There are several ways to pay investment advisors, and it's important to understand the fee structure before engaging their services. Financial advisors are usually compensated through commissions, flat fees, retainer fees, or a combination of fees and commissions. Commissions are paid upfront as a portion of the money invested, while flat fees are charged for specific services or projects. Retainer fees are paid upfront for an estimated amount of service or time, and fee-based advisors charge an hourly rate for their services. It is essential to ask questions and understand the different fee structures to ensure you are getting value for your money.

| Characteristics | Values |

|---|---|

| Type of fee | Fixed-rate fee, asset-based fee, commission, hourly fee, flat fee, retainer fee, performance-based fee |

| Commission | 3-6% of your investment in a fund |

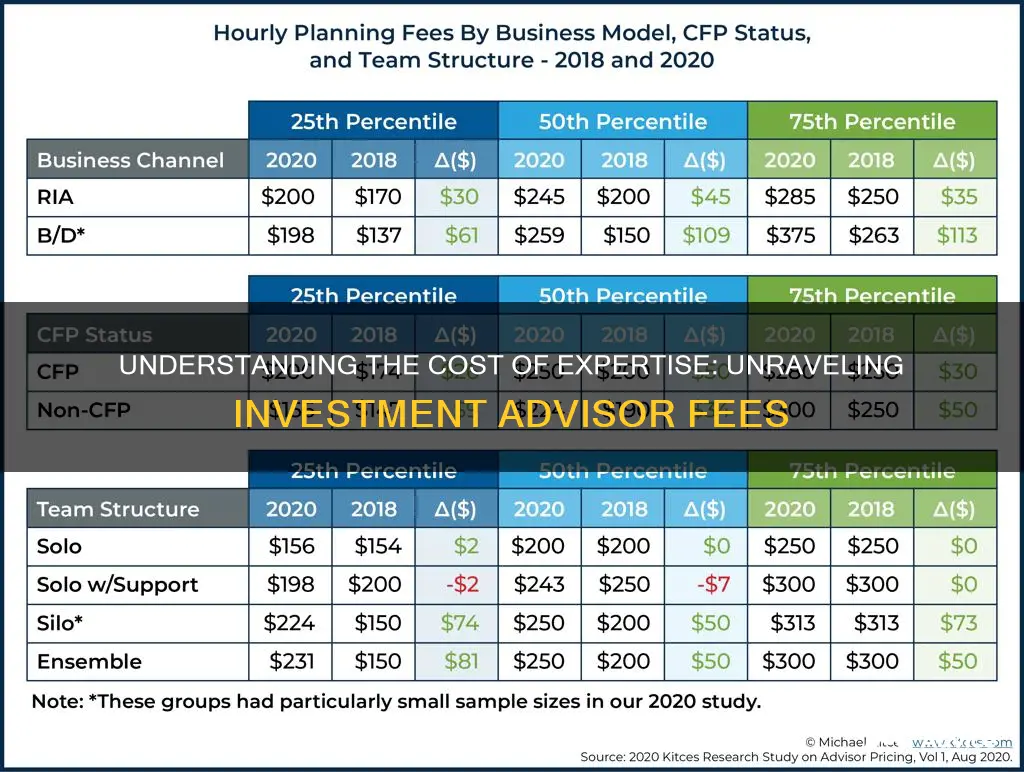

| Hourly fee | $120-$300 per hour |

| Flat fee | $7,500 - $55,000 |

| Retainer fee | $6,000 - $11,000 or 0.5-2% of assets under management |

| Robo-advisor fee | 0.25% - 0.5% of assets under management |

| Traditional advisor fee | 1% of assets under management |

What You'll Learn

Percentage of assets under management

The percentage of assets under management (AUM) fee structure is a common way for financial advisors to charge for their services. This model is often used by registered investment advisors (RIAs) and involves charging a percentage of the total assets of a client's account. The fee is typically charged quarterly and can be calculated using the formula:

> ((AUM Fee %) x (Average Account Value)) ÷ 4 = Quarterly AUM Fee

For example, an advisor managing a $1,000,000 portfolio with a 1% AUM fee would charge a quarterly fee of $2,500.

The AUM fee incentivizes advisors to grow their clients' assets, as their fees increase with the growth of their clients' portfolios. This model also aligns the interests of the advisor and client, as both benefit from asset growth. However, it's important for clients to ensure that the advisor's investment strategy remains focused on prudent growth rather than taking excessive risks to increase AUM.

The AUM fee structure typically ranges from 0.25% to 1% per year, with the specific percentage often depending on the size of the account. Accounts under $1 million commonly incur a 1% AUM fee, while larger accounts may negotiate a lower fee, such as 0.75% for accounts between $1-5 million or 0.50% for accounts over $5 million.

It's worth noting that the AUM fee reduces net investment returns and can seem like a small percentage but translate to a large dollar amount. Additionally, advisors charging this fee may have less incentive to recommend low-cost investments. When considering an advisor using the AUM fee structure, it's crucial to evaluate the total costs, including any hidden fees, and the potential impact on investment returns.

