Globalization has significantly transformed the landscape of foreign direct investment (FDI), creating both opportunities and challenges for businesses and countries worldwide. This complex relationship has led to an increase in cross-border investments, as companies seek to expand their operations and tap into new markets. The interconnectedness of economies through globalization has facilitated the flow of capital, technology, and expertise across borders, allowing multinational corporations to establish a global presence. However, the impact of globalization on FDI is multifaceted, as it has also led to increased competition, regulatory complexities, and the need for companies to adapt to diverse cultural and legal environments. Understanding these dynamics is crucial for businesses and policymakers alike as they navigate the evolving global investment arena.

What You'll Learn

- Economic Integration: Globalization facilitated the removal of trade barriers, encouraging FDI by creating larger, more integrated markets

- Political Stability: Political stability and good governance became more important for attracting FDI as globalization increased transparency and accountability

- Technological Advancements: Technological advancements and innovation were key drivers of FDI, as globalization enabled access to new markets and resources

- Environmental Concerns: Environmental regulations and sustainability practices became important factors in FDI decisions as globalization raised awareness of ecological issues

- Cultural Exchange: Cultural exchange and diversity influenced FDI, as globalization led to a more interconnected and accepting global community

Economic Integration: Globalization facilitated the removal of trade barriers, encouraging FDI by creating larger, more integrated markets

