them to harness the potential of compound dividend growth.

The concept of compound growth is a powerful tool in investing. It refers to the process where the earnings or dividends from an investment are reinvested, generating additional income over time. With each reinvested dividend, the total amount grows exponentially, leading to substantial long-term gains. For instance, if an investor purchases shares of a company that pays a consistent dividend, and they decide to reinvest those dividends, the initial investment can grow significantly over the years. This is because the reinvested dividends contribute to the purchase of more shares, which then generate their own dividends, and the cycle continues.

Long-term investors often aim to build a substantial portfolio that can provide a steady income stream. Dividend reinvestment facilitates this goal by allowing investors to accumulate shares of a company at a lower cost over time. As the stock price fluctuates, investors can take advantage of market dips to buy more shares, increasing their ownership in the company. This strategy not only benefits from potential price appreciation but also from the cumulative effect of reinvesting dividends.

Over time, the power of compound dividend growth becomes evident. Each reinvested dividend contributes to the purchase of additional shares, increasing the investor's holding. As the company's earnings grow, so do the dividends, providing a steady income stream. This income can then be reinvested, further accelerating the growth of the portfolio. The longer the investment horizon, the more significant the impact of compound dividend growth can be.

In summary, dividend reinvestment is a valuable strategy for long-term investors who want to maximize their returns. By reinvesting dividends, investors can benefit from compound growth, accumulate shares at a lower cost, and build a substantial portfolio over time. This approach aligns with the long-term investment philosophy, where patience and strategic reinvestment can lead to significant wealth accumulation.

Navigating Short-Term Investments: Asset or Liability?

You may want to see also

Historical Performance: Past performance is not indicative of future long-term returns

When considering whether trading securities can be classified as long-term investments, it's crucial to understand the distinction between the two. Long-term investments typically refer to assets held for an extended period, often years, with the primary goal of capital appreciation and income generation over time. On the other hand, trading securities are bought and sold frequently, often within a short time frame, aiming to profit from short-term price fluctuations rather than long-term growth.

The historical performance of trading securities is often characterized by volatility and rapid changes in value. These securities are designed to capitalize on market trends and short-term opportunities, which can lead to significant gains or losses in a relatively short period. For instance, day traders might buy and sell stocks, currencies, or derivatives multiple times a day, taking advantage of small price movements. While this strategy can be lucrative, it also carries a higher risk due to the frequent buying and selling, which can result in transaction costs and potential losses if the market moves against the trader's position.

In contrast, long-term investments are generally more stable and focused on building wealth over an extended period. Investors who adopt a long-term perspective often aim to hold assets like stocks, bonds, or real estate for years, allowing them to benefit from compound interest and the potential for significant growth. Historically, long-term investments have tended to outperform short-term trading strategies, as the market's long-term trend has been upward, with periods of correction and decline being relatively short-lived.

However, it's essential to recognize that past performance does not guarantee future results. The financial markets are inherently unpredictable, and what worked in the past may not work in the future. Market conditions can change rapidly due to various factors, including economic policies, geopolitical events, and technological advancements. For instance, the dot-com bubble of the late 1990s and early 2000s saw a surge in technology stocks, but many of these investments turned out to be short-lived, and many investors suffered significant losses when the bubble burst.

Therefore, while historical performance can provide valuable insights, it should not be the sole basis for making investment decisions. Investors must consider their risk tolerance, investment goals, and the time horizon they are willing to commit to. A well-rounded investment strategy might include a mix of long-term holdings and short-term trading, tailored to the investor's needs and market conditions. It is also advisable to diversify investments to manage risk effectively, ensuring that the portfolio can weather market fluctuations and provide stable returns over the long term.

Annuities: Long-Term Investment Strategy or Short-Term Plan?

You may want to see also

Frequently asked questions

Long-term investments in trading securities typically involve holding assets for an extended period, often years, with the primary goal of capital appreciation rather than short-term price movements. These investments are usually in high-growth companies or sectors with strong potential for future value increase.

Long-term investments focus on the fundamental analysis of a company's financial health, business model, and competitive advantage. Short-term trades, on the other hand, often rely on technical analysis, market trends, and price fluctuations, aiming to capitalize on quick price movements.

While long-term investments may provide more stable returns over time, they are not necessarily less risky. The risk profile depends on the specific securities and market conditions. However, long-term holding allows investors to weather short-term market volatility and benefit from the power of compounding.

Long-term investors often employ strategies like buy-and-hold, where they purchase securities and hold them for extended periods, ignoring short-term market fluctuations. They may also use dividend reinvestment plans, index funds, or actively managed mutual funds to benefit from long-term market growth.

Absolutely! Long-term investments can be highly profitable, especially when invested in well-researched, high-quality companies with strong growth potential. Over time, these investments can compound, leading to significant wealth accumulation, making them a popular choice for long-term financial goals.