Robin Hood Investment App is a popular mobile application that offers a unique approach to investing. It provides a user-friendly platform where individuals can invest in fractional shares of stocks and exchange-traded funds (ETFs) with just a few taps on their smartphones. The app aims to democratize investing by allowing users to invest in companies they believe in, even if they can't afford to buy a full share. With a focus on accessibility and simplicity, Robin Hood enables users to build a diversified portfolio and potentially benefit from the long-term growth of the stock market. This introduction sets the stage for further exploration of the app's features, benefits, and how it works to empower individual investors.

| Characteristics | Values |

|---|---|

| Investment Platform | Robin Hood is a mobile app-based investment platform that allows users to trade stocks, options, ETFs, and cryptocurrencies. |

| Commission-Free Trading | The app offers commission-free trading for US-listed stocks, ETFs, and options. |

| Fractional Shares | Users can invest in fractional shares, allowing them to own a portion of a company's stock with a small amount of money. |

| Cryptocurrency Trading | It provides access to trade various cryptocurrencies, including Bitcoin, Ethereum, and others. |

| Social Features | The platform includes a social feed where users can share their trades, insights, and market commentary. |

| Research and Education | Robin Hood offers educational resources, market insights, and research tools to help users make informed investment decisions. |

| Portfolio Management | Users can track their investment portfolio, view performance, and receive personalized recommendations. |

| Customer Support | 24/7 customer support via in-app chat, email, and phone. |

| Security | Two-factor authentication, encryption, and fraud monitoring to protect user accounts. |

| Accessibility | Available on iOS and Android devices, with a user-friendly interface. |

| Regulatory Compliance | Adheres to US financial regulations and is a member of the Securities Investor Protection Corporation (SIPC). |

What You'll Learn

- Investment Platform: Robin Hood offers a mobile app for investing in stocks, ETFs, and options

- Commission-Free Trading: Users can trade stocks, ETFs, and options without paying commissions

- Fractional Shares: Invest in partial shares of companies, allowing access to diverse portfolios

- Social Impact: The app promotes financial literacy and encourages investing in companies with social missions

- User-Friendly Interface: An intuitive design makes it easy for beginners to navigate and manage investments

Investment Platform: Robin Hood offers a mobile app for investing in stocks, ETFs, and options

Robin Hood is a popular mobile investment app that has revolutionized the way people invest in the stock market. It provides a user-friendly platform, allowing individuals to buy and sell stocks, exchange-traded funds (ETFs), and even options, all from their smartphones. This app has gained a significant following due to its simplicity, accessibility, and commitment to democratizing investing.

