Factor investing is a strategy that aims to capture the excess returns associated with specific factors or characteristics of securities, such as value, momentum, quality, or low volatility. It involves constructing portfolios based on these factors rather than traditional market-capitalization-weighted indices. While factor investing has gained popularity in recent years, there is ongoing debate and research regarding its effectiveness and consistency over time. This paragraph introduces the topic by highlighting the concept of factor investing and the need to evaluate its performance and potential benefits for investors.

What You'll Learn

- Historical Performance: Factor investing strategies have shown consistent outperformance over long periods

- Academic Research: Numerous studies support the effectiveness of factor-based investing

- Market Anomalies: Factors like value, momentum, and quality exploit market inefficiencies

- Risk-Adjusted Returns: Factor investing can provide higher returns with lower volatility

- Backtesting: Historical data confirms the predictive power of factors

Historical Performance: Factor investing strategies have shown consistent outperformance over long periods

Factor investing, a strategy that focuses on specific characteristics or factors of securities, has gained significant traction in the investment world due to its historical performance. This approach challenges the traditional market-capitalization-weighted indexing, which simply allocates capital based on the overall market's size. Instead, factor investing aims to capture the excess returns associated with various factors, such as value, momentum, quality, and low volatility.

The concept of factor investing is based on the idea that certain characteristics of securities can consistently generate alpha, the excess return over the risk-free rate. For instance, the value factor identifies undervalued stocks, while the momentum factor targets stocks with upward price trends. These factors are believed to be persistent and can be identified through statistical models.

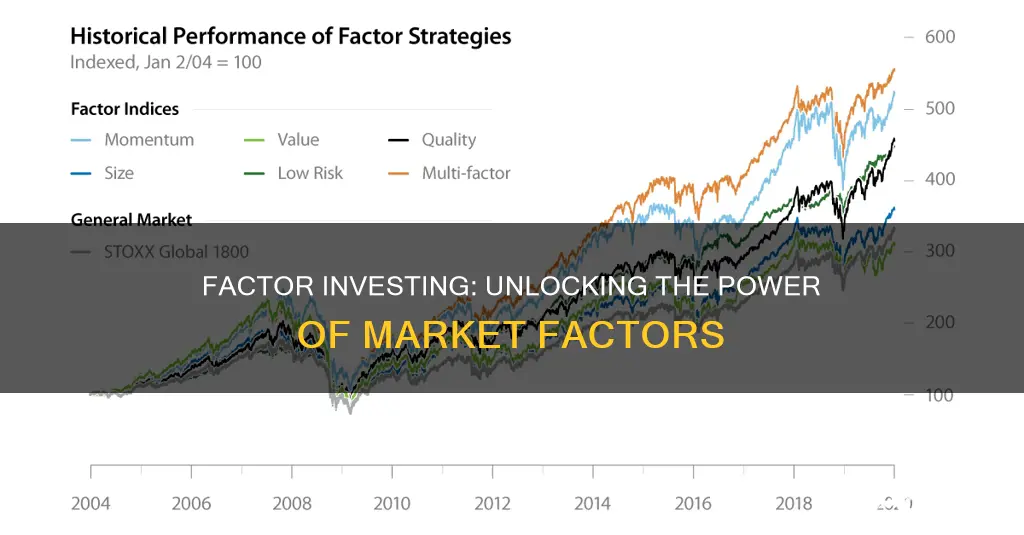

Historical data and research have provided compelling evidence of the success of factor investing strategies. Numerous studies have shown that these strategies have consistently outperformed traditional market-beating approaches over extended periods. For example, a study by Kenneth French and his colleagues analyzed the performance of various factor-based portfolios over a 25-year period, revealing that value and momentum factors significantly contributed to outperformance. Similarly, the quality and low volatility factors have demonstrated their ability to generate excess returns over time.

The consistency of factor investing's performance is a key attraction for investors. Unlike some investment strategies that may perform well in certain market conditions but struggle in others, factor-based strategies have shown resilience across different economic cycles and market environments. This consistency is particularly appealing to investors seeking long-term, risk-adjusted returns.

In conclusion, the historical performance of factor investing strategies indicates their potential to deliver superior returns. By focusing on specific factors, investors can potentially enhance their portfolios' performance and achieve their investment objectives. As the field of factor investing continues to evolve, further research and analysis will contribute to a deeper understanding of its effectiveness and the factors that drive its success.

Wealth or Retirement: Navigating Your Investment Journey

You may want to see also

Academic Research: Numerous studies support the effectiveness of factor-based investing

The concept of factor investing has gained significant traction in the financial world, and its effectiveness is well-documented in academic research. Numerous studies have delved into the strategies and performance of factor-based investing, providing valuable insights for investors and financial professionals. These studies consistently highlight the potential of factor investing as a robust approach to portfolio construction and asset allocation.

