Utility ETFs are a tempting investment, as people will always need to use utilities. However, changing regulations, lawsuits, and the massive investments required to prepare for tougher carbon emissions rules mean that individual utility companies can be much riskier than they once were. For example, Pacific Gas & Electric was forced into bankruptcy reorganization due to its role in California wildfires. Therefore, if you're nervous about owning individual utility stocks but still want exposure to the sector, a low-cost exchange-traded fund (ETF) that lets you buy a broad basket of utility companies in one transaction might be a good option.

| Characteristics | Values |

|---|---|

| Risk | Utilities ETFs are considered lower-risk than other investments, but individual utility companies can be much riskier. |

| Returns | The Vanguard Utilities Index Fund provided investors with an 11% annualized 10-year return as of the end of 2021. |

| Diversification | ETFs allow investors to buy a broad basket of utility companies in one transaction, reducing the impact that any one company will have on the portfolio. |

| Dividends | Utilities ETFs provide stable income from dividends, with the Vanguard Utilities Index Fund paying quarterly dividends. |

| Volatility | Utilities ETFs tend to have lower volatility than the total stock market. |

| Correlation | Utilities ETFs have low correlation relative to the total stock market. |

| Performance | Utilities ETFs tend to perform well during market downturns as demand for utilities is relatively constant. |

| Expense Ratio | The Vanguard Utilities Index Fund has an expense ratio of 0.1%. |

What You'll Learn

Utility ETFs are less risky than individual utility stocks

ETFs, or exchange-traded funds, are a popular investment vehicle for both active and passive investors. They are similar to mutual funds but trade like stocks, allowing investors to broaden the diversity of their portfolios without increasing the time spent on managing and allocating their investments.

ETFs are often lauded for the diversification they offer, and this is one of the reasons why they are considered less risky than individual stocks. When you buy a stock, you invest in a specific company with a specific business model. In contrast, ETFs are made up of multiple components, allowing for built-in diversification. For example, the SPDR S&P 500 ETF Trust (SPY) is one of the most popular exchange-traded funds and is benchmarked to the S&P 500 index, which includes the 500 largest U.S. stocks, such as Apple, Tesla, and JPMorgan Chase & Co.

Additionally, ETFs can be more affordable than investing in individual stocks. In the past, creating a diversified portfolio required steep management fees. However, certain ETFs provide investors with access to these investing strategies at very affordable prices. According to FactSet, Vanguard, an asset management giant, had an asset-weighted expense ratio of just 0.06% in 2020. This means that for every $10,000 invested, investors would pay only $6 annually.

Furthermore, index ETFs, which are ETFs linked to a benchmarking index, tend to outperform active managers. A simple approach that follows a diversified index like the S&P 500 consistently outperforms "active management" styles, where a manager hand-picks stocks. In 2020, even with the challenges posed by COVID-19, 57% of active funds underperformed broad stock market indexes, according to the S&P Indices Versus Active (SPIVA) Scorecard.

While all investments carry some level of risk, ETFs that are well-diversified and offer affordable expense ratios can be a safer option for investors compared to individual utility stocks.

Fidelity's X Shares ETF Strategy: Pros and Cons

You may want to see also

Utility ETFs provide a broad basket of utility companies in one transaction

Some of the top-performing Utility ETFs include the Vanguard Utilities ETF, the Utilities Select Sector SPDR® ETF, the iShares US Utilities ETF, and the Invesco S&P 500® Equal Weight Utilts ETF. These funds seek to track the performance of various indices, such as the MSCI US Investable Market Index (IMI)/Utilities 25/50 and the Russell 1000 Utilities RIC 22.5/45 Capped Index.

One of the benefits of investing in Utility ETFs is the built-in diversification within the sector. By purchasing a single ETF, investors gain exposure to a diverse range of utility companies, reducing the risk associated with investing in individual stocks. This diversification can help protect against financial difficulties faced by any one company within the sector.

Additionally, Utility ETFs offer a convenient way to invest in the utility sector without the headaches and unique risks of buying individual stocks. They provide a low-cost, index-based option for investors seeking exposure to the sector and its characteristics, such as relatively stable and mature companies with dividend income.

A Beginner's Guide to Investing in ETFs with Fidelity

You may want to see also

Utility ETFs are more stable than the broad market

Utility ETFs seek capital appreciation by investing primarily in equity securities of public utilities, including electric, gas, and telephone service providers. They can also include independent power producers and energy traders, as well as companies involved in the generation and distribution of renewable energy.

Some of the top-performing Utility ETFs include:

- Vanguard Utilities ETF

- IShares US Utilities ETF

- Fidelity MSCI Utilities ETF

- First Trust Utilities AlphaDEX® ETF

- Invesco Dorsey Wright Utilities Momt ETF

These ETFs provide exposure to stocks in the utility sector and tend to be more stable than the broad market. They can be a good option for investors seeking stable returns and regular dividend income. However, it is important to note that the growth potential of these ETFs may be limited compared to other investments in the wider market.

