Fidelity Investments, a well-known financial services company, has been a trusted name in the industry for decades. With a focus on providing comprehensive investment management and retirement services, they cater to a wide range of clients. Now, the question arises: Does Fidelity Investments work with Venmo, the popular mobile payment app? This paragraph aims to explore this intriguing relationship and shed light on the potential benefits and considerations for users of both services.

| Characteristics | Values |

|---|---|

| Integration | Yes, Fidelity Investments offers an integration with Venmo, allowing users to transfer funds between their Fidelity account and Venmo. |

| Account Linking | Users can link their Venmo account to their Fidelity Investments account to facilitate seamless transactions. |

| Investment Options | Fidelity provides a wide range of investment products, including mutual funds, stocks, bonds, and more, which can be accessed through the Venmo integration. |

| Security | The integration is designed with security measures to protect user data and transactions. |

| User Experience | The process is user-friendly, enabling quick and efficient transfers between the two platforms. |

| Fees | Transferring funds between Fidelity and Venmo may incur fees, which can vary depending on the account type and transaction amount. |

| Availability | This feature is available to eligible Fidelity customers with a Venmo account. |

| Support | Fidelity offers customer support for any issues related to the Venmo integration. |

What You'll Learn

- Fidelity Investments and Venmo Integration: Exploring the partnership and its benefits

- Venmo as a Payment Option: How Venmo facilitates transactions for Fidelity investors

- Fidelity's Mobile App and Venmo: Seamless money transfers via the Fidelity mobile platform

- Security and Fraud Prevention: Measures to protect Venmo transactions with Fidelity Investments

- Fidelity's Customer Support for Venmo: Assistance and troubleshooting for Venmo-related issues

Fidelity Investments and Venmo Integration: Exploring the partnership and its benefits

The integration of Fidelity Investments and Venmo represents a significant development in the financial services industry, offering users a seamless and efficient way to manage their investments and payments. This partnership combines the strengths of two leading financial institutions, providing a comprehensive solution for individuals seeking to streamline their financial activities.

Fidelity Investments, a renowned name in the investment management sector, has built its reputation on providing a wide range of financial products and services. With a focus on individual investors, they offer retirement planning, brokerage, and wealth management solutions. On the other hand, Venmo, a popular mobile payment platform, has revolutionized the way people send and receive money, especially among peers. By integrating these two services, users can now effortlessly transfer funds between their Venmo accounts and their Fidelity Investments portfolios.

The partnership's primary benefit is the convenience it offers to users. With just a few taps on their mobile devices, individuals can now move money between their spending and investment accounts. This seamless transfer capability allows users to quickly allocate funds, making it easier to manage their financial goals. For instance, a user can quickly send money from their Venmo balance to purchase stocks or mutual funds through Fidelity, ensuring a swift and efficient investment process.

Furthermore, this integration caters to a wide range of investors, from beginners to experienced traders. Fidelity's extensive investment options, including stocks, bonds, and mutual funds, can now be accessed and managed through the user-friendly Venmo interface. This accessibility and ease of use can encourage more people to engage in investing, potentially increasing the number of retail investors in the market.

In addition to convenience, the partnership also enhances security. Both companies have robust security measures in place to protect user data and transactions. By combining their security protocols, they provide an added layer of protection, ensuring that users' financial information remains safe and secure during the transfer process. This is particularly important in the digital age, where online security is a top concern for many.

In summary, the integration of Fidelity Investments and Venmo is a strategic move that brings together the best of both worlds. It simplifies the investment process, making it more accessible and user-friendly, while also prioritizing security. This partnership has the potential to attract a broader investor base and encourage more people to take control of their financial future. As the financial industry continues to evolve, such innovative collaborations will likely play a significant role in shaping the way people manage their money.

Wealthy Investing: Should They Continue?

