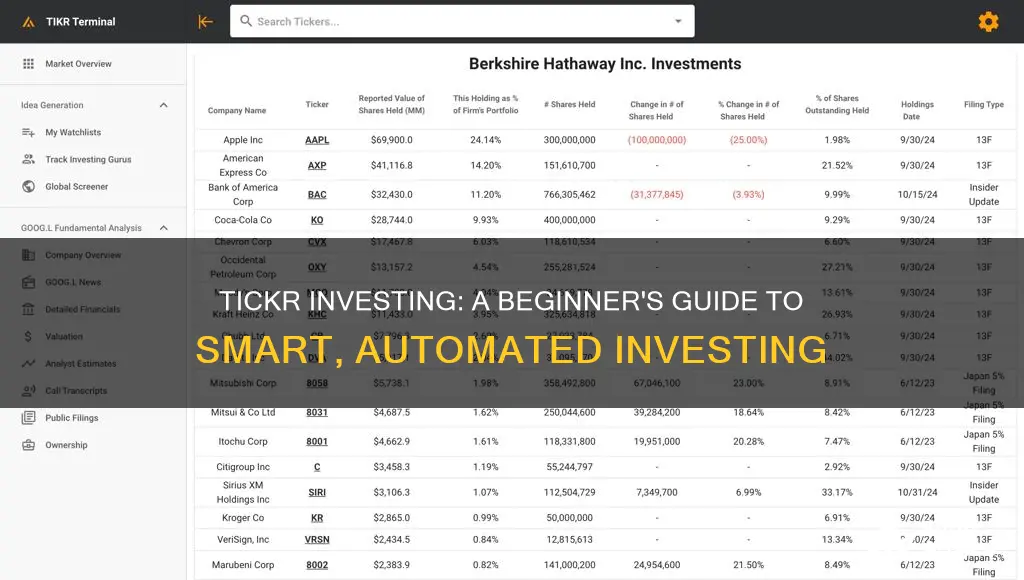

Tickr Investing is a revolutionary online platform that simplifies the process of investing in the stock market. It offers a user-friendly interface and automated investment strategies, making it accessible to both novice and experienced investors. With Tickr, users can create a personalized investment portfolio by selecting from a range of pre-built portfolios or building their own based on their financial goals and risk tolerance. The platform utilizes advanced algorithms to analyze market trends and make data-driven investment decisions, ensuring that users can make informed choices. Tickr's automated rebalancing feature helps maintain a balanced portfolio, and its real-time performance tracking keeps investors informed about their investments' growth. This innovative approach to investing aims to democratize access to the financial markets, allowing individuals to take control of their financial future with ease and efficiency.

What You'll Learn

- Tickr Investing Basics: Understanding the platform, its features, and how to create an account

- Portfolio Management: Strategies for building and managing a diversified investment portfolio

- Investment Options: Overview of available investment products and their suitability for different goals

- Risk Management: Techniques to minimize risks and protect investments

- Performance Tracking: How to monitor and analyze investment performance over time

Tickr Investing Basics: Understanding the platform, its features, and how to create an account

Tickr Investing is an innovative online platform designed to simplify the process of investing in the stock market. It offers a user-friendly interface and a range of features to cater to both novice and experienced investors. The platform aims to democratize access to the financial markets, making it easier for individuals to build and manage their investment portfolios. Here's a breakdown of the basics to get you started:

The Tickr platform provides a comprehensive suite of tools and resources. It offers a vast selection of investment options, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). Users can explore various sectors and industries, allowing for diversification and tailored investment strategies. One of its key features is the ability to create customizable watchlists, where investors can track their favorite stocks and stay updated on price movements. Additionally, Tickr provides real-time market data, financial news, and research reports to empower users with information for informed decision-making.

Creating an account on Tickr Investing is a straightforward process. Here's a step-by-step guide: First, visit the Tickr website and click on the 'Sign Up' button. You'll be prompted to provide your email address and create a secure password. Tickr may also offer a sign-up bonus or promotional offer for new users, which can be a great incentive. After signing up, you'll be directed to a profile setup page where you can input personal details such as your name, date of birth, and contact information. This step ensures compliance with regulatory requirements and allows Tickr to provide personalized services.

