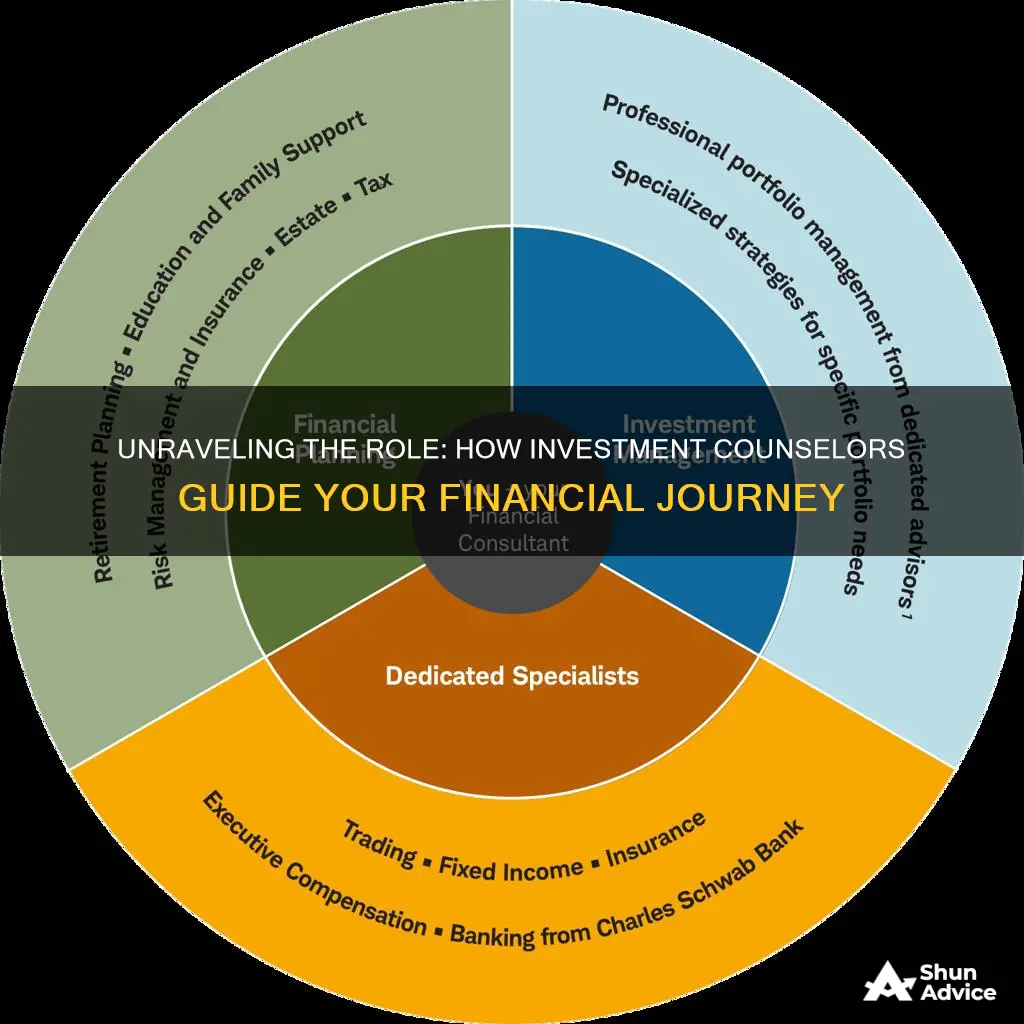

Investment counselors play a crucial role in helping individuals and institutions manage their financial portfolios. These professionals provide personalized guidance and strategies to help clients achieve their financial goals, whether it's growing wealth, saving for retirement, or managing investments. They work closely with clients to understand their financial situation, risk tolerance, and investment objectives. Investment counselors then create tailored plans, offering advice on asset allocation, security selection, and regular portfolio reviews. Their expertise lies in navigating the complex world of financial markets, providing insights on market trends, economic indicators, and investment opportunities. By offering ongoing support and adapting strategies as needed, investment counselors ensure that clients' investments are aligned with their long-term financial aspirations.

What You'll Learn

- Client Assessment: Investment counselors start by evaluating clients' financial goals, risk tolerance, and investment preferences

- Portfolio Construction: They build diversified portfolios tailored to individual needs, considering asset allocation and security selection

- Regular Review: Counselors monitor and adjust portfolios periodically to ensure they align with changing market conditions and client objectives

- Risk Management: They employ strategies to mitigate risks, such as diversification, asset allocation, and regular portfolio rebalancing

- Communication and Education: Investment counselors provide clear and transparent communication, educating clients about market trends and investment decisions

Client Assessment: Investment counselors start by evaluating clients' financial goals, risk tolerance, and investment preferences

When an individual or a group of clients approach an investment counselor, the first and most crucial step is to conduct a comprehensive client assessment. This process is fundamental to understanding the client's unique financial situation and goals, which in turn allows the counselor to provide tailored investment advice. The assessment involves a detailed examination of the client's financial landscape, including their current assets, liabilities, income, and expenses. It also delves into their long-term financial aspirations, such as retirement planning, education savings, or wealth accumulation. By gathering this information, the counselor can gain a clear picture of the client's financial starting point and their desired destination.

