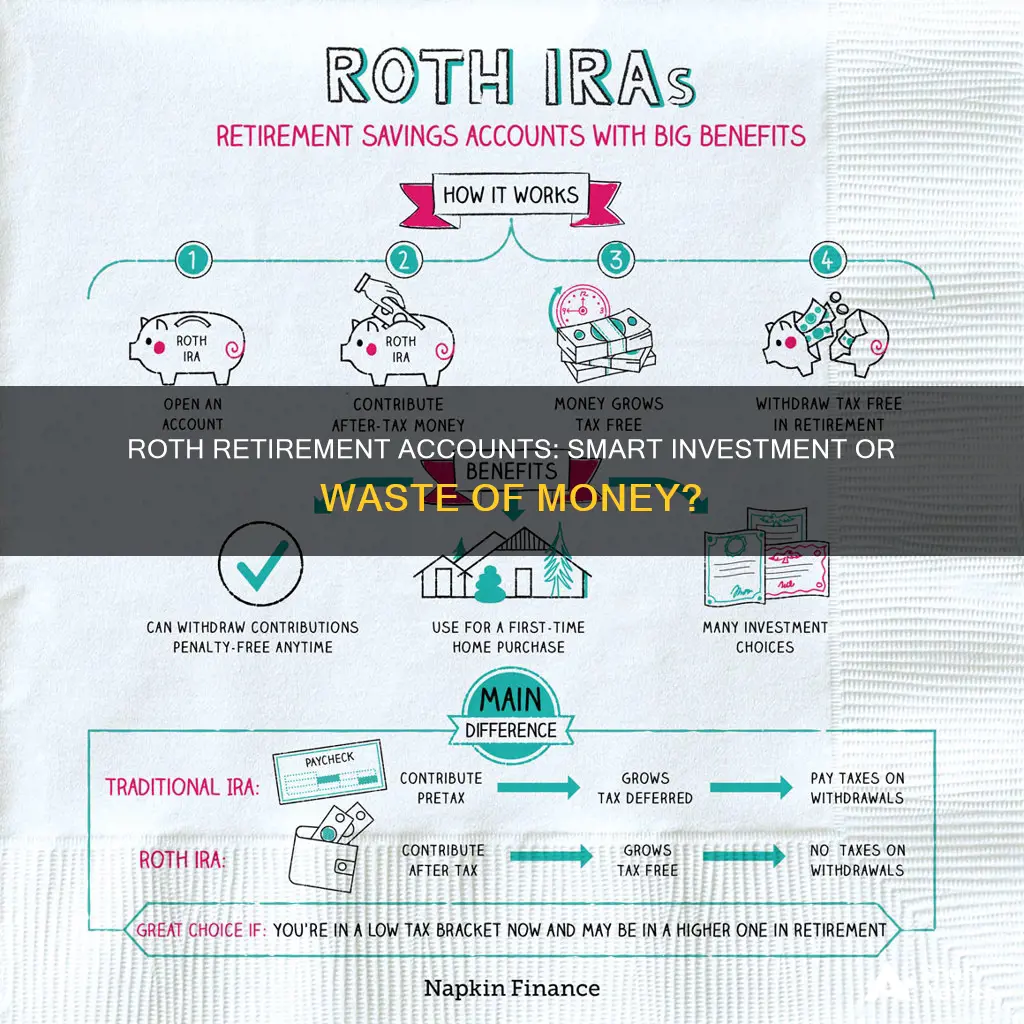

A Roth IRA is a type of individual retirement account that lets you contribute after-tax money to save for retirement. The main draw of a Roth IRA is that the money grows tax-free and can be withdrawn tax-free after age 59 1/2 as long as the account has been open for at least five years. The main difference between a Roth IRA and a traditional IRA is tax treatment. In a traditional IRA, contributions are tax-deductible in the year they're made, but withdrawals in retirement are taxed as ordinary income.

When deciding whether to invest in a Roth IRA, it's important to consider your current and future tax rates, income, and financial goals. If you expect to be in a higher tax bracket during retirement than you are now, a Roth IRA may be more beneficial due to the potential for long-term tax savings. On the other hand, if you're in your peak earning years or expect to have lower taxable income in retirement, a traditional IRA may be a better option as it allows you to reduce your taxes today. Additionally, eligibility and contribution limits for Roth IRAs are based on income, so it's important to consider whether you fall within the income ranges for contributing directly to a Roth IRA.

