The concept of initial investment is a crucial aspect of business finance, and it often sparks debates among entrepreneurs and investors. One intriguing question that arises is whether the work of a captain, a professional who leads and navigates a ship, can be considered an initial investment. This paragraph aims to explore this unique perspective, examining the potential value of a captain's work in the context of starting a business or venture. By delving into the skills and expertise required, the risks taken, and the long-term benefits, we can gain insight into whether the captain's role truly counts as an initial investment and how it might shape the success of a business.

What You'll Learn

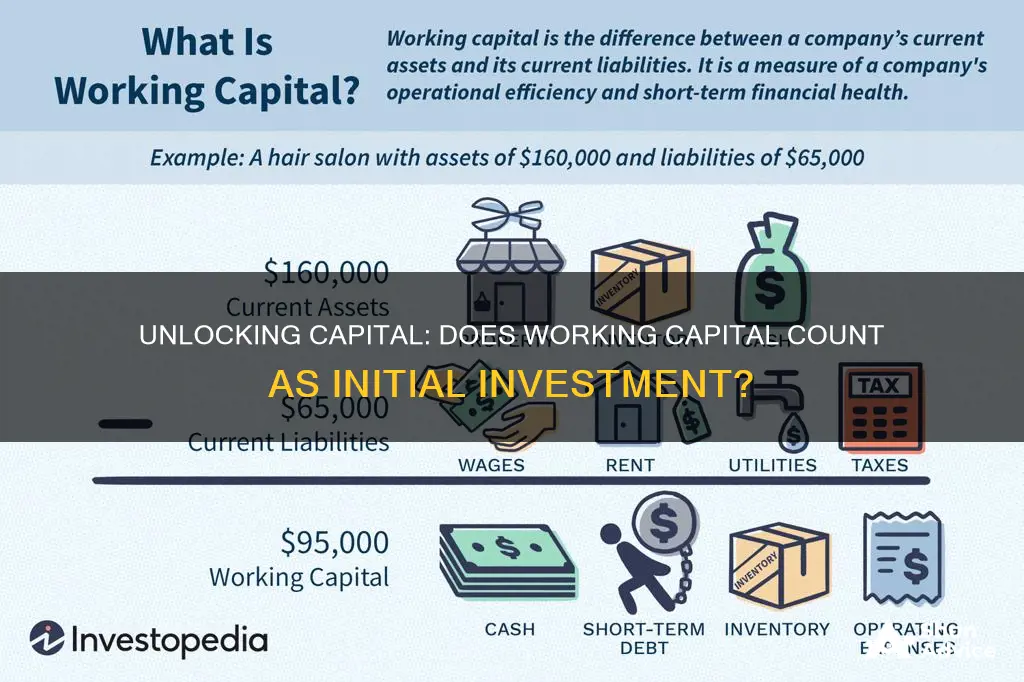

- Capital Definition: Working capital is a measure of a company's liquidity and financial health

- Initial Investment: It represents the initial funds invested in a business

- Working Capital Cycle: This cycle involves the conversion of assets into cash and vice versa

- Cash Flow Management: Effective management is crucial for maintaining positive working capital

- Return on Investment: Working capital can impact the return on investment in a business

Capital Definition: Working capital is a measure of a company's liquidity and financial health

Working capital is a critical concept in business finance, representing the capital or funds that a company needs to operate and maintain its day-to-day activities. It is a measure of a company's short-term financial health and its ability to meet its short-term obligations. This includes the capital required to pay for inventory, accounts receivable, and accounts payable, as well as other short-term assets and liabilities.

The definition of working capital is often expressed as the difference between a company's current assets and its current liabilities. Current assets are those that can be converted into cash within a year or less, such as cash, accounts receivable, and inventory. Current liabilities, on the other hand, are obligations that a company expects to pay within the same time frame, including accounts payable, short-term loans, and accrued expenses.

A positive working capital position indicates that a company has sufficient liquid assets to cover its short-term debts and operational costs. This is a sign of financial stability and efficiency, as it suggests that the company can manage its cash flow effectively and has the resources to fund its day-to-day operations. In other words, a healthy working capital position allows a company to invest in its growth and expansion while maintaining its financial obligations.

On the other hand, a negative working capital position can be a cause for concern. It may indicate that a company is struggling to manage its cash flow, has difficulty in paying its short-term debts, or is facing challenges in its day-to-day operations. Such a situation could lead to financial distress and may require the company to seek additional funding or implement cost-cutting measures to improve its financial health.

Working capital is an essential metric for investors, creditors, and company management alike. It provides a clear picture of a company's financial stability and its ability to generate cash. For investors, it helps assess the company's capacity to generate returns and manage its financial risks. Creditors use it to evaluate the company's ability to repay short-term debts, while management uses it to make strategic decisions regarding investments, expansion, and cost management.

