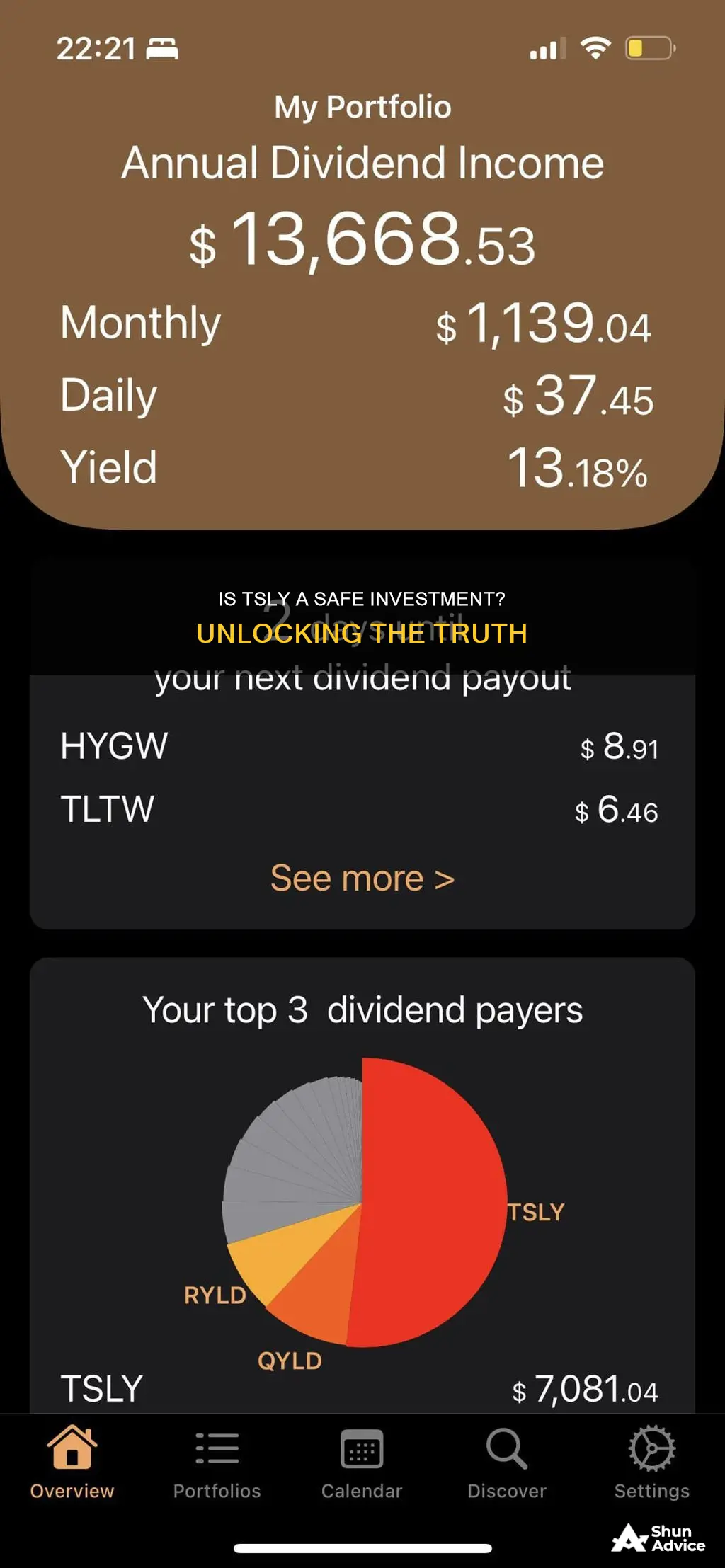

When considering whether Tsly is a safe investment, it's important to understand the company's financial health, market position, and potential risks. Tsly, a technology company known for its innovative products, has gained significant attention in recent years. However, like any investment, it comes with its own set of advantages and disadvantages. This paragraph will explore the factors that contribute to the safety of investing in Tsly, including its financial stability, competitive landscape, and potential risks associated with the tech industry.

