Investing for a term goal is a smart financial strategy that can help you achieve your long-term objectives, whether it's buying a house, funding your child's education, or planning for retirement. It involves a careful approach to selecting the right investment options, understanding risk tolerance, and creating a diversified portfolio. This guide will provide an overview of the key steps to help you navigate the process of investing for a specific term goal, including setting realistic expectations, determining the amount to invest, and exploring various investment vehicles to ensure your financial future is on track.

What You'll Learn

- Risk Tolerance: Assess your comfort with potential losses to guide investment choices

- Time Horizon: Determine how long you're investing for to choose appropriate asset classes

- Diversification: Spread investments across asset types to manage risk and maximize returns

- Cost Analysis: Understand fees and expenses to optimize investment performance and returns

- Tax Efficiency: Strategize to minimize taxes on investment gains and income

Risk Tolerance: Assess your comfort with potential losses to guide investment choices

When it comes to investing for a term goal, understanding your risk tolerance is crucial. It's about assessing how comfortable you are with the potential for losses in your investments. This evaluation will help you make informed decisions about the types of assets you choose and the overall strategy you adopt.

Risk tolerance is a personal assessment of your financial situation and your ability to handle market volatility. It's important to consider your financial goals, time horizon, and emotional comfort with risk. For instance, if you have a long-term goal, like saving for retirement, you might be more willing to take on higher risks to potentially achieve greater returns over time. On the other hand, if you have a shorter-term goal, like saving for a down payment on a house, you may prefer a more conservative approach to minimize the impact of potential losses.

To determine your risk tolerance, start by evaluating your financial situation. Consider your income, savings, and any existing debts. If you have a stable income and a substantial emergency fund, you may be more inclined to take on higher risks. Conversely, if you are in a more precarious financial position, you might opt for lower-risk investments to ensure a more secure future.

Another factor to consider is your time horizon. If you have a long-term goal, such as funding your child's education or planning for retirement, you can typically afford to take on more risk. Market fluctuations will have less of an impact on your financial plans over a longer period. However, if your goal is imminent or short-term, like saving for a vacation or a new car, you should opt for less risky investments to avoid potential losses that could disrupt your plans.

Additionally, your emotional comfort with risk plays a significant role. Some investors are naturally more comfortable with the ups and downs of the market, while others may find volatility stressful. If you tend to become anxious during market downturns, you might prefer a more conservative investment strategy. Conversely, if you are an experienced investor who embraces market volatility, you may be more inclined to invest in higher-risk assets.

In summary, assessing your risk tolerance is a critical step in investing for a term goal. It involves evaluating your financial situation, time horizon, and emotional comfort with potential losses. By understanding your risk tolerance, you can make informed decisions about the types of investments that align with your goals and ensure a more secure financial future. Remember, it's a personal journey, and the right approach for one person may not be the best for another.

Markatale Securities: Unraveling the Short-Term Investment Mystery

You may want to see also

Time Horizon: Determine how long you're investing for to choose appropriate asset classes

When it comes to investing for a specific term goal, understanding your time horizon is crucial. The time horizon refers to the length of time you plan to invest for, and it significantly influences the asset classes you should consider. Here's a breakdown of how to determine your time horizon and choose suitable investments:

Assess Your Financial Goals and Needs: Begin by clearly defining your financial objectives. Are you saving for a down payment on a house, funding your child's education, or planning for retirement? Each goal has a different time frame. For instance, a house down payment might be a short-term goal, while retirement planning typically requires a longer investment period. Understanding the urgency and importance of your goal will help you set a realistic time horizon.

Evaluate Risk Tolerance: Your risk tolerance is your ability and willingness to withstand fluctuations in the value of your investments. It's closely tied to your time horizon. If you have a longer time horizon, you can typically afford to take on more risk, as market volatility is less concerning over an extended period. Conversely, short-term goals often require more conservative investments to preserve capital. Assess your comfort with market volatility and choose investments that align with your risk tolerance.

Determine the Investment Timeframe: Based on your financial goals and risk tolerance, decide on a suitable time horizon. Common investment time horizons include short-term (1-3 years), medium-term (3-10 years), and long-term (10 years or more). Short-term goals might include an emergency fund or a specific purchase, while medium-term goals could be funding a child's education or a business venture. Long-term goals often focus on retirement planning or wealth accumulation.

Choose Asset Classes: Once you've established your time horizon, you can select appropriate asset classes. Here's a general guideline:

- Short-Term: For goals within 1-3 years, consider money market funds, high-yield savings accounts, or short-term bonds. These options offer liquidity and relatively low risk.

- Medium-Term: In the 3-10 year range, you can explore a mix of stocks, bonds, and mutual funds. Diversification is key here to balance risk and potential returns.