You may want to see also

Venmo as a Payment Option: How Venmo facilitates transactions for Fidelity investors

Venmo, a popular peer-to-peer payment app, has become an increasingly attractive option for investors looking to facilitate transactions with Fidelity Investments. This integration allows users to seamlessly transfer funds between their Fidelity accounts and Venmo, providing a convenient and efficient way to manage their investments. Here's how Venmo works in conjunction with Fidelity:

Seamless Fund Transfers: One of the key advantages of using Venmo for Fidelity investors is the ability to transfer funds effortlessly. Investors can link their Fidelity account to their Venmo account, enabling them to send and receive money directly. This process is particularly useful when investors need to make contributions to their Fidelity retirement plans, such as IRAs, or when they want to transfer funds between different investment accounts. With just a few taps on their mobile devices, users can initiate a transfer, making the process quick and accessible.

Convenient Payment Method: Venmo offers a user-friendly interface, making it an ideal choice for those who prefer a simple and intuitive payment method. Investors can easily send money to their Fidelity account or to other Venmo users, ensuring that transactions are executed promptly. This convenience is especially beneficial for regular contributions or when investors need to settle shared expenses with fellow investors. The app's social features, such as the ability to add notes or comments to transactions, further enhance the user experience and provide a transparent record of payments.

Security and Protection: Fidelity and Venmo prioritize security, ensuring that investors' funds and personal information are protected. Venmo employs encryption and security protocols to safeguard transactions, providing peace of mind to users. Additionally, Venmo offers buyer and seller protection, which can be advantageous when making investments or transferring funds. This protection ensures that investors are covered in case of unauthorized transactions or disputes, adding an extra layer of security to their financial activities.

Wider Acceptance and Integration: Venmo's popularity and widespread acceptance make it a versatile payment option. Many online and offline retailers accept Venmo payments, allowing investors to utilize their Venmo balance for various purchases. This flexibility extends to investing, as investors can potentially use Venmo to buy stocks, bonds, or other assets offered by Fidelity. The integration of Venmo with Fidelity's investment platforms enables investors to manage their portfolios and make transactions seamlessly, providing a comprehensive solution for their financial needs.

By leveraging Venmo as a payment option, Fidelity investors can benefit from a streamlined and efficient transaction process. The app's ease of use, security measures, and widespread acceptance make it a valuable tool for managing investments and facilitating payments. As the financial industry continues to embrace digital payment solutions, the partnership between Venmo and Fidelity Investments highlights the evolving landscape of investment and payment technologies.

Invest in AMC: What to Know

You may want to see also

Fidelity's Mobile App and Venmo: Seamless money transfers via the Fidelity mobile platform

