Fidelity is a well-rounded brokerage with a range of investment options for both beginner and active investors. The company offers no commissions on stock or ETF trades, and a selection of no-expense-ratio index funds. Fidelity also provides a variety of resources for investors, including educational content and research tools. In addition, Fidelity has excellent investment platforms, such as mobile, desktop, and the downloadable Active Trader Pro, which make trading accessible for all types of investors. The company's commitment to execution, quality, and price improvement is notable, with an average price improvement of $12.97 for a 1,000-share equity order. With its range of products, services, and tools, Fidelity is a great choice for those looking for a comprehensive investment strategy.

| Characteristics | Values |

|---|---|

| Investment options | Stocks, bonds, mutual funds, ETFs, options, forex, cryptocurrencies, fractional shares, ADRs, CDs, bond funds, individual stocks or bonds, target date funds, robo advisors, managed accounts |

| Investment accounts | Brokerage account, 401(k), IRA, Roth IRA, rollover IRA, traditional IRA |

| Investment strategies | Dollar-cost averaging, tax-smart investing, creating an exit strategy |

| Investment resources | Online planning resources, investment research, educational resources, investment guides |

| Investment tools | Online trading platform, Active Trader Pro, Fidelity Go, Fidelity Youth Account, Virtual Assistant |

| Investment support | 24/7 phone, email, chat, social media, physical branch support, dedicated advisor, advisory team |

| Investment fees | $0 trading commissions, no account fees, no transfer fees, no closure fees, options contract fee ($0.65 per contract) |

| Investment minimums | $0 minimum for brokerage account, $500 minimum for Fidelity Wealth Services, $100 minimum for Fidelity Managed FidFolios, $50,000 minimum for Fidelity Advisory Services Team, $50,000 minimum for Fidelity Wealth Management, $2 million minimum for Fidelity Private Wealth Management |

What You'll Learn

Fidelity's investment platforms for active traders and investors of all types

Fidelity has excellent investment platforms for active traders and investors of all types. The company offers a range of options, from digital investment management to working directly with a Fidelity advisor.

For those who want to work with an advisor, Fidelity offers personalized portfolios with a comprehensive, multi-asset class approach. This provides exposure to a mix of stocks and bonds based on your time horizon, comfort with risk, and investment preferences. There is no minimum amount required to open a Fidelity Go account, but to invest according to the chosen investment strategy, your account balance must be at least $10.

Fidelity also offers digital investment management and access to coaching. This service has no minimum to open an account, but access to coaching is granted once your balance reaches $25,000.

Fidelity's trading platforms include Fidelity.com, the Active Trader Pro, and the Fidelity Mobile app. The Active Trader Pro is a downloadable desktop platform with intuitive shortcuts, a pre-built market, technical and options filters, advanced options tools, and a multi-trade ticket that can store orders for later and place up to 50 orders at a time. The platform includes more than 45 market filters, streaming quotes, real-time gain and loss data, streaming balances, and order statuses.

The Fidelity Mobile app is easy to use and award-winning, putting all your investment activity at your fingertips. It allows you to view, manage, and act on your portfolio wherever you are, 24/7.

Fidelity also provides industry-leading research and analysis tools, with research offerings from several third-party providers, including Zacks Investment Research and Argus. The company's research tools are ranked #1 by Investor's Business Daily.

Fidelity's platforms cater to investors of all types, from beginners to advanced active traders, with excellent customer support and a wide range of investment options.

HDFC Balanced Fund: Is it a Smart Investment Choice?

You may want to see also

Fidelity's low-cost and fee-free mutual funds

Fidelity offers a range of low-cost and fee-free mutual funds, with no minimum investment requirements and zero account fees. These funds provide investors with access to a diverse range of asset classes, including stocks, bonds, and real estate, and are designed to meet various investment objectives and risk tolerances.