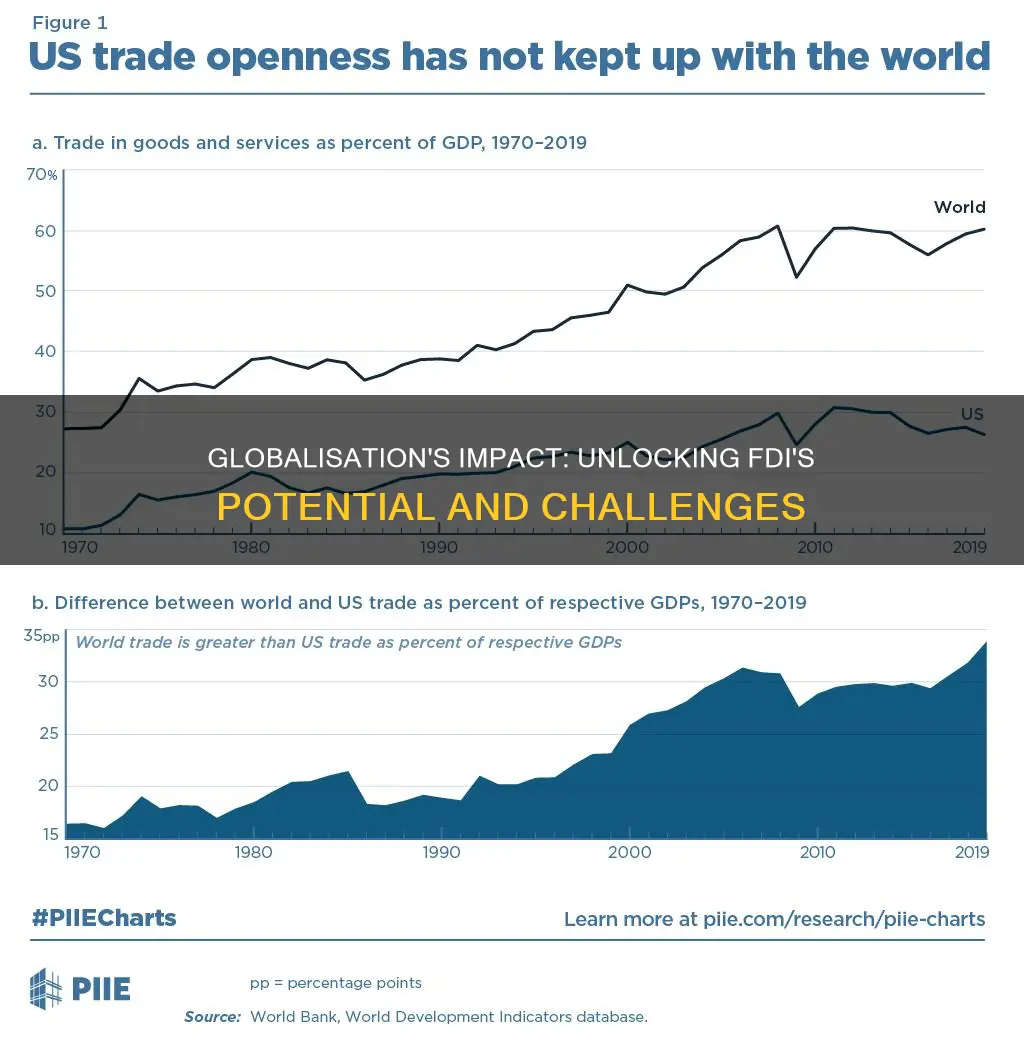

Globalization has played a pivotal role in transforming the landscape of foreign direct investment (FDI), particularly in the realm of economic integration. One of its most significant impacts is the removal of trade barriers, which has had a profound effect on the flow of capital and the establishment of multinational corporations.

The reduction of trade barriers, such as tariffs and quotas, has been a cornerstone of global economic policies. By liberalizing trade, countries have created an environment that fosters international trade and investment. This liberalization has led to the formation of larger, more integrated markets, where businesses can operate across borders with relative ease. As a result, multinational corporations have been able to expand their operations globally, seeking opportunities in these newly accessible markets. For instance, a company based in a developed country might invest in a manufacturing plant in a developing nation, taking advantage of lower production costs and a larger consumer base. This expansion of FDI has not only increased the volume of investment but also diversified the sources of investment, reducing the concentration of capital in a few traditional destinations.

Economic integration, a direct outcome of these trade liberalization efforts, has been a powerful driver of FDI. When countries join forces to form economic unions or trade blocs, they collectively remove barriers to trade and investment among themselves. This integration encourages FDI by providing a more stable and predictable business environment, as well as access to a larger market. The European Union (EU) is a prime example of this, where the removal of internal trade barriers has facilitated the movement of goods, services, and capital among its member states. This has led to a surge in FDI within the EU, as companies can easily relocate production facilities or establish regional headquarters, benefiting from the collective market and regulatory advantages.

Furthermore, the creation of larger, more integrated markets has allowed businesses to achieve economies of scale. By combining markets, companies can produce goods and services more efficiently, reducing per-unit costs. This is particularly attractive to investors, as it increases profitability and makes their operations more competitive on a global scale. For instance, a pharmaceutical company might set up a research and development facility in one country and a manufacturing plant in another, taking advantage of the combined market's size and the cost savings that come with it.

In summary, the removal of trade barriers and the subsequent economic integration have been key facilitators of FDI. Globalization has not only made it easier for companies to operate across borders but has also created a more conducive environment for investment. This trend has led to a more diverse and widespread distribution of FDI, impacting both developed and developing nations. As the world continues to globalize, these economic integration efforts will likely continue to shape the patterns of FDI, influencing the flow of capital and the development of international business.

Robin Hood Investing: A Beginner's Guide to Trading

You may want to see also

Political Stability: Political stability and good governance became more important for attracting FDI as globalization increased transparency and accountability

The impact of globalization on foreign direct investment (FDI) has been profound, and one of the key aspects that emerged is the heightened importance of political stability and good governance in attracting international investors. As the world became more interconnected through globalization, investors sought environments that offered stability, predictability, and a level playing field. This shift in focus towards political stability and governance is a direct response to the increased transparency and accountability that globalization brought to the forefront.

In the context of FDI, political stability refers to a consistent and secure political environment where the rules of the game remain relatively unchanged over time. This stability is crucial because it provides investors with the confidence to make long-term investments without fear of sudden policy changes or political upheavals. For instance, a country with a stable political system, where the government is accountable to its citizens and has a clear vision for economic development, is more likely to attract FDI. This is because such an environment fosters trust, which is essential for investors to commit their capital and resources.

Good governance, on the other hand, encompasses a set of principles and practices that ensure the efficient and equitable use of resources, protection of human rights, and the rule of law. As globalization increased the visibility and scrutiny of governance practices, investors became more discerning about the quality of governance in the countries they considered for investment. A country with a strong legal framework, independent judiciary, and transparent public institutions is more likely to attract FDI, as these factors contribute to a stable and predictable business environment.