- Long-Term: For goals beyond 10 years, equity investments like stocks and real estate are often recommended. These asset classes have historically provided higher returns over the long term but come with higher volatility.

Remember, your time horizon is a dynamic concept and may change over time due to life events or shifts in financial goals. Regularly review and adjust your investment strategy to ensure it remains aligned with your evolving needs.

Navigating Short-Term Investments: Operating Assets and Their Role

You may want to see also

Diversification: Spread investments across asset types to manage risk and maximize returns

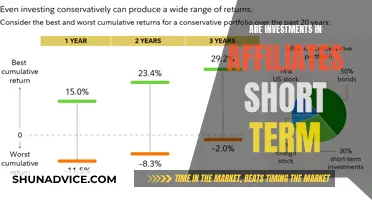

When it comes to investing for a term goal, such as saving for a house down payment or a child's education, diversification is a key strategy to consider. Diversification means spreading your investments across different asset classes to reduce risk and potentially increase returns over the long term. Here's a breakdown of why and how to diversify:

Understanding Risk and Return: Diversification is based on the principle that different asset classes perform differently over time. For example, stocks tend to be more volatile and offer higher potential returns compared to bonds or real estate. By allocating your investments across these asset classes, you can smooth out the impact of market fluctuations. If one asset class underperforms, others may compensate, ensuring your overall portfolio remains stable.

Asset Allocation: Diversification involves dividing your investment portfolio into various asset categories. A common approach is to use a 60/40 or 50/50 model, where a portion of your money is invested in stocks and the rest in fixed-income securities like bonds. This allocation can be further tailored to your risk tolerance and investment goals. For instance, if you're saving for a long-term goal with a higher risk tolerance, you might allocate more to stocks for potentially higher returns.

Benefits of Diversification: This strategy offers several advantages. Firstly, it reduces the impact of market volatility. If the stock market takes a downturn, your bond investments might perform well, and vice versa. Secondly, diversification can lead to better risk-adjusted returns over time. By spreading your investments, you're less likely to experience significant losses, and your portfolio is more likely to grow steadily.

Implementing Diversification: To diversify your investments, you can start by evaluating your current portfolio. If it's heavily weighted towards a single asset class, consider rebalancing. You can also open new investment accounts and allocate funds accordingly. For instance, you could invest in a mix of index funds, mutual funds, or individual stocks from different sectors and industries. Additionally, consider consulting a financial advisor who can provide personalized guidance based on your specific term goal and risk profile.

Remember, diversification is a long-term strategy, and it may take time to see the benefits. It's essential to regularly review and adjust your portfolio as your financial situation and goals evolve. By adopting a diversified approach, you can build a robust investment strategy that aligns with your term goal, providing financial security and potentially achieving your desired milestones.

Navigating Short-Term Investments: Understanding Their Liability Status

You may want to see also

Cost Analysis: Understand fees and expenses to optimize investment performance and returns

When it comes to investing for a term goal, understanding the costs associated with your investments is crucial for optimizing performance and maximizing returns. Cost analysis is a fundamental aspect of investment management that can significantly impact your long-term financial success. Here's a detailed guide on how to approach this:

- Identify Investment Fees: Different investment vehicles come with various fees, which can eat into your potential returns. Start by identifying the fees associated with your chosen investment options. Common fees include management fees, which are charged by fund managers for their services, and expense ratios, which represent the ongoing costs of managing a mutual fund or exchange-traded fund (ETF). These fees can vary widely, so it's essential to compare them across different investment products. For example, actively managed mutual funds might have higher management fees compared to passively managed ETFs.

- Understand Transaction Costs: Transaction costs include brokerage commissions and fees incurred when buying or selling investments. These costs can vary depending on the type of account and the frequency of trades. High-frequency trading or frequent buying and selling may lead to substantial transaction costs over time. Consider the impact of these costs on your investment strategy, especially if you're investing for a long-term goal. Low-cost trading platforms and tax-efficient investment strategies can help minimize these expenses.

- Evaluate Tax Implications: Taxes can significantly affect your investment returns. Different investment types have varying tax treatments. For instance, capital gains taxes apply to the profit made from selling investments, while dividends may be taxed differently. Understanding the tax implications of your investment choices is vital. Tax-efficient strategies, such as tax-advantaged retirement accounts or specific investment vehicles, can help optimize your after-tax returns.

- Compare Investment Options: Conduct a thorough comparison of different investment options to assess their cost structures. This analysis will help you make informed decisions. Look for low-cost investment vehicles that align with your term goal. For example, index funds or ETFs often have lower expense ratios compared to actively managed funds. Additionally, consider the overall cost ratio of a fund, which includes management fees and other expenses, to get a comprehensive view of its cost-effectiveness.