In summary, working capital is a vital indicator of a company's liquidity and financial stability. It reflects the company's ability to manage its short-term assets and liabilities, ensuring that it can meet its immediate financial obligations and maintain its operations. Understanding and managing working capital effectively is crucial for businesses to ensure their long-term success and sustainability.

The Looming AI Takeover: Investing's Inevitable Future

You may want to see also

Initial Investment: It represents the initial funds invested in a business

The concept of initial investment is a fundamental aspect of business finance, referring to the total amount of capital that is required to launch a new venture. This investment is crucial as it provides the necessary resources to establish the business, cover initial expenses, and generate revenue. When considering what constitutes an initial investment, it's important to recognize that this term encompasses a wide range of financial contributions, including both tangible and intangible assets.

In the context of starting a business, initial investment often includes the purchase of assets such as property, equipment, and inventory. For instance, a bakery might invest in a commercial oven, mixing bowls, and ingredients to stock their shelves. These tangible assets are essential for the business's operations and contribute directly to its ability to generate sales. Additionally, initial investment can also involve the cost of licensing, permits, and legal fees, which are necessary to ensure compliance with regulations and establish the business's legitimacy.

Beyond tangible assets, initial investment also encompasses intangible assets, such as intellectual property, trademarks, and brand recognition. These intangible assets can be just as valuable as physical assets, as they contribute to the business's competitive advantage and market presence. For example, a software company might invest in developing a unique algorithm or acquiring a patent, which becomes a key component of their initial investment.

Furthermore, the initial investment also includes the personal financial contribution of the business owner(s). This can be in the form of personal savings, loans, or investments made to support the venture. For instance, an entrepreneur might use their personal savings to cover the initial rent and utilities for a new office space, or they might take out a loan to purchase specialized equipment for their business.

In the case of a business that utilizes working capital, it can indeed be considered part of the initial investment. Working capital refers to the funds used to finance day-to-day operations, including accounts receivable, inventory, and accounts payable. When a business relies on working capital to get started, it is essentially using its own financial resources to cover short-term expenses until it becomes profitable. This approach can be strategic, allowing the business to become operational quickly and generate revenue sooner. However, it's important to carefully manage working capital to ensure the business can sustain itself and eventually become self-funding.

Turkey: Invest Now or Later?

You may want to see also

Working Capital Cycle: This cycle involves the conversion of assets into cash and vice versa

The Working Capital Cycle is a fundamental concept in finance and accounting, representing the continuous process of converting assets into cash and managing short-term financial obligations. This cycle is crucial for businesses to maintain liquidity, ensure smooth operations, and support long-term growth. At its core, the cycle involves the strategic management of a company's assets and liabilities, focusing on the efficient use of resources and the timely generation of cash.

In simple terms, the cycle begins with the acquisition of raw materials or inventory, which are then converted into finished goods through production. These finished goods are sold, generating sales revenue. The cash received from sales is then used to pay off short-term debts and operational expenses, ensuring the business can continue its operations. The key here is to manage the timing of these transactions to optimize cash flow.

The process involves several interrelated activities. Firstly, the purchase of raw materials and inventory requires investment, which is a critical aspect of the initial investment phase. This investment is necessary to stock up on goods and materials, ensuring the business has the resources to produce and sell products. Secondly, the production process converts these assets into finished goods, ready for sale. Efficient production management is vital to minimize costs and maximize output.

Once the goods are produced and sold, the cycle continues with the collection of accounts receivable, which represents the money owed to the company by customers. This cash is then utilized to pay off accounts payable, which are short-term obligations to suppliers and creditors. Effective management of accounts receivable and payable is essential to maintain a healthy cash flow and avoid liquidity issues. The cycle completes when the business reinvests the cash generated back into the process, either by purchasing additional inventory or investing in growth opportunities.

Understanding the Working Capital Cycle is vital for businesses to make informed financial decisions. It highlights the importance of efficient asset management, timely cash conversions, and effective liability management. By optimizing this cycle, companies can improve their financial health, ensure stability, and support their overall growth objectives. This process is a critical aspect of financial management, especially for small and medium-sized enterprises, as it directly impacts their ability to operate, expand, and compete in the market.

The Great Debate: Paying Off Your Home vs. Investing — Which Path is Right for You?

You may want to see also

Cash Flow Management: Effective management is crucial for maintaining positive working capital

Effective cash flow management is a critical aspect of business operations, especially when it comes to maintaining a healthy and positive working capital position. Working capital, often referred to as the lifeblood of a business, is the difference between a company's current assets and liabilities and plays a vital role in its short-term financial health. It represents the funds available to a business to fund its day-to-day operations, manage short-term debts, and invest in growth opportunities.

The concept of working capital is closely tied to a company's cash flow, as efficient cash flow management directly impacts the availability and utilization of working capital. Positive cash flow ensures that a business has the financial resources to meet its short-term obligations, such as paying suppliers, employees, and other expenses. It also enables the company to invest in inventory, manage accounts receivable, and fund any necessary operational improvements.