The relationship between political stability, good governance, and FDI is symbiotic. Political stability encourages investors to bring in capital, create jobs, and contribute to economic growth. This, in turn, reinforces the stability of the political environment, as a thriving economy can lead to improved governance and reduced social tensions. Good governance, by ensuring a fair and transparent business climate, attracts investors who can then contribute to the country's development and further strengthen its governance structures.

In summary, as globalization intensified, the importance of political stability and good governance in attracting FDI became increasingly evident. Investors sought environments that offered stability, predictability, and a high level of governance quality. This shift in focus has had a transformative effect on the global investment landscape, influencing the policies and practices of both host countries and international investors. Ultimately, the interplay between political stability, good governance, and FDI is a critical aspect of understanding the broader implications of globalization on the global economy.

Oakmark's Cash Strategy: Liquidated Investments and Holdings

You may want to see also

Technological Advancements: Technological advancements and innovation were key drivers of FDI, as globalization enabled access to new markets and resources

Technological advancements and innovation have played a pivotal role in shaping the landscape of foreign direct investment (FDI) in the context of globalization. The rapid pace of technological progress has been a significant catalyst for FDI, as it has opened up a myriad of opportunities for businesses to expand their reach and tap into new markets.

In the digital age, companies are increasingly leveraging technology to streamline their operations, enhance productivity, and gain a competitive edge. This has led to a surge in FDI as multinational corporations seek to establish a presence in regions where they can capitalize on emerging technologies and innovative business models. For instance, the rise of e-commerce platforms has facilitated cross-border trade, allowing businesses to connect with customers worldwide, thereby attracting FDI in the retail and logistics sectors.

Globalization has been instrumental in providing the necessary infrastructure and connectivity for technological advancements to drive FDI. Improved communication networks, faster internet speeds, and the widespread adoption of digital technologies have enabled companies to overcome geographical barriers. This has resulted in a more integrated global market, where businesses can quickly adapt to changing consumer demands and market trends, thus fostering a conducive environment for FDI.

Moreover, technological innovation has led to the development of new products and services, creating a demand for specialized resources and expertise. As a result, FDI has been directed towards sectors that leverage cutting-edge technologies, such as renewable energy, artificial intelligence, and biotechnology. These industries require substantial investments in research and development, and the globalized market provides access to a diverse talent pool, fostering collaboration and knowledge exchange.

In summary, technological advancements and innovation are powerful drivers of FDI, fueled by the opportunities presented by globalization. The ability to access new markets, resources, and talent has encouraged businesses to invest across borders, fostering economic growth and development in various regions. As technology continues to evolve, its impact on FDI is likely to intensify, shaping the global economy and the strategies of multinational enterprises.

Cashing Out of Circle Invest: A Step-by-Step Guide

You may want to see also

Environmental Concerns: Environmental regulations and sustainability practices became important factors in FDI decisions as globalization raised awareness of ecological issues

The impact of globalization on foreign direct investment (FDI) has been significant, and one of the most notable effects is the increased emphasis on environmental concerns. As global connectivity and trade intensified, the world became more aware of the environmental consequences of economic activities. This heightened awareness has led to a crucial shift in FDI decisions, where environmental regulations and sustainability practices play a pivotal role.

Environmental regulations have become a critical aspect of FDI, especially in industries with high ecological impact. Governments worldwide have implemented stricter laws and standards to protect natural resources and ecosystems. These regulations often include emissions controls, waste management protocols, and conservation measures. As a result, foreign investors are now more cautious about their investment choices, ensuring that their operations comply with these environmental standards. This trend is particularly evident in sectors like energy, manufacturing, and agriculture, where the potential environmental footprint is substantial.

Sustainability practices have also emerged as a key differentiator for FDI. Investors are increasingly seeking opportunities that align with sustainable development goals. This includes investments in renewable energy, green technologies, and eco-friendly production methods. By embracing sustainability, companies can attract FDI from environmentally conscious investors who prioritize long-term viability and social responsibility. This shift in investment behavior encourages businesses to adopt cleaner and more efficient practices, ultimately contributing to global environmental goals.