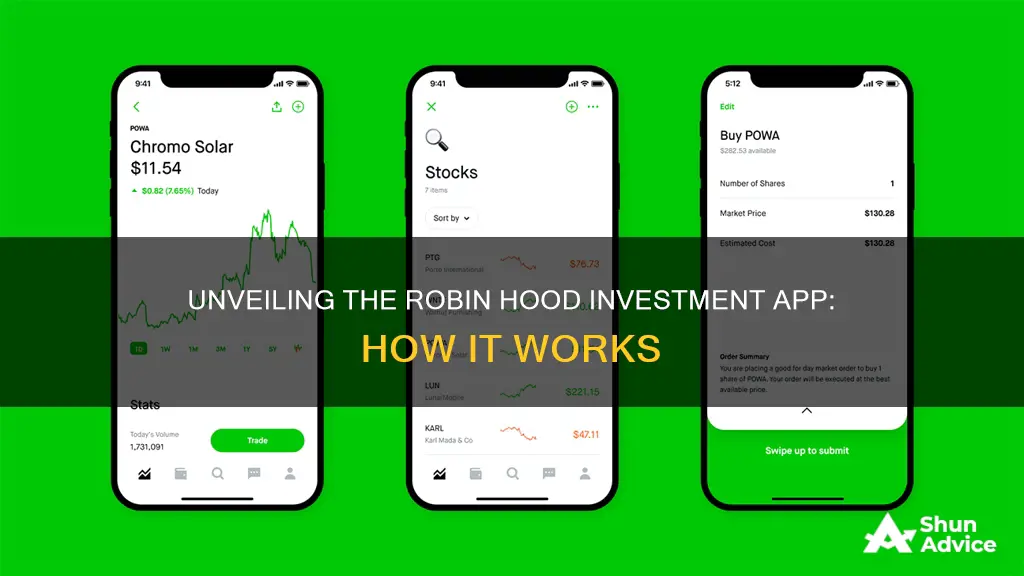

The Robin Hood app offers a straightforward interface, making it easy for beginners to navigate the world of investing. Users can quickly set up an account, fund it with a bank transfer or debit card, and start investing with just a few taps. The platform provides a comprehensive list of stocks and ETFs, allowing investors to choose from a wide range of companies and industries. Whether you're interested in tech giants, healthcare providers, or renewable energy companies, Robin Hood offers a diverse selection to cater to various investment preferences.

One of the key features of the Robin Hood app is its commission-free trading. Unlike traditional brokers, Robin Hood does not charge any fees for buying or selling stocks, ETFs, or options. This model, often referred to as a 'no-fee' or 'commission-free' trading app, has made investing more accessible to a broader audience. By eliminating these costs, the app encourages more frequent trading and empowers investors to take advantage of short-term market opportunities.

In addition to commission-free trading, the app provides educational resources to help users improve their investment knowledge. It offers a comprehensive learning center with articles, tutorials, and videos covering various topics, from basic investing principles to advanced strategies. This educational approach ensures that users can make informed decisions and build their investment portfolios over time.

Furthermore, Robin Hood's app provides real-time market data and personalized watchlists. Users can track their chosen stocks and ETFs, receive price alerts, and stay updated on market trends. The app also offers portfolio tracking, allowing investors to monitor their holdings' performance and make adjustments as needed. With its intuitive design and powerful features, the Robin Hood investment app has become a go-to choice for those seeking a convenient and cost-effective way to invest in the stock market.

New Media Investment Group Merger: When Will It Be Finalized?

You may want to see also

Commission-Free Trading: Users can trade stocks, ETFs, and options without paying commissions

Robin Hood, a popular mobile investing app, has revolutionized the way people invest by offering commission-free trading for stocks, ETFs (Exchange-Traded Funds), and options. This feature has attracted a large user base, especially among those who are new to investing or prefer a more cost-effective approach. Here's a detailed look at how commission-free trading works on the Robin Hood app:

When you sign up for an account on Robin Hood, you'll have access to a wide range of investment options, all without the burden of traditional trading fees. The app's primary focus is to provide an accessible and user-friendly platform for trading, making it an attractive choice for beginners and experienced investors alike. Commission-free trading means that users can execute trades without incurring additional costs, which is a significant advantage over traditional brokerage firms that often charge per-trade fees. With Robin Hood, you can buy and sell stocks, ETFs, and options without worrying about these extra charges, allowing for more flexibility and potentially higher returns.

The app's interface is designed to be intuitive, making it easy for users to navigate and place trades. When you select a stock, ETF, or option to trade, the app provides a clear overview of the security's performance, historical data, and relevant news. This information empowers users to make informed decisions. For instance, you can view a stock's price history, dividend information, and key financial metrics, all of which are essential for assessing the potential of an investment. The app also offers educational resources and tutorials to help users understand the basics of investing and trading.

One of the key benefits of commission-free trading on Robin Hood is the ability to build a diversified portfolio. Users can easily buy and hold various stocks, ETFs, and options, allowing for a well-rounded investment strategy. For example, you might invest in a mix of large-cap and small-cap stocks, sector-specific ETFs, and even individual options contracts to hedge against market risks. The app's low-cost structure enables investors to take advantage of long-term wealth-building opportunities without incurring excessive fees that could eat into potential profits.