Other factors to consider include the flexibility of early withdrawal options, required minimum distributions in retirement, and the potential for tax diversification when used in conjunction with other retirement accounts. While it's hard to predict future tax rates and income levels, carefully weighing these factors can help determine whether investing in a Roth IRA makes sense for your financial situation.

| Characteristics | Values |

|---|---|

| Tax treatment | Contributions are made with after-tax dollars; qualified withdrawals in retirement are tax-free |

| Tax deductions | No tax deductions |

| Income limits | Yes |

| Early withdrawals | Contributions can be withdrawn at any time without penalty |

| Required minimum distributions | No RMDs |

| Investment options | Stocks, bonds, mutual funds, ETFs, index funds, CDs |

| Eligibility | Based on income and tax filing status |

| Contribution limits | $7,000 for under 50s in 2024 and 2025 ($8,000 if 50 or older) |

What You'll Learn

Tax-free withdrawals

One of the most attractive features of a Roth IRA is the potential for tax savings. With a traditional IRA, you pay less in taxes every year that you contribute, but you'll generally have to pay taxes on the money you withdraw in retirement. With a Roth IRA, you contribute money that's already been taxed, and you can withdraw it tax-free in retirement, provided you've had the account for at least five years. This makes a Roth IRA ideal for those who expect to be in a higher tax bracket when they retire than they are now.

Another benefit of a Roth IRA is that you can withdraw the amount you contributed at any time, even before you retire, without incurring taxes or penalties. This is because the money you put in is money you've already paid income tax on. In contrast, withdrawals from a traditional IRA before the age of 59 1/2 are subject to taxes and a 10% penalty, unless you meet an exception.

A Roth IRA also has fewer restrictions for retirees. Traditional IRAs require you to start taking required minimum distributions (RMDs) at certain ages. That age was 72 previously; it increased to 73 in 2023 and will increase again to 75 in 2033. Unless you're inheriting the Roth IRA, Roth IRAs have no RMD rules, so you're free to let your savings stay in the account and continue to grow tax-free for as long as you live.

Additionally, a Roth IRA can be used for estate planning. You can pass on any money you don't use to your beneficiaries tax-free in an inherited Roth IRA.

Investing at 25: A Guide for Indians

You may want to see also

Eligibility

Firstly, you must have earned income to be eligible for a Roth IRA. This can be from employment, self-employment, certain military income streams, or certain disability benefits. Passive income does not qualify as earned income.

Secondly, your income must fall within certain thresholds. For 2024, if your modified adjusted gross income (MAGI) is less than $146,000 as a single filer, you can contribute the full annual amount. If your MAGI is $146,000 or more but less than $161,000, your contribution is reduced. If your MAGI is $161,000 or more, you are not eligible to contribute. For married couples filing jointly, the limits are $230,000 and $240,000, respectively, in 2024. These limits are adjusted annually by the IRS.

Thirdly, you can only contribute up to your earned income for the year. So, if you earned less than the maximum contribution limit, the dollar value of your earned income is the most you can contribute.

Finally, your contributions to a Roth IRA cannot exceed the annual limit. For 2024, the limit is $7,000, or $8,000 if you are aged 50 or older. This limit applies across all IRAs you might have.

Establishing a Managed Investment Trust: A Step-by-Step Guide

You may want to see also

Early withdrawals

However, there are certain situations in which you can withdraw contributions from your Roth IRA at any time without penalty. For example, you can withdraw your contributions tax- and penalty-free if you are using the funds for a first-time home purchase (up to a $10,000 lifetime maximum), qualified education expenses, certain emergency expenses, qualified expenses related to a birth or adoption, or unreimbursed medical expenses or health insurance if you're unemployed.

If you withdraw earnings from your Roth IRA before the age of 59 1/2, you may be able to avoid the penalty (but not the taxes) in the following situations:

- You are totally and permanently disabled

- You are terminally ill

- The distribution is made to a beneficiary or estate on account of the IRA owner's death

- The distribution is made as part of a series of substantially equal periodic payments

- The distribution is not in excess of your qualified higher education expenses

- The distribution is not in excess of $10,000 and is used for a qualified first-time home purchase

- The distribution is made directly to the government to satisfy an IRS levy

- The distribution is a qualified reservist distribution

- The distribution is not in excess of $5,000 and is a qualified birth or adoption distribution

- The distribution is made to a victim of domestic abuse by a spouse or domestic partner

- The distribution is made to qualified individuals who sustain an economic loss due to a federally declared disaster

- The distribution is made for personal or family emergency expenses

- The distribution is a permissible withdrawal from a SIMPLE IRA or SARSEP with automatic enrollment features

It is important to note that if you withdraw earnings early from your Roth IRA, you will likely owe income tax in addition to the 10% penalty. Additionally, you will miss out on the potential growth of your investment over time. Therefore, early withdrawals from a Roth IRA should only be made when absolutely necessary.

Understanding Your Total Investment Portfolio

You may want to see also

Required minimum distributions

When it comes to retirement, it's important to understand the differences between a Roth IRA and a traditional IRA. While both have their advantages, a key distinction lies in how they are taxed. With a traditional IRA, you contribute pre-tax dollars, reducing your taxable income for the year, but you pay taxes on withdrawals in retirement. On the other hand, with a Roth IRA, you contribute after-tax dollars, and qualified distributions in retirement are tax-free. This includes both the contributions and any investment earnings.

