Impact investing, a growing trend in the financial world, aims to generate positive, measurable social and environmental impact alongside financial returns. However, the effectiveness of this approach is a subject of debate among investors, academics, and policymakers. This paragraph will explore the various perspectives on whether impact investing truly delivers on its promises, examining its potential benefits and challenges.

What You'll Learn

- Environmental Impact: Does impact investing drive sustainable practices and reduce environmental harm

- Financial Returns: Can investors achieve competitive returns while supporting social causes

- Market Trends: How do impact investing trends influence global markets and investment strategies

- Policy Influence: Does impact investing shape policies for a more sustainable economy

- Ethical Considerations: Are ethical investment choices aligned with investor values and societal expectations

Environmental Impact: Does impact investing drive sustainable practices and reduce environmental harm?

Impact investing, a financial strategy that aims to generate positive environmental and social outcomes alongside financial returns, has gained significant traction in recent years. The concept is simple: investors channel their capital into companies and funds that prioritize environmental, social, and governance (ESG) factors alongside traditional financial metrics. This approach is particularly relevant in today's world, where concerns about climate change, social inequality, and corporate governance are at the forefront of global discussions.

The environmental impact of impact investing is a critical aspect that has sparked much debate and research. Proponents argue that this investment approach can drive sustainable practices and reduce environmental harm in several ways. Firstly, impact investors often prioritize companies with strong ESG performance, encouraging these businesses to maintain or improve their environmental standards. This can lead to reduced carbon emissions, more efficient resource use, and better waste management practices. For instance, investors might prefer companies with transparent and ambitious sustainability goals, pushing them to invest in renewable energy, adopt circular economy principles, or implement sustainable supply chain management.

Secondly, impact investing can lead to increased transparency and accountability in environmental practices. Many impact investment funds require their portfolio companies to disclose detailed ESG data, which can then be publicly available. This transparency encourages companies to be more environmentally responsible, as they are held accountable to investors and stakeholders. Moreover, impact investors can actively engage with companies to improve their environmental performance, providing a platform for dialogue and potential solutions.

However, critics argue that the environmental impact of impact investing is not as straightforward. Some suggest that the focus on financial returns might overshadow the environmental goals, leading to a 'greenwashing' effect where companies only pay lip service to sustainability. There are also concerns that impact investing could inadvertently lead to a 'flight to quality' where investors only support the most environmentally responsible companies, potentially leaving behind those that could benefit from improvement. This could result in a lack of incentive for less environmentally friendly companies to change their practices.

Despite these challenges, the potential for impact investing to drive environmental change is significant. It can encourage a shift towards more sustainable business models and foster innovation in green technologies. Additionally, impact investing can contribute to the development of green markets and the creation of new, environmentally conscious investment opportunities. As the global community continues to prioritize environmental sustainability, impact investing may play a crucial role in aligning financial markets with the goals of reducing environmental harm and promoting sustainable practices.

Ford: Invest Now or Never?

You may want to see also

Financial Returns: Can investors achieve competitive returns while supporting social causes?

Impact investing, a concept that has gained traction in recent years, aims to generate positive social or environmental impact alongside financial returns. It is an approach that many investors are embracing, but the question remains: Can investors achieve competitive financial returns while actively supporting social causes? This is a critical aspect of impact investing, as it addresses the core concern of many investors—whether they can make a meaningful difference without compromising their financial goals.