One of the key findings in academic research is that factor investing can lead to superior risk-adjusted returns. Factors such as value, momentum, quality, and low volatility have been shown to exhibit consistent and positive excess returns over time. For instance, a study by Fama and French (2010) analyzed the performance of the value and momentum factors in the US stock market and found that these factors provided significant predictive power for future stock returns. Similarly, research by Carhart (1997) introduced the three-factor model, which included size, value, and momentum, and demonstrated that these factors collectively explained a substantial portion of the variability in stock returns.

The academic literature also emphasizes the diversification benefits of factor-based investing. By incorporating multiple factors into a portfolio, investors can potentially reduce overall portfolio risk while maintaining or even enhancing expected returns. A study by Ang, Chen, and Zhang (2011) examined the impact of factor diversification on portfolio performance and concluded that combining factors can lead to more stable and higher returns compared to investing in a single factor. This diversification approach allows investors to capture the benefits of various market inefficiencies and trends.

Furthermore, factor investing has been shown to be resilient across different market conditions and geographic regions. Studies have analyzed its performance during market downturns, economic recessions, and various stages of the business cycle. For example, a research paper by Brown, Goetzmann, and Rouwenhorst (2009) investigated the robustness of factor investing strategies during the global financial crisis and found that factor-based portfolios continued to outperform passive benchmarks. This resilience is particularly appealing to investors seeking long-term strategies that can withstand market volatility.

In summary, academic research provides a strong foundation for the effectiveness of factor-based investing. The consistent positive returns, diversification benefits, and resilience across market conditions make factor investing an attractive strategy for investors. As the field continues to evolve, further studies will likely refine and expand upon these findings, offering valuable guidance for those seeking to optimize their investment portfolios.

Can Slimming Down Your Portfolio Yield Results? Exploring CanSlime Investing

You may want to see also

Market Anomalies: Factors like value, momentum, and quality exploit market inefficiencies

Factor investing is a strategy that aims to capitalize on market anomalies or deviations from the efficient market hypothesis. It involves identifying and exploiting specific factors or characteristics of securities that are believed to offer an edge in the market. These factors include value, momentum, and quality, among others. By understanding and targeting these anomalies, investors can potentially generate excess returns and outperform traditional market benchmarks.

The value factor, for instance, focuses on undervalued securities that are expected to appreciate as their true value is realized. Value investors seek companies with low price-to-book ratios, low price-to-earnings ratios, or other valuation metrics that suggest the stock is trading at a discount. This strategy is based on the idea that markets can be inefficient, and certain stocks may be temporarily overlooked or undervalued. By identifying and investing in these value stocks, investors can benefit from the market's eventual correction and revaluation.

Momentum investing, on the other hand, targets securities that have demonstrated positive performance trends and are likely to continue doing so. This factor identifies stocks that have experienced recent price appreciation and are expected to maintain or accelerate their upward trajectory. Momentum investors believe that positive momentum can persist for a certain period, allowing them to capture further gains. This strategy often involves a buy-and-hold approach, as investors aim to benefit from the continued momentum rather than frequent trading.

Quality, as a factor, involves investing in companies with strong financial fundamentals, consistent performance, and a history of resilience. Quality investors look for businesses with high return on equity, low debt levels, and a track record of stable or growing earnings. This factor assumes that high-quality companies are less likely to experience significant downturns and are more likely to provide stable returns over the long term. By focusing on quality, investors aim to build a portfolio that is less volatile and more resilient to market fluctuations.

These factors, when applied through factor investing, can be powerful tools for investors to navigate market inefficiencies. By systematically identifying and exploiting these anomalies, investors can potentially enhance their risk-adjusted returns. However, it is important to note that factor investing is not without its challenges and risks. Markets are dynamic, and factors may not always perform consistently, requiring investors to stay informed and adapt their strategies accordingly.

Understanding the Cost of Expertise: Unraveling Investment Advisor Fees

You may want to see also

Risk-Adjusted Returns: Factor investing can provide higher returns with lower volatility

Factor investing is a strategy that aims to capture the excess returns associated with specific factors or characteristics of securities. These factors can include value, momentum, quality, low volatility, and size, among others. The core idea is that these factors can be systematically identified and utilized to generate outperformance over the market or specific benchmarks. When it comes to risk-adjusted returns, factor investing has shown promising results, offering several advantages over traditional market-capitalization-weighted indices.

One of the key benefits of factor investing is its ability to provide higher returns while maintaining a lower level of volatility. This is achieved by carefully selecting and combining factors that have historically demonstrated positive excess returns. By diversifying across multiple factors, investors can construct portfolios that are less dependent on any single factor's performance, thus reducing overall portfolio volatility. This approach is particularly attractive to risk-averse investors who seek to optimize their risk-adjusted returns.