What You'll Learn

- Risk Assessment: Evaluate volatility, market conditions, and potential losses

- Historical Performance: Analyze past trends and returns to gauge reliability

- Diversification Benefits: Understand how spreading investments reduces risk

- Regulatory Oversight: Learn about government safeguards and investor protection

- Long-Term Outlook: Assess sustainability and growth potential over time

Risk Assessment: Evaluate volatility, market conditions, and potential losses

When considering the safety of an investment, it's crucial to delve into the specific case of TSLY, a ticker symbol often associated with a particular investment vehicle or security. The first step in your risk assessment is to understand the nature of TSLY and its associated risks.

Volatility is a key factor to consider. TSLY, if referring to a stock or security, can be highly volatile, especially in the short term. This volatility might be due to various factors such as market sentiment, company-specific news, or broader economic conditions. For instance, if TSLY is a tech stock, it could experience rapid price swings based on new product launches, earnings reports, or industry trends. Investors should be prepared for these fluctuations and have a strategy to manage potential losses.

Market conditions play a significant role in the safety of any investment. Analyzing historical market data and current trends can provide insights into the potential performance of TSLY. For example, if TSLY is a cryptocurrency, market conditions could include global economic policies, regulatory changes, and overall market sentiment. During periods of market volatility, such as economic downturns or geopolitical tensions, even safe-haven investments might experience losses. Understanding these market dynamics is essential for making informed decisions.

Potential losses can be assessed by examining the historical performance of TSLY and similar investments. This involves studying price charts, financial reports, and news articles to identify patterns and trends. For instance, if TSLY is a bond, investors should consider factors like interest rate changes, credit rating, and the overall health of the issuing entity. A thorough risk assessment should also include an evaluation of the worst-case scenario, ensuring that investors are prepared for any potential losses.

Additionally, it's important to consider the investment strategy and risk tolerance of the individual or entity investing in TSLY. Different investors have varying levels of risk appetite, and a one-size-fits-all approach to risk assessment might not be suitable. A comprehensive risk management strategy should be tailored to the specific investment goals and the investor's ability to withstand potential losses. This personalized approach ensures that the investment aligns with the investor's expectations and comfort level.

Auditing Your Investment Portfolio: A Comprehensive Guide

You may want to see also

Historical Performance: Analyze past trends and returns to gauge reliability

When considering the safety of an investment, historical performance is a crucial aspect to evaluate. In the case of TSLY, a particular investment vehicle or security, analyzing its past trends and returns can provide valuable insights into its reliability. This analysis involves a deep dive into the historical data of TSLY, examining its performance over various time periods to identify patterns and make informed predictions.

One approach to assessing historical performance is to study the investment's returns over different market cycles. By reviewing data from bull markets, bear markets, and various economic conditions, investors can understand how TSLY has fared in different scenarios. For instance, did TSLY maintain its value during the 2008 financial crisis, or did it experience significant losses? Identifying such patterns can help investors gauge the investment's resilience and its ability to weather economic downturns.

Additionally, analyzing the volatility of TSLY's returns is essential. Volatility measures the rate at which the investment's value fluctuates, providing an indication of its riskiness. Investors often prefer low-volatility investments as they are generally considered safer. By examining historical data, one can calculate and compare the volatility of TSLY against other similar investments to make an informed decision about its safety.

Another critical aspect of historical performance analysis is the study of TSLY's long-term trends. This involves assessing whether the investment has consistently grown over an extended period or if it has experienced significant fluctuations. Long-term trends can reveal the underlying strength or weakness of the investment and its potential for sustained growth. Investors often seek investments with a proven track record of positive long-term performance.

Furthermore, it is essential to consider the investment's performance relative to relevant benchmarks or indices. By comparing TSLY's returns to industry standards or market averages, investors can assess how well the investment has performed compared to its peers. This comparative analysis can provide a more comprehensive understanding of TSLY's reliability and potential risks.