Once your account is created, you'll have access to a dashboard that serves as your investment hub. Here, you can review your portfolio performance, view transaction history, and manage your investments. Tickr often provides educational resources and tutorials to help users navigate the platform effectively. These resources can guide you through the process of placing trades, understanding market trends, and making informed investment choices.

Security is a top priority for Tickr Investing. The platform employs robust security measures to protect user data and funds. This includes two-factor authentication, encryption protocols, and regular security audits. Users are encouraged to enable security features like password managers and two-step verification to enhance their account security. Additionally, Tickr offers customer support to assist with any account-related issues or queries.

In summary, Tickr Investing is a user-friendly platform that empowers individuals to take control of their financial future. With its comprehensive features, educational resources, and robust security measures, it provides an accessible gateway to the world of investing. By following the simple account creation process, users can begin building their investment portfolios and exploring the vast array of financial instruments available on the platform.

E-Trade Investing: A Beginner's Guide to Getting Started

You may want to see also

Portfolio Management: Strategies for building and managing a diversified investment portfolio

When it comes to building and managing a diversified investment portfolio, there are several key strategies that investors can employ to ensure long-term success. Firstly, it's crucial to define your investment goals and risk tolerance. Are you saving for retirement, a child's education, or a specific financial objective? Understanding your goals will help you determine the appropriate asset allocation and investment strategies. Additionally, assessing your risk tolerance is essential; it's the level of risk you're willing to take to achieve your financial objectives. This will guide your decision-making process and help you avoid investments that are too aggressive or conservative for your needs.

Diversification is a cornerstone of portfolio management. It involves spreading your investments across various asset classes such as stocks, bonds, real estate, and commodities. By diversifying, you reduce the impact of any single investment's performance on your overall portfolio. For instance, if you invest solely in stocks, a downturn in the stock market could significantly affect your portfolio. However, by including bonds, real estate, or alternative investments, you create a more balanced approach that can provide stability during market fluctuations.

One effective strategy is to create a well-rounded portfolio by investing in different sectors and industries. This means allocating your assets among various market capitalizations, such as large-cap, mid-cap, and small-cap stocks, as well as different sectors like technology, healthcare, and energy. This approach ensures that your portfolio is not overly exposed to any one industry's performance. Regularly reviewing and rebalancing your portfolio is also essential. Market conditions and individual investment performances can change over time, so periodic adjustments are necessary to maintain your desired asset allocation.

Another critical aspect of portfolio management is staying informed and monitoring your investments. Keep track of market trends, economic indicators, and news that may impact your holdings. Utilize financial research and analysis tools to make informed decisions. Additionally, consider consulting a financial advisor who can provide personalized guidance based on your unique circumstances. They can offer valuable insights, help you navigate market complexities, and ensure your portfolio aligns with your financial goals.

Lastly, it's important to maintain a long-term perspective when managing your investments. Short-term market volatility is common, but historically, markets have trended upwards over the long term. Avoid making impulsive decisions based on temporary market fluctuations. Instead, focus on your investment strategy, regularly review and adjust your portfolio, and stay committed to your financial plan. This disciplined approach will contribute to building a robust and diversified investment portfolio.

Magic Formula Investing: Unveiling the Truth Behind the Strategy

You may want to see also

Investment Options: Overview of available investment products and their suitability for different goals

When considering investment options, it's essential to understand the various products available and how they align with your financial goals. Here's an overview to guide you through the process:

Stocks and Equities: This is a traditional investment avenue where you buy shares of individual companies. Stocks offer the potential for high returns but also carry higher risks. They are suitable for long-term investors who can withstand market volatility. Diversifying your stock portfolio across different sectors and industries is crucial to managing risk. You can invest in individual stocks or opt for mutual funds or exchange-traded funds (ETFs) that hold a basket of stocks, providing instant diversification.

Bonds and Fixed-Income Securities: Bonds are a more conservative investment, offering a steady income stream through regular interest payments. They are generally considered less risky than stocks but provide lower potential returns. Government bonds are often seen as a safe haven, while corporate bonds carry more risk but can offer higher yields. This investment is ideal for risk-averse investors seeking a consistent income stream.

