The concept of investment risk is a critical aspect of financial planning, as it directly impacts the potential returns and stability of an individual's or organization's financial portfolio. Understanding investment risk is essential for making informed decisions about where and how to allocate resources. This paragraph will explore the various types of investment risks, their sources, and how they can be managed to ensure a balanced and sustainable approach to investing.

What You'll Learn

- Return on Investment (ROI): How much profit or loss is generated from an investment

- Risk Assessment: Evaluating potential risks associated with an investment

- Diversification: Spreading investments across multiple assets to reduce risk

- Market Volatility: Fluctuations in asset prices and their impact on investments

- Long-Term vs. Short-Term: Understanding the time horizon for investment success

Return on Investment (ROI): How much profit or loss is generated from an investment

Return on Investment (ROI) is a crucial metric used to evaluate the profitability and efficiency of an investment. It provides a clear picture of how much profit or loss an investment generates relative to its initial cost. ROI is a simple yet powerful tool that helps investors and businesses make informed decisions about their financial endeavors.

To calculate ROI, you need to follow a straightforward formula: ROI = (Net Profit / Cost of Investment) * 100. Here's a breakdown of each component:

- Net Profit: This is the total earnings or gains from the investment after all expenses and costs have been deducted. It represents the actual financial benefit realized from the investment.

- Cost of Investment: This refers to the initial amount of money or resources invested. It includes the purchase price, any associated fees, and any other direct costs incurred to acquire the investment.

For example, let's say an investor purchases a piece of property for $100,000. Over the next five years, the property generates rental income of $15,000 annually, and various expenses, such as maintenance and property taxes, amount to $5,000 per year. After five years, the investor decides to sell the property for $140,000. The net profit would be calculated as follows: Net Profit = ($15,000 * 5) - ($5,000 * 5) - $100,000 = $75,000 - $25,000 - $100,000 = $50,000. The ROI would then be: ROI = ($50,000 / $100,000) * 100 = 50%.

ROI is a versatile metric that can be applied to various investment types, including stocks, real estate, businesses, and even personal savings accounts. It allows investors to compare the performance of different investments and make strategic choices. A higher ROI indicates a more profitable investment, while a negative ROI suggests a loss.

It's important to note that ROI doesn't provide a complete picture of an investment's success. Other factors, such as risk, time horizon, and cash flow, should also be considered. Additionally, ROI can be influenced by market conditions and external factors, so it's essential to analyze investments holistically.

In summary, ROI is a fundamental concept in investment analysis, offering a clear and concise way to measure the profitability of an investment. By understanding and utilizing ROI, investors can make more informed decisions and potentially increase their chances of achieving their financial goals.

The Equipment Conundrum: Is Buying Gear Really an Investment?

You may want to see also

Risk Assessment: Evaluating potential risks associated with an investment

When assessing the potential risks associated with an investment, it's crucial to conduct a comprehensive risk evaluation to ensure informed decision-making. Here's a detailed guide on how to approach this process:

- Identify Risks: Begin by identifying all possible risks related to the investment. This includes market risks, such as fluctuations in stock prices or interest rates, and specific risks tied to the investment itself. For instance, if investing in a tech startup, consider the industry's volatility, regulatory changes, and the company's unique challenges. Make a comprehensive list to ensure no potential risk factor is overlooked.

- Analyze Historical Data: Research and analyze historical data to understand the investment's past performance and any associated risks. Study market trends, economic cycles, and how similar investments have fared during past downturns or upswings. This historical perspective provides valuable insights into potential future scenarios. For example, examining the performance of a particular stock during economic recessions can reveal its resilience or vulnerability.

- Evaluate Risk Mitigation Strategies: Develop strategies to mitigate identified risks. This might involve diversifying your investment portfolio to reduce concentration risk, implementing stop-loss orders to limit potential losses, or utilizing insurance products tailored to investment risks. For instance, you could consider buying put options to hedge against potential stock price declines.

- Scenario Analysis: Perform scenario analysis by creating various hypothetical situations that could impact your investment. This involves stress-testing your investment strategy under different economic conditions, market trends, and potential events. By doing so, you can identify the investment's resilience and potential weaknesses. For example, simulate a scenario where interest rates rise rapidly and assess the impact on bond investments.

- Regular Review and Monitoring: Risk assessment is an ongoing process. Regularly review and update your risk analysis as new information becomes available or market conditions change. Stay informed about industry developments, regulatory shifts, and global events that could influence your investments. This proactive approach ensures that your risk assessment remains relevant and accurate.

By following these steps, investors can make more informed decisions, manage potential risks effectively, and ultimately improve their chances of success in the investment journey. Remember, a well-structured risk assessment is a powerful tool for navigating the complexities of the financial markets.

Investment Influx: Output Demand Shift

You may want to see also

Diversification: Spreading investments across multiple assets to reduce risk

Diversification is a fundamental strategy in investing that aims to minimize risk and maximize returns by allocating investments across various assets. The core principle is to spread your capital across different asset classes, sectors, and geographic regions to ensure that your portfolio is not overly exposed to any single investment or market downturn. By doing so, you create a balanced and resilient investment strategy.