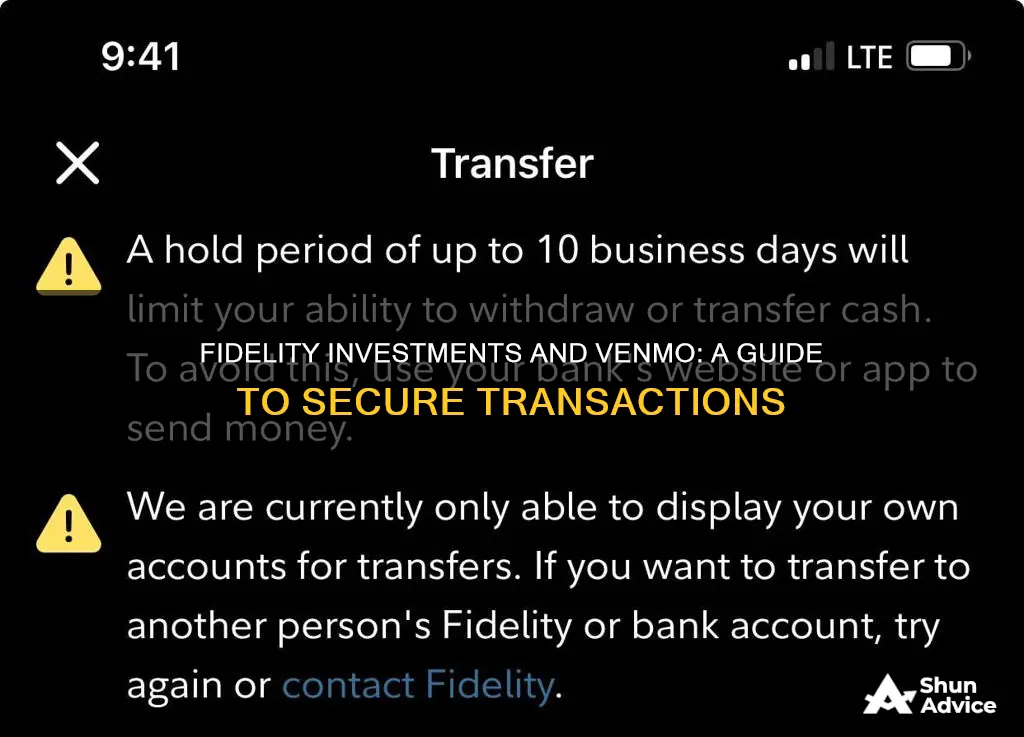

Fidelity Investments, a well-known financial services company, has integrated its mobile app with Venmo, a popular peer-to-peer payment platform, to offer users a seamless and convenient way to transfer money. This integration allows Fidelity customers to leverage the power of Venmo's extensive network for quick and secure transactions. By linking their Venmo account to the Fidelity mobile app, users can now send and receive funds directly from their investment accounts, making it easier to manage their finances.

The process of setting up this connection is straightforward. Users can log into their Fidelity mobile app and navigate to the settings or account management section. From there, they can locate the option to add a payment method and select Venmo as the preferred method. Once connected, the app will allow users to initiate transactions with a simple tap, providing a user-friendly experience. This feature is particularly useful for those who frequently use Venmo for social payments and now want to combine it with the investment capabilities of Fidelity.

One of the key advantages of this integration is the speed and ease of money transfers. Users can quickly send funds to friends, family, or even split expenses with ease. The transaction history within the Fidelity app also provides a comprehensive overview of all Venmo-related activities, ensuring users have full transparency and control over their financial interactions. This level of convenience is especially beneficial for those who want to manage their investments and personal finances in one place.

Fidelity's mobile app offers a range of investment options, and with the addition of Venmo, users can now access a seamless payment experience. This integration caters to the modern user's need for a unified financial platform where they can effortlessly move between investments and everyday transactions. By combining the strengths of both services, Fidelity provides a comprehensive solution for individuals who want to manage their money efficiently.

In summary, the partnership between Fidelity's mobile app and Venmo enables users to enjoy the benefits of both services, making money transfers and investment management more accessible and efficient. This integration showcases Fidelity's commitment to providing innovative solutions that meet the evolving needs of its customers in the digital age.

Chase Invest: Understanding Dividend Payments

You may want to see also

Security and Fraud Prevention: Measures to protect Venmo transactions with Fidelity Investments

Venmo, a popular digital wallet, has integrated with Fidelity Investments, a well-known financial services company, to offer users a seamless way to invest and manage their money. This partnership provides an opportunity to enhance security and fraud prevention measures, ensuring that users' transactions are protected when utilizing both services. Here are some key strategies to safeguard Venmo transactions with Fidelity Investments:

Multi-Factor Authentication (MFA): Implementing MFA adds an extra layer of security to user accounts. Venmo and Fidelity can require users to enable MFA, such as a one-time password (OTP) sent to their mobile device, in addition to their login credentials. This ensures that even if a user's password is compromised, unauthorized access to their account is prevented. By encouraging users to set up MFA, both companies can significantly reduce the risk of unauthorized transactions.

Encryption and Data Protection: Strong encryption protocols should be employed to secure sensitive data during transmission and storage. Venmo and Fidelity should utilize industry-standard encryption algorithms to protect user information, including transaction details and personal data. End-to-end encryption ensures that even if data is intercepted, it remains unreadable to unauthorized parties, thus preventing potential fraud. Regular security audits and updates to encryption methods can further strengthen data protection.

