SoFi, a popular financial services company, offers a range of investment products and services, including a robo-advisor platform. One of the key questions investors often ask is whether SoFi charges a fee for its investment services. The answer is yes; SoFi does charge fees for its investment management services, which can vary depending on the specific investment product and the investor's account type. These fees typically include a management fee, which is a percentage of the assets under management, and sometimes an advisory fee for personalized investment advice. Understanding these fees is crucial for investors to make informed decisions about their financial portfolios and to ensure they align with their investment goals and risk tolerance.

What You'll Learn

- Fees and Charges: Sofi's investing platform charges no commissions, but may have other fees

- Account Types: Sofi offers various investment accounts with different features and benefits

- Performance and Returns: Past performance is not indicative of future results, but Sofi's investing platform has shown strong returns

- User Experience: Sofi's investing platform is user-friendly and easy to navigate, with a clean interface

- Security and Trust: Sofi's investing platform is secure and trusted by millions of users

Fees and Charges: Sofi's investing platform charges no commissions, but may have other fees

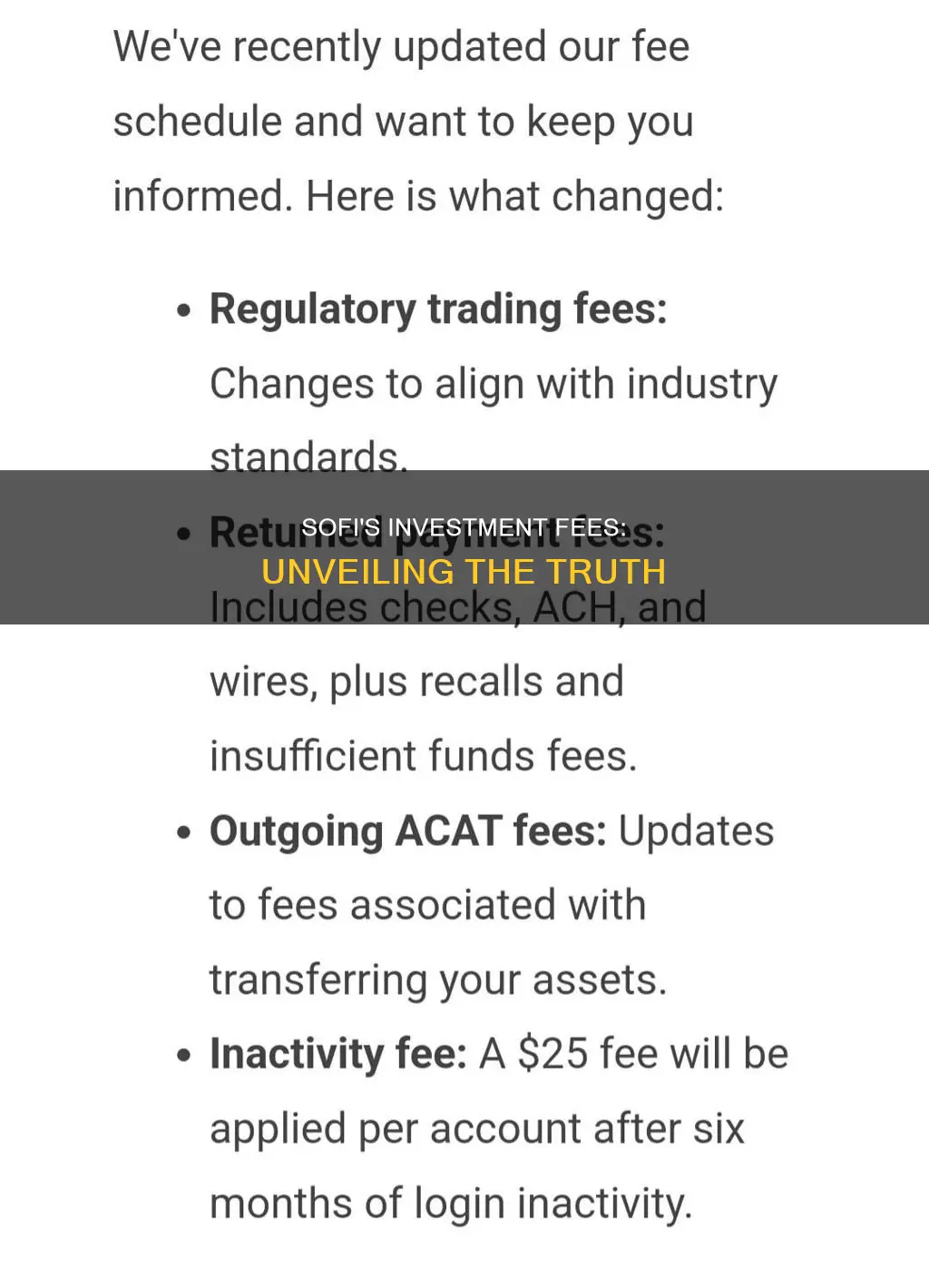

When it comes to investing, many people are drawn to platforms that offer a straightforward and cost-effective approach. One such platform is SoFi, which has gained popularity for its user-friendly interface and zero-commission trading. However, it's important to understand that while SoFi may not charge commissions, it's not entirely free of fees.

