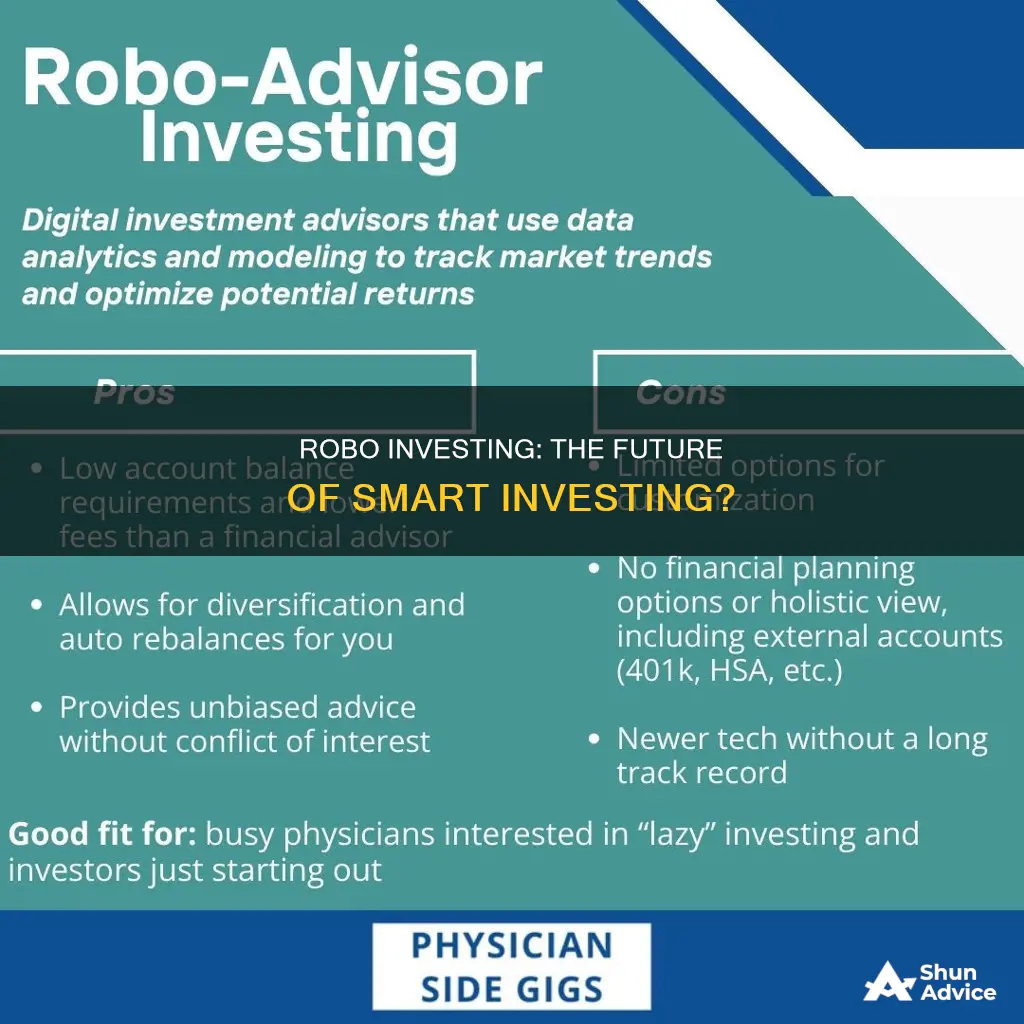

Robo-investing, a digital investment platform, has gained popularity for its automated investment strategies, offering an alternative to traditional financial advisors. This innovative approach to investing utilizes algorithms and data-driven models to provide personalized investment advice and portfolio management. With its accessibility and low-cost structure, robo-investing has sparked curiosity among investors, leading to the question: Does robo-investing work? This paragraph aims to explore the effectiveness of robo-investing, examining its benefits, potential drawbacks, and the factors that contribute to its success or limitations in the dynamic world of finance.