Mutual Funds: These are investment funds that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. Mutual funds are managed by professional fund managers, making them a popular choice for beginners. They offer instant diversification and are suitable for long-term wealth accumulation. There are various types, including equity funds, bond funds, and balanced funds, each catering to different risk appetites.

Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds but trade on stock exchanges like individual stocks. They offer diversification and are cost-effective due to lower management fees. ETFs can track specific indexes, sectors, or even focus on unique investment strategies. This flexibility allows investors to tailor their portfolios to their goals, whether it's sector-specific exposure or thematic investments.

Real Estate Investment Trusts (REITs): REITs allow investors to invest in real estate without directly purchasing properties. They offer the opportunity to earn income through dividends and potential capital appreciation. REITs provide diversification across various real estate assets, including office buildings, malls, and residential properties. This investment is suitable for those seeking a blend of income and growth potential.

Understanding your risk tolerance, investment horizon, and financial goals is crucial before choosing investment options. Diversification is a key strategy to manage risk, and consulting a financial advisor can provide personalized guidance based on your unique circumstances.

Socially Responsible Investing: Does It Deliver? Uncovering the Impact

You may want to see also

Risk Management: Techniques to minimize risks and protect investments

Tickr Investing is an innovative approach to investing that utilizes advanced algorithms and data-driven insights to optimize investment strategies. While it offers a promising way to navigate the complex world of finance, it's essential to understand the inherent risks and employ effective risk management techniques to safeguard your investments. Here are some strategies to minimize risks and protect your financial interests:

Diversification: One of the fundamental principles of risk management is diversification. Instead of concentrating your investments in a single asset or sector, distribute your capital across various assets, industries, and geographic regions. Diversification helps reduce the impact of any single investment's performance on your overall portfolio. For example, if you invest in Tickr's algorithm-based portfolios, ensure that these portfolios are diversified across different asset classes, such as stocks, bonds, and real estate, to mitigate the risks associated with any one market segment.

Risk Assessment and Analysis: Conduct thorough risk assessments for each investment opportunity. Tickr's algorithms should provide risk-adjusted returns and volatility metrics for different investment options. Analyze these metrics to understand the potential risks associated with each investment. Look for investments with a balanced risk-reward profile, ensuring that the potential upside is proportional to the risk taken. Regularly review and update your risk assessments as market conditions and investment performance evolve.

Stop-Loss Orders: Implement stop-loss orders to limit potential losses. A stop-loss order is an instruction to sell an asset when it reaches a certain price. By setting a stop-loss, you can automatically sell an investment if it declines, preventing further losses. For instance, if you invest in a Tickr-managed fund, you can set a stop-loss trigger at a specific percentage below the purchase price. This ensures that you sell the investment if it drops to a level you deem unacceptable, thus minimizing potential drawdowns.

Regular Portfolio Review: Periodically review and rebalance your investment portfolio. Market conditions and individual asset performances can change rapidly, impacting your risk exposure. Review your Tickr-generated investment plan and make adjustments as necessary. Rebalance your portfolio to maintain your desired asset allocation, ensuring that no single investment or sector dominates your holdings. Regular reviews also allow you to identify and address any emerging risks promptly.

Risk Monitoring and Management Tools: Utilize risk management tools and software that can provide real-time insights into your investments. Many investment platforms, including those powered by Tickr, offer risk management features. These tools can help you track and analyze various risk metrics, such as value at risk (VaR), expected shortfall, and correlation matrices. By monitoring these indicators, you can make informed decisions and take proactive measures to manage risks effectively.

Long-Term Perspective: Adopting a long-term investment perspective is crucial for risk management. Short-term market fluctuations and volatility are common, and trying to time the market can be challenging. Tickr's algorithms may be designed to navigate these short-term swings, but it's essential to remember that long-term success often requires patience and a focus on fundamental investment principles. Avoid making impulsive decisions based on short-term market movements.

Tata Steel: Invest Now?