Compared to other fee structures, such as commissions or hourly rates, the AUM model provides advisors with recurring revenue tied to long-term asset growth. This model also ensures that the advisor's incentives align with the client's goal of growing their assets.

When deciding on a financial advisor, it's important to understand their fee structure and ensure that the fees are fair and commensurate with the value provided.

PewDiePie vs T-Series: Why the Obsession?

You may want to see also

Hourly rate

Hourly fee structures are often used for special projects or consulting services. For example, a client may require advice on portfolio management as they approach retirement, and an hourly fee structure can be suitable for this type of engagement.

It is important to note that the total fee for hourly services can range from $2,000 to $5,000 for various projects, such as generating an estate plan. Additionally, some advisors may offer full-service management of investment portfolios for an hourly fee, while others may only bill for their time and leave the money management and investing decisions to the client.

When considering an hourly fee structure, it is essential to understand the services included and to get an estimate of the number of billable hours expected based on your specific circumstances.

Investments: Where People Put Their Money Now

You may want to see also

Flat fee

Paying your investment advisor a flat fee can bring several benefits, including increased transparency, reduced conflicts of interest, and more objective advice.

Transparency

Flat-fee structures provide transparency around costs, as you know how much you'll be paying in advance. This predictability can be helpful for both advisors and clients. It also makes it easier to keep track of expenses, as you know what to expect and can verify the cost.

Reduced Conflicts of Interest

When advisors are compensated through commissions or asset-based fees, there is an inherent conflict of interest. They may be incentivised to recommend certain products or investments that increase their earnings, rather than those that are in the client's best interest. Flat-fee advisors, on the other hand, charge a set rate for their services, reducing this conflict. They are also often fee-only advisors, who cannot accept commissions for selling financial products, further reducing potential conflicts.

Objective Advice

Flat-fee advisors are less likely to be influenced by their compensation structure when providing advice. For example, if a client is considering investing in the stock market or buying a property, a flat-fee advisor will not be financially incentivised to recommend one option over the other. This can result in more objective and unbiased advice.

Other Considerations

While flat-fee advisors offer many advantages, there are also some potential drawbacks. Flat fees may be more expensive, especially for individuals with smaller portfolios or limited resources. Additionally, flat-fee advisors may offer a more limited range of products and services. It's important to note that flat fees can vary depending on factors such as income, portfolio size, and the complexity of the client's circumstances.

TFSA Dividend-Paying Investments: Maximizing Tax-Free Returns

You may want to see also

Performance-based fees

Performance fees can be charged on any profit, or they can be charged only when the management of funds outperforms a predetermined benchmark. Hedge funds, for example, often use performance-based fees, and these fees are a major part of how hedge fund managers make their money.

There is one major advantage to performance fees: they incentivize your investment manager to earn you the most money possible, because it will in turn earn them money. However, this advantage also has a major disadvantage. Advisors who know that a major return could mean a big payday for them are more likely to take risks with their clients’ money that could result in a major loss of principal.

When starting a relationship with an advisor, it is important to ask questions about what types of fees they charge, and to find out exactly which fees you’ll be paying and how they are calculated.

Pay Off the House or Invest: The Barefoot Investor's Guide to Financial Freedom

You may want to see also

Robo-advisors

However, robo-advisors have been criticised for their lack of empathy and complexity. They are ill-equipped to deal with unexpected crises or extraordinary situations, and a study by Investopedia and the Financial Planning Association found that 40% of participants wouldn't feel comfortable using an automated investing platform during extreme market volatility.

- Wealthfront: Best Overall, Best for Goal Planning, Best for Portfolio Management, Best for Portfolio Construction

- Betterment: Best for Beginners, Best for Cash Management

- Merrill Guided Investing: Best for Education

- M1 Finance: Best for Low Costs, Best for Sophisticated Investors, Best for SRI

- ETRADE: Best for Mobile

Invest Aggressively Now?

You may want to see also

Frequently asked questions

Financial advisors are usually paid in one of the following ways:

- Commission-based: You pay the commission upfront as a portion of the money you invest.

- Hourly fee: You pay for the time spent with the advisor, typically per hour.

- Flat fee: You pay a flat fee for a bundle of services offered by the advisor.

- Retainer fee: You pay a fee upfront for an estimated amount of service or time.

- Fee-based: A combination of fees and commissions.

Financial advisors typically charge a fixed-rate fee of $7,500 to $55,000 or an asset-based fee of 1.02% of your assets under management (AUM). The average financial advisor fee in 2023 was 1.02% for $1 million AUM, which is approximately $10,200 annually.

The cost of a financial advisor depends on your location, your investment amount, and the complexity of your financial plan.

You can use websites like Paladin Registry and SmartAsset to find a financial advisor in your area. It is important to ask questions about their qualifications, experience, and communication style to ensure they are a good fit for your needs.