One of the key advantages of Fidelity's low-cost and fee-free mutual funds is their low expense ratios. The Fidelity ZERO Total Market Index Fund (FZROX), for example, has a 0% expense ratio, meaning investors pay no fees on their investments. This fund seeks to provide investment results that correspond to the total return of a broad range of publicly traded companies in the US, offering an "all-in-one" portfolio holding. Similarly, the Fidelity ZERO International Index Fund (FZILX) also has a 0% expense ratio and seeks to provide investment results that correspond to the total return of foreign developed and emerging stocks.

In addition to the ZERO funds, Fidelity offers a range of other low-cost mutual funds with competitive expense ratios. The Fidelity 500 Index Fund (FXAIX), for instance, has a net expense ratio of just 0.015%, making it one of the lowest-cost investments in the mutual fund universe. This fund tracks the Standard & Poor's (S&P) 500 Index and has over $534 billion in assets under management (AUM) as of Q1 2024. For investors seeking exposure to mid-cap stocks, the Fidelity Mid-Cap Stock Fund (FMCSX) offers active management and has at times outperformed its benchmark index, although underperformance in some years should be noted. This fund carries an expense ratio of 0.80%, which is higher compared to other Fidelity funds but still competitive relative to the industry.

Fidelity also offers sector-specific funds, such as the Fidelity Real Estate Investment Portfolio (FRESX), which invests in securities of companies principally engaged in the real estate industry. This fund provides diversification benefits to an investor's portfolio and has over $2.5 billion in assets, with an expense ratio of 0.67%. For those seeking protection from economic risk, the Fidelity Inflation-Protected Bond Index Fund (FIPDX) is a defensive investment option with a four-star Morningstar rating and a low 0.05% net expense ratio.

Overall, Fidelity's low-cost and fee-free mutual funds provide investors with a range of options to build a diversified portfolio while minimizing fees and expenses. With no minimum investment requirements and competitive expense ratios, these funds offer a compelling proposition for investors of all types.

What Makes a Fund of Funds a Variable Investment Entity?

You may want to see also

Fidelity's superior trading platforms for all types of investors

Fidelity offers a range of trading platforms and tools to cater to the needs of all types of investors, from beginners to advanced traders. Here are some of the key features of Fidelity's trading platforms:

Fidelity.com

Fidelity's website provides users with award-winning research, in-depth analytics, and idea generation tools integrated with an easy-to-use trading ticket. It is recommended for intermediate and advanced investors. The website offers a wide range of tools and resources to help investors make informed decisions, including real-time market data, research ideas, and the ability to execute trades.

Active Trader Pro

Active Trader Pro is a full-featured downloadable desktop platform that offers real-time insights, dynamic visual analytics, and powerful trading tools. It includes intuitive shortcuts, technical and options filters, advanced options tools, and a multi-trade ticket that allows users to store orders and place up to 50 orders simultaneously. This platform is recommended for advanced traders who want to customize their trading experience.

Fidelity Mobile App

Fidelity's mobile app is easy to use and award-winning, putting all your investment activity in one place. It allows users to view, manage, and take action on their portfolio anytime, anywhere. The app includes real-time quotes, multi-leg options trading, a consolidated version of the company's research offerings, and a notebook to save ideas and articles from the mobile browser. It is recommended for beginners, intermediate, and advanced investors.

Single-Screen Trade Station

The single-screen trade station is a web-based platform that allows users to tackle all their trading needs on a single screen. It provides real-time market data, research ideas, and the ability to execute trades instantly. It is compatible with any browser, desktop, or tablet and is recommended for intermediate and advanced investors.

Fidelity's trading platforms offer flexibility, ease of use, and a wide range of features to suit the needs of all types of investors. With no account fees or minimums to open a retail brokerage account, Fidelity helps investors spend and save smarter.

Robo Advisors: Index Fund Investing Strategies Explored

You may want to see also

Fidelity's accessible and knowledgeable customer service

Fidelity offers accessible and knowledgeable customer service through a variety of channels, including phone, email, chat, social media, and in-person at their branches. Their customer support is available 24/7, ensuring that clients can get assistance whenever needed.

