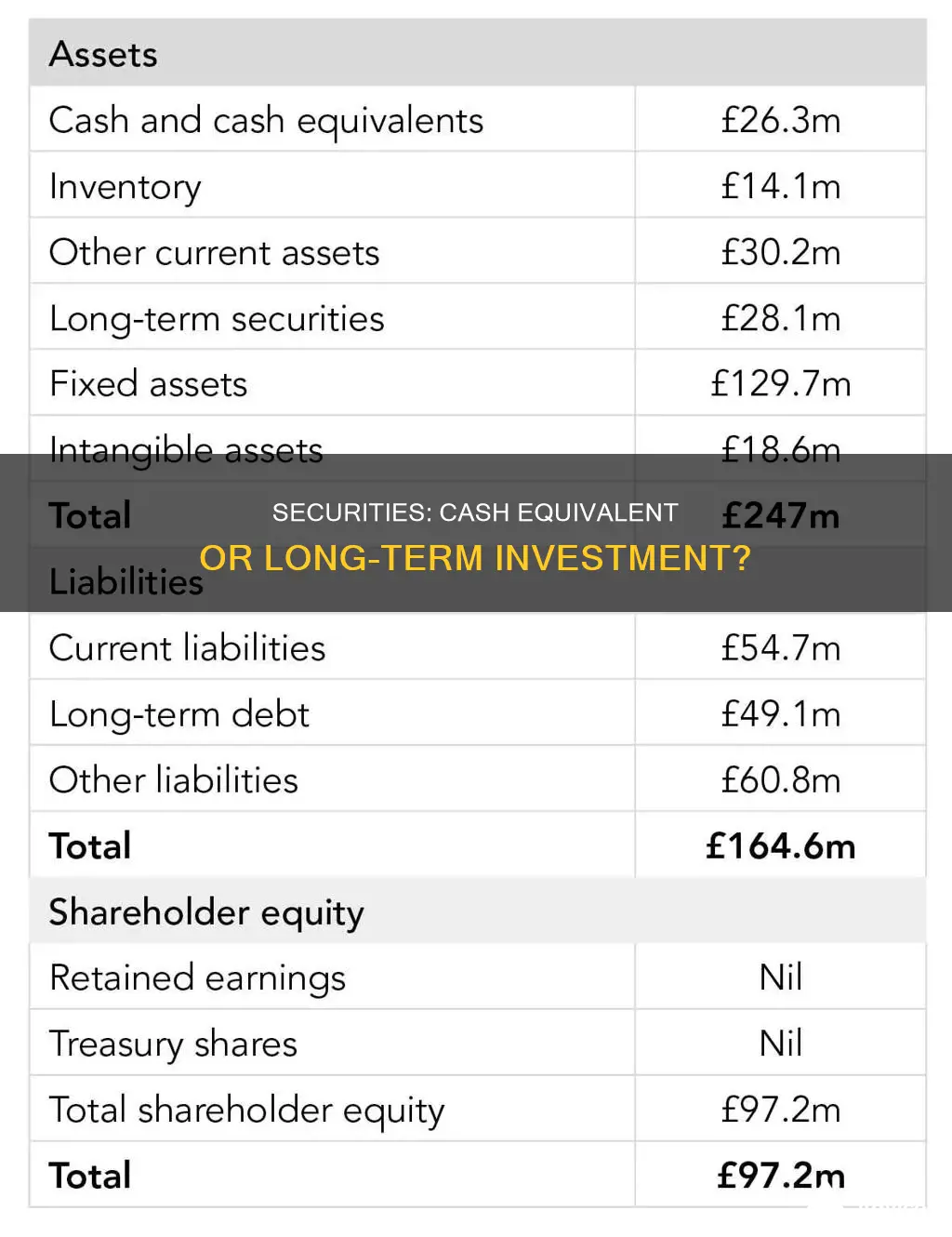

Securities, such as stocks, bonds, and derivatives, are often considered a form of cash equivalent for short-term investments due to their liquidity and relatively low risk. However, when it comes to long-term investments, the picture becomes more complex. While securities can provide a steady stream of income through dividends or interest, they may also carry risks associated with market volatility, company performance, and economic cycles. In this discussion, we will explore the nuances of securities as a long-term investment option, considering factors such as risk management, diversification, and the potential for capital appreciation or depreciation over extended periods.

