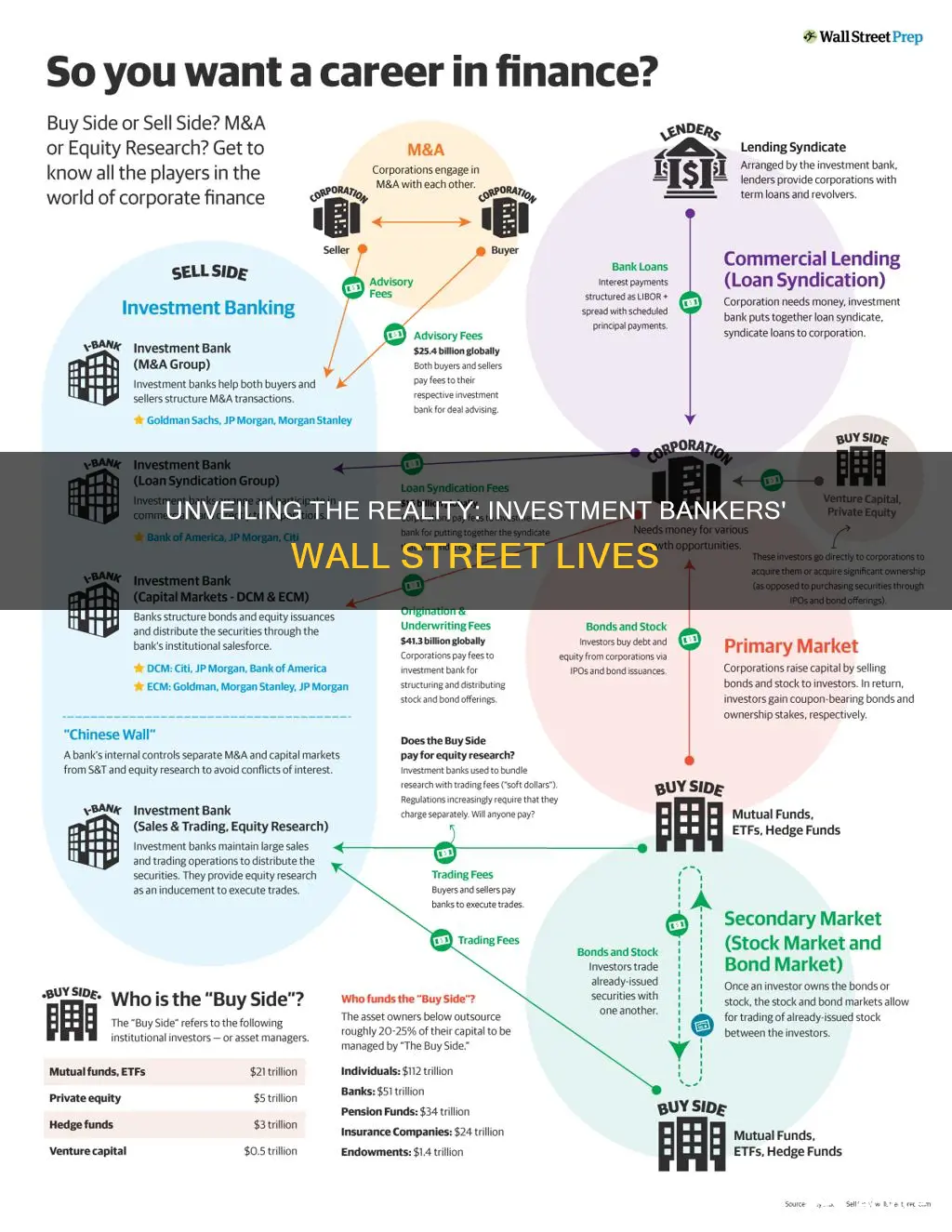

Investment banking is a dynamic and influential sector of the financial industry, and one of the most iconic symbols of this world is Wall Street. This paragraph introduces the topic by exploring the relationship between investment bankers and Wall Street. It highlights how investment bankers, often seen as the elite of the financial world, are deeply intertwined with the iconic streets of New York City. The paragraph sets the stage by mentioning the bustling atmosphere of Wall Street, where investment bankers play a crucial role in facilitating financial transactions, advising on mergers and acquisitions, and providing strategic guidance to corporations and governments. It also hints at the high-pressure environment and the significant impact these professionals have on the global economy.