- Regular Review and Optimization: Cost analysis is an ongoing process. Regularly review the fees and expenses associated with your investments to ensure they remain aligned with your financial goals. Market conditions and investment strategies may change, impacting costs. Stay informed about any changes in fees, and consider rebalancing your portfolio to optimize cost efficiency. This proactive approach ensures that your investment strategy remains cost-effective and efficient over the long term.

By conducting a thorough cost analysis, you can make informed decisions about your investments, ensuring that you're paying reasonable fees and expenses. This process empowers you to optimize your investment performance and work towards achieving your term goals with greater efficiency. Remember, even small differences in fees can accumulate over time, significantly impacting your overall investment returns.

Understanding Short-Term Investments: Operating Activities or Not?

You may want to see also

Tax Efficiency: Strategize to minimize taxes on investment gains and income

When it comes to investing for the long term, tax efficiency is a crucial aspect that can significantly impact your overall returns. Here are some strategies to consider for minimizing taxes on your investment gains and income:

Understand Tax Implications: Start by familiarizing yourself with the tax laws and regulations related to investments in your jurisdiction. Different types of investments, such as stocks, bonds, mutual funds, or real estate, may be taxed differently. For example, capital gains taxes may apply to the sale of assets, while dividends and interest income are often taxed at different rates. Understanding these nuances is essential for making informed decisions.

Utilize Tax-Advantaged Accounts: Take advantage of tax-efficient investment vehicles like retirement accounts (e.g., 401(k), IRA) or health savings accounts (HSA). These accounts often offer tax benefits, allowing your investments to grow tax-deferred or tax-free. Contributions to traditional retirement accounts may be tax-deductible, and earnings can accumulate without immediate taxation. Additionally, investing in a Roth IRA or Roth 401(k) provides tax-free growth and withdrawals in retirement.

Diversify Your Portfolio: Diversification is a powerful strategy to manage tax efficiency. By spreading your investments across various asset classes, sectors, and geographic regions, you can potentially reduce the overall tax impact. For instance, if you own stocks in different countries, you may benefit from tax treaties that prevent double taxation. Diversification also helps in managing risk and can contribute to more consistent long-term returns.

Consider Tax-Efficient Investment Vehicles: Explore investment options specifically designed to minimize taxes. Index funds and exchange-traded funds (ETFs) often have lower expense ratios and can provide broad market exposure. These funds typically have lower turnover, resulting in fewer taxable events. Additionally, look for investments that offer tax-free income, such as municipal bonds, which are exempt from federal and sometimes state income taxes.

Time Your Investments Strategically: Tax-loss harvesting is a technique where you sell investments that have decreased in value to offset capital gains. By strategically timing your investments, you can realize losses in one year to counteract gains in another. This strategy can help reduce the overall tax burden. However, it's important to maintain a long-term investment perspective and not engage in frequent trading solely for tax purposes.

Stay Informed and Seek Professional Advice: Tax laws and investment strategies evolve over time. Stay updated on any changes in legislation that may impact your investments. Consider consulting a financial advisor or tax professional who can provide personalized guidance based on your specific circumstances. They can help you navigate complex tax scenarios and ensure your investment strategy aligns with your goals and tax efficiency objectives.

Maximizing Affiliate Investments: Strategies for Long-Term Success

You may want to see also

Frequently asked questions

Investing for a term goal, such as saving for a house down payment or a child's education, requires a strategic approach. Start by setting a clear timeline and defining the specific amount you need to save. Then, consider your risk tolerance and the time horizon for your goal. You can opt for a mix of investments, such as a balanced portfolio of stocks, bonds, and mutual funds, or explore dedicated term-focused savings plans offered by financial institutions.

To maximize growth, it's essential to regularly review and adjust your investment strategy. Stay informed about market trends and economic factors that may impact your investments. Consider consulting a financial advisor who can provide personalized advice based on your goals and risk profile. They can help you make informed decisions about asset allocation, rebalancing your portfolio, and exploring investment options with higher growth potential.

Yes, there can be tax benefits associated with certain investment vehicles. For example, contributions to retirement accounts like a 401(k) or IRA may be tax-deductible, allowing your savings to grow faster. Additionally, some investment accounts offer tax-advantaged growth, where earnings are not taxed until withdrawal. It's important to understand the tax implications of your chosen investment strategy and consult a tax professional for guidance.

For longer-term goals like retirement, it's crucial to start early and take advantage of compound interest. Consider contributing to tax-advantaged retirement accounts regularly. Diversify your investments across various asset classes to manage risk. As your goal approaches, you can gradually shift your portfolio towards more conservative investments to preserve capital. Regularly reviewing and adjusting your strategy will help ensure your retirement savings grow steadily over time.