Additionally, Robin Hood's commission-free trading model encourages frequent trading, which can be beneficial for short-term investors. Users can take advantage of market fluctuations and news events to execute trades multiple times a day without incurring additional costs. This accessibility and flexibility have made the app particularly popular among day traders and active investors who aim to capitalize on short-term market movements.

In summary, Robin Hood's commission-free trading feature is a game-changer for investors, offering a cost-effective and user-friendly approach to trading stocks, ETFs, and options. The app's intuitive design, educational resources, and low-cost structure make it an excellent choice for both beginners and experienced traders looking to optimize their investment strategies. By eliminating traditional trading commissions, Robin Hood empowers users to take control of their financial future and potentially build wealth over time.

Investing: Personal Definitions of Risk and Reward

You may want to see also

Fractional Shares: Invest in partial shares of companies, allowing access to diverse portfolios

Fractional shares are a revolutionary concept in the world of investing, allowing individuals to own a portion of a company's stock without purchasing the entire share. This innovative approach to investing has gained significant popularity, especially with the rise of mobile investment apps like Robinhood. The idea behind fractional shares is to democratize investing, making it accessible to a wider range of people, including those with limited funds.

With traditional investing, buying a single share of a company often requires a substantial amount of capital, which can be a barrier for many investors. Fractional shares change this by enabling investors to purchase a fraction of a share, typically a tenth or a hundredth of a share. For example, if a company's share price is $100, you can invest in 0.1 shares, which would cost $10, or even 0.01 shares for a $1 investment. This approach allows investors to build a diversified portfolio by investing in multiple companies with smaller amounts of money.

The beauty of fractional shares lies in their ability to provide access to a diverse range of companies and industries. Investors can now easily invest in well-known blue-chip stocks, as well as emerging startups, without needing a large sum of money. This accessibility opens up opportunities for individuals to participate in the stock market and potentially benefit from the long-term growth of various companies. For instance, with a small investment, you could own a fraction of Apple, Microsoft, or even a promising tech startup, which was previously out of reach for many retail investors.

Robinhood, a popular investment app, has embraced this concept and offers fractional share investing as a core feature. Users can create a diverse investment portfolio by buying partial shares of numerous companies. This approach encourages a long-term investment strategy, as investors can hold a variety of stocks and benefit from the overall growth of the market. Additionally, the app's user-friendly interface and zero-commission trading model make it an attractive option for those new to investing or looking for a more accessible way to participate in the financial markets.

Fractional shares have the potential to empower a new generation of investors, providing them with the tools to build a diversified portfolio. This method of investing is particularly appealing to younger individuals who want to start investing early and benefit from long-term market growth. By allowing people to invest in partial shares, the financial industry is becoming more inclusive, and the barriers to entry for investing are being significantly reduced.

Investing in Corporations: Why?

You may want to see also

Social Impact: The app promotes financial literacy and encourages investing in companies with social missions

The Robin Hood investment app has gained popularity for its unique approach to investing, which includes a strong emphasis on social impact. This app aims to democratize access to the stock market and promote financial literacy among its users, particularly those who might not have had the opportunity to invest before. By doing so, it encourages a new generation of investors who are not only focused on financial gains but also on supporting companies with positive social missions.

Financial literacy is a critical aspect of the app's strategy. It provides educational resources and tools to help users understand the stock market, investment strategies, and the impact of their financial decisions. This is particularly beneficial for those who are new to investing, as it equips them with the knowledge to make informed choices. The app's interface is designed to be user-friendly, making it accessible to a wide range of individuals, from students to professionals.

One of the key features that sets Robin Hood apart is its focus on companies with social missions. These are businesses that go beyond profit and actively contribute to social causes such as environmental sustainability, community development, and ethical labor practices. The app allows users to invest in these companies, providing them with a platform to support and promote these social enterprises. By doing so, the app encourages a more conscious form of investing, where users can align their financial decisions with their values.