What You'll Learn

- Investment Banking Culture: The fast-paced, competitive environment of Wall Street

- Daily Responsibilities: Analyzing financial data, advising clients, and executing deals

- Client Interactions: Building relationships with corporations, governments, and investors

- Market Research: Conducting in-depth research to identify investment opportunities and trends

- Regulatory Compliance: Navigating complex regulations to ensure ethical and legal practices

Investment Banking Culture: The fast-paced, competitive environment of Wall Street

The investment banking industry, particularly on Wall Street, is renowned for its intense and dynamic culture, which has become a defining characteristic of the profession. This culture is often associated with long hours, high-pressure situations, and a highly competitive atmosphere. Investment bankers are expected to be adaptable, quick-thinking, and highly skilled in their respective fields, often dealing with complex financial products and strategies.

The fast-paced nature of Wall Street demands a constant state of alertness and readiness. Investment bankers must be able to make rapid decisions, often under tight deadlines, and possess the ability to manage multiple projects simultaneously. This environment encourages a strong work ethic, where long hours are the norm, and a deep commitment to the job is expected. The culture often fosters a sense of urgency, where missing a beat could mean the difference between a successful deal and a missed opportunity.

Competition is a key aspect of this culture. Investment banking is a highly sought-after career path, and the industry attracts top talent from around the world. This competition is not only between colleagues but also with other firms for clients and business. The environment encourages a drive for excellence, where professionals strive to be the best in their field, constantly updating their skills and knowledge to stay ahead of the curve.

The culture also emphasizes networking and relationship-building. Investment bankers often spend a significant amount of time networking with clients, potential investors, and other industry professionals. This involves attending industry events, conferences, and social gatherings, which are crucial for maintaining and building professional relationships. These connections can lead to new business opportunities and are a vital part of the investment banking process.

Despite the challenges and demands, many investment bankers thrive in this environment. The culture offers opportunities for rapid career progression, high earning potential, and the chance to work on exciting, high-profile projects. It attracts individuals who are passionate about finance, driven by success, and willing to dedicate themselves to a demanding yet rewarding career path. Understanding and embracing this unique culture is essential for anyone considering a career in investment banking on Wall Street.

Aussie-Made Knives: Cutting-Edge Quality and Craftsmanship

You may want to see also

Daily Responsibilities: Analyzing financial data, advising clients, and executing deals

The daily life of an investment banker is a fast-paced and dynamic environment, often centered around Wall Street, the iconic financial district in New York City. Investment banking professionals are at the heart of the financial industry, playing a crucial role in facilitating transactions and providing strategic advice to clients. Here's an overview of their daily responsibilities:

Analyzing Financial Data: Investment bankers spend a significant portion of their day scrutinizing vast amounts of financial information. This involves studying market trends, industry reports, company financial statements, and economic indicators. They use advanced analytical tools and techniques to identify patterns, assess risks, and make informed recommendations. For instance, they might analyze a company's financial performance over several quarters to determine its investment potential or assess the impact of a proposed merger on the market. This analytical process is fundamental to their decision-making and advice-giving process.

Advising Clients: A key aspect of investment banking is providing tailored financial advice to clients. Investment bankers work closely with corporations, governments, and high-net-worth individuals to understand their specific needs and goals. They offer strategic guidance on various financial matters, such as capital raising, mergers and acquisitions, restructuring, and market entry strategies. For example, they might advise a tech startup on its initial public offering (IPO) process, helping it navigate the complex regulations and market dynamics. Investment bankers must possess excellent communication and interpersonal skills to effectively convey complex financial concepts to clients.

Executing Deals: The execution of deals is a critical daily task for investment bankers. They facilitate transactions by bringing together buyers and sellers, negotiating terms, and ensuring compliance with legal and regulatory requirements. This process often involves multiple parties, including clients, investors, legal teams, and regulatory bodies. Investment bankers must demonstrate strong negotiation skills, attention to detail, and the ability to manage complex transactions. For instance, they might work on a deal to acquire a competitor, involving due diligence, valuation, and the creation of a comprehensive transaction plan.

In addition to these core responsibilities, investment bankers also engage in networking and relationship-building activities. They attend industry events, conferences, and social gatherings to expand their professional connections. These interactions can lead to new business opportunities and a deeper understanding of market dynamics. Furthermore, investment banking professionals often collaborate with colleagues across different departments, such as research, sales, and trading, to provide comprehensive solutions to clients.