The concept of risk-adjusted returns is crucial in evaluating the performance of factor-based strategies. Traditional measures such as the Sharpe ratio, which compares the excess return of an investment to its volatility, can be used to assess the efficiency of factor investing. Factor portfolios often exhibit higher Sharpe ratios compared to the market, indicating that they generate excess returns relative to the risk taken. This is especially true when factors are combined in a systematic and disciplined manner, creating a robust and well-diversified investment approach.

Additionally, factor investing can contribute to improved risk-adjusted returns by allowing investors to capture the benefits of small and mid-cap stocks, which often exhibit higher returns and lower volatility compared to large-cap stocks. By incorporating factors such as small-cap and value, investors can access a broader range of opportunities, potentially enhancing their overall risk-adjusted performance. This is particularly relevant in today's market environment, where traditional large-cap stocks may not provide the same level of returns as in the past.

In summary, factor investing has the potential to deliver higher risk-adjusted returns by providing access to excess returns associated with various factors. Through careful factor selection, diversification, and systematic portfolio construction, investors can achieve improved performance while managing volatility effectively. This approach offers a compelling alternative to traditional market-capitalization-weighted strategies, especially for those seeking to optimize their risk-adjusted returns in a dynamic and evolving market environment.

Apple's Crypto Calculation: Why Dogecoin Could Be a Risky Bet

You may want to see also

Backtesting: Historical data confirms the predictive power of factors

Backtesting is a crucial step in evaluating the effectiveness of factor investing strategies. It involves applying the same set of rules or criteria used in the strategy to historical market data to see how the strategy would have performed in the past. This process allows investors to assess the strategy's potential for success and identify any weaknesses or limitations. When it comes to factor investing, backtesting is particularly important because it helps confirm the predictive power of the factors being used.

The predictive power of factors refers to the ability of these factors to forecast future market movements. For example, a factor like value, which measures the price-to-book ratio of a company, might be expected to predict future stock market outperformance. Backtesting helps determine if this factor has indeed been a reliable predictor of market performance in the past. By analyzing historical data, investors can see if the factor has consistently contributed to positive returns during different market conditions.

In the backtesting process, historical market data is used to simulate the performance of a factor-based strategy. This data typically includes stock prices, financial ratios, and other relevant indicators. The strategy's rules are applied to this historical data, and the results are compared to the actual market performance during the same period. For instance, if a value factor strategy is backtested, the system would identify stocks with lower price-to-book ratios and assess their historical performance. If the strategy consistently outperforms a benchmark index during different market cycles, it provides evidence that the factor has predictive value.

The key to successful backtesting is ensuring that the historical data accurately represents the market conditions the strategy will face in the future. This includes considering factors such as market volatility, economic cycles, and changes in market dynamics. By backtesting over a diverse range of historical periods, investors can gain confidence in the strategy's ability to adapt to various market scenarios. Additionally, backtesting multiple factors and combining them in different ways can help investors understand the potential synergies and trade-offs between different factors.

In summary, backtesting is a powerful tool for confirming the predictive power of factors in factor investing. It provides empirical evidence of a strategy's historical performance and helps investors make informed decisions. By analyzing historical data, investors can assess the reliability of factors and their contribution to potential future returns. This process is essential for building confidence in factor-based investing and can guide investors in constructing robust and effective investment portfolios.

Retirement Investing: Why the Wait?

You may want to see also

Frequently asked questions

Factor investing is an investment strategy that aims to capture specific factors or characteristics of securities that drive their performance. These factors can include value, momentum, quality, low volatility, and size. The strategy involves selecting securities based on their exposure to these factors, with the goal of outperforming the market or a specific benchmark.

Factor investing takes a more systematic and rules-based approach compared to traditional active management. While active managers make subjective decisions based on their expertise and research, factor investing uses quantitative models and statistical analysis to identify and exploit market factors. This approach can be more disciplined and consistent, aiming to capture returns that are consistent with the identified factors.

Numerous academic studies and empirical research support the effectiveness of factor investing. These studies have shown that factors such as value, momentum, and quality tend to have persistent and positive returns over time. For example, the value factor has consistently outperformed growth stocks, while momentum investing has shown positive results. The evidence suggests that these factors are not just market anomalies but rather fundamental aspects of how markets function.

While factor investing can be a powerful strategy, it is not without risks. One risk is the potential for factors to become less effective or even reverse in the short term, leading to underperformance. Market conditions can change, and factors may not always be in favor. Additionally, factor investing often involves higher transaction costs and potential for lower liquidity, especially when dealing with smaller or less liquid securities. Diversification and a long-term investment horizon are recommended to mitigate these risks.