For instance, a user might choose to invest in a renewable energy company that is committed to reducing carbon emissions. This investment not only provides financial returns but also contributes to a more sustainable future. Similarly, investing in a company that promotes fair trade and ethical sourcing can support workers' rights and improve supply chain transparency. The app's ability to highlight these social impacts can motivate users to make investments that have a positive societal effect.

In summary, the Robin Hood investment app's social impact lies in its ability to educate and empower users to make informed investment choices. By promoting financial literacy and encouraging investments in companies with social missions, the app fosters a community of conscious investors. This approach not only benefits the users financially but also contributes to a more socially responsible and sustainable economy.

Retirement Investment Strategies: Navigating Your Golden Years

You may want to see also

User-Friendly Interface: An intuitive design makes it easy for beginners to navigate and manage investments

The Robin Hood investment app is designed with a user-friendly interface, making it accessible and intuitive for beginners to navigate and manage their investments. The app's layout is clean and straightforward, ensuring that users can easily find the information they need. Upon opening the app, users are greeted with a simple dashboard that provides an overview of their investment portfolio. This dashboard includes key metrics such as total assets, recent activity, and performance over time. The use of clear and concise language, along with visually appealing charts and graphs, allows users to quickly understand their investment status.

One of the key features of the user-friendly interface is the simplicity of the investment process. Users can quickly set up their investment accounts, choose from a variety of investment options, and make transactions with just a few taps. The app provides a step-by-step guide for each action, ensuring that beginners can follow along easily. For example, when investing in stocks, the app explains the process of selecting a company, entering the desired amount, and confirming the transaction. This level of guidance empowers new investors to make informed decisions without feeling overwhelmed.

Navigation within the app is seamless, with well-organized menus and categories. Users can easily switch between their portfolio, watchlist, and transaction history. The search function is powerful, allowing users to quickly find specific investments or categories. For instance, if a user wants to learn more about a particular stock, they can search for it and access detailed information, including company news, financial data, and analyst ratings. This level of organization and accessibility ensures that users can manage their investments efficiently, even if they are new to the world of investing.

The app also offers personalized recommendations and educational resources to further enhance the user experience. It provides tailored investment suggestions based on an individual's risk tolerance and financial goals. Additionally, the app includes an extensive knowledge base with articles, tutorials, and videos that cover various investment topics. These resources empower beginners to educate themselves and make more confident investment choices. The combination of a user-friendly interface, simple investment processes, and educational tools makes the Robin Hood app an excellent choice for those new to investing.

In summary, the Robin Hood investment app's user-friendly interface is a key factor in its success, especially for beginners. The intuitive design, simple investment processes, and organized navigation make it easy for users to manage their investments. With clear information presentation, seamless navigation, and personalized educational resources, the app ensures that new investors can feel confident and informed in their financial journey. This user-centric approach is a significant advantage for the app, attracting and retaining a wide range of investors.

The Great Debate: Paying Off Your Home vs. Investing — Which Path is Right for You?

You may want to see also

Frequently asked questions

Robin Hood is a mobile app that allows users to invest in stocks, ETFs, and options with no commission. It provides a user-friendly interface and offers a range of investment options, making it accessible for beginners and experienced investors alike. The app also includes educational resources and market insights to help users make informed decisions.

The app offers several features such as fractional shares, allowing investors to buy a portion of a stock, which is beneficial for those who want to invest in expensive stocks with smaller amounts. It also provides real-time market data, news feeds, and a social community where users can discuss investments and share insights. Additionally, the app offers automated investment plans and the ability to set up recurring investments.

Yes, Robin Hood prioritizes security and user data protection. The app utilizes encryption technology to safeguard user information and transactions. It also employs two-factor authentication for added security. Furthermore, the company has a strong focus on regulatory compliance, ensuring that user funds are protected and that the app operates within legal boundaries.