What You'll Learn

- Performance: Robo-investing platforms offer diversified portfolios with competitive returns, often outpacing traditional investing

- Fees: Low management fees and transparent pricing make robo-investing accessible and cost-effective for investors

- User Experience: Intuitive interfaces and automated processes enhance user engagement and ease of use

- Risk Management: Robo-advisors employ sophisticated algorithms to manage risk, providing personalized investment strategies

- Regulation: Compliance with financial regulations ensures robo-investing platforms operate ethically and securely

Performance: Robo-investing platforms offer diversified portfolios with competitive returns, often outpacing traditional investing

Robo-investing platforms have gained significant traction in the financial world, and for good reason. One of the key selling points of these automated investment services is their performance, which often surpasses traditional investment methods. The core strength of robo-investing lies in its ability to provide investors with diversified portfolios tailored to their risk tolerance and financial goals.

These platforms utilize sophisticated algorithms and data analytics to construct portfolios that are both well-balanced and optimized for performance. By employing a systematic approach, robo-investors can offer a wide range of investment options, ensuring that investors' capital is spread across various asset classes, sectors, and geographic regions. This diversification is a critical factor in risk management and can lead to more consistent returns over time.

The performance of robo-investing platforms is often measured against traditional investment advisors or fund managers. Studies have shown that robo-investing can deliver competitive returns, sometimes even outperforming human-led investment strategies. This is primarily due to the automated nature of these platforms, which can quickly adapt to market changes and rebalance portfolios accordingly. As a result, investors benefit from a more dynamic and responsive investment approach.

Robo-investing platforms typically charge lower fees compared to traditional investment advisors, making them an attractive option for cost-conscious investors. Lower fees contribute to higher net returns over time, further enhancing the performance of these platforms. Additionally, the automated process eliminates the potential for emotional decision-making, which can often lead to suboptimal investment choices in traditional settings.

In summary, the performance of robo-investing platforms is a strong argument for their effectiveness. By offering diversified portfolios, competitive returns, and a more efficient investment process, these platforms provide investors with a compelling alternative to traditional investment methods. As the robo-investing industry continues to evolve, it is likely that these platforms will further improve their performance, making automated investing an increasingly attractive option for a wide range of investors.

The Damaging Effects of Inflation and Taxes on Investment Value

You may want to see also

Fees: Low management fees and transparent pricing make robo-investing accessible and cost-effective for investors

Robo-investing has gained popularity due to its ability to provide low-cost, automated investment management, making it an attractive option for many investors. One of the key advantages of robo-investing is its focus on keeping fees low, which is a significant factor in the overall performance of an investment portfolio. Traditional investment management often comes with high fees, which can eat into the returns over time. Robo-investing platforms, however, have revolutionized the industry by offering a more cost-effective approach.

Management fees are a critical component of the investment process, and robo-investing platforms typically charge much lower management fees compared to traditional investment advisors. These platforms use sophisticated algorithms and automated processes to manage investments, eliminating the need for a large human workforce. As a result, the operational costs are significantly reduced, and these savings are passed on to investors in the form of lower fees. For example, some robo-investing platforms offer management fees as low as 0.05% to 0.30% of the assets under management, which is a fraction of what a traditional investment manager might charge.

Transparency in pricing is another essential aspect that sets robo-investing apart. These platforms provide clear and detailed fee structures, ensuring that investors know exactly what they are paying for. Many robo-investing services offer a breakdown of fees, including account maintenance fees, transaction costs, and any additional charges. This transparency allows investors to make informed decisions and choose the platform that best suits their needs and budget. With traditional investment advisors, fees can sometimes be complex and difficult to understand, leaving investors with uncertainty about the true cost of their investments.

By offering low management fees and transparent pricing, robo-investing platforms make investing more accessible to a wider range of individuals. Lower fees mean that investors can start with smaller amounts of capital and still benefit from professional investment management. This accessibility is particularly appealing to young investors who are just starting to build their portfolios or those who prefer a more hands-off approach to investing. Additionally, the cost-effectiveness of robo-investing can be especially beneficial for long-term investors, as the cumulative effect of lower fees can significantly impact the overall returns over time.

In summary, the low management fees and transparent pricing associated with robo-investing are significant advantages that make it a compelling choice for investors. These platforms provide an efficient, cost-effective way to manage investments, allowing individuals to take control of their financial future without incurring high costs. With the right robo-investing platform, investors can build and grow their portfolios with confidence, knowing that they are getting a fair and transparent service.