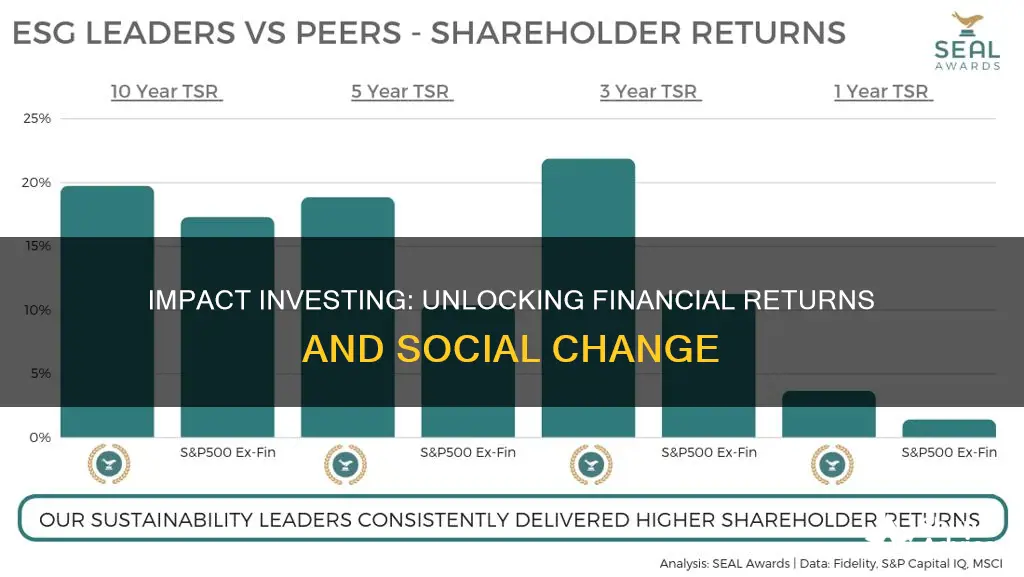

The answer to this question is a nuanced 'yes'. Impact investing can indeed deliver competitive financial returns, and numerous studies and real-world examples support this claim. For instance, a 2020 report by the Global Impact Investing Network (GIIN) revealed that impact investors achieved an average internal rate of return (IRR) of 7.2% over the past five years, outperforming the S&P 500's 5.6% IRR during the same period. This data suggests that impact investing is not just a feel-good strategy but can also be a viable option for investors seeking financial gains.

Several factors contribute to the potential for competitive financial returns in impact investing. Firstly, impact-focused companies often demonstrate strong governance and ethical practices, which can lead to more sustainable business models. These companies tend to have lower operational costs and higher customer loyalty, resulting in improved financial performance. Secondly, impact investing encourages a long-term perspective, where investors focus on the company's overall value creation rather than short-term gains. This approach often aligns with the interests of both investors and the companies they support, fostering a more stable and resilient investment environment.

Additionally, the rise of impact-focused investment funds and ETFs has made it easier for investors to gain exposure to this market. These funds are designed to track specific impact themes or sectors, allowing investors to diversify their portfolios and potentially benefit from the financial performance of these companies. As the impact investing space continues to grow, more investment opportunities are becoming available, further enhancing the potential for financial returns.

In conclusion, impact investing is not just a trend but a strategic approach that can deliver competitive financial returns while supporting social causes. The data and market trends indicate that investors can achieve their financial goals while making a positive impact. As the industry continues to evolve, it is essential for investors to conduct thorough research, understand the risks and opportunities, and make informed decisions to maximize their chances of success in this growing market.

Aston Martin Investments: Navigating the Iconic Automotive Brand

You may want to see also

Market Trends: How do impact investing trends influence global markets and investment strategies?

The concept of impact investing has been gaining traction in global markets, reshaping investment strategies and attracting a growing number of investors. This approach, which aims to generate positive, measurable social and environmental impact alongside financial returns, is transforming the way capital is allocated and managed. Here's an exploration of how these trends are influencing the investment landscape:

Growing Popularity and Market Size: Impact investing is no longer a niche concept. Its popularity has surged, with a significant increase in assets under management (AUM) dedicated to impact-focused funds. This trend is evident across various sectors, from venture capital to real estate, as investors recognize the potential for both financial and social returns. The market's growth has led to a wider range of investment products, making it more accessible to a diverse investor base.

Influencing Investment Strategies: Impact investing trends are driving a shift in traditional investment strategies. Investors are increasingly integrating environmental, social, and governance (ESG) factors into their decision-making processes. This involves not only considering the financial health of a company but also its impact on society and the environment. As a result, investment firms are developing new metrics and frameworks to assess and report on the sustainability and impact of their portfolios, ensuring that investments align with the values of socially conscious investors.

