The BA II Plus is a financial calculator made by Texas Instruments, designed for business professionals and students. It can be used for accounting, economics, finance, marketing, mathematics, real estate, science and statistics applications. The calculator can be used to find the annual investments by inputting the required data and performing the necessary calculations. For example, to calculate the net present value (NPV), you would input the uneven cash flows into the cash flow register and then press the NPV button on the calculator. The BA II Plus can also be used to calculate the internal rate of return (IRR), future value (FV), and present value (PV) of an investment.

| Characteristics | Values |

|---|---|

| Calculator | Texas Instruments BA II Plus |

| Use | To calculate the Net Present Value (NPV) and Internal Rate of Return (IRR) |

| Cash Flows | CFo, C01, C02, etc. |

| Initial Investment | Negative value |

| Frequency | F fields |

| NPV Calculation | Input rate of return, then press CPT |

| IRR Calculation | Press IRR, then CPT |

| Decimal Places | 4 |

| Operating System | Algebraic Operating System (AOS) |

| Payments per Year | 1 |

| Payments | End-of-Year |

| Compounding | Annual |

What You'll Learn

Net Present Value (NPV)

NPV is calculated by estimating the timing and amount of future cash flows and selecting a discount rate equal to the minimum acceptable rate of return. The discount rate may reflect the cost of capital or the returns available on alternative investments of comparable risk.

The formula for calculating NPV is:

NPV = Cash flow / (1 + i)^t – initial investment

Where:

- I = required return or discount rate

- T = number of time periods

NPV can be calculated using a Texas Instruments BA II Plus calculator. The steps are as follows:

- Input the initial investment by pressing the CF (cash flow) button and typing in the amount. Make the number negative since it is a payout.

- Hit enter, then the down arrow.

- Enter the future cash flows from the potential project. The calculator will prompt you for the first cash flow. Type in the amount, press enter, then the down arrow.

- For each subsequent cash flow, enter the amount and press enter. If the cash flow occurs more than once in a row, enter the frequency when prompted.

- Once all cash flows are entered, calculate the NPV by hitting the NPV key and entering the interest rate. Hit compute.

A positive NPV indicates that the projected earnings from an investment exceed the anticipated costs, and the investment is likely to be profitable. A negative NPV suggests that the investment will result in a net loss.

Understanding Cash Outflow: Investing Strategies and Money Management

You may want to see also

Compound Annual Growth Rate (CAGR)

The Compound Annual Growth Rate (CAGR) is a formula used to calculate the mean annual growth rate of an investment over a period of time longer than one year. It is considered one of the most accurate ways to calculate and determine returns for anything that can rise or fall in value over time.

CAGR is a useful metric for investors to gauge the performance of their investments over time. It provides a clearer picture of an investment's growth trajectory by smoothing out annual returns. However, it does not account for volatility or risk.

- Press [2nd] [P/Y], input 1, then press [ENTER] [2nd] [QUIT].

- Press [2nd] [CLR TVM].

- Input the number of years and press [N].

- Input the beginning value and press [+/-] [PV].

- Input the ending value and press [FV].

- Press [CPT] [I/Y]. The calculator will display the CAGR as a percentage.

You can also calculate CAGR manually using the following formula:

CAGR = ((Ending Value / Beginning Value) ^ (1/n)) - 1

Where:

- Ending Value = the value of an investment at the end of the period

- Beginning Value = the value of an investment at the start of the period

- N = the number of years

For example, if an investment grew from $10,000 to $19,500 in three years, the CAGR would be calculated as follows:

CAGR = ((19,500 / 10,000) ^ (1/3)) - 1 = 24.93%

Cash Investments: Where Are They Reported?

You may want to see also

Capital Budgeting

There are several methods of capital budgeting, including:

- Discounted cash flow analysis

- Payback analysis

- Throughput analysis

- Net Present Value (NPV) method

- Internal Rate of Return (IRR)

- Modified Internal Rate of Return (MIRR)

The choice of method depends on the specific project and business goals. For example, the NPV method provides a dollar-denominated present value return from the investment, while the IRR method provides a percentage return on investment.

A Texas Instruments BA II Plus calculator can be used to calculate capital budgeting. The steps to do so are as follows:

- Set Decimal Places to four: Press [2nd] [Format] [4] [2nd] [Set] [Enter] [2nd] [Quit].

