Investment management fees are fees paid to financial advisors for their services. These fees are typically calculated as a percentage of the assets under management (AUM) and can vary depending on the size of the account and the type of portfolio being managed. In the past, these fees were tax-deductible as miscellaneous itemized deductions, but the rules have changed since 2018. Now, there are different ways to report and claim deductions for investment management fees, depending on the tax software or platform being used. It is important to carefully review the applicable tax laws and regulations to ensure accurate reporting and compliance.

What You'll Learn

Investment management fees and tax returns

Investment management fees and financial planning fees were categorised as miscellaneous itemized deductions on your tax return prior to 2018. They had to exceed 2% of your adjusted gross income (AGI) to qualify. For instance, if your AGI was $100,000 and you paid $3,000 in investment management fees, you would be able to deduct $1,000 (the amount above $2,000, which is 2% of your AGI).

However, the Tax Cuts and Jobs Act (TCJA) eliminated these deductions from the tax code starting with the 2018 tax year. If you didn't claim these deductions before 2018 but were eligible to, you can still amend your tax return for up to three years from the date you filed it, or for two years from the date you paid any resulting tax, whichever is later.

To enter investment management fees in your tax return, you can follow these general steps:

- Open your tax return and select "My Account".

- Type "investment advisor fees" or "investment management fees" in the box and select "GO".

- Enter the amount of your investment management fees.

Please note that these steps may vary depending on the specific tax software or platform you are using. Additionally, the process may be different for residents of certain countries or states.

The Investment Management Industry: Size and Scope Explored

You may want to see also

Deducting fees from taxable income

According to the Income Tax Act, a taxpayer is allowed to deduct fees that are charged for advice on the buying or selling of specific shares or securities, or for the administration or management of securities held by that taxpayer, provided that the fee amounts paid are reasonable. For a fee to be deductible, it must be attributable to taxable income; fees for tax-exempt investments like municipal bonds are not deductible.

To be deductible, the fee must also be provided by a person (e.g. an advisor) or entity (e.g. an investment firm) whose principal business is providing buy/sell advice on specific securities or includes the administration or management of securities.

The deductibility of investment fees also depends on the type of investment account. Fees charged on registered assets, regardless of the investments held, are not tax-deductible. This includes fees for Tax-Free Savings Accounts (TFSAs) or Registered Retirement Savings Plans (RRSPs).

However, fees paid for taxable accounts are deductible. For example, if you have a mutual fund trust that has a combination of a management expense ratio (MER) and an advisor fee, the advisor fee is tax-deductible for the investor.

It's important to note that commissions paid on the trading of stocks and ETFs, transaction fees, fees paid for general financial counselling or planning, and subscription fees for financial magazines and newspapers are not deductible.

When claiming a deduction for investment fees, they must be greater than 2% of your adjusted gross income.

Managing Venezuela's Future: Foreign Investment and Aid

You may want to see also

Investment management fees and tax preparation fees

To enter your investment management fees, open your return and select 'My Account'. Type 'investment advisor fees' in the box, then select 'GO'.

To enter your tax preparation fees, follow the same process, typing 'tax preparation fees' in the box instead.

If you are using H&R Block’s 2018 tax software, you can enter your carrying charges on the 'Statement of investment income, carrying charges, and interest expenses' page, found under the 'PENSION PLANS AND INVESTMENTS' icon on the PREPARE tab.

If you are a Québec resident, you can enter your carrying charges on the 'Statement of investment income and adjustment of investment expenses (federal worksheet & Schedule N)' page, also found under the 'PENSION PLANS AND INVESTMENTS' icon on the PREPARE tab.

If you are using TaxAct®, click on the Federal tab, then click 'Itemized or Standard Deductions' to expand the category. Next, click 'Other expenses related to taxable income - Subject to 2% of AGI limit'. On the first screen, titled 'Itemized Deductions - Other Expenses - Subject to 2% of AGI Limit', you will see the amount on the line 'Investment fees & expenses from a regulated investment company' for the amounts that have been entered on Forms 1099-INT, DIV, or OID, if applicable.

Enter any other investment expenses in the field 'Investment fees, custodial fees, trust administration fees, and other expenses you paid for managing your investments that produce taxable income'.

Savings or Investing: Which Offers Better Liquidity?

You may want to see also

Investment management fees and tax filing software

Investment management fees and financial planning fees were deductible as miscellaneous itemized deductions on your tax returns until 2018, as long as they exceeded 2% of your adjusted gross income (AGI). However, the Tax Cuts and Jobs Act (TCJA) eliminated these deductions starting in 2018. This change is set to remain in effect until 2025, after which the tax cuts may be renewed or reversed.

Prior to the TCJA, if you had an AGI of $100,000 and paid $3,000 in financial planning, accounting, and/or investment management fees, you would be able to deduct the last $1,000 (the amount exceeding $2,000, or 2% of your AGI) from your taxes.

To enter investment advisory fees in TurboTax, you would:

- Open your return and select "My Account."