What You'll Learn

- Liquidity and Convertibility: Securities can be quickly converted to cash, making them a liquid asset

- Risk and Volatility: Long-term investments may be more volatile and less liquid

- Maturity and Duration: Cash equivalents typically have shorter maturity dates

- Interest and Dividends: Securities can generate income through interest or dividends

- Tax Treatment: Cash equivalents may be taxed differently from long-term investments

Liquidity and Convertibility: Securities can be quickly converted to cash, making them a liquid asset

Securities, such as stocks, bonds, and mutual funds, offer a unique advantage in terms of liquidity and convertibility, which sets them apart from traditional long-term investments like real estate or precious metals. This characteristic is particularly important for investors who prioritize accessibility and the ability to access their funds when needed.

Liquidity refers to the ease with which an asset can be converted into cash without significantly impacting its market value. Securities possess high liquidity because they can be quickly bought or sold in the market, often with minimal transaction costs. When an investor holds securities, they can readily convert them back into cash by selling them to another buyer in the market. This process is relatively straightforward and efficient, allowing investors to access their funds promptly.

The convertibility of securities is another crucial aspect. Securities can be easily converted into cash, providing investors with the flexibility to use their investments for various purposes. For instance, if an investor needs immediate funds for an unexpected expense, they can sell their securities and receive cash relatively swiftly. This feature is especially valuable for those who require quick access to their money, ensuring they can meet short-term financial obligations without significant delays.

In the context of long-term investments, securities offer a more liquid alternative compared to tangible assets. While real estate or collectibles may take time and effort to sell, securities can be traded on stock exchanges or over-the-counter markets, ensuring a continuous and relatively efficient market for buying and selling. This liquidity aspect is essential for investors who want to maintain a level of financial flexibility and quickly adapt to changing financial needs or opportunities.

Furthermore, the liquidity and convertibility of securities contribute to their role as a safe-haven asset during economic downturns or market volatility. Investors often turn to securities as a means to preserve capital and quickly access funds if needed. This characteristic makes securities a preferred choice for risk-averse investors who seek both liquidity and the potential for capital appreciation over the long term.

Understanding Inventory's Role in Short-Term Investment Strategies

You may want to see also

Risk and Volatility: Long-term investments may be more volatile and less liquid

When considering long-term investments, it's important to understand the inherent risks and volatility associated with these assets. Long-term investments, such as stocks, bonds, or real estate, are typically characterized by their extended holding periods, which can range from several years to decades. While these investments offer the potential for significant returns, they also come with a higher degree of risk and uncertainty.

One of the primary risks associated with long-term investments is market volatility. Markets are inherently unpredictable, and various factors can cause fluctuations in asset prices. Economic downturns, geopolitical events, or changes in interest rates can all impact the value of long-term investments. For instance, a prolonged recession might lead to a decline in stock prices, making it challenging for investors to recoup their initial investments. Similarly, real estate markets can experience periods of downturn, affecting property values and rental income.

Volatility also extends to the liquidity of these investments. Liquidity refers to how easily an asset can be converted into cash without significantly impacting its price. Long-term investments often have lower liquidity compared to short-term or cash equivalents. This means that selling these assets quickly and at a fair price can be difficult. For example, selling a large holding of stocks or a property might require time and may not always result in the desired price, especially during market downturns.

Additionally, the time horizon of long-term investments plays a crucial role in managing risk. Investors who are more risk-averse or require immediate access to their funds may find long-term investments less suitable. These investments are often recommended for those with a longer investment timeframe, such as retirement planning or wealth accumulation over several decades. The longer investment period allows for the potential to weather short-term market fluctuations and benefit from the compounding effect of returns.

