Ally Invest, a popular online investment platform, offers a range of investment options to cater to diverse financial goals. One of the key features that attracts investors is the ability to trade options, which can be a powerful tool for those seeking to generate income or hedge their existing positions. In this article, we will explore how Ally Invest's options trading platform works, the types of options available, and the benefits and risks associated with this investment strategy. Whether you're a seasoned options trader or new to the world of derivatives, understanding Ally Invest's options offerings can help you make informed decisions and potentially enhance your investment portfolio.

| Characteristics | Values |

|---|---|

| Platform | Ally Invest |

| Option Types | Stocks, ETFs, Options, Bonds, Mutual Funds |

| Option Trading | Yes, Ally Invest offers options trading for self-directed investors. |

| Commission Structure | Per-contract fees for options trades. |

| Minimum Deposit | $0 |

| Account Types | Individual, Joint, Trust, Retirement (IRA) |

| Research Tools | Limited compared to full-service brokers, but includes market data, charts, and news. |

| Customer Support | Phone, email, live chat, and online resources. |

| Mobile App | Yes, with real-time quotes, charts, and trade execution. |

| Security Features | Two-factor authentication, encryption, and fraud monitoring. |

| Regulatory Compliance | SEC-registered, FINRA member, SIPC protection. |

| Education Resources | Limited educational content available on their website. |

| Performance | Competitive pricing and a user-friendly platform. |

What You'll Learn

Ally Invest's Options Trading Platform: Features, Fees, and Tools

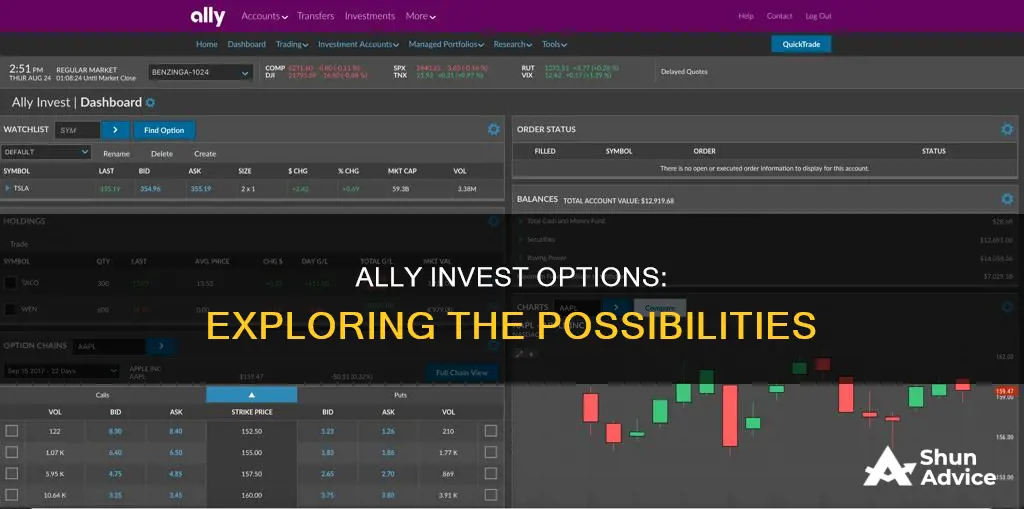

Ally Invest, a well-known online brokerage, offers a comprehensive options trading platform that caters to both novice and experienced traders. This platform provides a user-friendly interface and a range of features designed to enhance the options trading experience. Here's an overview of what Ally Invest's options trading platform has to offer:

Features:

- User-Friendly Interface: Ally Invest's platform is designed with simplicity in mind. It provides an intuitive dashboard, making it easy for traders to navigate through various options trading tools and resources. The platform is accessible via web browsers and mobile apps, ensuring traders can monitor their positions and execute trades on the go.

- Options Trading Education: New to options trading? Ally Invest offers extensive educational resources to help traders understand the basics and advanced concepts. This includes tutorials, webinars, and a comprehensive knowledge base, ensuring traders can make informed decisions.

