When it comes to investments, cash flow is an important metric to consider. Cash Flow from Investing Activities (CFI) is a section of a company's cash flow statement that outlines the cash inflow and outflow from various investment activities, such as purchasing and selling investments, as well as earnings from those investments. This includes investments in physical assets, securities, or the sale of securities or assets. While negative cash flow can be an indicator of poor performance, this is not always the case with CFI. Investments in the long-term health of a company, such as research and development, can lead to short-term losses but potentially significant long-term gains if managed well.

Cash investments, on the other hand, refer to short-term financial instruments with high liquidity, minimal market risk, and a maturity period of less than 3 months. These include cash management accounts and money market funds, which offer higher returns than traditional savings accounts while maintaining low risk. However, cash investments may not always keep up with inflation and may not generate returns above the inflation rate, impacting purchasing power over time. Therefore, it is crucial to strike a balance between cash and investments in a portfolio, with cash occupying only a small portion relative to stocks and bonds.

| Characteristics | Values |

|---|---|

| Cash Flow from Investing Activities | One of the three sections of a company's cash flow statement |

| Cash Flow from Investing Activities (CFI) | Tracks the cash inflow and outflow from investing activities |

| CFI | Gives the net amount of cash flow for a specific time (accounting period) |

| CFI | Comprises all the transactions of buying and selling non-current assets and marketable securities |

| Non-current assets | Assets that are expected to deliver value and benefits in the long run (1+ years) |

| Non-current assets | Highly illiquid, meaning they can't be easily or rapidly converted to cash |

| Marketable securities | A lot more liquid, meaning they're much easier to convert to cash |

| Cash investments | Short-term financial instruments with high liquidity, minimal market risk, and a short maturity period (usually less than 3 months) |

| Cash investments | Cash management accounts and money market funds |

| Cash investments | Tend to generate more modest returns than stocks or bonds |

| Cash | Available when you need it and there's little risk to principal |

| Cash | Not a substitute for stocks or bonds |

| Cash | May sometimes feel like the safest way to go, but having too much can slow progress toward your goals |

What You'll Learn

Cash flow from investing activities (CFI)

CFI reports how much cash has been generated or spent from various investment-related activities in a specific period. This includes the purchase of physical assets, investments in securities, or the sale of securities or assets.

A negative cash flow from investing activities is not necessarily a bad sign. It can indicate that management is investing in the long-term health of the company, such as research and development. While this may lead to short-term losses, it could result in significant growth and gains if those investments are managed well.

The total cash flow from investing in an accounting period is found by adding together both positive and negative investing activities listed on the cash flow statement.

The cash flow statement bridges the gap between the income statement and the balance sheet. It shows how much cash is generated or spent on operating, investing, and financing activities for a specific period.

General Partners: Cash Investment Strategies and Decisions

You may want to see also

Cash investments and savings products

Cash investments are short-term financial instruments with high liquidity, minimal market risk, and a maturity period of less than three months. They are readily available and allow you to keep your money safer from market risk.

Types of Cash Investments

Cash investments include cash management accounts and money market funds. Money market funds are a type of mutual fund with ultra-short-term maturities ranging from a few days to a year and are considered lower-risk investments. They are extremely liquid, allowing quick access to your money. Money market funds invest in low-risk assets like U.S. Treasury bills and CDs, making them one of the safest investments.

Certificates of Deposit (CDs) are not considered cash due to their longer maturity and minimum investment period. However, they are appropriate for certain types of savings. CDs are promissory notes issued by banks, insured by the FDIC, and considered safe if held until maturity. They have a specified interest rate and maturity date, usually five years or less, and may offer higher interest rates for longer terms.

Advantages of Cash Investments

Cash investments tend to generate more modest returns than stocks or bonds but offer the advantage of keeping your money safer and easily accessible. They are suitable for short-term financial goals, providing higher returns than traditional bank savings accounts while avoiding the risk of losing money in a market downturn.

Factors to Consider

When deciding on a cash investment or savings product, consider how they provide yields, how soon you need access to your money, and whether you prefer Federal Deposit Insurance Corporation (FDIC) insurance coverage. While cash investments strive to reduce risk, their yields can change frequently and are closely tied to the federal funds rate.

When to Invest in Cash

Cash should occupy a small portion of most investment portfolios, primarily serving two strategic purposes: emergency funds and money to be invested. For emergency funds, financial advisors recommend highly liquid forms of cash, such as bank savings or checking accounts, with savings to last at least three months.

For money to be invested, consider cash investment vehicles based on the time frame before deployment. Bank accounts or traditional money market mutual funds offer immediate daily access, while "prime" money market funds may offer higher rates but with a waiting period of several days. If your timeframe is longer, a managed solution like a separately managed account could provide higher yields with incrementally higher risk.

Opportunity Cost of Holding Too Much Cash

While cash may feel like the safest option, holding too much cash can slow progress toward your financial goals. It is important to stay invested for the long term to capture the opportunities that equities and bonds offer. Additionally, trying to time the market by pulling money out of markets after price declines and hesitating to reinvest until recovery can be counterproductive, causing you to miss out on potential gains.

