Understanding how 401(k) investment works is crucial for anyone looking to secure their financial future. A 401(k) is a retirement savings plan that allows employees to invest a portion of their paycheck prior to taxes being taken out. Employers often match a percentage of the employee's contribution, providing a valuable boost to savings. The investments made in a 401(k) can include a variety of options, such as stocks, bonds, and mutual funds, which grow tax-deferred until retirement. This feature allows the investments to accumulate value over time, potentially resulting in substantial savings. This guide will explore the mechanics of 401(k) investments, including how to choose the right investment options, understand fees and risks, and maximize the benefits of this powerful retirement savings tool.

What You'll Learn

- Contribution Limits: Understand annual 401(k) contribution caps and eligibility rules

- Matching Contributions: Learn how employer matching funds boost your retirement savings

- Investment Options: Explore the variety of investment choices available in a 401(k) plan

- Asset Allocation: Discover how to balance investments for long-term growth and risk management

- Tax Advantages: Understand the tax benefits of 401(k) investments and their impact on retirement savings

Contribution Limits: Understand annual 401(k) contribution caps and eligibility rules

Understanding the contribution limits for your 401(k) plan is crucial for maximizing your retirement savings. These limits are set by the IRS and are adjusted annually to account for inflation. Here's a breakdown of the key points:

Annual Contribution Limits:

- For 2023 and 2024: The annual contribution limit is $22,500. This limit applies to employees who are age 50 or younger.

- Age 50+: If you're age 50 or older, you're eligible for a catch-up contribution of $6,500 on top of the regular limit. This brings your total contribution to $29,000 for the year.

Important Considerations:

- Employer Matching: Many employers offer matching contributions, which can significantly boost your savings. Make sure you contribute enough to take full advantage of any employer match.

- Roth 401(k) Options: Some 401(k) plans offer a Roth 401(k) option. Roth contributions are made with after-tax dollars, but qualified withdrawals in retirement are tax-free. Check if your plan includes a Roth option and consider contributing a portion of your salary to it.

- Eligibility: You must be employed by an employer who offers a 401(k) plan to contribute.

Tax Implications:

- Traditional 401(k): Contributions to a traditional 401(k) are typically tax-deductible, reducing your taxable income for the year.

- Roth 401(k): Contributions to a Roth 401(k) are made with after-tax dollars, but qualified withdrawals in retirement are tax-free.

Maximizing Your Savings:

- Start Early: The power of compound interest means the earlier you start contributing, the more your savings will grow.

- Maximize Contributions: Aim to contribute as much as you can, especially if your employer offers matching contributions.

- Diversify Your Investments: Spread your investments across different asset classes to minimize risk and maximize returns.

Remember, these contribution limits are subject to change each year. Stay informed about any updates to ensure you're taking full advantage of your 401(k) plan.

Invest Aggressively Now?

You may want to see also

Matching Contributions: Learn how employer matching funds boost your retirement savings

Employer matching contributions are a powerful incentive for employees to maximize their retirement savings. When an employer offers to match a certain percentage of an employee's contributions to their 401(k) plan, it's like getting free money towards your retirement. This is a valuable benefit that can significantly boost your long-term financial security. Here's how it works and why it's worth taking advantage of:

When you contribute a portion of your paycheck to your 401(k), the employer may choose to match a percentage of that amount. For example, if you contribute 6% of your pay and your employer matches 50% of that, they will contribute 3% to your account. This means that for every dollar you put in, your employer adds an additional 50 cents, effectively doubling your contribution. Over time, this can lead to a substantial increase in your retirement savings.

The beauty of employer matching lies in its ability to provide immediate financial benefits. Unlike traditional investments that may take years to grow, matching contributions are essentially a bonus that can be used to accelerate your retirement savings. This is especially valuable for those who may not have the financial means to contribute large sums regularly. By taking advantage of the employer match, you can ensure that your retirement savings grow faster and reach a more substantial amount by retirement.