- Choose the Algebraic Operating System (AOS): Press [2nd] [Format] [UP][UP][UP][UP] [2nd] [Set] [Enter] [2nd] [Quit].

- Set Payments per Year (P/Y) to one: Press [2nd] [P/Y] [1] [Enter] [2nd] [Quit].

- Check if Payments are End-of-Year: Press [2nd] [BGN]. If the display reads AEND@, exit by pressing [2nd] [Quit]. If the display reads ABGN,@ press [2nd] [Set], so the display reads AEND@. Then exit by pressing [2nd] [Quit].

- Input the number of years, the initial investment (as a negative number), and the expected cash flows for each year.

- Calculate the NPV by pressing the NPV key and entering the interest rate. Hit Compute. If the NPV is positive, the project should be accepted.

- Calculate the IRR by pressing the IRR button after calculating the NPV and hitting Compute.

Where Should Your Cash Be Held?

You may want to see also

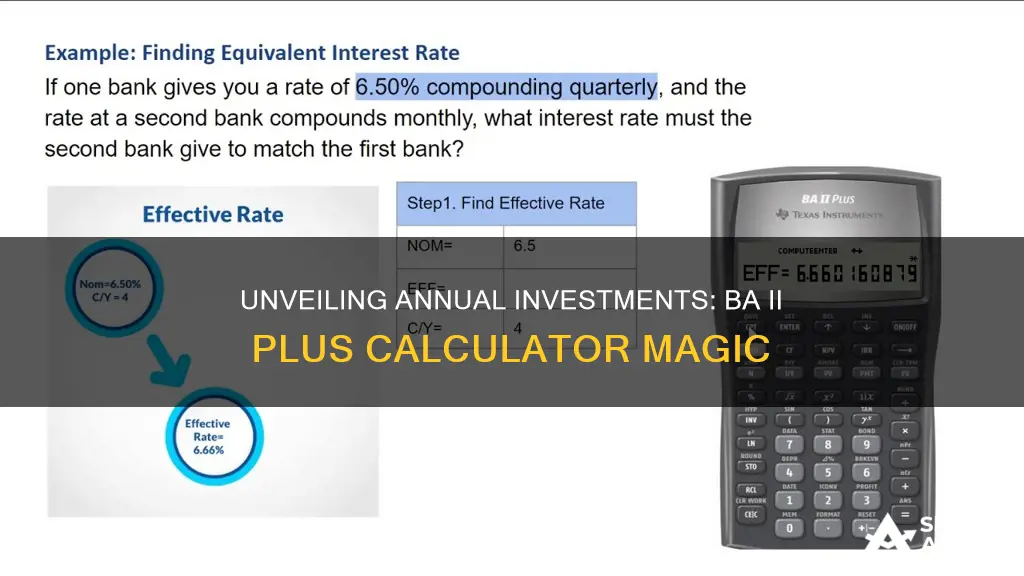

Interest Rate

The Texas Instruments BA II Plus calculator can be used to calculate interest rates. This is done using the Time Value of Money feature. The interest rate is one of four possible inputs (N, I/Y, PV, and FV) in a lump-sum problem. The other three are the number of payments (N), present value (PV), and future value (FV). To calculate the interest rate, the other three values must be known.

For example, let's calculate the interest rate on a mortgage of $75,000 with payments of $576.69 each month for 360 months. Here are the steps:

- Press the [2nd] key and the [I/Y] key to enter the P/Y worksheet.

- Set P/Y to 12 for monthly payments by entering 12 and pressing [ENTER]. This sets the C/Y (compounding periods) to monthly.

- Press [2nd] and [CPT] to exit the P/Y worksheet.

- Press [2nd] and [FV] to clear the TVM worksheet.

- Input 75000 and press [PV] to store the value in the Present Value register.

- Input 576.69, press the [+/-] key, and press [PMT] to store the value in the Payment register.

- Input 360 and press [N] to store the value in the N register.

- Press [CPT] and [I/Y]. The calculator will display the interest rate, which in this case is 8.50%.

