The EB-5 Immigrant Investor Visa program offers a pathway to U.S. permanent residency for foreign investors. This program allows individuals to obtain a green card by investing a minimum amount of $900,000 in a commercial enterprise that creates or preserves at least 10 full-time jobs for U.S. workers. The investment can be made directly into a business or through a regional center, which is a designated entity that manages the investment and creates jobs. This program is designed to stimulate the U.S. economy and provide an opportunity for foreign nationals to become permanent residents while contributing to job creation and economic growth.

What You'll Learn

Eligibility: Who is eligible for EB-5 investment visas?

The EB-5 Investment Visa program is a pathway to permanent residency in the United States for foreign investors. It is designed to stimulate the U.S. economy by encouraging foreign investment and creating jobs. To be eligible for this visa, applicants must meet specific criteria, ensuring they are not only qualified but also contribute positively to the U.S. economy.

Eligibility Criteria:

- Investment Amount: The primary requirement is investing a minimum of $900,000 in a new commercial enterprise or a regional center. This investment must create at least 10 full-time jobs for U.S. workers within two years of the visa's approval. For investments made in a high-unemployment area or rural region, the minimum investment amount is reduced to $500,000.

- Source of Funds: Applicants must demonstrate that the funds used for the investment are from lawful sources. This includes personal savings, business profits, or gifts from family members who are U.S. citizens or permanent residents. It is essential to provide detailed documentation to support the legitimacy of the funds.

- Job Creation: The EB-5 program emphasizes job creation. The investment must result in the direct creation of full-time jobs, which are typically defined as positions that require at least 30 hours of work per week. The number of jobs required depends on the size of the investment and the location of the business.

- Entrepreneurial or Manager Background: Applicants must have a job-creating capacity or have managed a business with at least one paid employee for at least two years. This requirement ensures that the investor has the necessary skills and experience to contribute to the U.S. economy.

- Education and Experience: While not mandatory, having a bachelor's degree or its equivalent is advantageous. Additionally, relevant work experience in a managerial or executive capacity can strengthen an applicant's case.

- Age and Health: There are no specific age restrictions, but applicants must be in good health and pass a medical examination.

The EB-5 visa is a popular choice for individuals seeking to immigrate to the U.S. for various reasons, including business opportunities, education, and family reunification. It provides a unique opportunity for foreign investors to become permanent residents while contributing to the U.S. economy. Meeting the eligibility criteria is essential to ensure a successful application process.

Buy-to-Let Investing: A Guide to Building Wealth Through Property

You may want to see also

Investment Options: Types of investments accepted by the EB-5 program

The EB-5 Immigrant Investor Visa program offers a pathway to permanent residency in the United States for foreign investors who contribute a significant amount of capital to create or preserve jobs in the country. One of the key aspects of this program is the requirement for investors to choose the right investment option, which can vary in terms of the type of investment and the level of risk involved. Here's an overview of the investment options accepted by the EB-5 program:

Direct Investment: This is the most common and straightforward investment option. Investors must invest a minimum of $1,000,000 in a new commercial enterprise that will create or preserve at least 10 full-time jobs within two years of the investment. The investment can be in the form of a business loan, equity, or a combination of both. The business must be new or expanded, and it should be located in a commercial enterprise that has been in operation for less than two years or is in a targeted employment area (TEA), which includes rural areas, areas with high unemployment, or areas experiencing economic decline. This option provides a high level of control over the investment and allows investors to actively participate in the business's operations.

Regional Center Investment: Regional Centers are designated investment vehicles that manage a pool of EB-5 funds and invest in various projects to meet the job creation requirement. Investors can invest a minimum of $500,000 (or $100,000 if the investment is in a TEA) with a Regional Center. These centers typically invest in a diversified portfolio of projects, such as real estate development, business acquisitions, or infrastructure projects. The advantage of this option is that it simplifies the investment process, as the Regional Center handles the management and job creation responsibilities. However, investors have less direct control over the specific projects and may have limited involvement in the day-to-day operations.

Targeted Employment Area (TEA) Investment: As mentioned earlier, TEA investments are eligible for a lower minimum investment amount of $500,000 (or $100,000 for new commercial enterprises). TEA investments are made in areas that have high unemployment rates, are rural, or are experiencing economic decline. These investments are designed to stimulate job creation in regions that need economic development. The EB-5 program encourages investors to support job creation in these areas, providing an opportunity to contribute to local communities while securing permanent residency.

Real Estate Investment: The EB-5 program also accepts real estate investments, which can be made directly or through Regional Centers. This option involves investing in commercial or residential real estate projects that meet the job creation criteria. Real estate developers or investors can offer EB-5 investments in the form of construction loans, equity investments, or a combination of both. This investment type is popular among EB-5 investors as it provides a tangible asset and can offer potential returns through property appreciation and rental income.

When considering investment options, EB-5 investors should carefully evaluate their risk tolerance, financial goals, and the level of involvement they desire in the investment. Each investment type has its own advantages and considerations, and seeking professional advice is essential to making informed decisions. The EB-5 program offers a unique opportunity for foreign investors to contribute to the U.S. economy while securing a green card, making it an attractive option for those seeking both investment and immigration benefits.