The influence of environmental considerations in FDI decisions has led to a more responsible and ethical approach to business. It encourages companies to go beyond compliance and actively contribute to environmental conservation. This can be seen in the rise of green bonds and sustainable investment funds, which channel FDI towards projects with positive environmental outcomes. As a result, globalization has not only facilitated international trade but has also driven the integration of environmental consciousness into the very fabric of FDI.

In summary, the globalization of markets has brought environmental concerns to the forefront of FDI strategies. This shift is essential for creating a more sustainable future, where economic growth and environmental protection go hand in hand. As environmental regulations and sustainability practices continue to evolve, FDI will likely play a crucial role in driving positive change and fostering a more environmentally conscious global economy.

Screening for Value: Strategies for Finding Profitable Investments

You may want to see also

Cultural Exchange: Cultural exchange and diversity influenced FDI, as globalization led to a more interconnected and accepting global community

Globalization has significantly transformed the landscape of foreign direct investment (FDI), and one of its most profound impacts is the enhancement of cultural exchange and diversity. As the world became more interconnected, the barriers between nations and cultures began to dissolve, fostering an environment where ideas, traditions, and practices could flow freely across borders. This cultural interconnection had a direct influence on FDI, creating a more welcoming and accepting global community.

In the past, FDI was often driven by economic factors such as market size, resource availability, and cost advantages. However, with the rise of globalization, cultural considerations have become increasingly important. Multinational corporations and investors now recognize the value of cultural diversity and its potential to enhance their operations and market presence. For instance, a company expanding into a new market might consider the local cultural norms and values to ensure its products or services resonate with the target audience. This approach not only increases the chances of success but also demonstrates a respect for the host country's culture, fostering positive relationships.

The interconnectedness of the global community has facilitated the exchange of cultural practices, traditions, and knowledge. This exchange has led to a more nuanced understanding of different markets and consumer behaviors. For example, the popularity of international cuisine, music, and fashion in various countries is a testament to the cultural exchange that has occurred due to globalization. As a result, investors and businesses are more inclined to explore opportunities in diverse markets, knowing that their products or services can be adapted to local tastes and preferences.

Moreover, cultural diversity has encouraged innovation and creativity in FDI. When companies embrace cultural differences, they often find unique solutions to challenges. This is particularly evident in the technology and media sectors, where localized content and user experiences are highly valued. By incorporating cultural elements into their products, companies can create more engaging and relevant offerings, thus increasing their FDI potential.

In summary, the impact of globalization on FDI is deeply intertwined with cultural exchange and diversity. As the world becomes more interconnected, the acceptance and appreciation of different cultures have become essential factors in investment decisions. This shift has led to a more thoughtful and inclusive approach to FDI, where cultural considerations are integral to the success and sustainability of international business ventures. Embracing cultural diversity not only benefits businesses but also contributes to a more harmonious and globally conscious society.

Invest Cash: Safe, Liquid Strategies for Beginners

You may want to see also

Frequently asked questions

Globalization has significantly transformed the landscape of FDI by creating a more interconnected and integrated global market. It has led to the liberalization of trade policies, reduced barriers to entry, and increased cross-border capital flows. As a result, FDI has become more diverse, with investments flowing across borders for various reasons, including market access, resource acquisition, and strategic partnerships. This shift has also encouraged multinational corporations to adopt a more globalized approach, establishing operations in multiple countries to optimize their supply chains and tap into new markets.

The globalization process has prompted host countries to reevaluate and adjust their FDI policies. Many nations have adopted more welcoming and liberal approaches to attract foreign investors, offering incentives such as tax benefits, streamlined regulations, and special economic zones. This shift aims to enhance the ease of doing business, promote technology transfer, and create employment opportunities. Additionally, globalization has led to increased competition among countries to attract FDI, driving them to improve their business environments and infrastructure to remain competitive in the global market.

Globalization has played a pivotal role in reshaping the distribution of FDI. It has led to a more balanced and diverse investment pattern, with developing and emerging markets attracting a significant portion of FDI. This shift is attributed to the growing economic potential and emerging middle classes in these regions. Moreover, globalization has facilitated the movement of FDI towards industries with higher value-added, such as services and knowledge-intensive sectors, in both developed and developing countries. This trend has contributed to the structural transformation of economies and the evolution of global production networks.