The BA II Plus calculator can also be used to calculate the Compounded Annual Growth Rate (CAGR) of an investment. CAGR is the year-over-year growth rate of an investment over a length of time. For example, to calculate the CAGR of an investment that grows from $10,000 to $19,500 in three years:

- Press [2nd] [P/Y], input 1, then press [ENTER] [2nd] [QUIT].

- Press [2nd] [CLR TVM].

- Input 3 and press [N].

- Input 10000 and press [+/-] [PV].

- Input 19500 and press [FV].

- Press [CPT] [I/Y]. The calculator will display the CAGR, which in this case is 24.93%.

Unlocking Cash Flow Assets: Strategies for Smart Investing

You may want to see also

Annuities

To calculate the present value of an annuity, you need to know the number of payments (N) and the amount of each payment (PMT). You can input these values into the BA II Plus calculator and press the [CPT] [PV] button to get the present value. This represents the worth of future cash flows, discounted to the present. It is entered as a negative value in the calculator since it is a cash outflow.

For example, let's consider Bob, who wants to know the future value of $4,000 invested today for five years at a 10% interest rate. To calculate the present value of this annuity, you would input the following into the BA II Plus calculator: 5 [N] (number of payments), 10 [I/Y] (interest rate per period), and -4000 [PV] (present value as a negative value). Pressing [CPT] [PV] will give you the present value, which is $3,447.42 in this case.

To calculate the future value of an annuity, you use the same inputs as for the present value but press the [CPT] [FV] button instead. This gives you the total accumulated value of all payments at the end of the investment period.

For example, let's say you plan to save $500 per month for the next 20 years in an account with an annual interest rate of 6%. To calculate the future value of this ordinary annuity, you would first clear any previous work. Then, input N = 20 x 12 (number of months), I/Y = 6/12 (monthly interest rate), and PMT = -500 (negative due to outflow). Pressing [CPT] [FV] will give you the future value of your savings.

The BA II Plus calculator also allows you to switch between calculating ordinary annuities and annuities due. Ordinary annuities are the most common type, with periodic payments made at the end of each period. Annuities due, on the other hand, have periodic payments made at the beginning of each period, such as in lease agreements. To set the calculator for annuities due, you need to change the calculation mode to "Begin" or "BGN" by pressing [2nd] and [BGN]. Then, press [2nd] and [SET] to toggle to BGN mode. Remember to switch back to ordinary annuity mode when you're done with your calculations.

Cash App Investing: Free or Fee-Based?

You may want to see also

Frequently asked questions

To calculate the NPV, first enter the uneven cash flows into the cash flow register on the calculator by pressing the CF key. Then, navigate the register with the arrow keys to input the values in the appropriate fields: CFo, C01, C02, etc. If there is the same cash flow for over a year, use the F fields. Once you have inputted the cash flows, press NPV, navigate to the "NPV=" field and input the rate of return. Finally, press CPT to determine the NPV.

First, press the CF button and type in the initial investment. Make the number negative since it is what you will be paying out. Hit enter, and then the down arrow. Now, you are ready to begin entering your future cash flows from this potential project. The calculator will prompt you with the notation "CO1" for the first cash flow. Type the number, press enter, and then the down arrow. The calculator will then give you the prompt "FO1" for frequency, where you can enter how many times in a row the cash flow occurs. Once all cash flows are entered, you can calculate the IRR by hitting the IRR button and then hitting compute.

First, press [2nd] [P/Y], input 1, then press [ENTER] [2nd] [QUIT]. Then, press [2nd] [CLR TVM]. Input the number of years and press N, input the beginning value and press [+/-] [PV], input the ending value and press [FV], and finally, press [CPT] [I/Y] to get the CAGR.

First, clear the calculator by pressing [2nd] [CLR TVM]. Then, input the number of periods and press N, input the interest rate and press I/Y, input the payment and press PMT, and input the future value and press FV. Finally, press CPT and then PV to get the present value.

First, press the [2nd] key and the [I/Y] key to enter the P/Y worksheet. Set P/Y to the number of payments per period by entering the number and pressing [ENTER]. Then, press the [2nd] key and the [CPT] key to exit the P/Y worksheet. Next, press the [2nd] key and the [FV] key to clear the TVM worksheet. Input the present value and press [PV], input the payment and press [+/-] and [PMT], input the number of periods and press [N], and finally, press [CPT] and [I/Y] to get the interest rate.