Insurance as Investment: A Risky Gamble or Safe Bet?

You may want to see also

User Experience: Intuitive interfaces and automated processes enhance user engagement and ease of use

In the world of investing, the rise of robo-advisors has brought about a revolution in how individuals approach their financial portfolios. These automated investment platforms are designed with a strong focus on user experience, aiming to make investing more accessible, intuitive, and efficient. By leveraging technology, robo-advisors offer a unique and modern approach to wealth management, catering to a wide range of investors.

One of the key aspects that enhance user engagement is the intuitive interface these platforms provide. Robo-advisors often feature clean and user-friendly dashboards, making it easy for investors to navigate their accounts. The interface typically includes clear visuals, simple language, and organized sections for various investment activities. For instance, users can quickly view their portfolio performance, make adjustments to their asset allocation, and access educational resources with just a few clicks. This level of simplicity and ease of use encourages investors to actively participate in managing their investments, even if they are new to the world of finance.

Automated processes are another critical component that contributes to a seamless user experience. Robo-advisors automate various tasks, such as portfolio rebalancing, tax-loss harvesting, and investment adjustments, based on predefined rules and algorithms. This automation ensures that investment strategies are executed efficiently and promptly. For example, when market conditions change, the robo-advisor can automatically rebalance the portfolio to maintain the desired risk level, providing investors with a hands-off approach while still actively managing their investments. This level of automation not only saves time but also reduces the emotional decision-making often associated with investing, leading to more consistent and disciplined investment strategies.

The benefits of intuitive interfaces and automated processes extend beyond convenience. These features also contribute to better risk management and long-term investment success. By providing a user-friendly platform, robo-advisors can educate and guide investors, helping them understand their risk tolerance and make informed decisions. Automated processes, on the other hand, ensure that investment strategies are consistently applied, reducing the impact of human errors or emotional biases. As a result, investors can benefit from a more disciplined and data-driven approach to building and growing their wealth.

In summary, robo-investing platforms have transformed the investing landscape by prioritizing user experience. Through intuitive interfaces and automated processes, these platforms empower investors with a simple, efficient, and disciplined approach to managing their financial portfolios. This level of user engagement and ease of use is a significant factor in the growing popularity of robo-advisors, making investing more accessible and potentially more successful for a diverse range of individuals.

Inheritance Dilemma: Invest or Pay Off Mortgage?

You may want to see also

Risk Management: Robo-advisors employ sophisticated algorithms to manage risk, providing personalized investment strategies

Robo-advisors have revolutionized the way individuals approach investing by offering a highly automated and data-driven approach to wealth management. One of the key strengths of robo-investing is its ability to effectively manage risk, which is crucial for long-term investment success. These digital platforms utilize sophisticated algorithms and machine learning techniques to analyze vast amounts of financial data and construct personalized investment portfolios tailored to each user's risk tolerance and financial goals.

At the heart of risk management in robo-investing is the algorithm's ability to assess and categorize risk. These algorithms employ various statistical models and historical data to identify patterns and trends in the market. By analyzing factors such as asset correlations, volatility, and historical performance, the algorithms can make informed decisions about asset allocation. This process ensures that the investment strategy is well-diversified, reducing the impact of any single asset's performance on the overall portfolio.

Robo-advisors often use risk assessment questionnaires or surveys to gauge an individual's risk profile. These tools help determine the investor's comfort level with market fluctuations, their investment time horizon, and their financial objectives. Based on this information, the algorithm suggests an appropriate asset allocation strategy. For instance, a conservative investor might be recommended a portfolio with a higher proportion of bonds and stable investments, while a more aggressive investor could be advised to take on more equity exposure.

The algorithms continuously monitor market conditions and adjust the portfolio accordingly. They can quickly respond to market changes, rebalancing the portfolio to maintain the desired risk level. This dynamic approach ensures that investors' risk exposure remains aligned with their initial risk tolerance, even as market conditions evolve. Additionally, robo-advisors provide regular performance reports and updates, allowing investors to stay informed about their portfolio's risk and overall performance.

In summary, robo-investing platforms excel at risk management by leveraging advanced algorithms and data analytics. These tools enable them to offer personalized investment strategies, adapting to individual risk preferences. The automated nature of robo-advisors ensures that risk management is an ongoing process, providing investors with a dynamic and responsive approach to wealth accumulation and preservation. This level of sophistication and customization has made robo-investing an attractive option for those seeking efficient and effective investment management.

