The integration of Prosper and Velocity Investments is a topic of growing interest in the financial industry. Prosper, a peer-to-peer lending platform, and Velocity Investments, a venture capital firm, have been exploring ways to collaborate and leverage each other's strengths. This partnership aims to enhance investment opportunities and provide a more comprehensive financial ecosystem for both companies' clients. By combining Prosper's lending capabilities with Velocity Investments' expertise in venture capital, the collaboration seeks to create innovative financial products and services that can benefit a diverse range of investors. This introduction sets the stage for a discussion on the potential benefits and challenges of such a partnership.

What You'll Learn

- Prosper's Investment Model: How Prosper's lending platform integrates with velocity investment strategies

- Risk Assessment: Prosper's risk assessment tools and their impact on velocity investments

- Market Timing: Timing investments with Prosper's platform to maximize velocity returns

- Liquidity Management: Strategies for managing liquidity with Prosper's short-term lending options

- Regulatory Compliance: How Prosper's lending practices comply with velocity investment regulations

Prosper's Investment Model: How Prosper's lending platform integrates with velocity investment strategies

The concept of Velocity Investing, which emphasizes rapid buying and selling of assets, can be an intriguing strategy for investors seeking quick returns. When it comes to Prosper, a peer-to-peer lending platform, the integration of its lending model with Velocity Investing strategies presents an interesting opportunity. Here's an overview of how Prosper's lending platform can be utilized within the context of Velocity Investing:

Prospers lending platform operates by connecting borrowers seeking loans with investors willing to provide funding. The key aspect here is the ability to facilitate quick transactions. Velocity Investing strategies often require rapid execution, and Prosper's platform can accommodate this by providing a streamlined process for loan origination and funding. Investors can quickly assess and decide on loan applications, allowing for swift investment decisions. This efficiency is crucial when aiming to capitalize on short-term market opportunities.

The platform's algorithm plays a vital role in matching borrowers and investors. By analyzing borrower profiles and creditworthiness, Prosper can efficiently pair investors with suitable loan opportunities. This automated process saves time and reduces the risk of human error, which is essential when implementing Velocity Investing tactics. Investors can quickly identify and invest in loans that align with their risk appetite and investment goals.

One of the advantages of Prosper's model is the ability to diversify investments. Velocity Investing often involves a high turnover rate, and the platform enables investors to spread their capital across multiple loans. This diversification strategy can help manage risk and provide a steady stream of returns. Additionally, the platform's transparency ensures that investors have access to detailed borrower information, allowing for informed decision-making.

In the context of Velocity Investing, Prosper's platform can also facilitate rapid loan repayment and reinvestment. Once a loan is repaid, investors can quickly reinvest the proceeds, taking advantage of new lending opportunities. This iterative process can lead to a continuous cycle of investment, allowing investors to potentially maximize their returns. However, it is essential to carefully manage the timing and frequency of investments to align with Velocity Investing principles.

By integrating Velocity Investing strategies with Prosper's lending platform, investors can explore a dynamic approach to peer-to-peer lending. The platform's efficiency, automation, and transparency make it a suitable tool for implementing rapid investment strategies. However, it is crucial to conduct thorough research, understand the risks involved, and regularly monitor investments to ensure they align with the Velocity Investing model.

Investing for Your Imminent Retirement: Strategies for the Final Stretch

You may want to see also

Risk Assessment: Prosper's risk assessment tools and their impact on velocity investments

The integration of risk assessment tools by Prosper into its lending platform has had a significant impact on the velocity investments it facilitates. Prosper, a peer-to-peer lending marketplace, utilizes advanced algorithms and data analytics to assess the creditworthiness of borrowers, which is crucial for velocity investments that require rapid decision-making and execution. By employing sophisticated risk assessment techniques, Prosper can quickly evaluate borrowers' financial health, repayment history, and other relevant factors, enabling it to make informed lending decisions within a short timeframe.

