Investing $50,000 in the short term can be a strategic move to build wealth quickly. Whether you're a seasoned investor or new to the game, understanding the various investment options available is crucial. This guide will explore the different ways to invest $50,000 in the short term, including stocks, bonds, mutual funds, real estate, and alternative investments. Each option has its own set of advantages and risks, and choosing the right one depends on your financial goals, risk tolerance, and time horizon. We'll also discuss the importance of diversification and how to create a balanced investment portfolio to maximize returns while minimizing risk.

What You'll Learn

- Market Analysis: Research trends, identify sectors, and assess risk-reward ratios

- Asset Allocation: Diversify across stocks, bonds, ETFs, and real estate for balanced returns

- Trading Strategies: Explore day trading, swing trading, and short-term options for quick gains

- Risk Management: Implement stop-loss orders, position sizing, and portfolio rebalancing to minimize losses

- Tax Implications: Understand short-term capital gains taxes and tax-efficient investment vehicles

Market Analysis: Research trends, identify sectors, and assess risk-reward ratios

When considering a short-term investment strategy with a $50,000 capital base, a comprehensive market analysis is crucial to guide your decision-making process. This involves a thorough examination of various factors that can influence potential returns and risks. Here's a structured approach to conducting this analysis:

- Research Market Trends: Begin by studying the current market dynamics and trends. Identify sectors or industries that are experiencing growth or have the potential for short-term gains. For instance, you might focus on sectors like technology, healthcare, or renewable energy, which often offer opportunities for rapid expansion and innovation. Analyze historical data, market reports, and industry news to understand the factors driving these trends. Look for sectors that have demonstrated resilience or are expected to benefit from upcoming regulatory changes or technological advancements.

- Identify Sectors and Industries: Narrow down your research to specific sectors that align with your investment goals and risk tolerance. For short-term investments, you might consider sectors with high liquidity, allowing for quicker entry and exit points. Equities, particularly in the technology and healthcare sectors, often provide short-term trading opportunities. Alternatively, you could explore sectors like real estate investment trusts (REITs) or exchange-traded funds (ETFs) that offer diversification and potential capital appreciation.

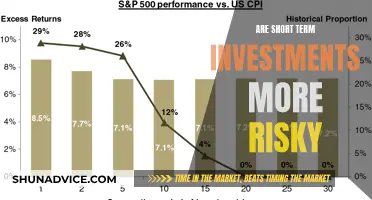

- Assess Risk-Reward Ratios: This is a critical step in evaluating the potential returns against the associated risks. Calculate the risk-reward ratio for each identified sector or investment option. This ratio compares the potential upside (reward) to the downside risk. For instance, a higher potential return might indicate a more significant risk. Assess your risk tolerance and determine the sectors or investments that align with your risk profile. Consider factors such as volatility, market sentiment, and the potential impact of external events or news on the chosen sectors.

- Utilize Technical Analysis: Employ technical analysis tools and indicators to identify entry and exit points for short-term trades. Study price charts, moving averages, and relative strength indicators to determine potential support and resistance levels. This approach helps in making timely investment decisions based on market behavior and historical price patterns.

- Stay Informed and Adapt: Market conditions can change rapidly, so it's essential to stay updated with the latest news and trends. Regularly review your market analysis and be prepared to adjust your strategy based on new information. Short-term investments often require a dynamic approach, allowing you to capitalize on emerging opportunities while minimizing potential losses.

Understanding NAV: The Key to Investment Clarity

You may want to see also

Asset Allocation: Diversify across stocks, bonds, ETFs, and real estate for balanced returns

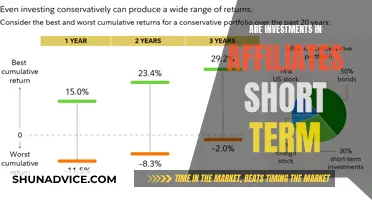

When you have a short-term investment horizon of 50k, a strategic asset allocation is key to balancing risk and return. Here's how to diversify your funds across different asset classes:

Stocks:

- Index Funds or ETFs: Consider investing in Exchange-Traded Funds (ETFs) that track a broad market index like the S&P 500. This provides instant diversification across a wide range of companies, reducing risk compared to picking individual stocks.

