Planning how to divide your retirement investments is a crucial step in securing your financial future. While there is no one-size-fits-all approach, there are some general principles to consider. Firstly, it's recommended to have an emergency fund containing three to six months' worth of expenses in a savings account. Secondly, investing for retirement early on is advantageous as compounding returns can maximise growth over time. Diversification is another key strategy, spreading investments across stocks, bonds, cash, and other assets to balance risk and return. Retirement accounts can be more aggressive, while taxable brokerage accounts should be more conservative. Lastly, the right mix of investments should consider your age, income, goals, risk tolerance, and time horizon.

What You'll Learn

How much cash should I have on hand?

The amount of cash you should have on hand is dependent on your financial situation and budget. A general rule of thumb is to have enough cash to cover your regular bills, discretionary spending, and an emergency fund.

Financial experts recommend keeping an emergency fund that can cover between three to six months' worth of living expenses. However, some experts suggest that retirees should aim for a more substantial emergency fund of six to twelve months' worth of daily living expenses, or even up to three years' worth. This larger reserve provides safety during stock market downturns, peace of mind, and potentially higher overall returns.

It is important to note that your emergency fund should be easily accessible and kept in an account that does not fluctuate with the market, such as an FDIC-insured bank account, to avoid losing value.

In addition to an emergency fund, it is recommended to keep some physical cash on hand. This includes keeping between $100 and $300 in your wallet and about $1,000 in a safe at home for unexpected expenses.

When it comes to retirement investments, it is beneficial to diversify your assets among stocks, bonds, and cash. Stocks provide long-term growth potential, while bonds and cash offer protection against market setbacks. The right allocation depends on your investment horizon and your tolerance for short-term fluctuations in your portfolio's value.

Overall, the key is to ensure that you have sufficient cash reserves to provide financial security and peace of mind during retirement, while also investing for the long term to maintain your purchasing power.

Investments: Where People Put Their Money Now

You may want to see also

What are the best short-term investments?

When it comes to short-term investments, it's important to consider your financial goals and risk tolerance. Here are some of the best options for short-term investments:

High-yield savings accounts

High-yield savings accounts are ideal for those seeking a low-risk option. They provide higher interest rates than traditional savings accounts, making them a great choice for saving or emergency funds. Online banks tend to offer better rates due to their lower operating costs. However, it's important to note that interest rates for these accounts are not fixed and may have minimum deposit or balance requirements.

Certificates of Deposit (CDs)

CDs offer higher interest rates than savings accounts, with the trade-off being limited liquidity. Your money is locked up for a specified period, and early withdrawals typically result in penalties. CDs are considered low-risk as they are generally insured, but it's crucial to understand the terms and potential lack of flexibility before investing.

Money Market Accounts

Money market accounts offer higher interest rates than regular checking or savings accounts while providing the flexibility of easy access to your money. They are insured by the Federal Deposit Insurance Corporation (FDIC) up to $250,000, offering a degree of security. However, they may have minimum deposit or balance requirements and sometimes incur monthly maintenance fees.

Treasury Bills

Treasury bills, or T-bills, are low-risk government securities with maturities ranging from a few weeks to a year. They are backed by the US government and are exempt from state and local taxes. However, they typically yield lower returns than riskier assets, and the interest earned is subject to federal taxation.

Short-term Bond Funds

These funds invest in corporate bonds with maturities between one and five years. They offer diversification, steady income, and lower interest-rate risk than longer-term bonds. They can be easily traded through exchange-traded funds (ETFs) or mutual funds, but management fees and expense ratios can impact overall returns.

Short-term Municipal Bond Funds

Municipal bond funds, often held in ETFs or mutual funds, offer tax-free interest and lower risk compared to stocks. However, their yields are usually lower than corporate bonds, and there is a potential for the returns not to keep up with inflation. Additionally, while defaults are rare, it's important to carefully evaluate the credit quality of the municipalities issuing the bonds.

Peer-to-peer Lending

Peer-to-peer lending platforms connect individuals or businesses seeking loans with investors. They offer the potential for higher returns than traditional savings accounts and provide opportunities for diversification. However, they also come with risks, such as default risk and a lack of FDIC insurance.

It's important to remember that short-term investments typically generate lower returns than long-term investments but carry less risk. When choosing a short-term investment, look for options that offer liquidity, capital preservation, suitability for your financial goals, and low fees.

Vanguard Investors: How Many?

You may want to see also

How do I invest the rest of my portfolio?

