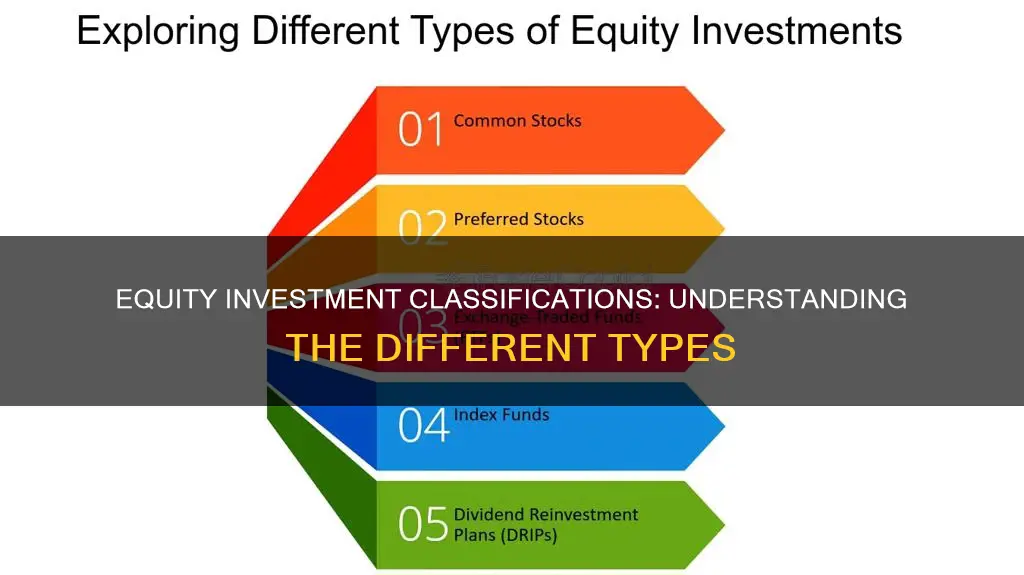

Equity investments refer to money invested in a company by purchasing shares of that company in the stock market. These shares are typically traded on a stock exchange. Equity investments are generally classified as current in a classified balance sheet. They are required to be presented as a separate line item on the balance sheet. Equity investments are important because they represent the value of an investor's stake in a company, represented by the proportion of its shares. They are also important for portfolio diversification. Equity investments have different classifications, including common stock, preferred stock, other classes of stock, rights to acquire equity, and rights to sell equity.

| Characteristics | Values |

|---|---|

| Definition | Ownership interest in a company or asset |

| Example | Owning shares in a company |

| Purpose | Raise money for a company or business |

| Benefits | Potential to increase the value of the principal amount invested |

| Diversification of portfolio | |

| Types | Common stock, preferred stock, other classes of stock, warrants, call options, put options, forward sale contracts |

| Accounting Treatment | Carried at fair value, with changes included as a component of earnings |

| Exceptions: investments under the equity method, investments requiring consolidation, NAV carrying value practical expedient, no readily determinable fair value | |

| Under the measurement alternative: carried at cost less any impairment | |

| Balance Sheet Classification | Current asset, even if not intended to be disposed of within a year |

| Separate line item on the balance sheet | |

| Disclosure Requirements | Unrealized gains and losses for each reporting period |

| Fair value disclosure requirements under ASC 820 |

What You'll Learn

Equity securities vs. debt securities

Equity investments do have classifications, and the two main types are equity securities and debt securities.

Equity securities represent a claim on the earnings and assets of a corporation. They are financial assets that represent ownership of a corporation. The most prevalent type of equity security is common stock. Owning an equity security means that your shares represent part ownership of the issuing company. In other words, you have a claim on a percentage of the issuing company's earnings and assets. For example, if you own 1% of the total shares issued by a company, your ownership stake in the company is equivalent to 1%.

On the other hand, debt securities are investments in debt instruments. They are financial assets that entitle their owners to a stream of interest payments. Debt securities require the borrower to repay the principal borrowed. Examples of debt securities include government bonds, corporate bonds, and preferred stock.

The main difference between equity and debt securities is that when you purchase an equity security, you own a part of the company, whereas when you purchase a debt security, you do not have any ownership in the company. Equity securities, unlike debt securities, do not guarantee the investor repayment of their initial investment. The return earned by the investor in equity securities is dependent on the market performance of the equity issuer.

Debt securities are generally considered a less risky form of investment compared to equity securities. In the event a corporation goes bankrupt, it pays debt holders before equity holders.

Understanding Investment Management Fees: Cost Analysis

You may want to see also

Common stock vs. preferred stock

Equity investments can be classified into common stock and preferred stock. Both types of stocks represent fractional ownership in a company, but there are some key differences between the two.

Common Stock

Common stock is the type of stock that most people invest in. It grants shareholders ownership rights and voting rights, usually at one vote per share owned. Common stock shareholders can vote on important decisions such as electing the board of directors and certain policy decisions and management issues. The value of common stock is determined by supply and demand and tends to be more volatile than preferred stock. Common stock has higher long-term growth potential than preferred stock but also has a lower priority for dividends and a payout in the event of liquidation. Common stockholders are last in line when it comes to company assets, which means they will be paid after creditors, bondholders, and preferred stock shareholders.