In summary, long-term investments are associated with higher volatility and lower liquidity, which are essential factors to consider when evaluating their suitability. Understanding these risks is crucial for investors to make informed decisions, especially when comparing them to more liquid and stable cash equivalents. Diversification and a long-term perspective are often key strategies to mitigate the risks associated with market volatility.

Dividends: A Long-Term Investment Strategy?

You may want to see also

Maturity and Duration: Cash equivalents typically have shorter maturity dates

When considering the maturity and duration of investments, cash equivalents play a crucial role in the financial world. These financial instruments are designed to provide a safe and liquid option for investors, especially those seeking short-term gains or quick access to their funds. One of the key characteristics that distinguish cash equivalents from long-term investments is their maturity date.

Maturity refers to the date when an investment reaches its full value or when the principal amount is returned to the investor. Cash equivalents, such as treasury bills, certificates of deposit (CDs), and short-term corporate bonds, generally have shorter maturity periods compared to long-term investments like corporate bonds or stocks. For instance, treasury bills typically mature within a few days to a few months, while CDs can range from a few months to a couple of years. This shorter maturity is a defining feature of cash equivalents, making them an attractive option for risk-averse investors.

The shorter maturity of cash equivalents is essential for investors who prioritize liquidity and the ability to access their funds without significant risk. These investments are often used as a bridge between cash and more permanent investments, providing a temporary home for funds that need to be readily available but not tied up in long-term commitments. This characteristic is particularly useful for businesses and individuals who require quick access to capital for short-term expenses or opportunities.

In contrast, long-term investments usually have maturity dates that extend beyond several years. These investments are often more complex and carry higher risks, as they are subject to market fluctuations and changes in interest rates over an extended period. For example, a 30-year corporate bond will mature after three decades, providing a long-term return on investment but also exposing the investor to potential market volatility.

Understanding the maturity and duration of investments is vital for investors to make informed decisions. Cash equivalents offer a safe and liquid option with shorter maturity dates, making them suitable for short-term goals and risk-averse strategies. On the other hand, long-term investments provide opportunities for higher returns but come with increased risk and longer commitments. By recognizing these differences, investors can tailor their portfolios to align with their financial objectives and risk tolerance.

Understanding Long-Term Investment Strategies: Key Factors to Consider

You may want to see also

Interest and Dividends: Securities can generate income through interest or dividends

Securities, such as bonds, stocks, and other financial instruments, can indeed generate income for investors through interest and dividends. This aspect of investing is a crucial consideration when evaluating the role of securities as a long-term investment option.

Interest is a fundamental concept in the world of securities, particularly in the context of fixed-income investments. When an investor purchases a bond, they essentially lend money to the issuer (such as a government or corporation). In return, the issuer agrees to pay the investor a fixed amount of interest at regular intervals (usually annually, semi-annually, or quarterly). This interest rate is determined at the time of bond issuance and remains constant throughout the bond's life. For example, a 10-year government bond might offer an interest rate of 3%, meaning the investor will receive 3% of the bond's face value as interest annually. This regular income stream makes securities an attractive option for investors seeking a steady cash flow.

Dividends, on the other hand, are a form of income generated by equity securities, such as stocks. When a company's profits are substantial, it may choose to distribute a portion of those profits to its shareholders in the form of dividends. Dividends can be paid out regularly (monthly, quarterly, or annually) and are typically a percentage of the stock's price. For instance, a technology company might declare a dividend of $0.50 per share, which would be paid to shareholders every quarter. Over time, consistent dividend payments can provide investors with a substantial source of income, especially when reinvested to purchase additional shares, a strategy known as dividend reinvestment.