Encouraging Innovation and Sustainable Practices: The rise of impact investing has fostered innovation in various industries. Companies are under pressure to adopt sustainable practices and transparent reporting to attract impact investors. This has led to the development of new business models, technologies, and supply chains that prioritize environmental and social responsibility. As a result, impact investing is not just about financial gains but also about driving systemic change and creating long-term value.

Global Market Impact: On a global scale, impact investing trends are influencing market dynamics and geopolitical relationships. Investors are increasingly aware of the interconnectedness of economic, social, and environmental issues. This awareness is prompting a more holistic approach to investment, where financial decisions are made with a broader impact in mind. As a result, companies and governments are being held accountable for their environmental and social performance, leading to policy changes and international collaborations to address global challenges.

Challenges and Future Outlook: Despite its growing influence, impact investing faces challenges, including the need for standardized impact measurement and reporting. Investors and policymakers are working towards developing robust frameworks to ensure the authenticity and comparability of impact data. Looking ahead, the continued integration of impact investing into mainstream financial practices will likely lead to more diverse and resilient investment portfolios, contributing to a more sustainable global economy.

The Evolution of Investing: How Old Financial Tools are Shaping the Future of the Market

You may want to see also

Policy Influence: Does impact investing shape policies for a more sustainable economy?

The concept of impact investing has gained significant traction in recent years, with investors seeking to align their financial activities with positive social and environmental outcomes. This approach to investing involves directing capital towards companies, funds, and projects that generate measurable social and environmental impact alongside a financial return. While the effectiveness of impact investing is a subject of ongoing debate, its influence on policy-making and the development of a more sustainable economy is an area of growing interest.

Impact investing can shape policies by influencing regulatory frameworks and encouraging governments to adopt more sustainable practices. As impact investors increasingly demand transparency and accountability, companies are prompted to disclose their environmental, social, and governance (ESG) performance. This shift in corporate behavior can lead to the creation of new policies and regulations that promote sustainable business practices. For instance, governments might introduce mandatory ESG reporting requirements, forcing companies to address their environmental impact and social responsibilities. Such policies can drive industry-wide change, ensuring that businesses operate with a long-term view, considering the well-being of society and the environment.

Furthermore, the rise of impact investing can lead to the allocation of public funds and subsidies towards sustainable initiatives. Governments often use public investment to stimulate economic growth and address societal challenges. By integrating impact investing principles, policymakers can direct these funds towards projects with tangible social and environmental benefits. This approach not only supports sustainable development but also encourages private investors to follow suit, creating a self-reinforcing cycle of sustainable investment. For example, governments might offer tax incentives or grants to companies that meet certain sustainability criteria, thereby influencing corporate behavior and fostering a more eco-friendly economy.

In addition, impact investing can drive policy innovation by fostering collaboration between investors, businesses, and policymakers. As impact investors engage with companies and advocate for sustainable practices, they can provide valuable insights and expertise. This collaboration can lead to the development of new policies and initiatives that effectively address societal and environmental issues. For instance, impact investors might work with policymakers to design financial incentives that encourage businesses to adopt renewable energy sources or implement fair labor practices. By combining financial expertise with social impact goals, this partnership can result in more effective and targeted policies.

However, the influence of impact investing on policy is not without challenges. Critics argue that the focus on financial returns might overshadow the social and environmental impact, leading to potential greenwashing or a lack of genuine sustainability. To ensure that impact investing truly shapes policies for a more sustainable economy, there is a need for robust regulation, transparency, and long-term thinking. Regulators and policymakers must strike a balance between encouraging impact investing and preventing potential pitfalls, such as short-term financial gains at the expense of long-term sustainability.

In conclusion, impact investing has the potential to significantly influence policy-making and drive the transition towards a more sustainable economy. By promoting transparency, engaging with businesses, and fostering collaboration, impact investors can shape policies that encourage sustainable practices. However, this influence requires careful management to ensure that the financial objectives of impact investing are aligned with the broader goals of social and environmental responsibility. As the field continues to evolve, policymakers and investors must work together to create an environment where impact investing truly contributes to a more sustainable and resilient future.