Diversifying Savings: Beyond Stocks and Bonds

You may want to see also

Job Creation: Requirement to create 10 full-time jobs

The EB-5 Immigrant Investor Visa program is a United States immigration program that offers a pathway to permanent residency for foreign investors who make a substantial investment in a commercial enterprise in the United States. One of the key requirements for this program is the creation of a certain number of full-time jobs for U.S. workers. Specifically, the EB-5 program mandates that each EB-5 investor must create and maintain at least 10 full-time jobs within the first 2 years of the investment. This job creation requirement is a critical aspect of the EB-5 program's economic impact and is designed to stimulate job growth and benefit the U.S. economy.

To meet this job creation obligation, EB-5 investors typically invest in a targeted employment area (TEA), which includes areas experiencing high unemployment or underemployment, rural areas, and areas designated by the U.S. Department of Commerce as economically distressed. The investment can be made directly by the investor or through a regional center, which is an entity approved by the U.S. Citizenship and Immigration Services (USCIS) to manage EB-5 projects. The investment amount required for job creation is $500,000 for a direct investment or $1,000,000 for a regional center investment.

The process of creating these jobs involves several steps. First, the investor must select a qualified business or project that meets the EB-5 guidelines and has the potential to create the required number of jobs. This could be a new business venture, an expansion of an existing business, or a real estate development project. Once the project is identified, the investor must demonstrate that the investment will lead to the creation of the specified number of full-time jobs. This is typically done through a business plan, job creation analysis, and employment projections.

After the investment is made, the investor must ensure that the jobs are created and maintained over the specified period. This includes providing evidence of job hiring, employee benefits, and payroll records. The EB-5 program also requires that the jobs created are full-time and that the employees are U.S. citizens or permanent residents. The investor or the regional center must keep detailed records and provide periodic reports to the USCIS to verify the job creation and maintenance.

Meeting the job creation requirement is essential for the success of an EB-5 investment. It ensures that the program's economic goals are achieved and that the investment has a positive impact on the local community. Investors should carefully plan and research potential projects, ensuring they meet the job creation criteria and have a realistic chance of success. Additionally, seeking professional advice from immigration attorneys and financial advisors can provide valuable guidance throughout the EB-5 investment process.

Fixer-Upper or Move-In Ready: Navigating Your First Home Purchase

You may want to see also

Regional Centers: Role and importance of regional centers in EB-5

The EB-5 visa program is a popular pathway for foreign investors to obtain permanent residency in the United States. It is a unique immigration initiative that allows individuals to invest a substantial amount of capital in a commercial enterprise, creating or preserving at least 10 full-time jobs for U.S. workers. One of the key components of the EB-5 program is the concept of regional centers, which play a vital role in facilitating these investments.

Regional centers are designated by the U.S. Citizenship and Immigration Services (USCIS) and are responsible for managing and promoting EB-5 investment projects. These centers are typically private entities or organizations that have been approved to act as intermediaries between investors and the businesses seeking their capital. The primary function of regional centers is to identify and develop viable investment projects that meet the EB-5 program's requirements. They source and evaluate potential projects, ensuring that they create the necessary jobs and meet the financial and economic criteria set by the program.

The importance of regional centers lies in their ability to streamline the EB-5 process and provide a structured framework for investment. They offer a range of services, including project identification, due diligence, and ongoing management. By partnering with regional centers, investors can gain access to a diverse portfolio of investment opportunities, ensuring that their funds are utilized effectively and in compliance with the program's regulations. These centers also assist in the preparation and submission of the necessary paperwork, including the I-526 petition, which is the initial application for EB-5 status.

Furthermore, regional centers often provide investors with a level of assurance and security. They typically have established track records, allowing investors to assess their performance and reliability. This is particularly important in the EB-5 program, where investors are committing a significant amount of capital and are seeking a reliable and trustworthy partner. Regional centers can also offer ongoing support and guidance, helping investors navigate the complexities of the program and ensuring their investments remain on track.

In summary, regional centers are an integral part of the EB-5 investment process, providing a bridge between investors and eligible projects. They offer a structured approach to EB-5 investments, ensuring that the program's requirements are met and that investors have access to a diverse range of opportunities. By partnering with regional centers, investors can participate in the EB-5 program with confidence, knowing that their capital is being utilized effectively and in compliance with U.S. immigration laws.