The income generated through interest and dividends can be particularly valuable for long-term investors. These regular payments provide a steady cash flow, which can be used to cover living expenses, fund retirement, or simply grow the investor's wealth over time. Moreover, the reinvestment of dividends can lead to compound growth, where the accumulated dividends are used to purchase more shares, potentially increasing the overall return on investment.

It is important to note that the interest rates and dividend yields on securities can vary widely depending on market conditions, credit ratings, and other factors. Investors should carefully research and analyze different securities to identify those that offer attractive interest or dividend rates while also aligning with their investment goals and risk tolerance.

Debt Securities: Unlocking the Investment-Finance Connection

You may want to see also

Tax Treatment: Cash equivalents may be taxed differently from long-term investments

When it comes to tax treatment, the distinction between cash equivalents and long-term investments is crucial for investors to understand. Cash equivalents, such as money market funds, treasury bills, and short-term certificates of deposit, are considered highly liquid assets that can be quickly converted into cash with minimal impact on their value. On the other hand, long-term investments, including stocks, bonds, and real estate, are typically held for extended periods, often years or even decades.

The tax implications of these two categories can vary significantly. Cash equivalents are generally taxed as ordinary income when they are sold or redeemed. This means that any gains or interest earned from these investments are treated as taxable income and are subject to income tax rates. For example, if an investor sells a money market fund, the profits may be taxed at their regular income tax rate, which could be higher than the capital gains tax rate applied to long-term investments.

In contrast, long-term investments often benefit from favorable tax treatment. Many countries offer reduced tax rates for long-term capital gains, which encourages investors to hold these assets for extended periods. For instance, in the United States, long-term capital gains are taxed at 0%, 15%, or 20%, depending on the investor's income level, whereas ordinary income tax rates can be significantly higher. This tax advantage provides an incentive for investors to adopt a long-term investment strategy.

Additionally, the tax rules for cash equivalents may differ from those for long-term investments in terms of tax-efficient strategies. Investors can utilize tax-efficient strategies like tax-loss harvesting, where they sell investments at a loss to offset capital gains, which is more commonly associated with long-term holdings. These strategies can help reduce the overall tax burden on investment income.

Understanding the tax treatment of cash equivalents and long-term investments is essential for effective financial planning. Investors should consider the potential tax implications when making investment decisions, as it can impact their overall returns and financial goals. By recognizing the differences in tax treatment, investors can make informed choices to optimize their investment portfolios and minimize tax liabilities.

Unlocking the Long-Term Potential: Savings vs. Investments

You may want to see also

Frequently asked questions

Securities are financial instruments that represent ownership or a debt claim on an entity. They can include stocks, bonds, derivatives, and other financial assets. Cash equivalents, on the other hand, are highly liquid assets that can be quickly converted into cash with minimal impact on their market value. Examples of cash equivalents include treasury bills, short-term government bonds, and certain money market funds.

While securities can be part of a long-term investment strategy, they are not typically classified as long-term investments themselves. Long-term investments usually refer to assets held for extended periods, often years, with the expectation of capital appreciation and income generation over time. Securities are more often associated with short-term trading, speculation, or medium-term investments.

Cash equivalents and long-term investments serve different purposes in a financial portfolio. Cash equivalents are designed for liquidity and safety, providing an easily accessible store of value with minimal risk. They are ideal for meeting short-term financial obligations or as a bridge between investments. Long-term investments, however, are intended to grow over time, providing capital gains and regular income through dividends or interest.

Securities can be liquid, meaning they can be bought or sold quickly without significantly impacting their price, but this is not always the case. Some securities, especially those in smaller markets or with less frequent trading, may have lower liquidity, making it harder to sell them promptly without incurring losses. Liquidity can vary depending on the type of security and the market conditions.

Long-term investments can take various forms, such as real estate, precious metals, collectibles, or even certain business ventures. These investments are typically held for extended periods and may provide income or capital appreciation over time. For instance, purchasing a rental property is a long-term investment strategy, while buying and selling stocks frequently is more characteristic of short-term trading.