During this evaluation, investment counselors also assess the client's risk tolerance, which is a critical factor in determining suitable investment strategies. Risk tolerance refers to an individual's ability to withstand market fluctuations and potential losses without feeling anxious or distressed. It is a highly personalized measure, as it varies from person to person and can change over time due to life events or shifting financial circumstances. Counselors use various tools and questionnaires to gauge risk tolerance, ensuring that the recommended investments align with the client's comfort level with risk.

Investment preferences are another essential aspect of the client assessment. This includes understanding the client's investment style, such as whether they prefer a more active or passive approach. Active investors might enjoy the process of researching and selecting individual stocks or bonds, while passive investors often opt for index funds or exchange-traded funds (ETFs) that track a specific market index. Additionally, counselors consider the client's time horizon, which is the length of time they plan to invest. This factor influences the asset allocation strategy, as longer investment periods typically allow for a higher tolerance for risk.

The client assessment also involves discussing the client's current investment portfolio, if any. Investment counselors analyze the existing holdings to identify potential gaps or areas for improvement. They may assess the diversification of the portfolio, ensuring it aligns with the client's risk tolerance and financial goals. By understanding the client's current position, counselors can provide more informed advice on rebalancing or making strategic adjustments to optimize the portfolio's performance.

In summary, the client assessment is a critical phase in the investment counseling process. It enables counselors to create a customized plan that caters to the client's financial needs and aspirations. Through this evaluation, counselors gain insights into the client's financial goals, risk tolerance, and investment preferences, allowing them to offer tailored advice and strategies for wealth management and growth. This personalized approach is at the heart of effective investment counseling, ensuring clients receive guidance that is relevant and beneficial to their unique circumstances.

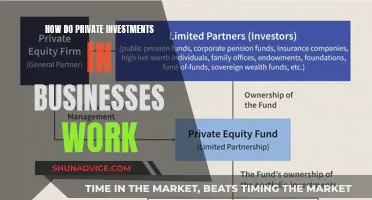

Investing in Innovation: Turning Ideas into Reality

You may want to see also

Portfolio Construction: They build diversified portfolios tailored to individual needs, considering asset allocation and security selection

When it comes to portfolio construction, investment counselors play a crucial role in creating well-diversified investment plans that align with their clients' financial goals and risk tolerances. This process involves a meticulous approach to asset allocation and security selection, ensuring that the portfolio is not only robust but also tailored to the specific needs of each client.

The first step in portfolio construction is understanding the client's objectives and constraints. Investment counselors conduct thorough financial assessments to gather information about the client's income, expenses, savings, and investment goals. They also evaluate the client's risk tolerance, which refers to the level of market volatility they are willing to accept in pursuit of their financial objectives. This risk tolerance assessment is critical as it guides the counselor in determining the appropriate asset allocation strategy.

Asset allocation is the process of dividing a portfolio among different asset classes such as stocks, bonds, cash, and alternative investments. Investment counselors use various models and frameworks to determine the optimal allocation based on the client's risk profile, investment horizon, and financial goals. For instance, a more conservative investor with a shorter time horizon might prefer a higher allocation to fixed-income securities and cash, while a more aggressive investor with a longer time horizon could benefit from a larger exposure to equity securities. The goal is to create a balanced portfolio that aligns with the client's risk tolerance and financial objectives.

Security selection is the next critical step in portfolio construction. Once the asset allocation is determined, investment counselors research and analyze various securities within each asset class to identify potential investment opportunities. They consider factors such as company fundamentals, market trends, and economic indicators to make informed decisions. For example, in the equity market, counselors might focus on companies with strong financial performance, innovative products, and a competitive advantage. They may also consider factors like dividend yield, price-to-earnings ratio, and analyst recommendations to build a well-rounded portfolio.

The investment counselor's role in security selection is to ensure that the chosen securities are not only individually strong but also contribute positively to the overall portfolio performance. They aim to build a diversified portfolio by selecting securities from different sectors, industries, and market capitalizations. This diversification helps to reduce risk by spreading investments across various assets, thereby minimizing the impact of any single security's performance on the entire portfolio. Additionally, counselors may employ strategies such as active management, where they actively buy and sell securities to optimize the portfolio's performance, or passive management, which involves tracking a specific market index to achieve broad market exposure.