- Type "investment advisor fees" in the box and select "GO."

While investment management fees are not currently deductible, there are a few ways to reduce taxes on investment-related spending:

- Investment interest expenses: You can claim interest on loans used to buy assets, such as margin loans for purchasing stocks or mortgage loans for investment properties, as an investment interest expense. The deductible amount is limited to your net investment income for the year, and any excess can be carried over to the next year.

- Qualified dividends: You can choose to treat qualified dividends, which meet certain requirements, as ordinary income taxed at a lower rate than the ordinary income tax rate. This can increase your investment interest expense deduction and reduce your tax liability.

- Tax-loss harvesting: You can sell underperforming assets, such as ETFs or individual stocks, to offset your capital gains. Individual investors can deduct up to $3,000 in capital losses from their ordinary income each year, and married couples filing separately can deduct $1,500 each.

- Paying fees from an IRA: If you own an IRA, you can pay financial planning or investment management fees directly from the account. Since these fees are considered investment expenses, they are paid with pre-tax dollars, and you can avoid paying income tax on that portion. However, you can only pay the percentage of the fee that is linked to the IRA.

It's important to note that commissions, trading fees, and fees for general financial counselling or planning do not qualify for deductions. Additionally, fees associated with registered accounts like Tax-Free Savings Accounts (TFSAs) or Registered Retirement Savings Plans (RRSPs) are not tax-deductible.

Liquidating an Inherited Investment Portfolio: A Comprehensive Guide

You may want to see also

Investment management fees and tax deductions

Investment management fees and financial planning fees were previously deductible as miscellaneous itemized deductions on your tax return if they, along with tax preparation fees, exceeded 2% of your adjusted gross income (AGI). However, since the Tax Cuts and Jobs Act (TCJA) came into effect in 2018, these deductions have been eliminated.

Deductible Fees

Prior to the implementation of the TCJA, if your AGI was $100,000 and you paid $3,000 in financial planning, accounting, and/or investment management fees, you could deduct the last $1,000 (the amount that exceeds $2,000 of 2% of your AGI).

Non-Deductible Fees

The following investment-related items cannot be claimed as tax deductions:

- Commissions paid on the trading of stocks and ETFs

- Transaction fees to purchase and sell investments

- Fees paid for general financial counselling or planning

- Subscription fees for financial magazines and newspapers

- Fees in a registered account, such as Tax-Free Savings Accounts (TFSAs) or Registered Retirement Savings Plans (RRSPs)

Strategies to Reduce Tax Liabilities

While the TCJA removed deductions on most investment-related expenses, there are still a few strategies to reduce tax liabilities:

- Investment interest expenses: Investors can claim interest on loans used to buy assets, such as interest from margin loans or mortgage loans for investment properties, as an investment interest expense.

- Qualified dividends: Investors can treat qualified dividends as ordinary income, which can increase their investment interest expense deduction and reduce the tax rate.

- Tax-loss harvesting: Investors can use capital losses to offset capital gains by selling underperforming assets and can deduct up to $3,000 in capital losses from their ordinary income each year.

- Financial advisory fees: Investors with an IRA can pay financial planning or investment management fees directly from the managed account, as these fees are considered investment expenses and are paid pre-tax.

Types of Investment Management Fees

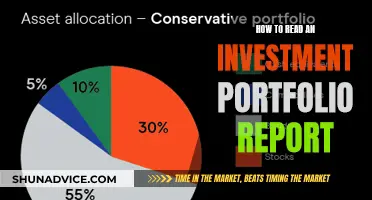

Investment management fees are typically calculated as a percentage of the total assets under management (AUM) and can range from 0.2% to 2%. There are several fee structures, including:

- Asset-based fees: Based on the assets within the account, with cash reserves incurring little to no fees.

- Flat fees: A single rate is charged, regardless of the asset or investment type.

- Tiered fees: Different rates are charged for different asset levels, with all clients paying the same rate at the deposit level.

- Wrap fees: The investment manager consolidates fees for various services, such as investment advice, commissions, and trading fees, ranging from 1% to 3% of AUM per year.

Amending Previous Returns

If you did not claim deductions for investment advisory fees prior to 2018, you may still be able to do so by amending your tax return. You can go back and amend your return for three years from the filing date or two years from the date you paid the resulting tax, whichever is later.

The TSP: Where Your Money Is Invested

You may want to see also

Frequently asked questions

In your open return, select My Account, then type "investment advisor fees" in the box and select GO.

Enter your IMA fees under the Carrying charges, interest paid, and other expenses section on the Statement of investment income, carrying charges, and interest expenses page. You can find this page under the PENSION PLANS AND INVESTMENTS icon on the PREPARE tab.

From within your TaxAct return, click on the Federal tab, then click Itemized or Standard Deductions to expand the category, then click Other expenses related to taxable income - Subject to 2% of AGI limit.

Investment management fees are deducted as miscellaneous itemized deductions on Schedule A.