The idea behind diversification is to recognize that different assets perform differently under various market conditions. For example, stocks in one country might suffer during a recession, while real estate investments in another region could thrive. By diversifying, you reduce the impact of any one asset's poor performance on your overall portfolio. This approach is particularly crucial for long-term investors seeking to weather market volatility and build wealth over time.

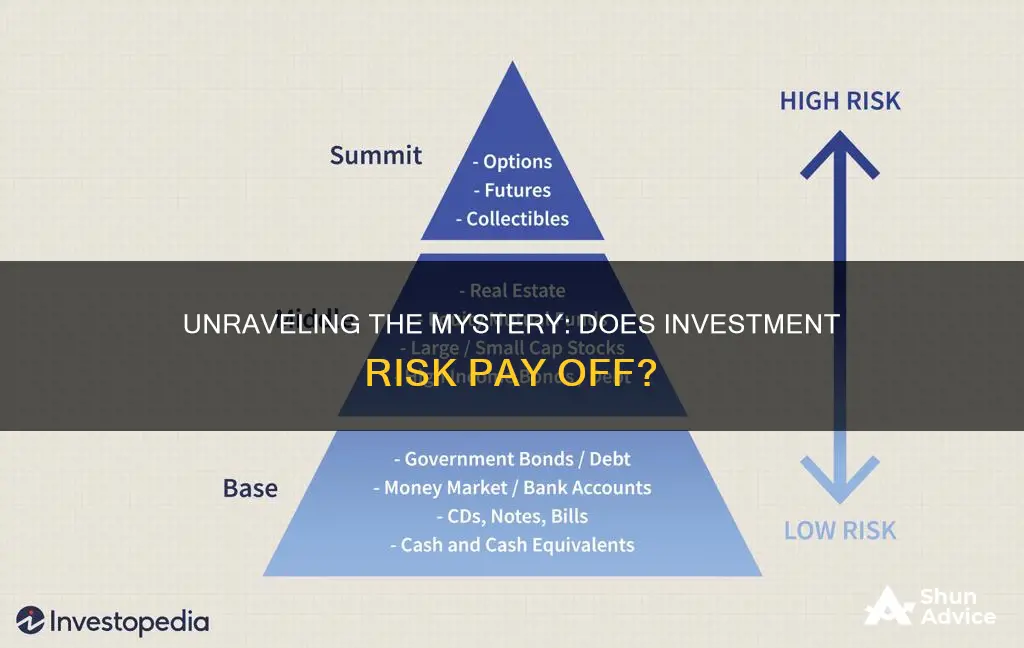

To implement diversification, investors can follow a few key steps. Firstly, identify the asset classes that align with your investment goals and risk tolerance. Common asset classes include stocks, bonds, real estate, commodities, and cash equivalents. Each asset class has its own characteristics and risk-return profile. For instance, stocks generally offer higher potential returns but come with higher risk, while bonds are considered less risky but may provide lower returns.

Secondly, consider the specific sectors and industries within each asset class. Diversifying across sectors ensures that your portfolio is not heavily reliant on the performance of a single industry. For example, investing in technology stocks alone might expose you to significant risk if the tech sector experiences a downturn. By diversifying into other sectors like healthcare, consumer goods, or energy, you create a more balanced approach.

Lastly, geographic diversification is another important aspect. Investing in companies or assets from different countries can help reduce the impact of country-specific risks and economic events. International investments can provide exposure to global growth opportunities while also offering a hedge against domestic market fluctuations. This strategy allows investors to tap into the potential of emerging markets while managing risks associated with geopolitical events.

In summary, diversification is a powerful tool for investors to manage risk and optimize returns. By spreading investments across multiple assets, sectors, and regions, investors can create a well-rounded portfolio that is less susceptible to market volatility. This approach enables investors to stay committed to their long-term financial goals while navigating the complexities of the investment landscape with greater confidence.

Buy-to-Let UK: Where to Invest for Long-Term Returns

You may want to see also

Market Volatility: Fluctuations in asset prices and their impact on investments

Market volatility refers to the rapid and significant changes in the prices of assets, such as stocks, bonds, commodities, and currencies. It is a natural and inevitable aspect of financial markets, and understanding its dynamics is crucial for investors seeking to navigate the investment landscape effectively. Volatility can be both a friend and a foe, offering both opportunities and risks.

In the investment world, volatility is often measured by the standard deviation of asset prices over a specific period. This statistical measure quantifies the dispersion of returns around the expected value, providing a clear picture of how much prices fluctuate. High volatility indicates that asset prices are highly sensitive to market forces and external factors, while low volatility suggests more stable and consistent price movements.

The impact of market volatility on investments is profound. During periods of high volatility, asset prices can experience dramatic swings, leading to substantial gains or losses for investors. For instance, in the stock market, a highly volatile day might see a company's share price surge by 20% in one day and drop by a similar amount in the next, creating a rollercoaster effect. Such volatility can be particularly challenging for investors who prefer a more stable and predictable environment.