Fidelity's online learning centre, Virtual Assistant, is an automated natural language search engine that helps clients find information on the Fidelity website. It provides direct answers to queries and guides users to relevant resources. The company also has over 200 branches where clients can receive in-person advice and educational support.

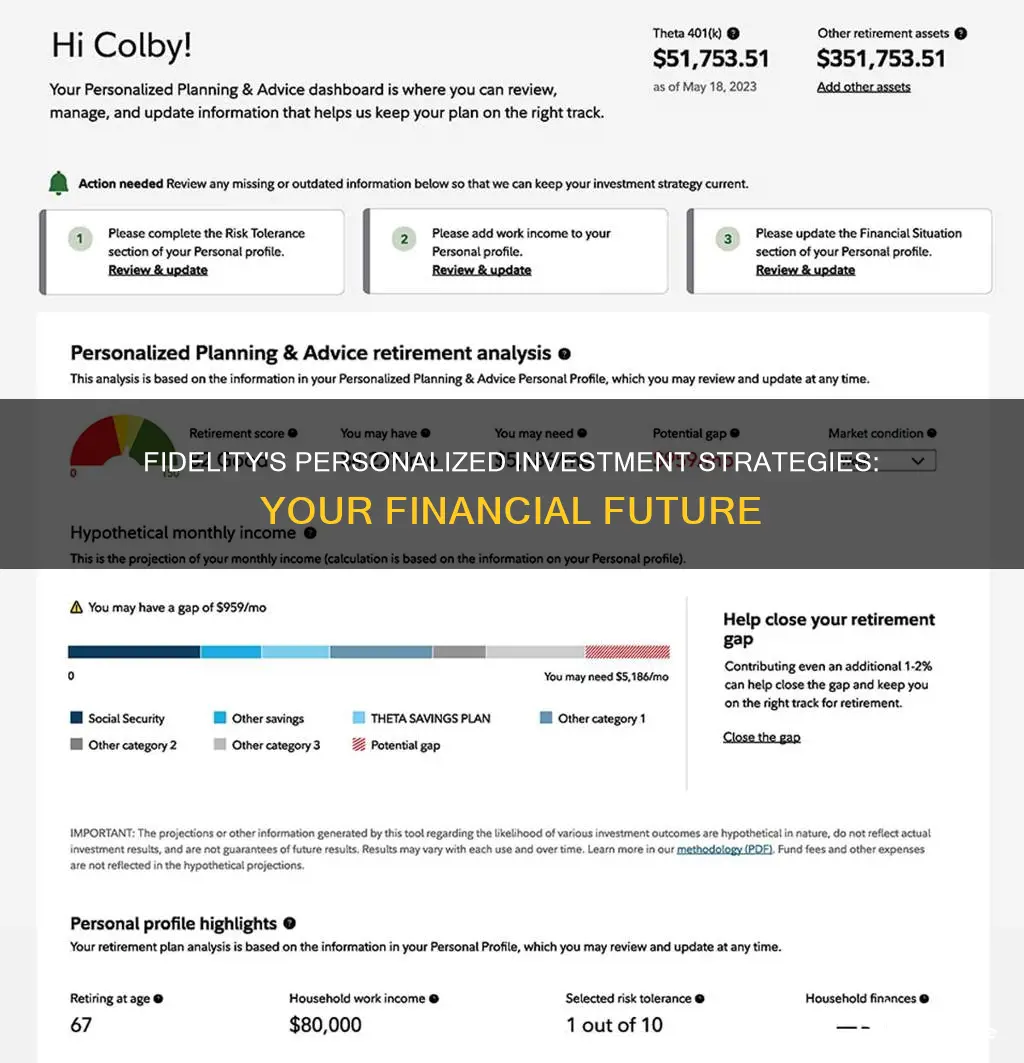

For those who prefer digital investment management and advice, Fidelity offers online resources to help choose an investment strategy and plan for the next steps. Their digital platform provides clear instructions and progress tracking. Additionally, clients with a balance of $25,000 or more can access coaching services.