Invest More Now?

You may want to see also

Regulation: Compliance with financial regulations ensures robo-investing platforms operate ethically and securely

Robo-investing platforms have gained significant popularity in recent years, offering automated investment services to individuals seeking a convenient and cost-effective way to build their wealth. However, the success and trustworthiness of these platforms heavily rely on their ability to adhere to strict financial regulations. Compliance with regulations is crucial for several reasons, ensuring that robo-investing platforms operate ethically, securely, and in the best interest of their clients.

Financial regulations provide a framework that governs the behavior and practices of robo-investing platforms. These rules are designed to protect investors, maintain market integrity, and promote fair competition. By adhering to these regulations, robo-investing platforms must establish robust processes for identifying and mitigating risks. This includes implementing comprehensive due diligence procedures for investment products, ensuring proper valuation of assets, and maintaining accurate records of transactions. Compliance with regulations also mandates that platforms provide transparent and clear communication to their clients, disclosing fees, risks, and potential conflicts of interest.

One critical aspect of regulation is the protection of investor funds. Robo-investing platforms must ensure that client assets are segregated and held in secure, insured accounts. This segregation protects investors from potential losses and fraud, as it separates client funds from the platform's operational capital. Additionally, regulations often require platforms to maintain high levels of liquidity, allowing investors to access their funds quickly and efficiently when needed.

Compliance with financial regulations also fosters a culture of ethical behavior within robo-investing platforms. These rules establish standards for fair treatment of clients, preventing discriminatory practices and ensuring equal access to investment opportunities. By adhering to regulations, platforms are encouraged to act in the best interest of their clients, providing personalized investment advice and tailored portfolios. This ethical approach builds trust and confidence among investors, attracting more users to the platform.

Furthermore, regulation plays a vital role in safeguarding the security and privacy of investor data. Robo-investing platforms handle sensitive personal and financial information, and compliance with data protection regulations is essential. These regulations ensure that platforms implement robust security measures to protect client data from unauthorized access, breaches, or misuse. By maintaining data security, robo-investing platforms can provide a safe and reliable service, attracting a wider user base.

In summary, compliance with financial regulations is essential for robo-investing platforms to operate successfully and earn the trust of their clients. It ensures ethical practices, secure fund management, and transparent communication. By adhering to these regulations, platforms can provide a reliable and trustworthy service, offering individuals an accessible and efficient way to invest and grow their wealth. As the robo-investing industry continues to evolve, maintaining regulatory compliance will be a cornerstone of its long-term sustainability and success.

Unlocking Wealth: Life Insurance as a Smart Investment Strategy

You may want to see also

Frequently asked questions

Robo-investing, also known as automated investing or algorithm-based investing, is a digital platform or service that provides automated investment management. It uses algorithms and computer models to build and manage a portfolio based on an individual's financial goals, risk tolerance, and investment preferences.

Traditional investing often involves manual selection and management of investments by a human financial advisor or broker. Robo-investing, on the other hand, is a fully automated process, eliminating the need for human intervention. It offers a more cost-effective and accessible approach to investing, especially for those who prefer a hands-off strategy or have limited financial knowledge.

Yes, robo-investing can be an excellent choice for beginners. These platforms typically offer a user-friendly interface, allowing investors to easily set up their investment accounts and choose from various pre-built portfolios or asset allocation strategies. Robo-investing simplifies the investment process, making it more accessible to those new to investing.

Robo-investing offers several advantages, including low costs, diversification, and convenience. These platforms often have lower management fees compared to traditional investment advisors, making it an affordable option. They also provide instant diversification across various asset classes, reducing risk. Additionally, robo-investing allows investors to start with small amounts and automatically rebalance their portfolios, making it a flexible and efficient way to invest.

Absolutely! Robo-investing can be a powerful tool to help individuals reach their financial objectives. By providing automated portfolio management, these platforms ensure that investments are regularly reviewed and rebalanced to align with the investor's goals. The algorithms can adapt to market changes and adjust asset allocations accordingly, making it a dynamic and responsive investment strategy.