On the other hand, market volatility also presents opportunities. Investors who embrace volatility can potentially benefit from the following strategies:

- Long-Term Investing: Over extended periods, market volatility tends to even out. Investors who maintain a long-term perspective can weather short-term fluctuations and benefit from the overall growth of the market.

- Diversification: Spreading investments across various assets and sectors can reduce the impact of volatility. Diversification ensures that an investor's portfolio is not overly exposed to any single asset or market segment, thus mitigating potential risks.

- Risk Management: Understanding and managing risk is essential. Investors can employ strategies like stop-loss orders, which automatically sell assets when they reach a certain price, limiting potential losses during volatile periods.

- Arbitrage Opportunities: Volatile markets can create temporary price discrepancies between assets. Savvy investors can exploit these differences by taking advantage of arbitrage opportunities, buying assets in one market and selling them in another at a higher price.

In conclusion, market volatility is an inherent feature of financial markets, and investors must learn to adapt and respond accordingly. While it can be a source of anxiety, especially for risk-averse investors, it also presents opportunities for those who understand its dynamics. Embracing volatility, diversifying portfolios, and employing risk management techniques can help investors navigate the ups and downs of the market, ultimately contributing to their long-term investment success.

Wealthy Secrets: Where the Rich Invest

You may want to see also

Long-Term vs. Short-Term: Understanding the time horizon for investment success

When it comes to investing, understanding the concept of time horizons is crucial for success. The time horizon refers to the length of time an investor is willing to commit their money to an investment strategy. This decision significantly impacts the types of investments one can make and the overall approach to building wealth. The debate between long-term and short-term investing is a fundamental aspect of financial planning, and it's essential to grasp the nuances of each strategy.

Long-term investing is a strategy that focuses on holding investments for an extended period, often years or even decades. This approach is based on the idea that the stock market tends to reward patient investors over time. By investing for the long term, individuals can benefit from the power of compounding, where their returns grow exponentially as they earn interest or dividends on their initial investment and reinvest those earnings. This strategy is particularly effective for retirement planning, as it allows investors to weather short-term market fluctuations and build substantial wealth over the years. For instance, investing in index funds or well-diversified portfolios of stocks and bonds for a 30-year period has historically shown to outperform short-term trading strategies.

On the other hand, short-term investing involves a more active approach, aiming to capitalize on market trends and price movements within a relatively brief period. This strategy often requires a keen understanding of market dynamics and the ability to make quick decisions. Short-term investors may engage in frequent buying and selling, seeking to profit from short-term price fluctuations. While this approach can be lucrative in the short run, it often comes with higher risks. Short-term market volatility can lead to significant losses if not managed carefully. Additionally, frequent trading incurs higher transaction costs, which can eat into potential profits.

The choice between long-term and short-term investing depends on an individual's financial goals, risk tolerance, and investment knowledge. Long-term investing is generally recommended for those seeking retirement savings or long-term wealth accumulation, as it provides a more stable and less stressful investment journey. Short-term strategies might be more suitable for those with a higher risk tolerance and a shorter investment timeframe, such as active traders looking to capitalize on market opportunities.

In conclusion, understanding the time horizon for investment success is essential for making informed financial decisions. Long-term investing offers the potential for substantial wealth accumulation and is well-suited for retirement planning, while short-term strategies require more active management and can be riskier. By aligning investment strategies with personal goals and risk profiles, investors can navigate the financial markets with confidence and work towards their financial objectives.

Loans and Investments: Navigating the Path to Financial Freedom

You may want to see also

Frequently asked questions

Investment risk refers to the possibility of financial losses when investing in assets such as stocks, bonds, or other securities. It is the potential for the actual return on an investment to differ from the expected return, often due to market volatility, economic conditions, or specific company-related factors.

Evaluating investment risk involves analyzing various factors. These include studying historical market performance, understanding the industry and company-specific risks, assessing the overall economic environment, and considering your own risk tolerance and investment goals. Diversification is also a key strategy to manage risk by spreading investments across different asset classes and sectors.

While it is not possible to completely eliminate investment risk, it can be effectively managed and mitigated. Investors can employ strategies such as thorough research, diversification, regular portfolio rebalancing, and staying informed about market trends and news. Additionally, consulting financial advisors can provide personalized guidance to navigate risk effectively.

Investment risks can be categorized into several types, including market risk, credit risk, liquidity risk, and operational risk. Market risk relates to fluctuations in asset prices. Credit risk is associated with the possibility of borrowers defaulting on debt. Liquidity risk refers to the difficulty in converting an asset into cash without significant loss. Operational risk covers potential losses due to internal processes, human error, or system failures.

Protecting investments involves a combination of strategies. Diversification is crucial, as it reduces the impact of any single investment's performance on your overall portfolio. Regularly reviewing and rebalancing your portfolio can help maintain its alignment with your risk tolerance. Additionally, staying invested through market cycles, avoiding emotional decisions, and seeking professional advice can contribute to long-term investment success.