You may want to see also

Performance Tracking: How to monitor and analyze investment performance over time

Performance tracking is a critical aspect of investment management, allowing investors to monitor the growth and health of their portfolios over time. It involves a systematic approach to measuring and analyzing the returns and overall performance of investments. Here's a guide on how to effectively track and analyze your investment performance:

- Define Your Investment Goals: Before tracking performance, it's essential to establish clear investment objectives. Determine whether your investments are aimed at long-term wealth accumulation, short-term gains, retirement planning, or any other specific goal. This definition will help you set a baseline for performance measurement. For example, if your goal is to build a retirement fund, you might focus on tracking the growth of your portfolio in relation to the expected retirement savings needed.

- Choose Appropriate Metrics: Select key performance indicators (KPIs) that align with your investment strategy and goals. Common metrics include total return (both capital appreciation and dividend income), annualized return, risk-adjusted return (such as the Sharpe ratio), and drawdown (the peak-to-trough decline during a specific period). These metrics provide a comprehensive view of your investment's performance, considering both gains and potential losses. For instance, the Sharpe ratio measures excess return relative to the volatility of returns, offering a more nuanced understanding of risk-adjusted performance.

- Regularly Review and Update: Implement a consistent review process to track your investments' performance. This could be monthly, quarterly, or annually, depending on your investment strategy and market conditions. Regular reviews allow you to identify trends, make necessary adjustments, and ensure that your investments are on track. For instance, if you notice that a particular asset class is underperforming, you might consider rebalancing your portfolio to maintain your desired asset allocation.

- Compare Against Benchmarks: To gain a deeper understanding of your investment performance, compare it against relevant benchmarks or market indices. Benchmarks provide a standardized reference point to gauge how your investments are performing relative to the broader market or specific sectors. For example, if you're investing in stocks, you might compare your portfolio's performance to the S&P 500 index, which represents a large segment of the U.S. stock market. This comparison helps in identifying areas of outperformance or underperformance and allows for strategic adjustments.

- Analyze Risk Exposure: Risk tracking is an integral part of performance analysis. Assess the risk associated with your investments by examining metrics such as volatility, drawdown, and value at risk (VaR). These measures help you understand the potential impact of market fluctuations on your portfolio. For instance, tracking the maximum drawdown can provide insights into the resilience of your investments during market downturns. By regularly analyzing risk exposure, you can make informed decisions about risk management and diversification.

- Utilize Technology: Take advantage of investment tracking software and platforms that offer automated performance analysis. These tools can provide real-time data, visualizations, and alerts, making it easier to monitor your investments. Many online investment platforms and financial management apps offer portfolio tracking features, allowing you to connect your accounts and view a comprehensive overview of your investments. These tools often provide customizable reports and alerts, ensuring you stay informed about your portfolio's performance.

By following these steps, investors can effectively monitor and analyze their investment performance, enabling them to make informed decisions and adjust their strategies accordingly. Performance tracking is a powerful tool for maintaining a healthy and growing investment portfolio, ensuring that it aligns with the investor's goals and risk tolerance.

Venture Capitalists: Unlocking the Secrets to Gaining Investment

You may want to see also

Frequently asked questions

Tickr Investing is an automated investment platform that utilizes a unique algorithm to optimize investment strategies. It offers a user-friendly interface, allowing investors to build and manage their portfolios with ease. The platform's algorithm analyzes market trends, risk factors, and historical data to provide tailored investment recommendations.

Tickr Investing's algorithm is designed to mimic the expertise of a professional financial advisor. It employs a multi-factor approach, considering various indicators such as price momentum, volatility, and market sentiment. By processing vast amounts of data, the algorithm generates optimized investment portfolios, aiming to maximize returns while managing risk. The platform continuously learns and adapts, ensuring that investment strategies remain relevant and effective.

Absolutely! Tickr Investing provides a high level of customization to cater to different investment goals and risk appetites. Users can select from various pre-built portfolios or create their own by choosing specific assets, asset classes, and risk levels. The platform offers a wide range of investment options, including stocks, bonds, ETFs, and mutual funds, allowing investors to build a diversified portfolio that aligns with their financial objectives.