- Advanced Trading Tools: The platform provides powerful tools for technical analysis, such as charting capabilities, technical indicators, and customizable watchlists. These tools enable traders to identify potential trading opportunities and make data-driven decisions.

- Real-Time Market Data: Access to real-time market data is crucial for options traders. Ally Invest provides live quotes, charts, and market news, ensuring traders can stay updated on market movements and make timely trading strategies.

- Risk Management Tools: Ally Invest offers risk management features to help traders control their exposure. This includes stop-loss orders, trailing stops, and position sizing tools, allowing traders to set their risk tolerance and manage potential losses.

Fees:

- Commission-Based Trading: Ally Invest charges a per-contract commission for options trades. The fee structure is competitive, with no hidden charges, making it transparent for traders. The commission rate may vary based on the type of options and trading volume.

- Inactivity Fees: It's important to note that Ally Invest may impose inactivity fees on accounts that have not been actively traded for a certain period. This fee is designed to cover maintenance costs and is standard practice in the industry.

- Other Fees: There might be additional fees for certain services, such as wire transfers or early withdrawal of funds. These fees are typically disclosed in the platform's fee schedule.

Tools and Resources:

- Options Strategy Builder: This tool allows traders to create and test various options strategies. By inputting specific parameters, traders can simulate potential outcomes and evaluate the risk-reward profile of their strategies.

- Option Chain Analysis: The platform provides detailed option chain data, including strike prices, expiration dates, and implied volatility. This information is essential for traders to analyze and make informed decisions about options purchases or sales.

- News and Research: Ally Invest offers access to financial news, research reports, and market insights. Staying informed about market trends and company-specific news can be valuable for options traders.

- Customer Support: A dedicated customer support team is available to assist traders with any queries or issues. They can provide guidance on platform usage, account management, and trading strategies.

Ally Invest's options trading platform is a comprehensive solution for traders seeking a user-friendly and feature-rich environment. With its educational resources, advanced tools, and competitive fee structure, it caters to a wide range of traders, from beginners to experienced options traders. By utilizing the platform's features and staying informed, traders can make informed decisions and potentially enhance their options trading performance.

Uber: Invest or Avoid?

You may want to see also

Ally Invest Options Strategies: Long, Short, and Spread

Ally Invest offers a range of options trading strategies to cater to different investor goals and risk appetites. These strategies include long, short, and spread trades, each with its own unique characteristics and potential benefits. Understanding these strategies is crucial for investors looking to optimize their returns and manage risk effectively.

Long Options Strategy:

The long options strategy is a fundamental approach in options trading. When you go long, you are essentially buying an option contract, which gives you the right, but not the obligation, to buy or sell an underlying asset at a predetermined price (strike price) before or at a specified expiration date. This strategy is suitable for investors who believe the price of the underlying asset will increase. By going long, you can profit from upward price movements while limiting potential losses to the option premium paid. For example, if you buy a call option on a stock, you have the right to purchase that stock at the strike price if the market price rises above it, allowing you to capture the upside potential.

Short Options Strategy:

In contrast, the short options strategy involves selling an option contract, which obligates the seller to deliver the underlying asset at the strike price if the buyer exercises the option. This strategy is employed when investors anticipate a decline in the underlying asset's price. By going short, traders can benefit from downward price movements while potentially earning income from the option premium received. However, it's important to note that short options carry significant risk, as the potential loss can be unlimited, especially in volatile markets. For instance, selling a put option on a stock means you are obligated to sell the stock at the strike price if the market price falls below it, which can result in substantial losses if the market moves against your position.

Spread Options Strategy:

Spread options strategies combine both long and short positions to create a hedging or speculative opportunity. There are two common types of spreads: vertical and horizontal. A vertical spread involves buying one option and selling another with the same underlying asset but different strike prices and expiration dates. This strategy is used to limit risk or speculate on price movements. For example, a calendar spread, a type of vertical spread, involves buying a call option with a higher strike price and selling a call option with a lower strike price in the same underlying asset but different expiration months. Horizontal spreads, on the other hand, involve buying and selling options with the same strike price but different underlying assets, often used for hedging purposes. These strategies allow investors to manage risk and potentially profit from market movements in a more controlled manner.