- Growth Stocks: If you're comfortable with a bit more risk, you can allocate a portion of your 50k to individual growth stocks. Focus on companies with strong growth potential in sectors like technology, healthcare, or renewable energy.

Bonds:

- Government Bonds: For a portion of your 50k, invest in government bonds. These are generally considered low-risk and offer a steady stream of income through interest payments.

- Corporate Bonds: For a bit more yield, you can explore corporate bonds issued by established companies. These carry slightly higher risk but can provide higher returns.

ETFs:

Sector-Specific ETFs: Diversify further by investing in ETFs that focus on specific sectors like technology, healthcare, energy, or international markets. This allows you to capitalize on the growth potential of particular industries.

Real Estate:

Real Estate Investment Trusts (REITs): A relatively low-risk way to invest in real estate is through REITs. These companies own and operate income-generating properties, and they trade on stock exchanges. REITs offer diversification across various property types and geographic locations.

Important Considerations:

- Risk Tolerance: Your risk tolerance is crucial. If you're risk-averse, prioritize bonds and ETFs. If you're comfortable with risk, allocate more to stocks and potentially real estate.

- Time Horizon: Remember, your investment horizon is short-term. This means you might want to keep a portion of your 50k in liquid assets like high-yield savings accounts for emergencies.

- Fees and Expenses: Be mindful of fees associated with each investment vehicle. ETFs and index funds typically have lower expense ratios compared to actively managed funds.

Remember:

- Diversification is crucial for managing risk.

- Regularly review your portfolio and adjust your asset allocation as needed based on your changing circumstances and market conditions.

- Consult a financial advisor for personalized advice tailored to your specific financial goals and risk tolerance.

Markatale Securities: Unraveling the Short-Term Investment Mystery

You may want to see also

Trading Strategies: Explore day trading, swing trading, and short-term options for quick gains

When considering short-term investments with a $50,000 capital, it's essential to explore various trading strategies that can potentially generate quick returns. Here's an overview of three popular approaches:

Day Trading: This strategy involves taking advantage of small price movements in highly liquid stocks or currencies within a single trading day. Day traders aim to make multiple small profits throughout the day, often utilizing advanced charting tools and technical analysis. With a $50,000 investment, you can start with smaller positions and focus on stocks with high liquidity and volatility. It's crucial to develop a disciplined approach, including setting stop-loss orders to limit potential losses and managing risk effectively. Day trading requires constant monitoring and quick decision-making, making it a challenging but potentially rewarding strategy.

Swing Trading: Swing traders aim to capture larger price movements over a more extended period, typically holding positions for a few days to a few weeks. This strategy requires identifying trends and patterns in the market and entering and exiting trades accordingly. With a $50,000 capital, you can take advantage of moderate volatility and trend-following strategies. Swing traders often use a combination of technical indicators and price action analysis to make informed decisions. This approach allows for more significant price targets but also requires careful risk management to avoid significant losses during periods of market downturn.

Short-Term Options Trading: Options trading involves buying or selling the right to purchase or sell an underlying asset at a specific price before a certain date. Short-term options strategies, such as call spreads or put spreads, can be used to generate quick profits. With a $50,000 investment, you can allocate a portion to options trading, taking advantage of leverage and potential upside. However, options trading is complex and carries significant risk due to the potential for rapid losses if the market moves against your position. It's crucial to understand the underlying principles, including option pricing, expiration dates, and strike prices, before engaging in this strategy.

Each of these trading strategies has its own set of advantages and risks. Day trading offers quick profits but requires intense focus and discipline. Swing trading provides a balance between potential gains and risk management. Short-term options trading can amplify returns but demands a deep understanding of options mechanics. When implementing these strategies, it's essential to start with a well-defined plan, including risk management techniques, and to continuously educate yourself about market dynamics and trading practices. Remember, short-term trading can be volatile, and it's crucial to assess your risk tolerance and adjust your strategy accordingly.