Retirement Planning: Navigating the Investment Divide

You may want to see also

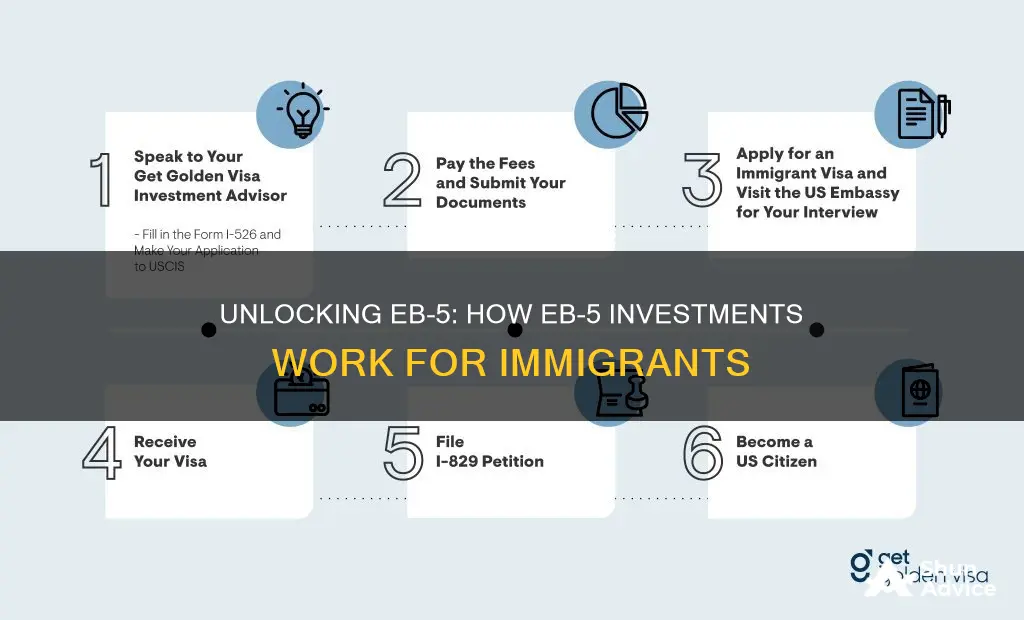

Visa Process: Steps to apply for an EB-5 visa

The EB-5 visa program is a popular pathway to permanent residency in the United States, offering an opportunity for individuals to invest in a commercial enterprise and obtain a green card. This visa category is designed to stimulate the U.S. economy by attracting foreign investors who contribute a significant amount of capital and create employment opportunities. Here is a step-by-step guide to understanding the visa process for EB-5 investors:

Step 1: Choose an Investment Vehicle

EB-5 investors typically invest in a regional center, which is a designated entity that manages investment funds and promotes economic development in specific areas. These regional centers are approved by U.S. Citizenship and Immigration Services (USCIS). Investors can choose from various investment options, such as direct investments in a business, real estate projects, or funds that pool capital from multiple investors. It is crucial to research and select a reputable regional center with a proven track record of success.

Step 2: File the I-526 Petition

The EB-5 visa process begins with filing Form I-526, Immigrant Petition by Alien Investor. This petition is submitted to the USCIS and requires providing detailed information about the investment, the business plan, and the investor's background. The petition must demonstrate that the investment meets the minimum requirements, including the amount of capital invested, the creation of full-time employment, and the source of funds. The USCIS will review the petition and may request additional documentation or evidence.

Step 3: Visa Approval and Interview

Once the I-526 petition is approved, the investor and their family members (spouse and unmarried children under 21) are granted conditional permanent residency. This status is valid for two years. During this period, the investor must maintain the investment and ensure the creation of the required number of jobs. After the two-year period, the investor can file for a permanent residency adjustment by submitting Form I-829, Petition by Entrepreneur to Remove Conditions on Residence. This form is typically filed with the USCIS and requires an interview at a U.S. consulate or embassy abroad.

Step 4: Permanent Residency and Green Card

If the I-829 petition is approved, the investor and their family members will receive permanent residency, commonly known as a green card. This provides the right to live and work permanently in the United States. The green card is valid for ten years, after which it can be renewed or replaced with a permanent resident card.

Step 5: Maintain Investment and Job Creation

Throughout the EB-5 visa process, investors must ensure that the investment continues to meet the program's requirements. This includes maintaining the investment amount, creating the agreed-upon number of jobs, and providing regular updates to the regional center and USCIS. Failure to meet these obligations may result in the revocation of the visa or permanent residency status.

The EB-5 visa process offers a structured pathway for foreign investors to obtain permanent residency in the United States. By following these steps and adhering to the program's guidelines, individuals can navigate the visa application process successfully and take advantage of the numerous benefits that come with EB-5 investment.

The Power of Compounding: Unlocking the Secret to Rapid Investment Growth

You may want to see also

Frequently asked questions

The EB-5 program is a U.S. immigration visa category designed to encourage foreign investment in the United States. It allows individuals to obtain permanent residency (green cards) by investing a specified amount of capital in a new commercial enterprise that creates or preserves jobs for U.S. workers.

The minimum investment amount is $1,000,000 for a new commercial enterprise or $500,000 if the investment is made in a targeted employment area (TEA), which includes rural areas or areas experiencing high unemployment. This investment is expected to create or preserve at least 10 full-time jobs for U.S. workers within two years of the investment.

The process typically involves the following steps:

- Finding a qualified EB-5 regional center or a direct investment vehicle that meets the program's requirements.

- Making the investment and creating a job-creating enterprise.

- Filing the necessary forms and documents with U.S. Citizenship and Immigration Services (USCIS).

- Attending an interview at a U.S. consulate or embassy.

- Receiving a conditional green card, which is valid for two years, and then a permanent green card after the investment meets the job creation criteria.