One of the key advantages of Prosper's risk assessment tools is their ability to provide a comprehensive view of a borrower's financial situation. These tools consider various data points, such as income, employment history, debt-to-income ratio, and existing credit obligations. By analyzing this information, Prosper can identify potential risks and predict the likelihood of borrowers defaulting on their loans. This level of detail allows velocity investors to make more accurate assessments and adjust their investment strategies accordingly.

The impact of Prosper's risk assessment on velocity investments is twofold. Firstly, it enables faster decision-making. Velocity investments often require quick responses to take advantage of market opportunities or mitigate potential losses. Prosper's automated risk assessment process streamlines the lending evaluation, allowing investors to receive loan approval or rejection decisions promptly. This speed is essential for velocity investments, as it ensures that capital is deployed efficiently and reduces the time between identifying an opportunity and executing the investment.

Secondly, Prosper's risk assessment tools contribute to the overall risk management of velocity investments. By analyzing a large volume of data and employing statistical models, these tools can identify patterns and trends that may not be apparent through traditional credit scoring methods. This enables investors to make more informed choices, considering not only the borrower's creditworthiness but also market dynamics and economic factors. As a result, velocity investors can better manage their risk exposure and make strategic decisions to optimize their investment portfolios.

However, it is important to note that the effectiveness of Prosper's risk assessment tools relies on the quality and accuracy of the data provided. Velocity investments often operate in dynamic markets, and the information used for risk assessment must be up-to-date and relevant. Prosper's ability to continuously update and refine its risk models is crucial to maintaining the integrity of its lending decisions and ensuring the success of velocity investments.

Unlocking the Door to Investment: A Guide to Purchasing a Second Home

You may want to see also

Market Timing: Timing investments with Prosper's platform to maximize velocity returns

Market timing is a critical strategy for investors aiming to maximize their returns, especially when utilizing platforms like Prosper, which offers a range of investment opportunities. Prosper, a peer-to-peer lending platform, provides an avenue for investors to lend money to individuals and businesses, potentially earning attractive returns. However, to truly optimize these returns, investors must employ strategic market timing techniques.

The concept of market timing involves entering and exiting investments at opportune moments to capitalize on favorable market conditions. When applied to Prosper's platform, this strategy becomes even more crucial due to the dynamic nature of the lending market. Prosper's velocity investments, which are short-term loans, are particularly susceptible to market fluctuations. Therefore, timing these investments correctly can significantly impact an investor's overall performance.

To effectively time investments on Prosper, investors should consider several key factors. Firstly, monitoring economic indicators and market trends is essential. Economic data, such as interest rates, inflation rates, and GDP growth, can provide valuable insights into the overall health of the economy and the potential performance of velocity investments. For instance, rising interest rates might lead to higher loan repayment costs, impacting the profitability of short-term loans.

Additionally, keeping an eye on the platform's performance metrics is vital. Prosper provides various statistics and analytics that investors can utilize. These include loan default rates, average loan terms, and borrower repayment behavior. By analyzing these metrics, investors can identify patterns and trends that may indicate optimal times to invest. For example, if default rates are consistently low during a particular period, it might suggest a favorable environment for velocity investments.

Another aspect of market timing is staying informed about industry-specific news and events. Prosper's velocity investments are often linked to specific industries, such as small business loans or consumer credit. News related to these sectors, such as regulatory changes or economic shifts, can significantly impact investment outcomes. Investors should subscribe to relevant news feeds and stay connected with industry experts to make well-informed decisions.

In conclusion, market timing is a powerful tool for investors using Prosper's platform to enhance their velocity investment strategies. By combining economic analysis, platform performance monitoring, and industry-specific knowledge, investors can make timely decisions to maximize returns. Effective market timing ensures that investors are not only lending during favorable conditions but also exiting investments when necessary, thereby optimizing their overall investment portfolio.

The Currency Investment Conundrum: Navigating the Ever-Changing Global Market

You may want to see also

Liquidity Management: Strategies for managing liquidity with Prosper's short-term lending options

The concept of liquidity management is crucial for any business, especially those utilizing short-term lending platforms like Prosper. Effective liquidity management ensures that a company can meet its short-term financial obligations and take advantage of opportunities without facing cash flow constraints. When it comes to Prosper's short-term lending options, understanding how to manage liquidity is essential for borrowers and investors alike.

