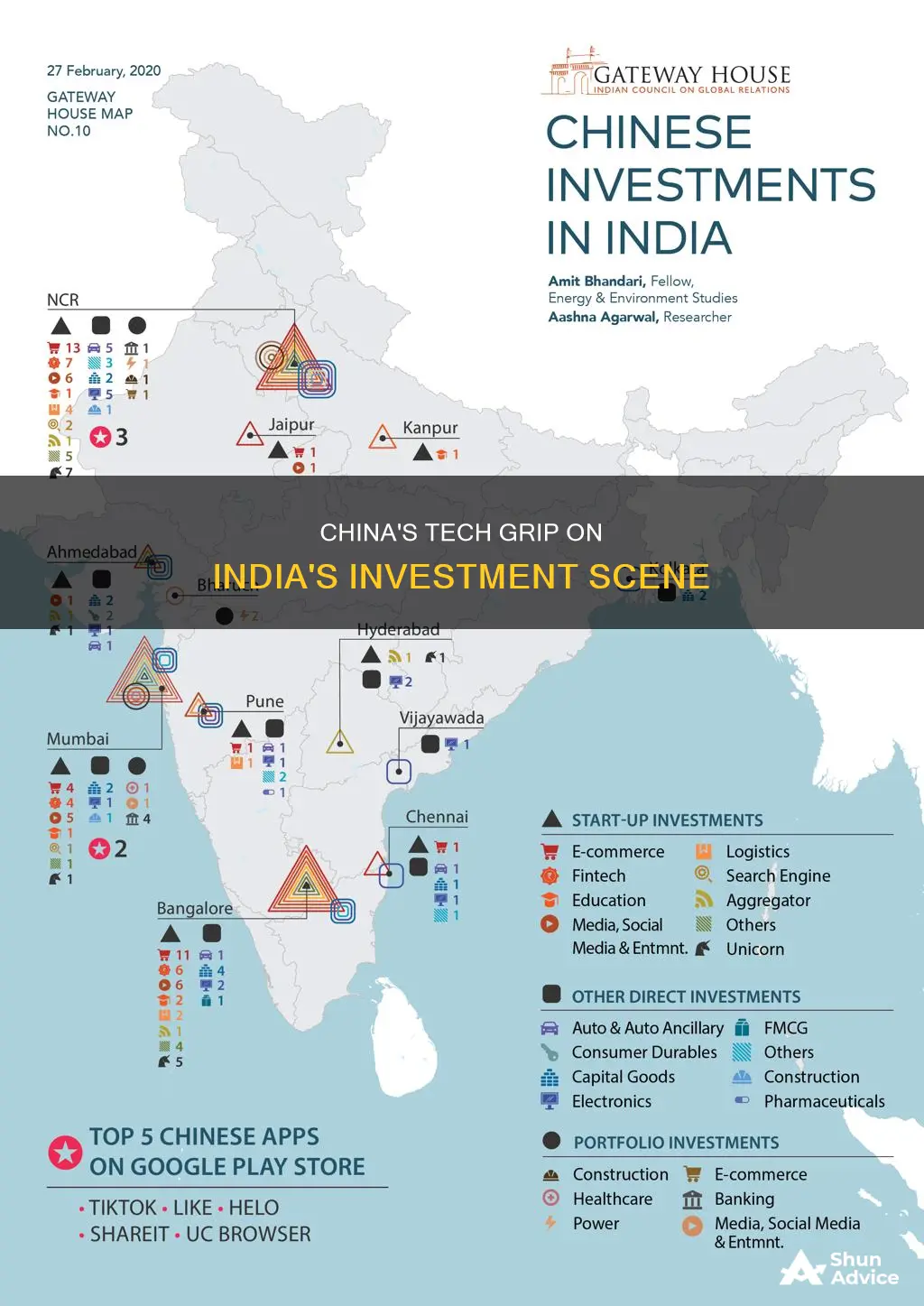

China dominates tech investments in India through its funding of Indian startups. Chinese investors have a major stake in 18 of India's top 30 unicorns, with investments in the country's tech startup sector estimated at $4 billion. Alibaba, ByteDance, and Tencent have funded over 90 Indian startups, including Big Basket, Flipkart, MakeMyTrip, Paytm, and Zomato. Chinese venture capitalists have also been increasingly scouting deals in India, with a seven-fold jump in Chinese funding since 2016. This has made China one of the most significant sources of funds for Indian startups, alongside established investors like Sequoia and SoftBank. While India has implemented restrictions on Chinese investments, particularly in the tech sector, the country still relies heavily on Chinese electronic components for its made in India products.