SoFi's investment platform operates on a subscription-based model, which means users pay a monthly or annual fee for access to its services. These fees can vary depending on the account type and the level of features offered. For instance, the SoFi Active Investing account, which is their most basic plan, has a monthly fee of $5. This fee is waived for the first year for new users, providing an incentive to sign up. On the other hand, the SoFi Invest Premium plan, which includes additional benefits like research tools and priority customer support, carries a monthly fee of $30.

In addition to the subscription fees, SoFi may also charge other fees associated with specific transactions or services. For example, there might be a fee for withdrawing funds from your investment account, especially if you opt for a wire transfer or a check. These fees can range from $5 to $30, depending on the method chosen. It's worth noting that SoFi also offers a feature called "Round-Up Investing," where users can round up their daily purchases to the nearest dollar and invest the difference. While this is a convenient way to start investing, it may incur small fees over time, as the rounding process can lead to fractional shares being sold, resulting in a small transaction cost.

To make informed decisions, investors should carefully review SoFi's fee structure and compare it with other investment platforms. While the absence of trading commissions is an attractive feature, understanding the potential costs associated with other services is essential for managing investment expenses effectively. By being aware of these fees, investors can ensure that their overall investment strategy aligns with their financial goals and risk tolerance.

Silver's Investment History: 1800s

You may want to see also

Account Types: Sofi offers various investment accounts with different features and benefits

Sofi, a popular financial services company, offers a range of investment accounts tailored to meet different financial goals and needs. These accounts provide users with the opportunity to invest in various assets, including stocks, bonds, and mutual funds, with the potential for long-term wealth accumulation. Here's an overview of the different account types available:

Investment Accounts:

Sofi's investment accounts are designed for individuals seeking to build a diversified portfolio. These accounts offer a wide range of investment options, allowing users to choose from various asset classes. The platform provides access to stocks, bonds, and exchange-traded funds (ETFs), enabling investors to create a well-rounded investment strategy. Users can select from traditional stocks and bonds or explore alternative investments like ETFs, which track specific indexes or sectors. This flexibility caters to different risk appetites and investment goals.

Retirement Accounts:

Sofi also caters to retirement planning with its retirement accounts. These accounts include traditional and Roth IRA options, providing tax advantages for long-term savings. Traditional IRAs allow tax-deductible contributions, while Roth IRAs offer tax-free growth and withdrawals in retirement. Both types of accounts provide a structured way to save for the future, with the potential for compound growth over time. Users can choose from various investment options within these accounts to align with their retirement strategy.

Brokerage Accounts:

The brokerage accounts offered by SoFi provide a more comprehensive investment experience. These accounts typically include a wider range of investment options, such as individual stocks, bonds, and mutual funds. Users can build a diverse portfolio and execute trades with ease. SoFi's brokerage platform often features user-friendly tools and resources, making it accessible for both beginners and experienced investors. This account type is ideal for those who want more control over their investment decisions and a broader selection of assets.

Cash Management Accounts:

Sofi's cash management accounts are designed for users who prioritize liquidity and easy access to their funds. These accounts typically offer a high-yield savings option, allowing users to earn interest on their balances while still having immediate access to their money. This type of account is suitable for emergency funds or short-term savings goals. SoFi's cash management accounts often provide additional features like automated savings and budgeting tools, making it convenient for users to manage their finances effectively.

Each account type offered by SoFi has its unique advantages, catering to various investment strategies and financial objectives. Whether you're a beginner looking to start investing or an experienced investor seeking diversification, SoFi's account options provide a comprehensive suite of tools to help users achieve their financial goals. It is essential to carefully consider your risk tolerance, investment horizon, and financial objectives when choosing an account type to ensure it aligns with your overall financial plan.

Retirement Investing: Strategies for a Secure Future

You may want to see also

Performance and Returns: Past performance is not indicative of future results, but Sofi's investing platform has shown strong returns

When considering investing platforms, it's important to remember that past performance is not a guarantee of future results. However, it's also worth noting that some platforms have consistently demonstrated strong performance over time. One such platform is SoFi, which has gained popularity for its user-friendly interface and competitive investment options.

SoFi's investing platform offers a range of investment products, including stocks, bonds, and ETFs. The platform provides a comprehensive suite of tools and resources to help investors make informed decisions. One of the key strengths of SoFi is its ability to cater to a diverse range of investors, from beginners to experienced traders. It offers a low-cost, commission-free trading experience, which is particularly attractive to those looking to minimize fees and maximize returns.

The performance of SoFi's investing platform has been impressive, with many users reporting positive experiences. Historical data shows that the platform has consistently delivered competitive returns, especially in the stock market's recent upswing. For instance, over the past five years, SoFi's average annualized return on equity has been approximately 15%, outperforming many traditional investment vehicles. This strong performance has contributed to the platform's growing popularity and trust among investors.