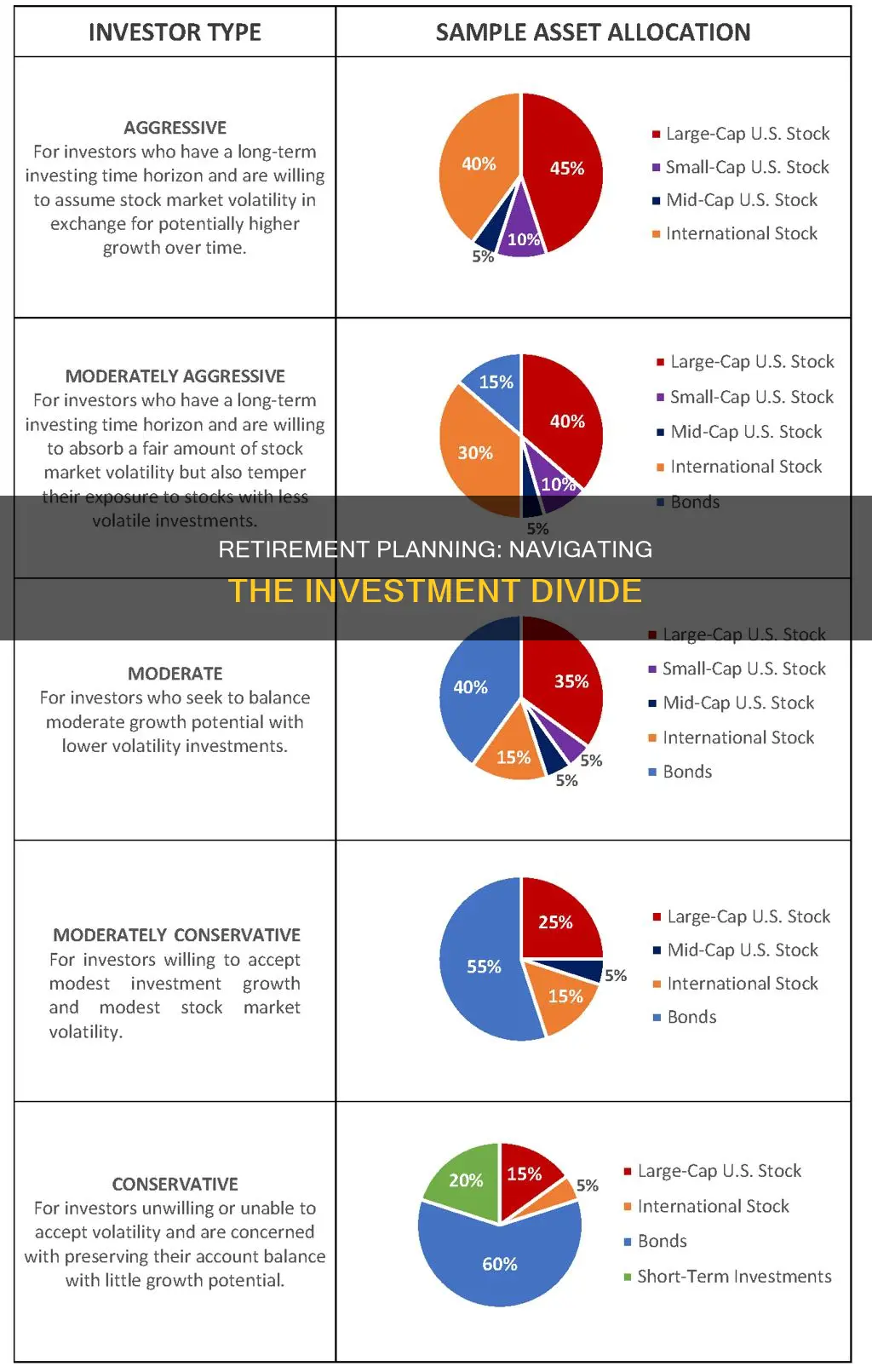

When it comes to investing the rest of your portfolio, it's important to keep your overarching goals in mind. Your investments should be guided by your age, income needs, financial goals, time horizon, and comfort with risk. The right mix of investments, also known as portfolio allocation, will help you achieve your retirement goals.

- Diversification: Diversification is a key strategy to reduce overall investment risk while increasing the potential for overall return. This means investing in a variety of assets, such as stocks, bonds, and cash, as well as different industries, company sizes, styles, and geographies. Diversification ensures that your portfolio is not overly exposed to any one asset class, industry, or market.

- Risk and Reward: Risk and reward are directly proportional. Investing in stocks and commodities may result in high potential returns but also carries greater risk due to market volatility. On the other hand, bonds and cash offer more stability and protection against market downturns but may provide lower returns. Your risk tolerance will depend on your financial goals and current financial situation.

- Time Horizon: The longer your investment horizon, the more sense it makes to invest in stocks. Stocks have historically provided better returns over the long term, but they can be volatile in the short term. If you're investing for the long haul (20+ years), you may want to allocate a larger portion of your portfolio to stocks. However, if you're nearing retirement or have a shorter time horizon, you may want to shift towards more conservative investments like bonds and cash.

- Tax Efficiency: Consider the tax implications of your investments. Retirement accounts, such as 401(k)s or IRAs, offer tax advantages. In traditional IRAs and 401(k)s, you don't pay taxes until withdrawals are made. Therefore, these accounts can be a good place to be more active or trade more frequently without immediate tax consequences.

- Asset Allocation: Your asset allocation should be based on your goals, risk tolerance, and time horizon. As you approach retirement, you may want to gradually adjust your allocation to become more conservative. This means shifting from more volatile stocks to more stable investments like bonds and cash to preserve your capital and generate income.