| Characteristics | Values |

|---|---|

| Chinese-linked investments in India's tech startup sector | $4 billion |

| Chinese investors have stakes in | Big Basket, Byju's, Delhivery, Dream 11, Flipkart, Hike, MakeMyTrip, Ola, Oyo, Paytm, Paytm Mall, PolicyBazaar, Quikr, Rivigo, Snapdeal, Swiggy, Uddan, Zomato, TikTok |

| Chinese investors have stakes in | Alibaba, ByteDance, and Tencent |

| Single most significant Chinese investment in India | $1.1 billion acquisition of Gland Pharma by Fosun in 2018 |

| Chinese investors have focussed on | e-commerce, fintech, media/social media, aggregation services, and logistics |

| Chinese venture capitalists participated in | over 54 funding rounds last year |

| Chinese funding since 2016 | seven-fold jump of $459 million |

| Chinese investors | Shunwei Capital, China Lodging Group, China-Eurasia Economic Cooperation Fund, Baring Asia, Ping An Global Voyager Fund |

| Chinese investors are also promoting domestic startups to expand their base in China | |

| India's FDI from China | $2.34 billion over the last two decades |

| India's FDI from other countries | $456.91 billion over the last two decades, with over 72% from just five countries – Mauritius, Singapore, Japan, Netherlands, and the United States |

| India's trade deficit with China | huge |

What You'll Learn

- Chinese investors have major stakes in 18 of India's top 30 unicorns

- Chinese investments in India's tech sector are estimated at $4 billion

- Chinese companies have invested in 90+ Indian startups

- Chinese investors are increasingly funding Indian startups

- India's growing electronics manufacturing relies on Chinese components

Chinese investors have major stakes in 18 of India's top 30 unicorns

Chinese investors have been able to gain a foothold in India's tech sector due to the country's reliance on overseas venture capital funding. Unlike a port or railway line, Chinese tech investments are often invisible assets, and their small size means they rarely cause immediate alarm. However, these investments have a significant impact given the increasing penetration of technology in India.

Some of the companies with major Chinese investments include Big Basket, Byju's, Delhivery, Dream 11, Flipkart, Hike, MakeMyTrip, Ola, Oyo, Paytm, PolicyBazaar, Quikr, Rivigo, Snapdeal, Swiggy, Uddan, and Zomato.

The Indian government has recently imposed restrictions on investments from neighbouring countries, especially China, which could impact the startup segment. Despite these restrictions, Chinese investors continue to play a significant role in India's tech ecosystem.

Saving and Investing: Key Factors for Decision-Making

You may want to see also

Chinese investments in India's tech sector are estimated at $4 billion

Leading Chinese companies such as Alibaba, ByteDance, and Tencent have funded over 90 Indian startups, including well-known names like Paytm, Ola, and Flipkart. These investments have allowed China to gain a foothold in India's economy and society, with popular apps like TikTok (owned by ByteDance) and widespread use of Xiaomi handsets and Huawei routers.

The impact of Chinese investment in India's tech sector is disproportionate to the value of the investments. This is because these investments are often made in small amounts (rarely over $100 million) and are not immediately noticeable as they are made by the private sector. However, they provide China with influence and access to data in India.

The Indian government has recently imposed restrictions on investments from neighbouring countries, especially China, to curb opportunistic takeovers during the COVID-19 pandemic. This has led to a slowdown in fresh Chinese investments in India's tech sector, as any new investments or transfers of ownership now require government approval.

Understanding Investment and Risk Management Tools for Success

You may want to see also

Chinese companies have invested in 90+ Indian startups

Alibaba, ByteDance, and Tencent have funded 92, 90, and 18 Indian startups, respectively. Other prominent Chinese investors include Fosun, Steadview Capital, and Shunwei Capital. These investments cover various sectors, including e-commerce, fintech, media/social media, aggregation services, and logistics.

The influx of Chinese investment has boosted the Indian startup ecosystem, providing capital and technological expertise. However, there are concerns about data security and the potential loss of control over data for Indian companies that receive Chinese investments.

The Indian government has recently imposed restrictions on Chinese investments, particularly in the tech sector, to curb opportunistic takeovers during the COVID-19 pandemic and due to geopolitical tensions. Despite these restrictions, Chinese investment continues to play a significant role in India's startup ecosystem.