It's important to note that these matching contributions are typically tax-deferred, meaning they grow tax-free until you withdraw them in retirement. This tax advantage further enhances the value of the employer match. Additionally, since these contributions are made pre-tax, they reduce your taxable income, providing an immediate tax benefit as well.

To maximize the benefit of employer matching, it's advisable to contribute enough to take full advantage of the match. Aim to contribute at least up to the percentage that your employer is willing to match. For instance, if your employer matches 50% up to 6%, contribute at least 6% to get the full match. This ensures that you're not leaving free money on the table.

In summary, employer matching contributions are a valuable tool for boosting your retirement savings. By taking advantage of this benefit, you can effectively double your contributions and accelerate your savings. It's a simple yet powerful way to secure your financial future and make the most of your 401(k) plan.

Telephone Bill Conundrum: Expense or Investment?

You may want to see also

Investment Options: Explore the variety of investment choices available in a 401(k) plan

When it comes to your 401(k) plan, understanding the investment options available is crucial for building a solid retirement strategy. The 401(k) plan offers a range of investment choices, allowing you to tailor your portfolio to your financial goals and risk tolerance. Here's an overview of the typical investment options you might find:

Traditional Mutual Funds: These are one of the most common investment options in 401(k) plans. Mutual funds pool money from many investors to invest in a diversified portfolio of stocks, bonds, or other securities. They are managed by professional fund managers, offering an easy way to gain exposure to various markets. You can choose from various mutual funds, including equity funds (investing in stocks), bond funds (investing in bonds), and balanced funds (a mix of stocks and bonds). Each fund has its own level of risk and potential return, allowing you to diversify your investments across different asset classes.

Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds but trade on stock exchanges like individual stocks. They offer diversification and are often more cost-effective than mutual funds. ETFs can track indexes, sectors, or specific investment strategies, providing exposure to a particular market or asset class. For example, you might find ETFs focused on technology stocks, international markets, or specific industries, allowing you to align your investments with your interests and goals.

Company Stock or Index Funds: Some 401(k) plans offer the option to invest directly in the company's stock or index funds that mirror a specific market index. Investing in your company's stock can be a way to support the business and potentially benefit from its success. Index funds, on the other hand, aim to replicate the performance of a particular market index, such as the S&P 500. These funds provide broad market exposure and are often considered a more conservative investment option.

Real Estate Investment Trusts (REITs): REITs allow investors to invest in real estate without directly purchasing property. They are companies that own and operate income-generating real estate, such as office buildings, malls, or residential properties. REITs offer diversification across various real estate assets and can provide a steady income stream through dividends. This investment option is particularly attractive for those seeking a mix of growth and income potential.

International and Global Funds: These funds offer exposure to markets outside the United States, allowing you to diversify your portfolio globally. International funds invest in companies and securities worldwide, providing access to emerging markets and international growth opportunities. Global funds, on the other hand, may include investments from various countries, offering a more comprehensive international exposure.

Remember, the key to successful 401(k) investing is diversification. By exploring these investment options and understanding your risk tolerance, you can build a well-rounded portfolio that aligns with your retirement goals. It's essential to review and adjust your investments periodically to ensure they remain on track with your financial plans.

The Great British Property Myth: Unraveling the Truth About Homeownership and Investments

You may want to see also

Asset Allocation: Discover how to balance investments for long-term growth and risk management