Ally Invest provides tools and resources to help investors understand and execute these options strategies effectively. It offers a user-friendly platform, educational materials, and real-time market data to facilitate informed decision-making. By exploring these strategies, investors can tailor their options trading approach to align with their financial objectives and risk tolerance.

Crafting a Careful Index Portfolio Strategy for the Retirement Home Stretch

You may want to see also

Ally Invest Options Education: Resources and Tutorials

Ally Invest offers a comprehensive suite of educational resources for those interested in learning about options trading. This is a crucial aspect of their platform, as options trading can be complex and requires a solid understanding of financial markets. Here's an overview of the educational tools and resources available:

Online Courses and Webinars: Ally Invest provides a range of online courses and webinars that cater to different skill levels. These educational sessions cover various topics, including options basics, strategies, and advanced concepts. For beginners, the "Options 101" course offers a gentle introduction, explaining what options are, how they work, and the key terms associated with them. More experienced traders can delve into topics like options strategies, risk management, and advanced pricing models. Webinars are also a great way to learn, as they often provide live demonstrations and Q&A sessions, allowing traders to ask questions and receive immediate feedback.

Interactive Tutorials: The platform features interactive tutorials that guide users through the process of trading options. These tutorials are designed to be engaging and informative, covering everything from account setup to executing trades. Users can learn at their own pace, with step-by-step instructions and visual aids. The tutorials also include practice exercises, enabling traders to apply their knowledge in a safe environment before venturing into live trading.

Market Insights and Research: Ally Invest provides access to market insights and research materials, which are essential for making informed trading decisions. This includes real-time market data, historical charts, and analysis tools. Users can study market trends, identify potential opportunities, and understand the factors influencing option prices. The research section also offers educational articles and reports, covering various economic indicators and their impact on options trading.

Customer Support and Community: Ally Invest's customer support team is available to assist traders with any questions or concerns they may have. This support can be particularly valuable for beginners, as it provides a direct line of communication for clarification and guidance. Additionally, the platform may offer a community forum or social media groups where traders can connect, share ideas, and discuss strategies. These communities can foster a collaborative learning environment, allowing traders to learn from each other's experiences.

By providing these educational resources, Ally Invest aims to empower its users to make informed decisions when trading options. The company understands that options trading can be a significant step for many investors, and thus, it emphasizes education as a core component of its platform. These resources not only help users understand the mechanics of options but also provide the skills and confidence needed to navigate the financial markets successfully.

Homes: The Ultimate Investment?

You may want to see also

Ally Invest Options Regulation: Compliance and Oversight

Ally Invest, a popular online investment platform, offers a range of investment options, including options trading, to its users. However, it is crucial to understand the regulatory framework surrounding options trading to ensure compliance and mitigate potential risks. This article delves into the regulatory aspects of Ally Invest's options trading services, highlighting the importance of oversight and adherence to financial regulations.

Options trading involves complex financial instruments that derive their value from an underlying asset. These assets can be stocks, commodities, currencies, or even other derivatives. Ally Invest, as a regulated broker-dealer, must adhere to specific rules and regulations set by financial authorities to protect investors and maintain market integrity. The primary regulatory body overseeing options trading in the United States is the Securities and Exchange Commission (SEC). The SEC's regulations, such as Regulation SHO and Regulation T, aim to prevent market manipulation, ensure fair trading practices, and safeguard investors' interests.

Compliance with these regulations is a multifaceted process. Firstly, Ally Invest must establish robust compliance policies and procedures. This includes implementing a comprehensive system to verify the identity of its customers, known as Know Your Customer (KYC) procedures, to ensure that options trading activities are authorized and legitimate. Additionally, the platform should have strict internal controls to monitor and report any suspicious activities, market manipulation, or unauthorized trading. Regular audits and risk assessments are essential to identify and address potential compliance gaps.