Now, let's focus on the topic of Required Minimum Distributions (RMDs). RMDs refer to the minimum amounts that you must withdraw annually from your retirement accounts starting at a certain age. Here are some key points about RMDs:

- Age Requirement: For traditional IRAs, SEP IRAs, SIMPLE IRAs, and retirement plans like 401(k)s, you generally must start taking RMDs in the year you turn 73. However, if you are still working and are a participant in a workplace retirement plan, you may be able to delay RMDs until retirement, unless you own 5% or more of the business.

- Calculation: The amount of the RMD is calculated by dividing the prior year-end balance of your retirement account by a life expectancy factor provided by the IRS. This calculation is done separately for each retirement account you own.

- Roth IRAs: During the account owner's lifetime, RMDs do not apply to Roth IRAs or Designated Roth accounts (401(k) or 403(b)). However, beneficiaries of these accounts are subject to RMD rules.

- Penalties: If you fail to take the required minimum distribution by the deadline, you may face a penalty. The penalty is typically a 25% excise tax on the amount that should have been withdrawn, but if the RMD is corrected within two years, the penalty can be reduced to 10%.

- Withdrawal Options: You have flexibility in how you take your RMD. You can opt for a one-time lump-sum withdrawal, a series of withdrawals, or schedule automatic withdrawals. Additionally, you can withdraw more than the minimum required amount.

In summary, while Roth IRAs do not require RMDs during the account owner's lifetime, it's important to be aware of the RMD rules that apply to beneficiaries of these accounts. Understanding the RMD requirements for different types of retirement accounts is crucial for effective retirement planning and ensuring compliance with tax regulations.

Investment Planning Manager: Role and Responsibilities Explained

You may want to see also

Tax diversification

The three types of investment accounts in terms of tax treatment are:

- Fully taxable investment accounts: These are funded with after-tax money and offer few immediate tax benefits. Examples include traditional brokerage accounts, bank savings accounts, and CDs held outside of a retirement plan.

- Tax-advantaged investment accounts: These accounts, such as 401(k)s, 403(b)s, and traditional IRAs, are considered tax-deferred. They are funded with pre-tax, tax-deductible, or after-tax contributions, and earnings are tax-deferred. However, withdrawals and annual minimum distributions (RMDs) are taxed as ordinary income.

- Tax-free investment accounts: This category includes Roth IRAs and Roth 401(k)s, which are funded with after-tax money. Earnings and withdrawals are generally tax-free if certain conditions are met. Other tax-free savings vehicles include 529 college savings plans and Health Savings Accounts (HSAs).

The benefits of tax diversification include:

- Control over your finances: Taxable and tax-free accounts do not have distribution requirements during your lifetime, giving you control over when and how much you withdraw.

- Fuel savings and prolong assets: By choosing which assets to use for income, you can spread your taxable distributions over more years, managing tax brackets and paying less in taxes.

- Flexibility: Life events can change your savings and income needs. Diversifying your savings among different tax treatments gives you greater flexibility to adapt.

- Passing on more to loved ones: Tax diversification can give you more flexibility when managing the transfer of your assets to beneficiaries.

When deciding between a Roth and a traditional account, consider your current and future marginal tax rates. If you expect your tax rate to be higher in retirement, paying taxes now with Roth contributions makes sense. If your tax rate is likely to be lower, you can use traditional contributions to defer taxes.

Understanding Passive Portfolio Investment Vehicles: Strategies and Benefits

You may want to see also

Frequently asked questions

A Roth IRA is an individual retirement account that you contribute to with after-tax dollars. While you don't get a tax break upfront, your contributions and investment earnings grow tax-free.

A Roth IRA offers several benefits, including:

- Long-term financial planning: If you expect to be in a higher tax bracket when you retire, a Roth IRA can be advantageous as you've already paid taxes on your contributions.

- Rising inflation: With high inflation, giving your money an opportunity to grow tax-free can be lucrative.

- Flexible early withdrawal: While early withdrawals from retirement accounts are generally discouraged, a Roth IRA allows you to withdraw contributions without penalties at any time.

- No required minimum distributions: Traditional IRAs require you to start taking minimum distributions at certain ages, whereas a Roth IRA has no such restrictions.

- Tax diversification: Funding a Roth IRA in conjunction with a 401(k) provides diversification for managing your tax burden in retirement.

Some drawbacks of a Roth IRA include:

- Waiting period for withdrawing earnings: You must wait five years from the first contribution to withdraw earnings tax-free, which can be a disadvantage if you're close to retirement.

- No upfront tax deductions: Contributions to a Roth IRA are not tax-deductible, and you won't get any tax deductions during the year you contribute.

- Income limits: Roth IRAs have income limits, and if you exceed these limits, you may not qualify for a Roth IRA.