ETFs: A Liquid Investment Option?

You may want to see also

Utility ETFs have limited growth opportunities

The massive investments that many utility companies will have to make to prepare for tougher rules on carbon emissions will also impact their growth opportunities. It is now much harder to pick solid utility stocks. However, investors can still gain exposure to the sector through low-cost exchange-traded funds (ETFs) that offer a broad basket of utility companies in one transaction.

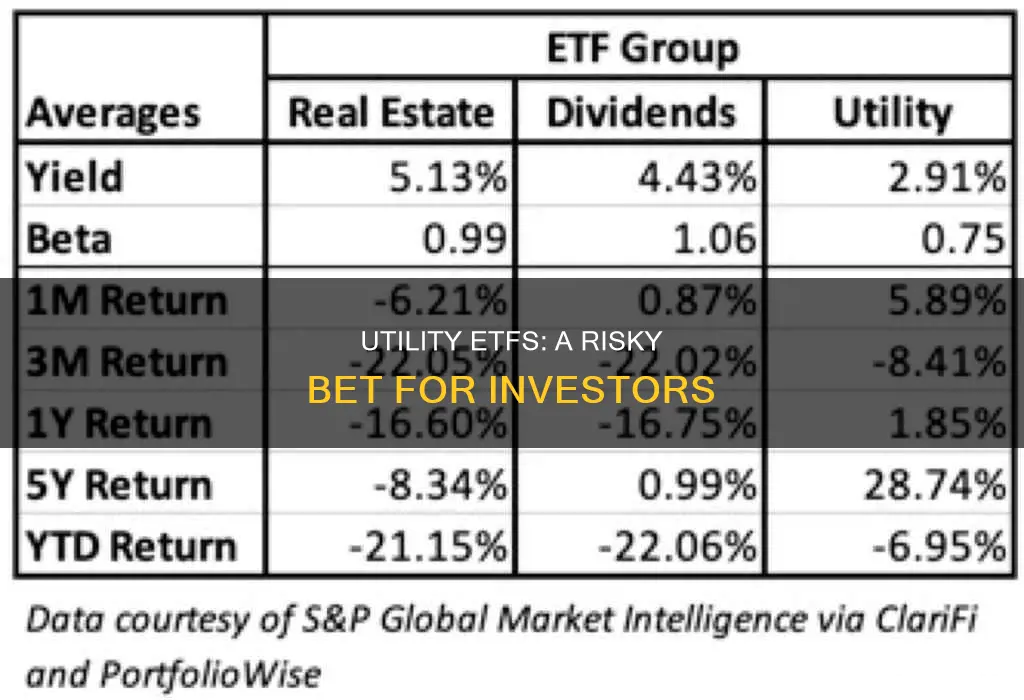

The benefits of investing in utility ETFs include stable income from dividends, lower volatility, and low correlation to the total stock market. Utilities also tend to perform well during market downturns as demand for utilities remains relatively constant. Additionally, utility ETFs can provide a diversification benefit to a portfolio, reducing overall volatility and risk.

When considering utility ETFs, it is important to look at the specific companies included in the ETF, the fees associated with the ETF, and the index it tracks. Some popular utility ETFs include the Utilities Select Sector SPDR Fund (XLU), the Vanguard Utilities ETF (VPU), and the Fidelity MSCI Utilities Index ETF (FUTY). These ETFs offer exposure to utility companies across the US, providing stable income and lower volatility compared to the broader market.

Ally Invest's SPDR ETF Offerings: What You Need to Know

You may want to see also

Utility ETFs are a good option for investors seeking income

One of the key advantages of investing in utility ETFs is the stable source of income they provide. Utility companies are known for their steady and predictable cash flows, and they often pay dividends to shareholders. This makes utility ETFs attractive to investors seeking consistent returns and a hedge against market volatility.

Additionally, utility companies tend to be defensive in nature. Their services are essential and less susceptible to changes in consumer demand, so they can perform well during economic downturns and recessions. This characteristic further adds to the income stability that utility ETFs offer.

When considering utility ETFs, investors should be aware of certain risks. The industry is heavily regulated, so changes in government policies can create uncertainty. Additionally, some utility companies carry significant debt, and rising interest rates can impact their profitability.

Despite these risks, utility ETFs can be a valuable component of an investment portfolio. They provide diversification benefits, reducing overall portfolio volatility and risk. For example, during the period from 1999 through July 2020, a 10% tilt towards utilities resulted in higher general and risk-adjusted returns, along with lower volatility and smaller drawdowns compared to the total stock market.

In summary, utility ETFs are a good option for investors seeking income due to their stable and defensive nature, consistent dividends, and ability to provide a hedge against market volatility.

BlackRock ETF: A Guide to Investing in Their Funds

You may want to see also