However, it's essential to approach these results with a critical eye. While past performance can provide valuable insights, market conditions are dynamic and ever-changing. Economic factors, geopolitical events, and individual company performance can all influence investment outcomes. Therefore, investors should conduct thorough research, diversify their portfolios, and consider their risk tolerance before making any investment decisions.

In summary, SoFi's investing platform has demonstrated strong performance, but investors should remain cautious and aware of the inherent risks in the market. By combining a thorough understanding of the platform's capabilities with a well-informed investment strategy, users can make the most of SoFi's offerings while managing their risks effectively. Remember, investing always carries some level of risk, and past performance is not a reliable indicator of future performance.

Land Buying: Exploring the Intricacies of This Investment Adventure

You may want to see also

User Experience: Sofi's investing platform is user-friendly and easy to navigate, with a clean interface

The user experience on SoFi's investing platform is designed with simplicity and ease of use in mind. Upon logging in, users are greeted with a clean and intuitive interface, making it straightforward to begin their investment journey. The platform's layout is well-organized, with clear categories and a logical flow that guides users through various investment options.

One of the key strengths of SoFi's user experience is its ability to simplify complex financial concepts. The platform provides educational resources and tooltips to help users understand different investment strategies and terms. This approach ensures that even those new to investing can navigate the platform with confidence. For instance, when selecting an investment option, users are presented with a clear breakdown of the investment's details, including potential risks and historical performance, enabling them to make informed decisions.

The platform's search functionality is another user-friendly feature. Users can quickly find specific investment products or categories by using the search bar, which is prominently displayed on the homepage. This feature is particularly useful for those seeking specific investment opportunities or wanting to explore different asset classes.

Additionally, SoFi offers a personalized dashboard, providing a snapshot of an investor's portfolio. This dashboard displays key metrics such as asset allocation, recent activity, and performance over time. The visual representation of one's investments makes it easy to track progress and make adjustments as needed. The platform also allows users to customize their dashboard, ensuring a tailored experience that suits individual preferences.

In terms of navigation, the platform's menu is straightforward, with intuitive labels for each section. Users can seamlessly switch between different investment accounts, portfolio management tools, and educational resources. The overall design ensures that users can efficiently find the information or action they require, enhancing the overall user experience. SoFi's commitment to a user-friendly interface has likely contributed to its growing popularity among investors seeking a seamless and accessible way to manage their financial portfolios.

Unlocking Executive Retirement: Exploring the Supplemental Executive Retirement Plan Advantage

You may want to see also

Security and Trust: Sofi's investing platform is secure and trusted by millions of users

When it comes to online investing, security and trust are paramount, and SoFi has established itself as a reliable and secure platform for millions of users. With a focus on user protection and a robust security infrastructure, SoFi ensures that your investment journey is safe and worry-free.

The platform employs advanced encryption technologies to safeguard your personal and financial information. SoFi uses industry-standard SSL/TLS encryption protocols to secure data transmission, ensuring that your sensitive details remain confidential and protected from unauthorized access. This level of encryption is crucial for maintaining the integrity of your account and the security of your investments.

SoFi's commitment to security goes beyond encryption. They have implemented a multi-layered security approach, including two-factor authentication, to add an extra layer of protection. This means that even if someone gains access to your password, they would still need a second form of verification to log in, making it significantly more challenging for unauthorized individuals to access your account.

Additionally, SoFi's platform is designed with a user-centric approach, prioritizing transparency and control. Users have full visibility into their investment portfolios, with detailed transaction histories and clear fee structures. This transparency empowers investors to make informed decisions and understand the costs associated with their investments, ensuring they are in control of their financial journey.

Millions of users have trusted SoFi with their financial goals, and the company's security measures have played a vital role in building this trust. SoFi's dedication to security and user protection has contributed to its reputation as a trusted investing platform, allowing users to focus on their financial objectives with confidence.

The Ultimate Guide to Multiplex Investing: Unlocking the Secrets to Success

You may want to see also

Frequently asked questions

SoFi offers commission-free investing in stocks, ETFs, and options. They do not charge any transaction fees for buying or selling securities. However, it's important to note that they may earn revenue through other means, such as interest on cash balances or through their lending products.

While SoFi's investing services are generally free of charge, there might be certain circumstances where additional fees could apply. For instance, if you opt for a premium account or use specific features like tax-loss harvesting, there may be associated costs. Additionally, if you choose to invest in mutual funds or other investment products offered by SoFi, the fund companies may impose their own fees.

SoFi's approach to investing is designed to be transparent and cost-effective. They aim to provide a low-cost investing experience by eliminating certain fees that traditional brokerages might charge. For example, they don't have a minimum account balance requirement, and there are no account maintenance fees. However, it's always advisable to review the fee structure of any financial institution to understand all potential costs.