To maintain a positive working capital position, businesses should focus on several key areas of cash flow management. Firstly, optimizing the collection of accounts receivable is essential. This involves implementing efficient invoicing and payment processes, offering incentives for early payments, and considering credit policies that balance the need for sales with the risk of bad debts. By improving the speed and efficiency of receivables, companies can increase their cash flow and reduce the time it takes to convert sales into available funds.

Secondly, managing inventory levels is crucial. Overstocking can tie up valuable cash, while understocking may lead to missed sales opportunities. Businesses should employ just-in-time inventory management techniques, analyze sales trends, and forecast demand accurately. This ensures that inventory is optimized, reducing the risk of excess stock and improving cash flow. Additionally, negotiating favorable payment terms with suppliers can provide a buffer against potential cash flow issues, allowing businesses to maintain a positive working capital balance.

Lastly, regular monitoring and forecasting of cash flow are essential. Businesses should create detailed cash flow statements and projections to identify potential shortfalls or surpluses. By analyzing historical data and market trends, companies can anticipate cash flow patterns and make informed decisions. This enables them to plan for seasonal variations, manage unexpected expenses, and secure additional funding if necessary, thus ensuring a stable and positive working capital position.

In summary, effective cash flow management is a strategic imperative for businesses to maintain a healthy working capital position. By optimizing accounts receivable, managing inventory, and employing robust cash flow forecasting, companies can ensure they have the financial flexibility to meet their short-term obligations and invest in growth. Understanding and managing cash flow is a critical skill for business leaders, as it directly impacts the overall financial health and sustainability of the organization.

Wealth Strategies: Savvy Saving and Investing for Long-Term Growth

You may want to see also

Return on Investment: Working capital can impact the return on investment in a business

Working capital, often referred to as the 'working capital ratio', is a critical financial metric that can significantly impact a business's return on investment (ROI). It represents the difference between a company's current assets and current liabilities, providing a snapshot of its short-term financial health and operational efficiency. When considering the initial investment, working capital is indeed a crucial factor to evaluate, as it directly influences the business's ability to generate returns.

In the context of ROI, working capital plays a pivotal role in several ways. Firstly, it indicates the efficiency of a company's operations. Positive working capital suggests that a business has sufficient liquid assets to cover its short-term obligations, which is essential for maintaining smooth day-to-day operations. This efficiency is vital because it allows the business to reinvest profits back into the company, thereby increasing its overall value and potential for growth. Efficient working capital management ensures that a company can quickly convert its assets into cash, enabling it to seize investment opportunities and expand its operations.

Secondly, working capital directly affects a company's profitability. A well-managed working capital position can lead to improved cash flow, allowing the business to negotiate better payment terms with suppliers, invest in cost-saving measures, and optimize inventory levels. By efficiently managing accounts receivable and payable, a company can reduce the time between paying for goods and services and receiving payment for its own products or services. This improved cash flow directly contributes to higher profitability, which is a key component of a positive ROI.

However, excessive working capital can also have drawbacks. If a business has too much liquid asset capital, it may indicate that the company is not efficiently utilizing its resources or that it is over-investing in short-term assets. This can lead to missed opportunities for long-term growth and development. Striking the right balance is essential, as it ensures that the business has enough capital to sustain operations while also having the financial flexibility to invest in growth initiatives.

In summary, working capital is a critical aspect of a business's initial investment and ongoing financial health. Effective management of working capital can enhance a company's ability to generate returns by improving cash flow, reducing costs, and optimizing operations. It provides a clear indication of a company's short-term financial stability and its capacity to invest in growth. By carefully monitoring and managing working capital, businesses can ensure they are on a path to achieving their financial goals and maximizing their return on investment.

Home Truths: Unlocking the Retirement Potential of Your Mortgage

You may want to see also

Frequently asked questions

Working capital is the capital required to fund the day-to-day operations of a business, and it is not typically considered an initial investment in the same way that equity or debt financing is. Initial investments often refer to the capital raised during the startup phase of a business, which is used to develop the business idea, purchase assets, and establish operations. Working capital, on the other hand, is the ongoing funding needed to support the business's short-term financial needs, such as inventory, accounts payable, and accounts receivable.

Working capital is a continuous process and is essential for the smooth operation of a business. It is the difference between a company's current assets (like cash, inventory, and accounts receivable) and its current liabilities (such as accounts payable and short-term loans). Initial investments, in contrast, are one-time infusions of capital that help establish the business and its operations. These investments are often used to build the business's foundation, purchase assets, and generate revenue in the early stages.

While working capital is not an initial investment, it can be viewed as a strategic investment in the long term. Effective management of working capital can significantly impact a company's financial health and growth. By optimizing working capital, businesses can improve cash flow, reduce costs, and enhance overall efficiency. This, in turn, can lead to better financial performance and the ability to invest in long-term growth opportunities, such as expanding operations, research and development, or market penetration.