Another critical aspect of compliance is the proper handling of customer assets and the segregation of client funds from the firm's own capital. Ally Invest must ensure that customer funds are protected and not used for proprietary trading. This segregation is a fundamental principle to prevent financial losses and maintain investor confidence. Furthermore, the platform should provide transparent reporting and disclosure to its customers, detailing their trading activities, fees, and any potential risks associated with options trading.

In summary, Ally Invest's options trading services are subject to stringent regulations to ensure a fair and secure trading environment. Compliance with SEC regulations, such as Regulation SHO and Regulation T, is essential for maintaining market integrity and investor protection. By implementing robust compliance policies, verifying customer identities, and segregating client funds, Ally Invest can provide its users with a reliable and trustworthy options trading experience. Understanding and adhering to these regulations is vital for any online investment platform offering options trading, fostering a more transparent and stable financial market.

Ebooks: Eco-Friendly, Accessible, Affordable

You may want to see also

Ally Invest Options Customer Support: Contact and Assistance

If you're an investor looking to explore options trading with Ally Invest, it's crucial to understand the support options available to you. Ally Invest offers a comprehensive suite of customer support services tailored to options traders, ensuring you can navigate the complexities of options trading with confidence. Here's a breakdown of how to access and utilize their customer support:

Contact Channels:

- Phone: Ally Invest provides a dedicated phone line specifically for options trading support. You can reach their options trading support team at [insert phone number]. This direct line ensures you can quickly connect with knowledgeable representatives who are well-versed in options strategies and can address your specific concerns.

- Live Chat: For immediate assistance, the live chat feature on the Ally Invest website offers real-time support. This option is convenient for quick queries or if you need immediate guidance while trading.

- Email: If your inquiry is more detailed or requires documentation, email support is available. You can send your questions or concerns to [insert email address]. Ally Invest's support team typically responds within a specified timeframe, ensuring you receive the information you need.

Customer Support Resources:

Ally Invest goes beyond traditional customer support by offering a wealth of resources specifically designed for options traders:

- Educational Materials: They provide a comprehensive library of educational resources, including articles, guides, and webinars, to help you understand options trading concepts, strategies, and risks. These resources are accessible on their website and can be a valuable tool for beginners and experienced traders alike.

- Webinars and Workshops: Ally Invest regularly hosts webinars and workshops led by industry experts. These sessions cover various topics, from options basics to advanced strategies. Attending these events can provide you with practical insights and tips to enhance your options trading journey.

- Research and Analysis: The platform offers in-depth research and analysis tools specifically tailored to options trading. This includes market data, option chain analysis, and real-time quotes, empowering you to make informed trading decisions.

Assistance for Specific Needs:

Ally Invest's customer support is equipped to handle a wide range of inquiries, including:

- Account Setup and Funding: Assistance with opening an options trading account, funding options, and understanding the associated fees and requirements.

- Order Placement and Execution: Guidance on placing options orders, executing trades, and managing your portfolio.

- Risk Management: Support in understanding and managing the risks associated with options trading, including margin requirements and potential losses.

- Technical Issues: Help with resolving any technical glitches or platform-related issues you may encounter while trading options.

Proactive Support:

Ally Invest also offers proactive support features:

- Market Alerts: Stay informed with real-time market alerts that notify you of significant price movements or news related to your options trades.

- Personalized Support: For high-net-worth investors or those with complex needs, Ally Invest provides personalized support, ensuring tailored assistance and dedicated account management.

By utilizing Ally Invest's comprehensive customer support, you can navigate the world of options trading with confidence, knowing that you have access to expert guidance and valuable resources.

Conservative Investing in Retirement: Strategies for a Secure Future

You may want to see also

Frequently asked questions

Ally Invest does not offer options trading directly. They provide a range of investment products, including stocks, bonds, and mutual funds, but options are not included in their current offerings.

At this time, Ally Invest has no immediate plans to introduce options trading. The company focuses on providing a user-friendly and secure platform for various investment needs, and options trading may not align with their current strategy.

Yes, there are several online brokerage firms and investment platforms that offer options trading. These platforms provide access to a wide range of financial instruments, including options, allowing investors to build diversified portfolios. It is recommended to research and compare different providers to find the one that best suits your investment goals and risk tolerance.