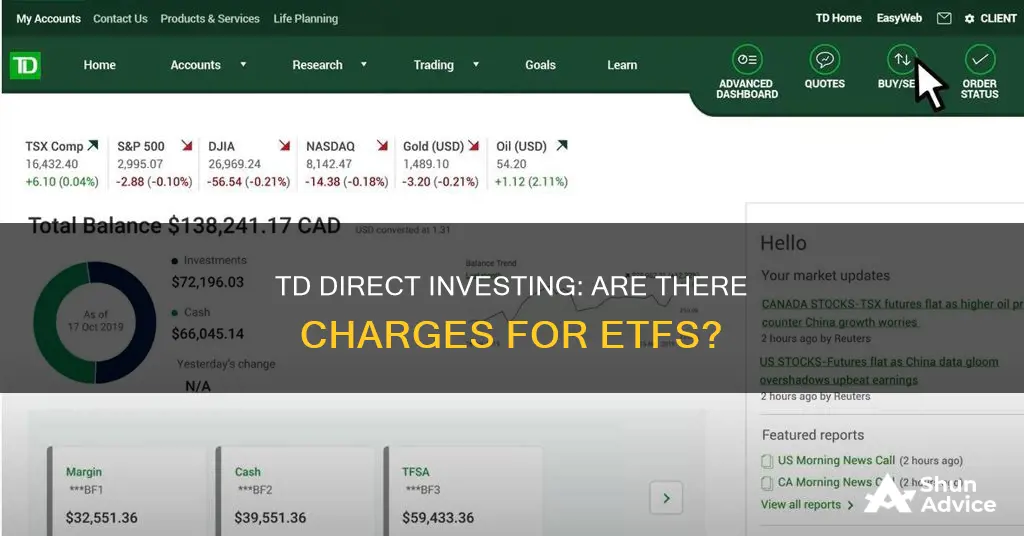

TD Direct Investing offers a range of investment options, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). While the platform provides access to various tools and resources to support investors in making informed decisions, it is important to understand the associated fees and charges. TD Direct Investing adopts a straightforward pricing model, with a standard rate flat-fee structure for online commission rates. This includes a $9.99 flat fee for trades of one full share or more and $1.99 for trades of less than one share (partial shares). The platform also offers active trader pricing for those executing a higher volume of trades per quarter, with reduced rates of $7 for Canadian and U.S. stocks. It is worth noting that TD Direct Investing may charge a maintenance fee of $25 per quarter if the total balance in the account falls below $15,000, although this fee can be waived through their Household Program.

Now, let's focus specifically on ETFs. Exchange-Traded Funds (ETFs) are baskets of securities that trade on stock exchanges, providing investors with diversified exposure to various assets, sectors, or markets. ETFs are a popular investment choice due to their diversification benefits and lower costs compared to actively managed funds. When considering ETFs on the TD Direct Investing platform, it is essential to understand the associated fees. TD Direct Investing does not explicitly mention ETF-specific fees, indicating that the standard commission rates may apply. However, it is always advisable to review the platform's terms and conditions and fee schedule for a comprehensive understanding of the charges.

| Characteristics | Values |

|---|---|

| Number of commission-free trades per year | 50 |

| Commission fee for trades after the first 50 per year | $9.99 per trade |

| Commission fee for trades of partial shares | $1.99 per trade |

| Commission fee for trades of TD ETFs | $0 |

| Account maintenance fees | $0 |

What You'll Learn

TD Direct Investing ETF fees

TD Direct Investing offers a variety of pricing options for investors, depending on their needs and the platform they choose to use.

TD Easy Trade App

The TD Easy Trade App offers investors the ability to trade with no account minimums and no monthly fees. The app provides 50 commission-free stock trades per year and unlimited commission-free TD Exchange-Traded Fund (ETF) trades. The app also allows for partial shares trading, where investors can own a fraction of a share for a smaller investment amount.

The standard commission fees for TD Easy Trade are as follows:

- $0 for the first 50 stock trades each year

- $9.99 flat fee for trades of 1 full share or more

- $1.99 for trades less than a share (partial share)

- $0 commission on TD ETF trades

- $0 account maintenance fees

TD Direct Investing Platforms

TD Direct Investing offers several platforms with varying pricing structures, including WebBroker, Telephone Support Services, Advanced Dashboard, Active Trader, and the TD Mobile App.

The standard commission fees for these platforms are:

- $9.99 flat fee for trades of 1 full share or more

- $1.99 for trades less than a share (partial share)

Additionally, there is a $43 flat fee for telephone brokerage commissions for transactions with principal values less than $2,000.

TD Direct Investing also offers a Household Program, which can help clients qualify for waived maintenance fees, free streaming market data, and lower trading commissions. To qualify for waived maintenance fees, clients must meet one of the following conditions:

- The combined assets of all TD Direct Investing accounts in the Canadian household exceed $15,000

- Register one or more accounts in the household with a Systematic Investment Plan (SIP) or set up a pre-authorized deposit of at least $100 per month

- Complete three or more commissionable trades in the preceding quarter within household accounts

- Hold a Registered Disability Savings Plan (RDSP) account within the household

- Be within the introductory six months of the first account opened within the household

ETFs and Insurance: A Secure Investment Strategy?

You may want to see also

TD Direct Investing ETF pros and cons

Pros

- There is no commission fee for buying and selling TD ETFs.