Extra Cash: Where to Invest for Maximum Returns

You may want to see also

Cash flow from operating activities

The cash flow statement is divided into three sections: cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities. The first section, cash flow from operating activities, depicts the cash-generating abilities of a company's core business activities. It typically includes net income from the income statement and adjustments to modify net income from an accrual accounting basis to a cash accounting basis.

There are two methods for depicting cash from operating activities on a cash flow statement: the indirect method and the direct method. The indirect method is the most commonly used, as it is simple to prepare and most companies use the accrual method of accounting. It begins with net income from the income statement and then adds back non-cash items to arrive at a cash basis figure. The direct method, recommended by the Financial Accounting Standards Board (FASB), tracks all transactions in a period on a cash basis and uses actual cash inflows and outflows on the cash flow statement.

The cash flow from operating activities is an important metric for investors, who use it to determine where a company is getting its money from. It is also a good gauge of a company's performance and liquidity, as it focuses on the main product or service within a company. Positive cash flow from operating activities indicates that the core business activities of the company are thriving.

Temporary Investments: Are They Really Cash?

You may want to see also

Cash flow from financing activities

CFF provides investors with insight into a company's financial strength and how well its capital structure is managed. It measures the movement of cash between a company and its owners, investors, and creditors. This includes debt, equity, and dividend transactions.

Financing activities include transactions involving debt, equity, and dividends. For example, when a company takes on debt, it issues bonds or takes out a loan from a bank. This is reflected in the cash flow from financing section, which varies with the different capital structures, dividend policies, or debt terms that companies may have.

The formula for calculating CFF is:

> CFF = CED − (CD + RP)

>

> where:

>

> CED = Cash in flows from issuing equity or debt

>

> CD = Cash paid as dividends

>

> RP = Repurchase of debt and equity

Another way to calculate CFF is:

> Cash Flow from Financing = Debt Issuances + Equity Issuances + (Share Buybacks) + (Debt Repayment) + (Dividends)

Here, debt and equity issuances are shown as positive cash inflows, while share buybacks, debt repayments, and dividends are negative cash outflows.

Positive CFF indicates that more money is flowing into the company than out, increasing its assets. However, this could be a warning sign if the company already has a lot of debt. Negative CFF could mean the company is servicing, retiring debt, or making dividend payments and stock repurchases, which investors may view as positive.

Understanding the Investing Activities on a Cash Flow Statement

You may want to see also

Cash flow statement

A cash flow statement is a financial document that provides a detailed picture of a business's cash flow during a specified period, known as the accounting period. It demonstrates a business's ability to operate in the short and long term, based on how much cash is flowing into and out of the business. The cash flow statement is typically broken into three sections: operating activities, investing activities, and financing activities.

Operating Activities

Operating activities detail cash flow that is generated once a company delivers its regular goods or services and includes both revenue and expenses. This includes cash received from the sale of goods and services, salary and wage payments, and payments to suppliers for inventory or goods needed for production.

Investing Activities

Investing activities include cash flow from the purchase or sale of assets, including physical property (such as real estate or vehicles) and non-physical property (such as patents). This section also includes cash flow from investments in securities.

Financing Activities

Financing activities detail cash flow from both debt and equity financing. This includes cash flow from issuing debt or equity, as well as cash flow from dividend payments, stock repurchases, and repayment of debt.

The cash flow statement is an important tool for investors, creditors, and business owners to understand a company's financial health and make informed decisions. It is one of the three main financial statements, along with the balance sheet and the income statement.

There are two methods for calculating cash flow: the direct method and the indirect method. The direct method involves listing all cash receipts and payments during the reporting period. The indirect method starts with net income and adjusts for changes in non-cash transactions.

Securities Trading: Part of Investing Cash Flow?

You may want to see also

Frequently asked questions

CFI is one of the three sections on a company's cash flow statement, alongside cash flow from operations and cash flow from financing activities. It reports the net amount of cash generated or lost from investing activities in a specific period.

Investing activities include purchasing and selling investments, as well as earnings from investments. Examples include buying property, equipment, or marketable securities like stocks, and selling off or leasing equipment, property, or securities.

CFI gives a clear breakdown of how much money is spent on future growth and how consistently investments are made. It can help track how cash is allocated and determine if investments have paid off. It also shows how much cash is in marketable securities, which can be used to free up cash when needed.

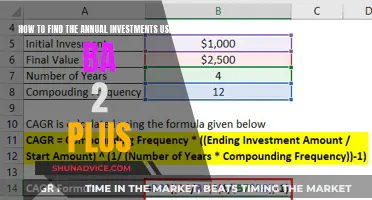

There is no singular formula, but a generally accepted one is: Cash flow from investing activities = CapEx/purchase of non-current assets + marketable securities + business acquisitions - divestitures (sale of investments).