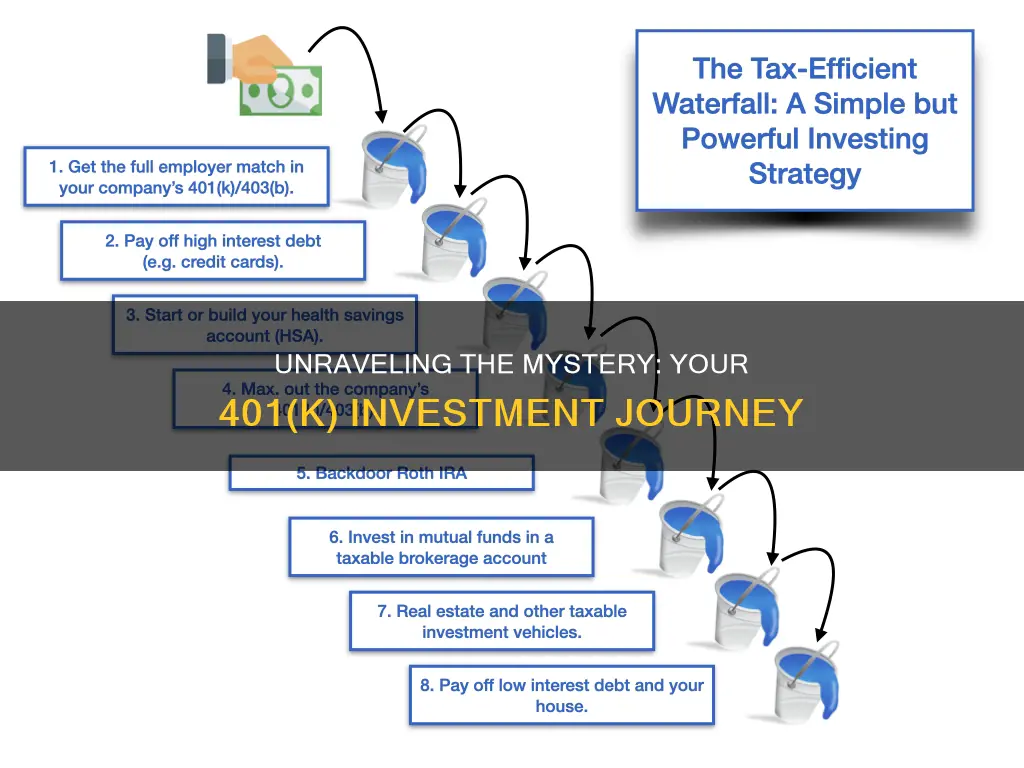

Asset allocation is a fundamental concept in investing, especially when it comes to long-term financial goals like retirement planning. It involves dividing your investment portfolio across different asset classes to achieve a balance between growth potential and risk management. This strategy is crucial for 401(k) plans, as it helps investors navigate the journey towards retirement with confidence.

The primary goal of asset allocation is to create a well-diversified portfolio that can weather market volatility and economic cycles. By allocating your investments wisely, you can potentially maximize returns while minimizing the impact of downturns. Here's a breakdown of how to approach asset allocation for your 401(k):

Understand Your Risk Tolerance: The first step is to assess your risk tolerance, which refers to your ability and willingness to endure market fluctuations. Younger investors might opt for a more aggressive approach, favoring stocks, as they have a longer time horizon to recover from potential losses. In contrast, older investors may prefer a more conservative strategy, leaning towards bonds and fixed-income securities, to preserve capital. Regularly evaluating your risk tolerance is essential as it may change over time due to life events or market conditions.

Diversify Across Asset Classes: Asset allocation typically involves a mix of stocks, bonds, and sometimes alternative investments like real estate or commodities. Stocks offer the potential for higher returns but come with higher risk. Bonds provide a more stable, fixed-income stream, while alternative investments can offer protection against market downturns. Aim for a diversification that aligns with your investment objectives and risk profile. For instance, a 60/40 stock-bond allocation is a common starting point, but you can adjust this based on your specific needs.

Consider Market Conditions and Time Horizons: Market conditions and your investment time horizon play a significant role in asset allocation. During periods of economic growth, stocks may outperform, while in a recession, bonds could provide stability. Adjusting your asset allocation periodically based on market trends can help optimize returns. Additionally, if you have a longer investment horizon, you might consider a more aggressive allocation, allowing for potential higher growth.

