Investing isn't free. While the fees associated with investment accounts vary, there are several common fees that most investors will encounter. These fees, which are often deducted automatically from investors' accounts, can significantly eat into overall returns over time. Therefore, it is important to understand the fees you are paying and how they will impact your investment portfolio.

Some common investment fees include management or advisory fees, trading fees, expense ratios, sales charge fees, and transfer fees. Management or advisory fees are paid to the advisor or financial institution managing your account, while trading fees are incurred when buying or selling an investment. Expense ratios refer to the total annual operating expenses of a fund, expressed as a percentage of your average net assets. Sales charge fees are similar to commission fees and are charged when investors buy or redeem shares in a mutual fund. Finally, transfer fees are charged when investors transfer their investment account funds or initiate a wire transfer.

While it is not always possible to avoid these fees, there are ways to reduce investment costs. For example, investors can review their monthly statements to understand how their brokerage's fee structure is impacting their returns and consider switching to a lower-cost brokerage if necessary. Additionally, reducing trading activity and using a robo-advisor instead of a human investment advisor can help minimise costs.

| Characteristics | Values |

|---|---|

| Importance of understanding fees | Fees may seem small but can have a major impact on your investment portfolio over time. |

| Investment fees | Broker fees, trading fees, expense ratios, annual fees, custodian fees, advisory fees, commissions, and loads. |

| Minimizing fees | Minimizing fees tends to maximize performance, but it should not dominate your investment decision-making process. |

| High-fee investments | Derivatives, esoteric assets, and frontier market mutual funds. |

| Low-fee investments | Indexed ETFs, bond funds, index funds, and no-load mutual funds. |

| Impact of fees | Fees reduce the returns on your investments, especially when buying and selling often or holding long-term. |

| Average fees | 0.40% for mutual and exchange-traded funds in 2021, ranging from 0.20% to 2.00% for management fees. |

| Fee reduction strategies | Use no-fee brokers, low-cost index funds, no-load mutual funds, and robo-advisors. |

What You'll Learn

Management or advisory fees

There are two main types of management or advisory fees: asset-based fees and transaction-based fees. Asset-based fees are calculated as a percentage of the total assets under management (AUM), typically ranging from 0.25% to 1% per year. Transaction-based fees, on the other hand, involve paying commissions or 'loads' to purchase products or trade in the market. These fees are usually associated with full-service broker-dealer transactions.

Some financial advisors also charge a flat fee or hourly rate that is not tied to commissions or asset-based fees. These fee-based advisors offer more transparency and do not involve any sales commissions or percentage of AUM.

When considering management or advisory fees, it is important to remember that fees can significantly impact your investment returns over time. Higher fees result in lower net returns, so it is crucial to carefully evaluate and compare the fees charged by different financial advisors to ensure you are getting value for your money.

Sanlam Payout Speed: Unlocking Your Investments

You may want to see also

Trading fees

Some brokers may offer discounted trading fees for large-volume trades. Others may charge a flat trade fee regardless of the number of shares purchased. The fee you pay may also differ depending on the type of security, such as stocks, mutual funds, or ETFs. With options trading, you may pay a base fee or a per-contract fee.

More online brokerages are now offering commission-free trading, but this typically applies only to certain types of securities. For example, E-Trade and TD Ameritrade offer zero trading fees for stock, ETF, and options trades but still charge fees for traditional mutual funds and per-contract fees for options.

- Brokerage fees: annual fees, monthly account maintenance fees, inactivity fees, research fees, paper statement fees, or transfer fees.

- Management or advisory fees: a flat dollar amount or a percentage of your account assets under management.

- Expense ratio: an annual fee charged by mutual funds, index funds, and exchange-traded funds as a percentage of your investment in the fund. The average expense ratio for funds is around 0.56%.

ETFs: Invest Now or Later?

You may want to see also

Expense ratios

When it comes to investing, it's important to be aware of the fees you'll be paying in the process. One such fee is the expense ratio, which is a fee that investors pay for the management of a fund. This includes all administrative, marketing, and management fees.

The expense ratio is calculated by dividing a fund's net operating expenses by its net assets. It is usually expressed as a percentage of the fund's average net assets, rather than a flat dollar amount. For example, an expense ratio of 0.2% means that for every $1,000 invested in a fund, the investor pays $2 annually in operating expenses. These expenses are taken out over time and can add up, so it's important to be aware of them.

Actively managed mutual funds typically have higher expense ratios than passively managed funds because they have managers and researchers who are actively choosing assets to buy and sell. In contrast, passively managed funds like index exchange-traded funds (ETFs) usually have lower expense ratios because they aim to perform as well as the overall market, rather than trying to beat it.

Over the past 20 years, expense ratios among all funds have been trending downward. According to Morningstar's 2020 US Fund Fee Study, the asset-weighted average expense ratio fell to 0.41% in 2020 from 0.93% in 2000.

It's worth noting that while minimizing fees can help maximize performance, it's important not to let fees dominate your investment decision-making process. Some investment products, like derivatives, inherently carry high fees. On the other hand, certain asset classes, like indexed ETFs and bond funds, tend to have lower fees.

Investing: A New National Pastime?

