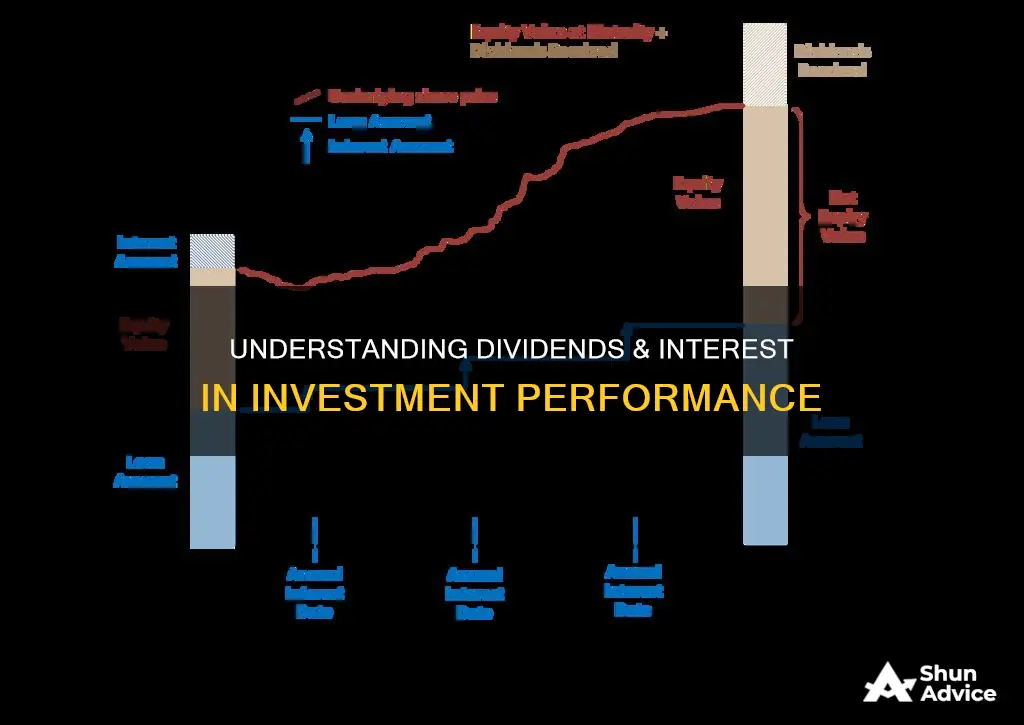

Dividends and interest are two terms that frequently arise in the world of finance and investing. They both involve monetary returns, but they have distinct meanings and are associated with different types of investments. Interest is the cost of borrowing money or the return earned on debt investments, while dividends are the portion of profits distributed by companies to their shareholders. Interest primarily arises from debt instruments, while dividends are associated with equity investments. Dividends are typically declared and paid periodically, depending on the company's financial performance, profitability, and management decisions. On the other hand, interest income is generally taxable at the individual's applicable tax rate, although the specific tax treatment may vary depending on the country and the type of investment.

| Characteristics | Values |

|---|---|

| Definition | Interest is the cost of borrowing money or the return earned on debt investments. Dividends are the portion of profits distributed by companies to their shareholders. |

| Risk | Dividends are variable and not guaranteed, and their amount can vary depending on a company's profitability and dividend policy. Equity investments carry a higher level of risk compared to debt instruments. |

| Tax | Interest income is generally taxable at the individual's applicable tax rate. Dividend taxation varies across jurisdictions and can be subject to different tax rates. In some cases, dividends may be subject to preferential tax rates or receive certain tax exemptions or deductions. |

| Frequency | Dividends are typically paid out quarterly or annually. |

What You'll Learn

- Dividends are a way for companies to distribute a portion of their earnings to shareholders

- Dividends are not guaranteed and can vary depending on a company's profitability

- Interest is the cost of borrowing money or the return earned on debt investments

- Interest income is typically subject to taxation at the individual's applicable tax rate

- Dividends are typically associated with investments in equity, such as stocks or shares

Dividends are a way for companies to distribute a portion of their earnings to shareholders

Equity investments carry a higher level of risk compared to debt instruments, as their returns are influenced by market fluctuations and the company's financial performance. A stock-investing fund pays dividends from the earnings received from the many stocks held in its portfolio or by selling a certain share of stocks and distributing capital gains.

A bond-investing fund may pay monthly dividends because it receives monthly interest on its interest-bearing holdings and merely transfers the income from the interest fully or partially to the fund's investors. Interest is the cost of borrowing or the return earned on debt investments. It is the compensation paid by borrowers to lenders for the use of their funds. Interest primarily arises from debt instruments, while dividends are associated with equity investments.

Interest Rates and Investment: Inverse Relationship?

You may want to see also

Dividends are not guaranteed and can vary depending on a company's profitability

It is important to note that regular dividend payments should not be interpreted as a sign of stellar performance by the fund. While dividends provide shareholders with a return on their investment, they do not necessarily reflect the underlying health or performance of the company. Economists Merton Miller and Franco Modigliani argued that a company's dividend policy is irrelevant and has no effect on its stock price or cost of capital.