Regular Review and Rebalancing: Asset allocation is not a set-and-forget strategy. Regularly reviewing and rebalancing your portfolio is essential to maintain your desired risk level and investment goals. Market movements can cause your initial allocation to shift, and rebalancing ensures that your portfolio aligns with your risk tolerance. For example, if stocks have outperformed and now make up a larger portion of your portfolio than intended, you might reallocate some funds to bonds to restore the original balance.

In summary, asset allocation is a powerful tool for managing risk and maximizing returns in your 401(k) or any investment portfolio. It involves a thoughtful approach to diversification, considering your risk tolerance, market conditions, and investment timeframe. By regularly reviewing and adjusting your asset allocation, you can stay on track to achieve your long-term financial objectives. Remember, a well-allocated portfolio can provide the stability and growth potential needed to secure your retirement dreams.

Uncover Your Investment Strategy: A Guide to Defining Your Buying Approach

You may want to see also

Tax Advantages: Understand the tax benefits of 401(k) investments and their impact on retirement savings

A 401(k) plan is a powerful tool for retirement savings, offering a range of tax advantages that can significantly boost your long-term financial goals. One of the primary benefits is the ability to contribute a portion of your income tax-free, which directly impacts your take-home pay. When you contribute to your 401(k), you are essentially reducing your taxable income for the year, which can lead to lower taxes owed and a higher net income. This tax-deferred status allows your investments to grow without the immediate burden of taxes, which is a significant advantage over traditional savings accounts.

The tax benefits of 401(k) investments extend beyond the contribution phase. During the investment period, your 401(k) earnings are also tax-deferred. This means that any capital gains, dividends, or interest accrued on your investments are not taxed until you start making withdrawals during retirement. This compound growth can result in substantial savings over time, as your money has the potential to grow faster without the annual tax hit.

Additionally, when you reach retirement age and start taking distributions from your 401(k), you will be taxed at a lower rate compared to your working years. This is because you are typically in a lower tax bracket during retirement due to reduced income. As a result, the tax liability on your 401(k) withdrawals is generally lower, allowing you to take a larger portion of your savings as tax-free income or at a reduced tax rate. This strategic advantage can significantly enhance your retirement financial plan.

Furthermore, the tax-advantaged nature of 401(k) investments encourages long-term savings. By deferring taxes on contributions and earnings, individuals are more likely to keep their money invested for the long haul, allowing for potential significant growth. This behavior can lead to a more secure retirement, as it provides a substantial nest egg that has had time to accumulate and grow, free from the immediate tax burden.

In summary, the tax advantages of 401(k) investments are a critical aspect of their appeal. By offering tax-deferred contributions and earnings, as well as lower tax rates during retirement, 401(k) plans provide a powerful incentive for individuals to save for their future. Understanding these tax benefits is essential for anyone looking to maximize their retirement savings and ensure a more financially secure future.

Savings vs. Investing: Understanding the Key Differences

You may want to see also

Frequently asked questions

A 401(k) is a retirement savings plan offered by many employers in the United States. It allows employees to invest a portion of their paycheck before taxes are taken out, providing a tax-advantaged way to save for retirement. When you contribute to your 401(k), the money is typically invested in a variety of assets like stocks, bonds, mutual funds, or exchange-traded funds (ETFs). These investments grow over time, and the earnings are not taxed until withdrawal during retirement.

Selecting appropriate investments is crucial for your 401(k) plan. It's recommended to diversify your portfolio to manage risk. You can choose from a range of investment options offered by your employer, such as target date funds, index funds, or mutual funds. Target date funds are popular as they adjust their asset allocation based on your expected retirement date. It's essential to regularly review and rebalance your investments to ensure they align with your risk tolerance and retirement goals.

Yes, there are significant tax advantages to 401(k) contributions. When you make pre-tax contributions, you reduce your taxable income for the year, which can lower your current tax liability. Additionally, earnings on your 401(k) investments grow tax-deferred, meaning you won't owe taxes on those gains until you start making withdrawals in retirement. This allows your savings to grow faster over time.