One key strategy is to carefully assess the timing of loan repayments. Prosper offers various short-term lending products, including installment loans and lines of credit, which provide immediate access to capital. Borrowers should create a repayment schedule that aligns with their cash flow projections. By ensuring that loan repayments are made on time, borrowers can maintain a healthy cash flow and avoid potential penalties or negative impacts on their credit scores. This practice is particularly important for businesses with seasonal fluctuations or those launching new projects that require upfront capital.

Diversifying lending sources is another effective liquidity management strategy. Prosper connects borrowers with multiple investors, providing an opportunity to access funds from various sources. By diversifying the investor base, borrowers can reduce the risk of relying on a single lender or investor. This approach allows for more flexibility in managing liquidity, as borrowers can tap into different pools of capital when needed. Additionally, diversifying lending sources can help borrowers negotiate better terms and interest rates, further improving their overall financial health.

For investors, monitoring the performance of their investments on Prosper is vital. Velocity investments, which often involve short-term lending, require a keen eye for identifying high-quality borrowers. Investors should focus on assessing the creditworthiness of borrowers, considering factors such as credit history, income stability, and debt-to-income ratios. By carefully selecting investments, investors can minimize the risk of default and ensure a steady stream of returns. Regularly reviewing the portfolio and making adjustments based on market trends and borrower performance is essential for effective liquidity management.

In summary, managing liquidity with Prosper's short-term lending options requires a strategic approach. Borrowers should plan their repayments, diversify lending sources, and maintain a healthy cash flow. Investors, on the other hand, should carefully evaluate investments, monitor borrower performance, and stay informed about market dynamics. By implementing these strategies, businesses can optimize their liquidity management, ensuring they have the necessary capital to seize opportunities and navigate short-term financial challenges.

Jet Airways: Invest or Avoid?

You may want to see also

Regulatory Compliance: How Prosper's lending practices comply with velocity investment regulations

The concept of "velocity of money" is an important economic principle, and when it comes to lending platforms like Prosper, understanding how they navigate regulatory compliance in this area is crucial. Velocity investments, which are often associated with the velocity of money, refer to the rapid circulation of funds within an economy, emphasizing the importance of efficient and transparent lending practices. Here's an overview of how Prosper's lending practices align with these regulations:

Lending Platform's Role: Prosper, as a peer-to-peer lending platform, acts as a facilitator, connecting borrowers and investors. The platform's lending practices are subject to various regulations to ensure fair and transparent transactions. When it comes to velocity investments, Prosper must adhere to specific guidelines to maintain compliance. Firstly, the platform needs to implement robust due diligence processes for borrowers. This includes verifying their creditworthiness, income, and repayment history. By doing so, Prosper ensures that borrowers are capable of repaying their loans, which is essential for the velocity of money concept, as it promotes a healthy and efficient flow of funds.

Regulatory Compliance: Velocity investments often require platforms to maintain a certain level of transparency and disclosure. Prosper must provide clear and detailed information about the lending process, including interest rates, repayment terms, and potential risks. This transparency ensures that investors understand the nature of their investments and the associated risks, which is a key aspect of regulatory compliance. Additionally, Prosper should comply with anti-money laundering (AML) and know-your-customer (KYC) regulations, which are crucial in the context of velocity investments to prevent any illicit activities.

Risk Management: Effective risk management is vital for Prosper to comply with velocity investment regulations. The platform should employ sophisticated algorithms and models to assess and manage risks associated with each loan. By analyzing various data points, Prosper can make informed decisions regarding loan approvals, interest rates, and repayment terms. This risk-based approach ensures that the platform can maintain a healthy loan portfolio, which is essential for the stability and efficiency of velocity investments.

Ongoing Monitoring and Reporting: Compliance with velocity investment regulations requires ongoing monitoring and reporting. Prosper should regularly review its lending practices, assess the performance of loans, and identify any potential issues. This includes monitoring repayment rates, default rates, and borrower behavior. By doing so, the platform can quickly address any emerging risks and ensure that its lending practices remain compliant. Regular reporting to relevant authorities and investors is also necessary to provide transparency and build trust.