Reviewing Your Investment Portfolio: A Comprehensive Guide

You may want to see also

Chinese investors are increasingly funding Indian startups

Some of the notable Chinese investors in Indian startups include Alibaba Group, Ant Financial, Tencent Holdings, Fosun, and ByteDance. These companies have financed hundreds of millions of dollars in Indian startups, including well-known names such as Paytm, Zomato, Delhivery, BigBasket, and Ola.

The interest from Chinese investors in Indian startups can be attributed to the attractive risk-return trade-off and India's position as the second-fastest-growing economy in the world. Additionally, the growth rates in China's domestic market are decreasing, prompting Chinese investors to look for investment opportunities abroad. India, with its large and young population that extensively uses the internet, presents an attractive opportunity.

The sectors that have received the most attention from Chinese investors in India include e-commerce, fintech, media/social media, aggregation services, and logistics. Chinese investors tend to invest in Indian startups with business models similar to those that have been successful in China, leveraging their expertise and experience in their home market.

However, the increasing presence of Chinese investors in Indian startups has also raised concerns, particularly in the context of escalating tensions between the two countries. There is a growing backlash against Chinese-funded companies in India, with consumers boycotting Chinese products and services. Additionally, there are concerns about data security and the potential loss of control over data when Indian startups become part of Chinese ecosystems.

Wealth Managers and Startup Investing: A Match?

You may want to see also

India's growing electronics manufacturing relies on Chinese components

India's growing electronics manufacturing industry relies heavily on Chinese components. In the financial year 2023-24, India imported electronic components worth over $12 billion from China and $6 billion from Hong Kong, with the two accounting for more than half of the country's total electronic component imports. This trend has been consistent over the last five years, with imports from China alone outnumbering those from other major manufacturing hubs such as South Korea, Japan, Taiwan, and all ASEAN countries combined.

The electronic components imported from China include crucial building blocks for finished electronics products assembled in India, such as smartphones and televisions. These components include printed circuit boards, integrated circuits, advanced displays, and camera modules.

The reliance on Chinese components is due to China's established manufacturing base, which India's domestic industry lacks. India's attempts to reduce this dependence by incentivizing local manufacturing and assembly have had limited success, as tensions at the border and economic considerations have made it challenging to completely decouple from China.

Additionally, India's efforts to attract foreign investment in its technology sector have resulted in significant Chinese investment in Indian startups. Chinese companies like Alibaba, ByteDance, and Tencent have invested in over 90 Indian startups, including well-known names such as Flipkart, Ola, and Paytm. These investments give Chinese companies influence in the Indian market and access to data, raising concerns about national security and data privacy.

As a result, India has implemented restrictions on Chinese investments and banned certain Chinese apps and social media platforms, citing concerns about data security and the protection of Indian companies. However, these measures have had limited impact, as Chinese investments often come through funds based in Singapore and other Southeast Asian countries, making the actual investment in India higher than officially reported.

In summary, India's growing electronics manufacturing industry relies heavily on Chinese components due to China's established manufacturing capabilities and India's lack of a substantial domestic manufacturing base. This reliance has strategic implications and has led to concerns about data security and national interests, prompting India to take protective measures. However, reducing this dependence on Chinese components and investments remains a challenge for India.

Managing Multiple Investment Portfolios: Strategies for Success

You may want to see also

Frequently asked questions

Chinese investors have cornered a major stake in 18 out of India's top 30 unicorns. Chinese companies like Alibaba, ByteDance, and Tencent have funded over 90 Indian startups, including Big Basket, Byju's, MakeMyTrip, Paytm, and Zomato. Chinese tech investments are embedded in Indian society and hold influence due to the nature of tech investments and their penetration across sectors.

Chinese tech investments in India have led to concerns about data security and loss of control over data. Chinese investors can encourage Indian startups to use pre-existing Chinese solutions for their tech requirements, leading to potential data breaches. This allows China to create comprehensive profiles of individuals and their habits, which can be used for surveillance and intelligence-gathering purposes.

India has implemented restrictions on Chinese investments, particularly in the tech sector, to curb opportunistic takeovers and protect its domestic companies. India has also banned several Chinese social media and gaming apps, such as TikTok, due to concerns about data security and national security. Additionally, India is trying to reduce its reliance on Chinese electronic components and is working on an incentive scheme to promote domestic manufacturing of electronic components.