Debt Securities: Unlocking the Investment-Finance Connection

You may want to see also

Risk Management: Implement stop-loss orders, position sizing, and portfolio rebalancing to minimize losses

When investing a substantial amount like $50,000 in the short term, risk management is crucial to ensure your capital is protected and to maximize potential returns. Here are some strategies to consider:

Stop-Loss Orders: This is a powerful tool to limit potential losses. A stop-loss order is an instruction to sell an asset when it reaches a certain price point. For instance, if you buy a stock at $100 and set a stop-loss at $95, the order will trigger a sell if the stock price falls to $95 or lower. This prevents significant losses if the market moves against your position. It's essential to set stop-loss levels based on your risk tolerance and the volatility of the asset. For short-term trades, closer stop-loss distances might be appropriate to limit potential drawdowns.

Position Sizing: Proper position sizing is about allocating your capital effectively. It involves determining the appropriate amount to invest in each trade. A common rule of thumb is the '1% rule,' which suggests investing no more than 1% of your total capital on a single trade. For a $50,000 investment, this means keeping each position's value below $500. Diversifying your portfolio across multiple assets is also crucial. By spreading your capital, you reduce the impact of any single trade's performance on your overall portfolio.

Portfolio Rebalancing: Regularly reviewing and rebalancing your portfolio is essential for long-term success. Over time, market movements can cause your initial asset allocation to become imbalanced. For example, if you initially invested 60% in stocks and 40% in bonds, but stocks outperform, your allocation might shift to 70% stocks and 30% bonds. Rebalancing involves buying or selling assets to return the portfolio to its original target allocation. This strategy ensures that your risk exposure remains consistent with your investment goals and risk tolerance.

Implementing these risk management techniques can significantly contribute to preserving your capital and making informed investment decisions. Short-term investing often involves higher volatility, so managing risk is critical to success. Remember, effective risk management doesn't eliminate risk but rather provides a framework to navigate the market's inherent uncertainties.

Understanding Cash Equivalents: Short-Term Liquid Investments Explained

You may want to see also

Tax Implications: Understand short-term capital gains taxes and tax-efficient investment vehicles

When considering short-term investments with a 50,000-pound budget, it's crucial to understand the tax implications, especially regarding short-term capital gains. Short-term capital gains are typically taxed at your ordinary income tax rate, which can vary depending on your income level. This means that if you invest 50,000 pounds and make a profit within a year, you may face a relatively high tax rate on that gain. For instance, if you are in the 40% income tax bracket, you could be taxed at 40% on any short-term capital gains.

To minimize the impact of these taxes, consider investing in tax-efficient vehicles. One popular strategy is to utilize tax-advantaged retirement accounts, such as a Self-Directed IRA or a Roth IRA. These accounts offer tax benefits that can help reduce your taxable income and, consequently, the tax liability on any gains. For example, contributions to a traditional IRA may be tax-deductible, allowing you to defer taxes until withdrawals during retirement. Similarly, a Roth IRA enables tax-free growth and withdrawals if certain conditions are met.

Another approach is to invest in tax-efficient mutual funds or exchange-traded funds (ETFs) that focus on long-term capital gains. These funds often have lower tax rates because they hold investments for the long term, which can result in more favorable tax treatment. Additionally, investing in tax-free municipal bonds can provide an attractive alternative, as the interest earned is typically exempt from federal and state income taxes.

Diversification is also key to managing tax implications. By spreading your 50,000 pounds across various investment vehicles, you can potentially reduce the overall tax burden. For instance, you could allocate a portion to stocks, another part to real estate investment trusts (REITs), and a smaller amount to tax-efficient savings accounts. This strategy ensures that your investments are not all subject to the same tax treatment, providing a more balanced approach.

Lastly, it's essential to stay informed about tax laws and regulations, as they can change over time. Consult with a financial advisor or tax professional to ensure you are making the most tax-efficient decisions for your short-term investments. They can provide personalized advice based on your financial goals and risk tolerance, helping you navigate the complex world of taxation and investment strategies.

Maximize Your Short-Term Cash: Top Investment Strategies

You may want to see also