Fraud Monitoring and Detection: Advanced fraud detection systems should be in place to identify suspicious activities promptly. These systems can analyze transaction patterns, user behavior, and network traffic to detect anomalies. By employing machine learning algorithms, the companies can train their models to recognize fraudulent activities, such as unauthorized transfers or phishing attempts. Real-time monitoring allows for immediate responses to potential threats, minimizing financial losses.

Secure Payment Gateway Integration: When integrating payment gateways, Venmo and Fidelity should prioritize security. The payment gateway should be PCI DSS (Payment Card Industry Data Security Standard) compliant, ensuring that cardholder data is protected. This includes implementing secure data storage, encryption for card details, and regular security assessments. By adhering to industry standards, the companies can maintain the integrity of payment transactions and prevent unauthorized access to user financial information.

User Education and Awareness: Educating users about security best practices is crucial. Both platforms should provide clear guidelines and tutorials on how to protect their accounts and transactions. This includes advice on creating strong passwords, recognizing phishing attempts, and understanding the importance of regular account updates. By empowering users with knowledge, the risk of fraud can be significantly reduced. Additionally, implementing a reporting system where users can quickly flag suspicious activities will enable swift action against potential fraudsters.

The Ultimate Guide to Buying Investment Single-Family Homes

You may want to see also

Fidelity's Customer Support for Venmo: Assistance and troubleshooting for Venmo-related issues

Fidelity Investments, a well-known financial services company, has established a partnership with Venmo, a popular digital wallet and payment service, to offer its customers a seamless and integrated experience when it comes to managing their money. This collaboration allows Fidelity customers to link their Venmo accounts to their investment accounts, providing a convenient way to transfer funds, make payments, and even invest in various assets. However, like any financial service, users may encounter issues or have questions related to this integration. Here's an overview of how Fidelity's customer support can assist with Venmo-related matters:

When users experience problems with their Venmo accounts or transactions, Fidelity's customer support team is equipped to provide timely assistance. The support channels include phone, email, and live chat, ensuring customers can reach out through their preferred method. For Venmo-specific issues, customers can contact the dedicated support team, who are trained to handle inquiries related to the Venmo integration. This specialized support is crucial for addressing unique challenges that may arise from combining two distinct services.

Troubleshooting Venmo-related issues often involves a step-by-step process guided by the support team. For instance, if a customer is unable to link their Venmo account to their Fidelity investment account, the support representative will walk them through the account verification process, which may include providing specific account details and documentation. They might also assist in resolving issues related to fund transfers, payment processing, or any other Venmo-related transactions that customers may find confusing or problematic.

Fidelity's customer support also provides educational resources to help users understand the integration process and its benefits. This includes FAQs, how-to guides, and video tutorials that can be accessed through the Fidelity website or mobile app. By offering these resources, Fidelity empowers its customers to manage their Venmo accounts and investment portfolios independently, reducing the need for frequent support interventions.

In summary, Fidelity's customer support plays a vital role in ensuring a smooth and positive experience for customers using Venmo in conjunction with their investment services. The dedicated support team, combined with educational resources, enables users to overcome challenges and make the most of the integrated platform. This partnership between Fidelity and Venmo demonstrates a commitment to providing comprehensive financial solutions that cater to the diverse needs of investors and money managers.

The Art of Investing: Exploring Alternatives to the Picasso Path

You may want to see also

Frequently asked questions

Yes, Fidelity Investments offers the option to link your Venmo account to your investment account, allowing you to transfer funds and make payments easily.

You can follow the steps provided by Fidelity Investments to connect your Venmo account. This process typically involves logging into your Fidelity account, accessing the payment settings, and entering your Venmo account details.

Fidelity Investments may charge a small fee for certain transactions, but it is recommended to review their fee schedule for the most up-to-date information. Venmo itself may also have transaction fees, which you should be aware of before making transfers.

Absolutely! You can utilize Venmo to send funds to your Fidelity Investments account, providing a convenient way to make investments or transfers.

Fidelity Investments may have specific limits on transfer amounts, so it's essential to check their guidelines. Venmo also has its own transaction limits, which can vary depending on your account status and activity.