Preferred Stock

Preferred stock, on the other hand, acts more like a bond. It provides shareholders with a predictable flow of income in the form of fixed dividends. Preferred stock usually does not grant shareholders voting rights. It has a par value that is affected by interest rates – when interest rates rise, the value of the preferred stock declines, and vice versa. Preferred stock is less volatile than common stock and is callable, meaning the issuer has the right to redeem the shares from the market after a predetermined time. Preferred stock shareholders have priority over common stock shareholders when it comes to dividends and payouts in the event of liquidation.

The choice between common stock and preferred stock depends on an investor's risk tolerance and financial goals. Common stock offers unlimited growth but with higher risk, making it ideal for long-term investors. Preferred stock, on the other hand, provides fixed dividends and less volatility, making it better suited for income-focused investors.

Ask Your Investment Manager: Key Questions for Success

You may want to see also

Active equity strategies

Fundamental strategies emphasise the use of human judgement in the decision-making process, while quantitative strategies rely on rules-based quantitative models. The fundamental approach is subjective and forward-looking, using research and analysis to make investment decisions. In contrast, the quantitative approach is objective and backward-looking, employing data and optimisation techniques to arrive at decisions.

The main types of active management strategies include bottom-up, top-down, factor-based, and activist strategies. Bottom-up strategies initiate at the company level, assessing the intrinsic value of a company through company and industry analyses to determine if the stock is undervalued or overvalued relative to its market price. Top-down strategies, on the other hand, focus on the macroeconomic environment, demographic trends, and government policies to inform investment decisions.

Factor-based strategies, often used in quantitative equity investment strategies, aim to identify significant factors driving stock prices and construct portfolios biased towards these factors. These factors can be grouped based on fundamental characteristics, such as value, growth, and price momentum, or unconventional data.

Activist investors, another type of active equity strategy, specialise in acquiring meaningful stakes in listed companies to influence their management, strategy, or capital structures. The goal is to increase the stock's value and realise gains on their investment.

Overall, active equity strategies provide a diverse range of approaches to enhance portfolio performance and achieve financial goals.

Liquid Assets: Investment Portfolios for Quick Cash Access

You may want to see also

Equity investing styles

- Risk-Based Investment Styles: Conservative funds typically focus on income and fixed-income investments, such as money market funds, loan funds, and bond funds. These funds are considered less risky and are suitable for investors seeking stable returns. On the other hand, aggressive funds, such as growth funds, aggressive growth funds, and alternative hedge fund investment styles, aim for higher returns by taking on more risk. These funds may use leverage and derivatives and invest in broader markets, including emerging markets and international securities.

- Market Capitalization: This style focuses on the size of companies based on their market capitalization. Equity investments can be classified into large-cap, mid-cap, or small-cap. Large-cap companies are well-established and considered less risky, while small-cap companies are typically younger and more volatile but offer higher growth potential.

- Growth vs. Value: Growth investing focuses on stocks that are expected to outperform the market due to their future potential. Value investing, on the other hand, seeks stocks that are currently undervalued and trading below their intrinsic value. Growth investing is suitable for investors with a higher risk tolerance and a long-term horizon, while value investing can offer superior returns at a moderate risk level.

- Active vs. Passive: Active investment strategies aim to outperform the market by actively managing the portfolio and making frequent trades. Passive investment strategies, on the other hand, aim to replicate the performance of a specific market index or benchmark and typically involve lower fees and taxes.

- Income vs. Capital Appreciation: Income-focused equity investing styles prioritize regular dividend payments and stable returns. Capital appreciation strategies, on the other hand, focus on investing in companies with high growth potential, aiming for capital gains rather than dividend income.

It is important to note that these equity investing styles are not mutually exclusive, and a portfolio may incorporate elements from multiple styles based on the investor's goals, risk tolerance, and market conditions.

Webull Cash Management: FDIC Insurance Explained

You may want to see also

Equity law

The term "equity" is used to describe a type of ownership interest in property that may be offset by debts or other liabilities. This concept of equity is regulated through the system of equity law, which first developed in England during the Late Middle Ages to meet the growing demands of commercial activity.

The English legal system at the time comprised two types of courts: common law courts and equity courts. Common law courts dealt with questions of property title, while equity courts handled contractual interests in property. The same asset could have an owner in equity, who held the contractual interest, and a separate owner at law, who held the title indefinitely or until the contract was fulfilled.

For example, a person who owns a car worth $24,000 and owes $10,000 on the loan used to buy the car has equity of $14,000. Equity can apply to a single asset, such as a car or house, or to an entire business.

In the case of a deficit, where liabilities attached to an asset exceed its value, the terms of the loan determine whether the lender can recover the difference from the borrower.

Investment Portfolio: Where to Find and How to Start

You may want to see also

Frequently asked questions

Equity is an ownership interest in property that may be offset by debts or other liabilities. Equity can apply to a single asset, such as a car or house, or to an entire business.

An equity investment is money that is invested in a company by purchasing shares of that company in the stock market. These shares are typically traded on a stock exchange.

The main benefit of equity investment is the possibility to increase the value of the principal amount invested. This comes in the form of capital gains and dividends. Equity investments can also strengthen a portfolio's asset allocation by adding diversification.

While there are many potential benefits to investing in equities, there are also risks. Market risks impact equity investments directly. Stocks will often rise or fall in value based on market forces. As a result, investors can lose some or all of their investment due to market risk. Other types of risk that can affect equity investments include credit risk, foreign currency risk, liquidity risk, political risk, economic concentration risk, and inflation risk.