You may want to see also

Sales charge fees

When it comes to investing, fees are an important consideration. While some fees are inevitable, it is crucial to understand the different types of fees and their potential impact on your investments. Among these fees, sales charges, also known as loads, are an additional cost that investors may encounter when purchasing mutual funds.

A sales charge is a commission or fee paid by investors to a financial intermediary, such as a broker, financial planner, or investment advisor. This fee is typically expressed as a percentage of the investment value and serves as compensation for facilitating the transaction. In the context of mutual funds, sales charges can be structured in various ways, including front-end loads, back-end loads, and deferred sales charges.

Front-end sales charges are paid as a percentage of the purchase price at the time of investment, essentially reducing the amount available to purchase fund shares. For example, if an investor purchases $10,000 worth of fund shares with a 5% front-end load, they will pay a sales charge of $500, resulting in an actual investment of $9,500. Back-end sales charges, on the other hand, are paid as a percentage of the selling price when the shares are redeemed or sold. Deferred sales charges are a type of back-end sales charge that declines over time, sometimes reaching zero, and are contingent on the holding period.

Sales charges can have a significant impact on investor returns, and they are not always easily identifiable. For instance, an investor who intends to hold a mutual fund for an extended period may purchase shares with deferred sales charges, expecting the charges to eventually reach zero. However, if they need to sell their shares earlier than planned, they may be hit with an unexpected sales charge.

It is worth noting that sales charges are not factored into the gross and net expense ratio of a fund. This is because they are paid to financial intermediaries for their role in selling the fund, rather than to the fund itself. To avoid sales charges, investors can opt for no-load mutual funds or exchange-traded funds (ETFs). These funds do not charge a sales load, providing a more cost-effective alternative.

While sales charges can add to the overall cost of investing, they are just one component of the fees associated with mutual funds. It is important for investors to carefully review the fund's prospectus, including the fee table, to understand all the fees and charges associated with a particular fund. Additionally, asking questions and conducting thorough research can help investors make informed decisions and minimize the impact of fees on their investment returns.

Student Debt vs Retirement: Navigating the Investment Dilemma

You may want to see also

Transfer fees

For example, when transferring a brokerage account, the old broker may charge a fee, typically ranging from $50 to $100, for a full transfer out of the account. This fee may be reimbursed by the new broker through a formal program or an informal cash-back or free-trading bonus. While it may be challenging to avoid this fee entirely, it is worth considering the potential savings from reduced trading commissions at the new broker.

In addition to transfer fees, there are other costs associated with investing, such as expense ratios, market costs, custodian fees, advisory fees, commissions, and loads. These fees can impact investment returns and should be carefully considered when making investment decisions.

It is important to understand the fees associated with any investment product or service and to ask questions to ensure a comprehensive understanding of the costs involved. Over time, minimizing fees can help maximize investment performance.

Shares: Picking Winners

You may want to see also

Frequently asked questions

Investment fees are fees charged for the use of financial products and services. Examples include broker fees, trading fees, expense ratios, and advisory fees.

Investment fees are charged for the use of financial products and services, and they can vary depending on the type of investment and the financial institution. These fees are important because they can impact your overall returns, and it's crucial to understand them to invest wisely.

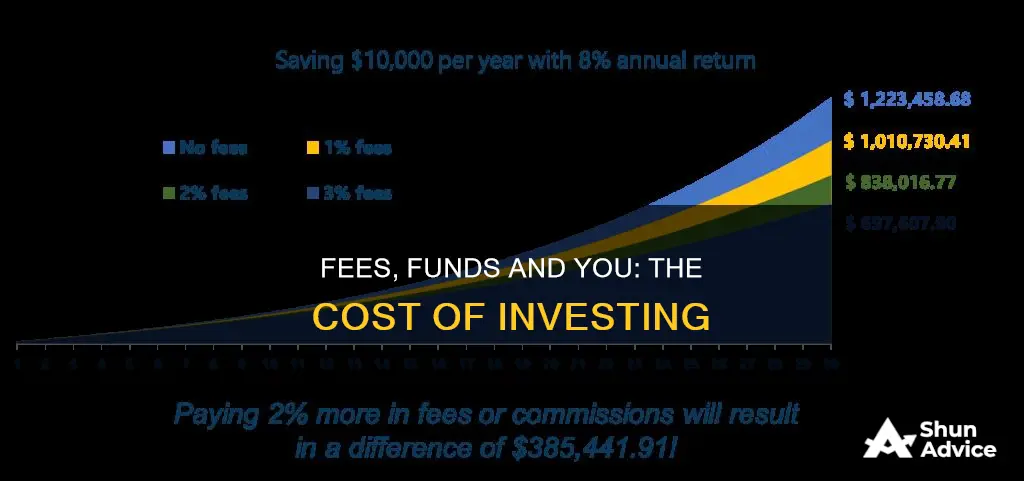

Investment fees reduce your returns. Even small fees can add up over time and eat into your savings due to compounding. It's important to understand the fees you're paying to make informed decisions about your investments.

You can reduce investment fees by reviewing your investment decisions and making adjustments. Consider using no-fee brokers, low-cost index funds with low expense ratios, and no-load mutual funds. You can also use a robo-advisor, which tends to be less costly than human advisors. Additionally, pay close attention to your brokerage's fee structure to make informed choices.