Fidelity also provides the option to work directly with a dedicated advisor. Their Wealth Management service offers customised planning and investment management, considering clients' full financial picture. This service is available to clients with $50,000 or more invested in eligible Fidelity accounts.

Fidelity's customer service extends to their mobile app, which has been highly rated by users. The app includes features such as real-time quotes, multi-leg options trading, and a consolidated version of the company's research offerings. It also allows clients to schedule appointments with their advisors.

Overall, Fidelity's accessible and knowledgeable customer service enhances their clients' investment experience, providing guidance, educational resources, and multiple channels of support.

Index & Mutual Funds: Low-Fee Investing Strategies

You may want to see also

Fidelity's extensive research and screeners

Fidelity's extensive research and screening tools are highly regarded in the industry. The company provides a large, free third-party research library of stock reports for clients. After inputting a stock ticker, users are provided with a detailed quote page with menu items, including chart, dividends and earnings, sentiment, analyst rating, comparisons, and statistics. The analyst research selection delivers an average rating and several research reports from well-known providers, such as Argus, Zacks, Ford, and Refinitiv/Verus.

Fidelity's stock screener is comprehensive, with 26 criteria and parameters set according to the user's preferences. The screener allows users to search ETFs by Fund Family, Market Cap, Sector, Fixed Income, Socially Responsible, Actively Managed, or Digital Assets. There are an additional 86 criteria for more in-depth screening. The ETF screening options cover nearly every category an investor might want, including type, expense ratio, investment philosophy, objectives, trading characteristics, performance, fundamentals, technicals, and more.

Fidelity also offers a Mutual Fund Screener, which is challenging to find among its competitors. With a pool of 9,330 mutual funds, its screener is among the best run by online brokerages. The pre-set mutual fund screeners for quick results include Asset Class and Category, Key Criteria, and Morningstar ratings. There are 32 additional screening criteria, including mutual funds that can be purchased with no transaction fees.

Fidelity's option screener is powered by LiveVol, with more than 25 pre-defined filters and nearly 200 individual criteria that can be incorporated into a search.

The company also provides a Fixed Income Screener, which includes fixed-income assets such as bonds, CDs, mutual funds, and ETFs. Investors hunting for CDs, corporate bonds, and Treasury bonds can scan a grid with assets listed down the Y-axis and maturities on the X-axis. By clicking on the interest rate, users are taken to a screen listing bonds that fit their criteria.

In addition to its screeners, Fidelity offers a wide range of tools and calculators, such as the Fidelity Free Financial Plan, which enables self-directed investors to link external accounts and create a comprehensive, goal-based financial plan. The company's screening and research capabilities have earned it recognition as the winner of the Best Overall Brokerage and Trading Account by Investopedia.

A Guide to Investing in Franklin Templeton Mutual Funds

You may want to see also

Frequently asked questions

Fidelity offers a variety of investment accounts, including brokerage accounts, 401(k)s, and individual retirement accounts (IRAs). Each account type has its own set of pros and cons, and the right choice depends on your financial goals and investment strategy.

Fidelity provides a range of resources and tools to help you make informed investment decisions. They offer research and analysis on various investment options, such as stocks, mutual funds, ETFs, and more. You can also work with a dedicated advisor or use their robo-advisor service, Fidelity Go®, to get personalized investment recommendations.

Fidelity offers a wide range of investment options, including stocks, bonds, mutual funds, ETFs, options, and more. They provide excellent research tools, screeners, and educational resources to help you make informed decisions. Additionally, Fidelity has low fees and no account minimums for opening or maintaining a brokerage account.

The first step is to figure out your investment goals and what you are investing for. Once you have a clear idea, you can choose the appropriate account type and start putting money into it. Fidelity offers a variety of resources and tools to guide you through the process, making it easier for beginners to get started with investing.