- Investment Products: There are various investment products to consider, such as mutual funds, index funds, ETFs, and individual stocks and bonds. Mutual funds and index funds offer diversification by pooling investor money into a collection of securities. ETFs are similar to mutual funds but can be traded throughout the day. Individual stocks and bonds may be suitable if you have the knowledge and resources to build a diversified portfolio.

- Financial Advisors: If you need guidance, consider consulting a financial advisor or using a robo-advisor. They can help you navigate the complexities of investing and provide personalized advice based on your goals and risk tolerance.

Remember, investing for retirement is a long-term endeavour, and it's important to regularly review and adjust your portfolio as your life circumstances and market conditions change.

Investing: Is It Right for Your Money?

You may want to see also

How do I balance my portfolio over time?

Balancing your portfolio is about ensuring your investments align with your risk tolerance and financial goals. While there is no one-size-fits-all approach, there are some general principles and strategies that can help you maintain a balanced portfolio over time. Here are some key considerations:

- Diversification: Diversifying your portfolio across different asset classes, such as stocks, bonds, and cash, is a common strategy to balance risk and return. Stocks typically provide long-term growth potential, while bonds and cash offer more stability and protection against market downturns.

- Age and Life Stage: Your age and life stage will influence your risk tolerance and investment choices. Generally, when you're younger, you can afford to take on more risk by investing a larger portion of your portfolio in stocks. As you get older, you may want to shift towards more conservative investments, such as bonds and dividend-paying stocks.

- Risk Tolerance: Consider your risk tolerance when deciding how to allocate your investments. If you are comfortable with market volatility and short-term fluctuations, you may be more inclined to invest a higher percentage of your portfolio in stocks. On the other hand, if market volatility keeps you up at night, allocating more funds to bonds or cash might be a better option.

- Rebalancing: Portfolios naturally get out of balance over time as the value of individual investments fluctuate. Therefore, it's important to periodically rebalance your portfolio to maintain your desired level of risk. You can rebalance by selling certain investments and using the proceeds to buy others or by allocating additional funds accordingly.

- Time Intervals and Thresholds: You can rebalance your portfolio at predetermined time intervals, such as yearly or after significant life events. Alternatively, you can rebalance only when your allocations deviate by a certain amount, such as a 5% or 10% threshold.

- Tax Implications: Consider the tax implications of your investment choices. Place investments that generate high taxable income, like bonds or high-dividend stocks, in tax-deferred accounts. On the other hand, investments with lower tax implications, such as stocks held for long-term capital gains, can be placed in taxable accounts.

- Seek Professional Advice: If you're unsure how to balance your portfolio or need help determining your risk tolerance and financial goals, consider seeking advice from a financial advisor or a robo-advisor. They can provide personalized recommendations based on your unique circumstances.

Remember, the key to balancing your portfolio over time is to regularly review and adjust your investments to ensure they align with your risk tolerance, financial goals, and life stage.

Crude Oil: Invest Now?

You may want to see also

What are the tax implications?

Retirement income is generally taxable, so it's important to understand the tax implications of your retirement funds. Here are some key points to consider:

- Pension payments are typically taxable at the time they are issued, unless they come from certain public pension funds.

- Withdrawals from accounts like 401(k)s, 403(b)s, and traditional IRAs are taxed when you withdraw the money. This is because contributions to these accounts are often tax-deductible, and earnings on those contributions accumulate tax-free.

- Social Security benefits may also be taxable depending on your total income and marital status.

- If you take early withdrawals from a 401(k) or other qualified retirement account before reaching the minimum age (typically 59 1/2), you will likely have to pay a tax penalty of 10% in addition to regular income tax on the withdrawn amount.

- Roth IRAs offer tax advantages as you don't receive a tax break on contributions, but withdrawals after reaching the minimum age are generally tax-free.

- Health Savings Accounts (HSAs) allow you to contribute pre-tax money or claim tax deductions on contributions. Withdrawals are also tax-free when used for qualifying medical expenses.

- The type of retirement account you choose can impact your tax obligations. Traditional retirement accounts allow you to defer taxes until withdrawal, while Roth accounts offer tax-free withdrawals but don't provide tax breaks on contributions.

- State tax rules on pension income vary, so it's important to check the regulations in your state. Some states don't tax pension payments, while others do.

- When planning for retirement, consider consulting a tax professional to optimize your tax obligations and take advantage of any available tax credits or deductions.

Investing: Nice People, Psychopaths?

You may want to see also

Frequently asked questions

This depends on your disposable income and your financial goals. Many advisors recommend saving 10% to 15% of your income, but some savers may fall outside that target range. If you are unsure, consult a retirement calculator to pressure-test your approach.

It is recommended to have at least one year's worth of cash on hand at the start of each year to supplement your income from other sources. The rest of your portfolio can be invested in stocks, bonds, and cash investments, depending on your risk tolerance and financial goals.

There are several options for retirement investments, including mutual funds, index funds, ETFs, individual stocks and bonds, and annuities. A target-date fund is a good option for those who want a low-maintenance way to maintain an appropriate asset allocation.