In summary, Prosper's lending practices must be designed to comply with velocity investment regulations, focusing on transparency, due diligence, risk management, and ongoing monitoring. By adhering to these principles, the platform can facilitate efficient lending, promote economic velocity, and maintain a strong regulatory standing. It is essential for Prosper to stay updated with evolving regulations and adapt its practices accordingly to ensure a seamless and compliant lending experience.

Sia Coin's Profit Potential: A Comprehensive Overview

You may want to see also

Frequently asked questions

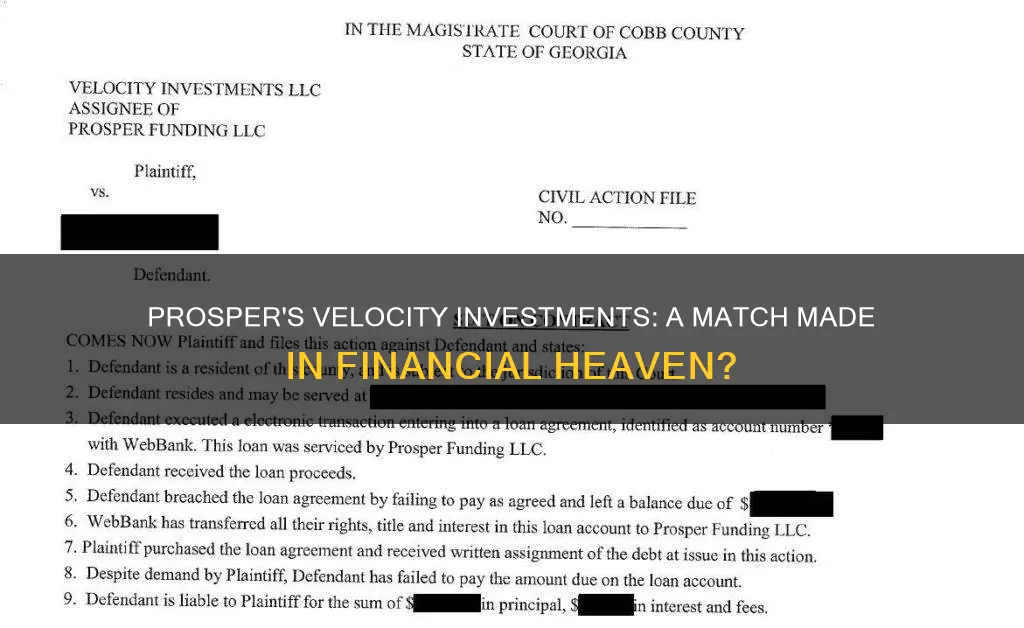

Prosper is a peer-to-peer lending platform that connects borrowers and investors. Velocity Investments is an investment firm that focuses on various financial products, including peer-to-peer lending. While Prosper and Velocity Investments operate in the same industry, they are separate entities with distinct roles.

Yes, Velocity Investments can potentially invest in loans originated on the Prosper platform. Prosper allows investors to fund loans, and these investments are then distributed to borrowers. Velocity Investments, as an investor, can choose to invest in these loans, providing funding to borrowers and earning returns.

Prosper's model enables individuals to lend money to borrowers, and these loans are then pooled and offered to investors. Velocity Investments, as an investor, can select specific loans or loan pools to invest in, diversifying their portfolio. Prosper's platform facilitates the matching of borrowers with investors, making it a valuable tool for Velocity Investments to access lending opportunities.

Working with Prosper can offer Velocity Investments several advantages. Firstly, it provides access to a diverse range of borrowers and lending opportunities. Secondly, Prosper's platform offers transparency and risk assessment tools, helping investors make informed decisions. Additionally, Prosper's peer-to-peer model can potentially offer higher returns compared to traditional investments.

Velocity Investments can actively manage their investments on Prosper by monitoring the performance of their funded loans. They can track repayment history, borrower behavior, and loan defaults. Prosper provides tools for investors to manage their portfolios, allowing Velocity Investments to make adjustments, diversify their investments, and optimize their returns.