The daily routine of an investment banker demands a high level of expertise, adaptability, and a strong work ethic. It requires a deep understanding of financial markets, a keen analytical mind, and excellent communication skills. While the role can be demanding, it offers the opportunity to work on exciting projects, influence major financial decisions, and contribute to the growth of businesses and economies.

Savings Strategies: Impacting Your Investment Journey

You may want to see also

Client Interactions: Building relationships with corporations, governments, and investors

Investment banking is a dynamic and highly competitive field, and at its core, the profession is built on strong client relationships. These relationships are the foundation of a successful investment banking career, and they require a strategic approach to develop and maintain. When interacting with clients, investment bankers aim to provide value beyond financial advice, fostering long-term partnerships.

Building relationships with corporations is a cornerstone of investment banking. Investment bankers often act as trusted advisors to companies, offering guidance on various financial matters. This includes assisting with initial public offerings (IPOs), where the banker's expertise is crucial in navigating the complex process of taking a company public. They help corporations raise capital, provide strategic advice on mergers and acquisitions, and offer insights on market trends and industry-specific challenges. For instance, an investment banker might work closely with a tech startup to secure funding for product development, offering not just financial support but also industry connections and strategic direction.

Government interactions are another critical aspect of client relationships. Investment bankers collaborate with government entities on a wide range of projects, such as public-private partnerships, infrastructure development, and policy advisory services. These relationships often involve a deep understanding of the political landscape and the ability to navigate complex regulatory environments. For example, an investment banker might advise a government on the privatization of a state-owned enterprise, requiring a nuanced understanding of economic policies and public opinion.

Investors, both institutional and individual, are also key clients. Investment bankers must understand the diverse needs of investors, from high-net-worth individuals seeking wealth management advice to large institutional investors managing vast portfolios. Building relationships with investors involves staying updated on market trends, providing research and analysis, and offering tailored investment strategies. For instance, a banker might work with a family office to customize an investment plan, considering the family's unique financial goals and risk tolerance.

Effective client interactions require a combination of financial expertise, industry knowledge, and strong communication skills. Investment bankers must demonstrate a deep understanding of their clients' businesses, industries, and goals. They should be adept at listening, asking probing questions, and providing solutions that are both financially sound and aligned with the client's strategic vision. Additionally, building trust and maintaining confidentiality are essential aspects of these relationships, ensuring that clients feel secure in sharing sensitive information.

Loan Payments: Financing or Investing?

You may want to see also

Market Research: Conducting in-depth research to identify investment opportunities and trends

Market research is a critical component of investment banking, and it involves a comprehensive process of gathering and analyzing data to identify potential investment opportunities and market trends. This research is essential for investment bankers to make informed decisions and provide valuable insights to their clients. The process typically begins with defining the scope of the research, which includes identifying the specific industries, sectors, or markets of interest. Investment bankers must carefully select the data sources, which can include financial reports, industry publications, market research reports, government statistics, and even social media trends, depending on the nature of the research.

In-depth research requires a systematic approach. It often starts with a thorough literature review to understand the current market dynamics and identify any gaps or emerging trends. This step helps in formulating research questions and hypotheses. For instance, an investment banker might want to explore the impact of technological advancements on a particular industry or study consumer behavior changes in a specific market segment. The next phase involves data collection, which can be qualitative or quantitative. Qualitative research might include interviews with industry experts, focus groups, or surveys to gather insights and opinions. Quantitative research, on the other hand, involves collecting numerical data through various methods such as market surveys, sales data, or financial ratios.

Once the data is collected, the analysis phase begins. This is where the real value of market research is added. Investment bankers use statistical tools and analytical techniques to interpret the data and identify patterns, correlations, and trends. They may employ regression analysis to understand the relationship between different market variables or use predictive modeling to forecast future market behavior. For example, they might analyze historical stock price data to predict potential market movements or study consumer spending patterns to identify investment opportunities in specific sectors.

The insights gained from market research are then used to develop investment strategies and recommendations. Investment bankers present their findings to clients, highlighting the potential risks and rewards associated with different investment options. This research-driven approach ensures that investment banking activities are well-informed and aligned with market realities. Moreover, market research also helps investment bankers stay updated on regulatory changes, economic shifts, and industry-specific developments, which are crucial for making strategic investment decisions.