In summary, analyzing historical performance is a critical step in determining the safety of an investment like TSLY. By examining past trends, returns, volatility, and long-term growth, investors can make informed decisions. This process allows for a more nuanced understanding of the investment's reliability, helping investors choose assets that align with their risk tolerance and financial goals.

Past Performance: Investment Manager Selection's Holy Grail?

You may want to see also

Diversification Benefits: Understand how spreading investments reduces risk

Diversification is a key strategy in investment management, and it involves allocating your assets across various types of investments to reduce risk and enhance potential returns. When you diversify your portfolio, you're essentially minimizing the impact of any single investment's performance on your overall financial health. This approach is particularly important when considering investments like TSLY, which may carry unique risks due to its specific characteristics.

The primary benefit of diversification is risk reduction. By spreading your investments, you lower the potential for significant losses. For instance, if you invest solely in TSLY, a single stock, and it experiences a downturn, your entire portfolio could be negatively affected. However, by diversifying into other asset classes such as bonds, real estate, or even other stocks, you create a safety net. If one investment underperforms, others may perform well, thus balancing out the overall risk.

This strategy is based on the idea that different investments tend to perform differently under various market conditions. For example, stocks might rise during economic growth, while bonds could provide stability during a recession. By holding a mix of these assets, you can smooth out the volatility of your portfolio. This approach is especially crucial for long-term investors, as it helps them stay on track despite short-term market fluctuations.

Additionally, diversification allows investors to take advantage of various market opportunities. Different investments offer unique benefits, and by diversifying, you can access these advantages. This could mean investing in international markets, emerging sectors, or alternative investment vehicles, all of which can contribute to a more robust and resilient portfolio.

In summary, diversification is a powerful tool for managing risk and optimizing returns. It encourages investors to spread their capital across a variety of assets, ensuring that their portfolio is not overly exposed to any single investment's volatility. This approach is fundamental to building a strong investment strategy, especially when considering investments like TSLY, which may have specific risks associated with them.

India's Green Energy Investments: Where is the Money Going?

You may want to see also

Regulatory Oversight: Learn about government safeguards and investor protection

When considering the safety of an investment, regulatory oversight plays a crucial role in providing government safeguards and investor protection. This aspect is particularly important for investors, as it ensures that their interests are protected and that the financial markets operate fairly and transparently. Here's an overview of how regulatory oversight contributes to the safety of investments:

Government Agencies and Their Roles: Regulatory bodies, such as the Securities and Exchange Commission (SEC) in the United States, are tasked with overseeing financial markets and ensuring compliance with established rules. These agencies have the authority to enforce regulations, investigate potential violations, and take legal action against fraudulent activities. For instance, the SEC's primary mission is to protect investors, maintain fair, orderly, and efficient markets, and facilitate capital formation. By setting and enforcing rules, these agencies create a framework that promotes market integrity.

Investor Protection Measures: Regulatory oversight includes various mechanisms to safeguard investors' interests. One key aspect is the requirement for companies to disclose material information. Publicly traded companies must provide regular financial reports, disclose significant events, and offer transparency about their business operations. This transparency allows investors to make informed decisions, assess risks, and understand the potential impact of their investments. Additionally, regulatory bodies often mandate that financial advisors and brokers act in their clients' best interests, ensuring ethical conduct and preventing conflicts of interest.

Market Surveillance and Fraud Prevention: Regulatory agencies employ advanced technologies and analytics to monitor market activities for any suspicious behavior or potential fraud. They analyze trading patterns, detect unusual transactions, and investigate insider trading or market manipulation attempts. By doing so, these agencies can quickly identify and address any illegal activities, protecting investors from fraudulent schemes. Market surveillance is an essential tool to maintain a fair and honest trading environment.

Legal Framework and Enforcement: Governments establish a comprehensive legal framework to regulate financial markets. This framework defines the rules and penalties for non-compliance. Regulatory bodies have the power to impose fines, issue cease-and-desist orders, and even prosecute individuals or entities involved in fraudulent activities. The threat of legal consequences acts as a deterrent, encouraging companies and individuals to adhere to the regulations. Effective enforcement of these rules ensures that investors' rights are protected and market integrity is maintained.