Farmland: The Ultimate Investment for Long-Term Stability

You may want to see also

Ethical Considerations: Are ethical investment choices aligned with investor values and societal expectations?

Impact investing, a concept that has gained traction in recent years, involves directing capital towards investments that aim to generate positive, measurable social and environmental impact alongside a financial return. This approach is driven by the belief that investors can contribute to sustainable development and address global challenges while also seeking financial gains. However, the effectiveness and ethical implications of impact investing are subjects of ongoing debate.

One of the primary ethical considerations in impact investing is ensuring that investment choices align with the values and expectations of investors. Many investors are increasingly conscious of the environmental and social consequences of their financial decisions. For instance, a growing number of individuals and institutions are seeking to invest in companies that promote sustainable practices, support social justice, or contribute to the United Nations' Sustainable Development Goals. These investors want their money to have a positive impact, and impact investing provides a means to achieve this. However, the challenge lies in defining and measuring the impact, as what constitutes a 'positive' impact can vary widely among investors.

The alignment of ethical investment choices with societal expectations is another crucial aspect. Impact investing has the potential to influence corporate behavior and promote responsible business practices. By investing in companies that demonstrate a commitment to sustainability, human rights, and ethical governance, investors can encourage these behaviors and drive positive change. For example, impact investors might support companies that prioritize renewable energy, fair labor practices, or community development, thereby fostering a more sustainable and equitable economy.

However, the effectiveness of impact investing in delivering on its promises is a matter of debate. Critics argue that the focus on financial returns might compromise the very impact that investors seek to achieve. If the primary goal is to maximize financial gains, there is a risk that social and environmental considerations may be secondary or even ignored. Additionally, the lack of standardized metrics and reporting frameworks for impact investing can make it challenging to assess the true impact of these investments. Investors might find it difficult to compare and evaluate the social and environmental performance of different investment options, potentially leading to confusion and uncertainty.

To address these ethical considerations, impact investing practitioners and researchers are working towards developing robust frameworks for impact measurement and reporting. These frameworks aim to provide transparency and consistency, allowing investors to make informed decisions that align with their values and societal expectations. Furthermore, collaboration between investors, companies, and regulatory bodies is essential to ensure that impact investing practices are ethical, effective, and aligned with the broader goals of sustainable development.

Retirement Investing Advice: The Coming Revolution

You may want to see also

Frequently asked questions

Impact investing is an investment approach that aims to generate positive, measurable social and environmental impact alongside a financial return. It involves investing in companies, organizations, and funds that demonstrate a commitment to sustainable and ethical practices. The core idea is to align financial goals with social and environmental objectives, allowing investors to contribute to meaningful change while potentially earning a competitive financial return. This approach often involves rigorous research and analysis to identify and assess the impact of investments, ensuring that the financial gains are not at the expense of long-term sustainability.

Impact investing is not just a passing trend but a growing and increasingly mainstream investment strategy. It has gained traction due to its potential to address global challenges and create a more sustainable future. Numerous studies and reports have shown that impact investing can deliver on its promises. These studies indicate that impact-focused investments can achieve competitive financial returns while also driving positive social and environmental outcomes. For example, research by the Global Impact Investing Network (GIIN) suggests that impact investors can achieve financial returns comparable to those of traditional investors while also contributing to the United Nations Sustainable Development Goals.

As an individual impact investor, you can take several steps to ensure your strategy is effective and aligned with your values. Firstly, define your investment criteria and priorities. This may include specific sectors, such as clean energy or social justice, or particular environmental, social, and governance (ESG) factors that are important to you. Research and engage with companies and funds that demonstrate a strong commitment to these criteria. Due diligence is crucial; assess the impact claims made by investment products and consider third-party verification and reporting. Additionally, consider diversifying your portfolio across various impact investment options to manage risk and maximize the potential for positive impact. Regularly review and assess your investments to ensure they continue to meet your impact and financial objectives.