In summary, dividends are a way for companies to share their profits with shareholders, but the amount and frequency of dividend payments can vary depending on the company's financial performance, profitability, and management decisions. Dividends are not guaranteed and are subject to higher risk compared to interest payments, as they are influenced by market fluctuations and the company's financial health.

Interest Rates: Investment Discouragement or Encouragement?

You may want to see also

Interest is the cost of borrowing money or the return earned on debt investments

On the other hand, dividends are the portion of profits distributed by companies to their shareholders. Dividends are typically associated with equity investments, such as stocks or shares of publicly traded companies. When individuals invest in these companies, they become shareholders and are entitled to receive a portion of the company's profits as dividends. Dividends are declared by the company's board of directors and are usually paid out quarterly or annually. The declaration and payment of dividends depend on the company's financial performance, profitability, and management decisions.

It is important to note that dividends are not guaranteed and their amount can vary depending on a company's profitability and dividend policy. Equity investments carry a higher level of risk compared to debt instruments, as their returns are influenced by market fluctuations and the company's financial performance. For example, a bond-investing fund may pay monthly dividends because it receives monthly interest on its interest-bearing holdings and transfers this income to its investors.

In summary, interest and dividends represent different concepts and financial outcomes in the world of finance and investing. Interest is primarily associated with debt instruments, while dividends are associated with equity investments. Interest income is generally taxable, while dividend taxation can vary across jurisdictions and may be subject to preferential tax rates or tax exemptions.

Venture Capitalists: Interest Rates, Loans, and Investment Bankers Compared

You may want to see also

Interest income is typically subject to taxation at the individual's applicable tax rate

Interest income is generally subject to taxation at the individual's applicable tax rate. However, the specific tax treatment may vary depending on the country and the type of investment. Interest is the cost of borrowing money or the return earned on debt investments, which can include government or corporate bonds, certificates of deposit, money market accounts, or loans extended to individuals or businesses. It is typically associated with debt instruments and is expressed as a percentage. Interest income is compensation paid by borrowers to lenders for the use of their funds.

Dividends, on the other hand, are a way for companies to distribute a portion of their earnings to their shareholders. They are typically associated with equity investments, such as stocks or shares of publicly traded companies. Dividends are declared by the company's board of directors and are usually paid out quarterly or annually. The declaration and payment of dividends depend on the company's financial performance, profitability, and management decisions. Dividend taxation varies across jurisdictions and can be subject to different tax rates, preferential tax rates, or tax exemptions and deductions.

It is important to note that interest and dividends represent different concepts and financial outcomes in the world of finance and investing. While interest primarily arises from debt instruments, dividends are associated with equity investments. Regular dividend payments should not be interpreted as a stellar performance by the fund. For example, a bond-investing fund may pay monthly dividends because it receives monthly interest on its interest-bearing holdings and transfers this income to its investors.

Invest Wisely, Live Comfortably Off Your Interest

You may want to see also

Dividends are typically associated with investments in equity, such as stocks or shares

Dividends are common in equity investments, where individuals become shareholders and are entitled to receive a portion of the company's profits as dividends. For example, a stock-investing fund pays dividends from the earnings received from the many stocks held in its portfolio or by selling a certain share of stocks and distributing capital gains.

Economists Merton Miller and Franco Modigliani argued that a company's dividend policy is irrelevant and has no effect on its stock price or its cost of capital. However, regular dividend payments should not be interpreted as a stellar performance by the fund. For instance, a bond-investing fund may pay monthly dividends because it receives monthly interest on its interest-bearing holdings and merely transfers the income to the fund's investors.

Dividends and interest represent different concepts and financial outcomes in the world of finance and investing. Interest is the cost of borrowing or the return earned on debt investments, while dividends are the portion of profits distributed by companies to their shareholders. Interest primarily arises from debt instruments, such as government or corporate bonds, certificates of deposit (CDs), or money market accounts. In contrast, dividends are associated with equity investments, which carry a higher level of risk due to their sensitivity to market fluctuations.

Investment Loan Interest: Higher or Lower?

You may want to see also

Frequently asked questions

Dividends are a way for companies to distribute a portion of their earnings to their shareholders. Interest is the cost of borrowing money or the return earned on investments.

Dividends are associated with equity investments, such as stocks or shares of publicly traded companies. Interest is primarily associated with debt instruments, such as government or corporate bonds, certificates of deposit (CDs), money market accounts, or loans extended to individuals or businesses.

Dividends provide shareholders with a share of the company's profits, rewarding them for their investment. Interest is the return earned on debt investments.

Dividends are typically paid out quarterly or annually, depending on the company's financial performance, profitability, and management decisions. Interest is typically paid at regular intervals, such as monthly or annually, depending on the terms of the investment.

Yes, dividend and interest taxation can vary across jurisdictions. Interest income is generally taxable at the individual's applicable tax rate, while dividends may be subject to preferential tax rates or receive certain tax exemptions or deductions.