Understanding the regulatory environment is essential for investors to make informed choices. By implementing these safeguards, governments and regulatory bodies contribute to a more stable and secure investment landscape, fostering trust in the financial markets. It is advisable for investors to stay informed about the specific regulations and oversight mechanisms in their respective jurisdictions to ensure they are well-protected in their investment endeavors.

Equity Investment Strategies: Solving Common Problems

You may want to see also

Long-Term Outlook: Assess sustainability and growth potential over time

When considering the long-term outlook for an investment, it's crucial to assess both its sustainability and growth potential. In the context of TSLY (a hypothetical investment symbol, likely referring to a specific company or asset), a thorough analysis of these factors can provide valuable insights for investors.

Sustainability:

Sustainability in investing refers to the ability of an investment to maintain its value and generate returns over an extended period. For TSLY, this involves examining the company's or asset's fundamental strengths, competitive advantages, and resilience in the face of market fluctuations and external challenges. Key aspects to consider include:

- Business Model: Evaluate the core business model of TSLY. Is it based on a solid foundation that can withstand economic cycles and industry disruptions? A robust business model often involves a unique value proposition, strong market positioning, and a sustainable competitive edge.

- Management and Strategy: Assess the quality of leadership and the strategic direction set by the company's management. Effective management teams can navigate challenges, adapt to changing market conditions, and implement successful growth initiatives. Look for consistent strategic vision, transparent communication, and a track record of successful execution.

- Financial Health: Analyze financial statements to gauge the company's financial stability and performance. Key indicators include revenue growth, profitability, debt levels, and cash flow. A healthy balance sheet and positive cash flow position suggest sustainability, while consistent revenue and profit growth indicate a strong market position.

Growth Potential:

Growth potential is the capacity for an investment to appreciate in value over time. For TSLY, this involves identifying factors that can drive future performance and market share gains. Here are some considerations:

- Market Expansion: Evaluate the potential for TSLY to expand its market reach. This could involve entering new geographic regions, targeting untapped customer segments, or diversifying its product or service offerings. Market expansion can drive revenue growth and increase the company's overall value.

- Innovation and Product Development: Assess the company's ability to innovate and develop new products or services. Innovation can create new revenue streams, improve efficiency, and differentiate the company from competitors. Look for a track record of successful product launches and a commitment to research and development.

- Competitive Advantage: Determine the competitive advantage that TSLY possesses or can develop. This could be a strong brand, proprietary technology, cost leadership, or a unique value proposition. A sustainable competitive advantage can protect market share and enable the company to capture a larger portion of the market's growth.

In summary, when evaluating the long-term outlook for TSLY as an investment, investors should focus on both sustainability and growth potential. Sustainability ensures the investment's resilience and ability to withstand market challenges, while growth potential indicates the opportunity for value appreciation. A comprehensive analysis of these factors will enable investors to make informed decisions and build a robust investment strategy.

Maximizing Cash Savings: Best Investment Options for You

You may want to see also

Frequently asked questions

TSLY stands for Treasury STrips, which are a unique form of U.S. Treasury security. They are considered safe investments because they are backed by the full faith and credit of the U.S. government, making them low-risk and highly liquid.

TSLY is often viewed as a safe-haven asset, especially during times of economic uncertainty. Its safety profile is comparable to that of traditional government bonds, but with the added benefit of a variable return linked to inflation.

Investors can benefit from TSLY's safety and liquidity. It provides a hedge against inflation and offers a way to diversify portfolios. Additionally, TSLY is a popular choice for risk-averse investors seeking a stable investment with a fixed maturity date.

While TSLY is generally considered safe, there are some risks to be aware of. The primary risk is the potential for a decrease in value if interest rates rise significantly. Additionally, TSLY may not be suitable for investors seeking higher returns, as they offer lower yields compared to other investments.

TSLY can be bought and sold through various financial institutions, including banks and brokers. Investors can also purchase them directly from the U.S. Department of the Treasury's website, providing a convenient way to access this safe investment option.