In summary, conducting in-depth market research is a fundamental aspect of investment banking, enabling professionals to navigate the complex world of finance and make sound investment choices. It empowers them to identify opportunities, manage risks, and provide clients with valuable insights, ultimately contributing to the success of investment banking firms and their clients' financial goals. This process requires a combination of analytical skills, industry knowledge, and a keen eye for market trends.

Advertising's Impact: Exploring the Demand-Side Dynamics

You may want to see also

Regulatory Compliance: Navigating complex regulations to ensure ethical and legal practices

The world of investment banking is a complex and highly regulated environment, and regulatory compliance is a critical aspect of the profession. Investment bankers must navigate a myriad of rules and regulations to ensure that their practices are ethical, transparent, and in full compliance with the law. This is especially important given the high-stakes nature of financial transactions and the potential for significant impact on clients, investors, and the broader economy.

Regulatory compliance in investment banking involves a comprehensive understanding of various laws and regulations, including those related to securities, derivatives, market manipulation, insider trading, and financial reporting. These rules are designed to protect investors, maintain market integrity, and prevent financial crimes. Investment bankers must stay abreast of these regulations, as they are frequently updated and can vary significantly across different jurisdictions. For instance, the regulations governing investment banking activities in the United States are set by the Securities and Exchange Commission (SEC), while in Europe, the European Securities and Markets Authority (ESMA) plays a similar role.

One of the key challenges for investment bankers is the dynamic and ever-changing nature of the regulatory landscape. New laws and amendments are introduced regularly, often in response to market events or global financial crises. Keeping up with these changes is essential to ensure that investment bankers can adapt their practices accordingly. This includes staying informed about industry-specific regulations, such as those related to initial public offerings (IPOs), mergers and acquisitions (M&A), and structured finance.

To navigate this complex regulatory environment, investment bankers employ various strategies. They often work closely with legal teams to ensure that all transactions and activities comply with the relevant laws and regulations. Additionally, they may utilize compliance software and tools to streamline the monitoring and reporting of regulatory requirements. These tools can help identify potential risks and ensure that all necessary documentation is in place.

Furthermore, investment bankers must foster a culture of compliance within their organizations. This involves training and educating staff on regulatory matters, encouraging open communication about potential risks, and promoting a strong ethical framework. By doing so, investment bankers can create an environment where ethical and legal practices are not just a requirement but a core value. This approach not only helps in avoiding legal pitfalls but also enhances the firm's reputation and builds trust with clients and investors.

Millennial Homeowners: Why Buying is the Smartest Investment Move

You may want to see also

Frequently asked questions

No, while Wall Street is a well-known financial district in New York City and a hub for many investment banks, investment bankers can work from various locations. Many investment banks have offices in major financial centers worldwide, such as London, Hong Kong, Singapore, and Tokyo. The nature of investment banking often involves global operations, and professionals in this field may travel frequently to meet clients and conduct business.

Absolutely not. While Wall Street is a significant employer in the investment banking sector, there are numerous other financial institutions and firms that offer investment banking services. These include boutique investment banks, private equity firms, hedge funds, asset management companies, and even large corporations with dedicated financial departments. Investment bankers can find opportunities in various cities and regions, not limited to Wall Street.

Investment bankers perform a wide range of tasks, including financial advisory services, capital raising, mergers and acquisitions (M&A) advice, initial public offerings (IPOs), debt and equity underwriting, market research, and investment analysis. They work closely with clients to provide strategic advice, structure deals, and facilitate transactions. Investment bankers often specialize in specific areas, such as technology, healthcare, energy, or real estate.

Yes, investment banking is known for its demanding work culture, often requiring long hours, especially during busy periods or when dealing with high-profile deals. The industry is fast-paced and competitive, and professionals are expected to be dedicated and committed to their work. However, the culture is evolving, and many firms are taking steps to promote work-life balance and employee well-being.

While a strong educational background is essential, investment banking firms look for a diverse range of qualifications. Many investment bankers hold advanced degrees such as MBAs or Masters in Finance, Economics, or related fields. However, a strong academic record, relevant work experience, and a solid understanding of financial markets and products are also highly valued. Additionally, skills in communication, analytical thinking, and team collaboration are crucial for success in this profession.