- TD Direct Investing offers a range of ETF options, including cryptocurrency ETFs.

- The TD Direct Investing platform provides access to real-time market data and quotes for Canadian and US markets.

- It offers a straightforward pricing structure with a flat fee for online commission rates.

- The TD Direct Investing platform provides access to a range of investment options, including stocks, bonds, options, and mutual funds.

- There is no minimum balance required to start investing with TD Direct Investing.

Cons

- The flat fee for online commission rates may be higher than competitors, depending on the number of trades made per quarter.

- There is a maintenance fee of $25 per quarter if the total balance in the TD Direct Investing account is less than $15,000, although this fee can be waived through the Household Program.

- The platform is designed for more experienced traders who understand market dynamics and can identify investment opportunities independently.

- There may be additional fees for telephone brokerage commissions if orders are placed over the phone.

A Smart Guide to Investing in Dow Jones ETFs

You may want to see also

TD Direct Investing ETF alternatives

When it comes to TD Direct Investing ETF alternatives, there are several options to consider.

Firstly, investors can explore different types of ETFs, such as Sector Tracking ETFs, Index ETFs, International ETFs, Developed Market ETFs, Country-Specific ETFs, Thematic ETFs, Commodity and Currency ETFs, and Complex ETFs. Each of these categories offers unique benefits and focuses on specific sectors, markets, or investment themes.

Additionally, investors can utilise platforms like WebBroker, which is available to TD Direct Investing customers. WebBroker provides robust tools and data, enabling investors to identify top-performing ETFs, compare different ETFs based on their parameters, and evaluate ETFs based on fund objectives, performance, and asset class allocation.

Another alternative is to consider other investment types offered by TD Direct Investing, such as stocks, options, mutual funds, GICs, and more. These options provide diversification and may align with different investment goals and strategies.

Furthermore, investors can explore different trading platforms and tools provided by TD, including WebBroker, Advanced Dashboard, Active Trader, and the TD Mobile App, each offering unique features and capabilities to enhance the investing experience.

Lastly, investors can evaluate their investment objectives, risk tolerance, and investment horizon to determine if other investment products or strategies may be better suited to their needs.

While TD Direct Investing offers a range of ETF alternatives, it's important for investors to conduct thorough research and consider seeking professional advice to make informed investment decisions.

ETFs and Unit Investment Trusts: What's the Difference?

You may want to see also

TD Direct Investing ETF management fees

TD Direct Investing is a division of TD Waterhouse Canada Inc., a subsidiary of The Toronto-Dominion Bank. It offers a range of investment products, including Exchange-Traded Funds (ETFs). ETFs are baskets of securities that trade on a stock exchange, and their prices fluctuate throughout the day as trades are executed on the open market.

When it comes to ETF management fees, TD Direct Investing provides a clear and straightforward pricing structure. Here's an overview:

- Commissions: TD Direct Investing may charge commissions for buying and selling ETFs. The standard commission rate is $9.99 for trades of one full share or more, and $1.99 for trades of less than one share (partial shares).

- Management Fees: ETFs typically have management fees, which are included in the ETF's management expense ratio (MER). These fees are paid to the ETF manager, such as TD Asset Management Inc., for their role in selecting and managing the securities within the ETF.

- Other Fees: There may be additional fees associated with ETF investments, such as account maintenance fees, currency conversion fees, and other service charges. These fees vary depending on the specific ETF and your account type.

It's important to note that the pricing structure for TD Direct Investing may differ based on your location and the platform you choose (WebBroker, Advanced Dashboard, etc.). Additionally, certain conditions may allow for fee waivers, such as maintaining a minimum balance or meeting specific trading requirements.

For detailed information about TD Direct Investing's ETF management fees and other charges, it is recommended to review their current pricing disclosures and consult with a licensed representative.

ETFs: Minimum Investment Requirements and How They Work

You may want to see also

TD Direct Investing ETF minimum investment

When it comes to TD Direct Investing, there is no minimum investment for ETFs. In fact, TD Direct Investing offers commission-free and unlimited TD ETF trades through its TD Easy TradeTM app. This means that you can trade TD ETFs at any time without incurring any fees, and there is no minimum investment amount.

The TD Easy TradeTM app is designed to be user-friendly and accessible, allowing you to trade full or partial TD ETFs. With partial shares trading, you can invest any amount you want in your favourite companies, even if it's less than the price of a cup of coffee.

In addition to the TD Easy TradeTM app, TD also offers other platforms for more experienced traders, such as WebBroker, Advanced Dashboard, and Active Trader. These platforms provide access to a diverse range of investment options, including stocks, ETFs, mutual funds, options, and bonds.

It's important to note that while there is no minimum investment for ETFs with TD Direct Investing, there may be other fees and charges associated with your account, such as maintenance fees, depending on your account balance and the specific services you use.

For more detailed information about fees and commissions, it is recommended to review the TD Direct Investing website or consult a financial advisor.

ETFs: Real Investments or Just a Fad?

You may want to see also

Frequently asked questions

TD Direct Investing does not charge any fees for ETFs.

With TD Direct Investing, you get 50 commission-free trades per year.

TD Direct Investing offers a range of benefits, including access to analytical tools, Canadian and US accounts, alerts, and more. It is a good platform for experienced traders who understand market dynamics and can identify and seize investing opportunities independently.