In summary, portfolio construction is a complex and critical aspect of an investment counselor's work. It involves a meticulous process of understanding client needs, conducting thorough research, and making informed decisions regarding asset allocation and security selection. By building diversified portfolios tailored to individual needs, investment counselors aim to optimize risk-adjusted returns and help clients achieve their financial goals. This process requires a deep understanding of financial markets, a disciplined approach to decision-making, and a commitment to providing personalized investment advice.

The Venture Capitalist's LLC Investment Strategy: Navigating the Funding Landscape

You may want to see also

Regular Review: Counselors monitor and adjust portfolios periodically to ensure they align with changing market conditions and client objectives

Regular reviews are an essential part of an investment counselor's role, as they provide an opportunity to assess the performance of a client's portfolio and make necessary adjustments to ensure it remains on track. These reviews are typically conducted at regular intervals, such as quarterly or semi-annually, but can also be more frequent for clients with dynamic financial goals or those facing significant market shifts. The primary objective is to ensure that the investment strategy is tailored to the client's specific needs and objectives, taking into account their risk tolerance, time horizon, and financial situation.

During these reviews, investment counselors employ various tools and techniques to evaluate the portfolio's performance. They analyze key metrics such as returns, volatility, and risk exposure. For instance, they might compare the portfolio's performance against relevant benchmarks to identify areas of underperformance or overperformance. This analysis helps counselors make informed decisions about potential adjustments to the investment strategy. They may also review the client's financial goals and life circumstances to ensure the portfolio is aligned with their changing needs.

One critical aspect of regular reviews is the ability to adapt to market conditions. Investment counselors must stay abreast of economic trends, industry performance, and global events that could impact their clients' investments. For example, a counselor might identify a sector that has been underperforming due to regulatory changes or a shift in consumer behavior. In response, they could suggest reallocating assets to more promising areas or implementing specific strategies to mitigate potential risks. This proactive approach ensures that the portfolio remains dynamic and responsive to market dynamics.

Additionally, regular reviews provide an opportunity to educate clients about their investments. Investment counselors can explain the rationale behind any changes made, ensuring clients understand the potential risks and rewards associated with their portfolio. This transparency fosters trust and allows clients to make informed decisions about their financial future. It also empowers clients to take an active role in their investment journey, promoting a collaborative relationship between the counselor and the client.

In summary, regular reviews are a critical component of an investment counselor's practice, enabling them to provide ongoing guidance and support to clients. By monitoring and adjusting portfolios, counselors can ensure that investments remain aligned with changing market conditions and client objectives. This process requires a combination of analytical skills, market awareness, and a deep understanding of client needs, all of which contribute to the successful management of investment portfolios.

Small Investments, Big Returns

You may want to see also

Risk Management: They employ strategies to mitigate risks, such as diversification, asset allocation, and regular portfolio rebalancing

Investment counselors play a crucial role in helping individuals and institutions manage their investment portfolios effectively, and one of their primary focuses is risk management. They employ a range of strategies to ensure that their clients' investments are well-protected and aligned with their financial goals. Here's an overview of how they approach risk management:

Diversification: This is a fundamental principle in investment counseling. Diversification involves spreading investments across various asset classes, sectors, and geographic regions. By diversifying, counselors aim to reduce the impact of any single investment's performance on the overall portfolio. For example, they might recommend holding a mix of stocks, bonds, real estate, and alternative investments. This approach minimizes the risk associated with any one asset class and provides a more stable investment environment.

Asset Allocation: Investment counselors determine the optimal distribution of assets within a portfolio. This allocation is tailored to the client's risk tolerance, investment goals, and time horizon. For instance, a conservative investor might have a higher proportion of bonds and less equity exposure, while a more aggressive investor may opt for a larger equity allocation. Asset allocation helps in managing risk by ensuring that the portfolio is appropriately balanced and aligned with the client's risk profile.

Regular Portfolio Rebalancing: Over time, market fluctuations can cause a portfolio's asset allocation to deviate from the original plan. Investment counselors regularly review and rebalance the portfolio to restore the desired asset allocation. Rebalancing involves buying or selling assets to adjust the portfolio's composition. For example, if the stock market has outperformed other asset classes, the counselor might sell some stocks and use the proceeds to buy underweight assets, thus rebalancing the portfolio and managing risk.

Additionally, investment counselors may use other risk management techniques such as stop-loss orders, which automatically sell an asset if it falls below a specified price, and they can also employ risk analysis tools to identify potential risks and develop strategies to mitigate them. The goal is to create a robust investment strategy that not only aims for growth but also ensures that clients' capital is protected.

By implementing these risk management strategies, investment counselors provide a comprehensive approach to investing, helping clients navigate market volatility and work towards their financial objectives with confidence. It is a critical aspect of their profession, ensuring that clients' investments are well-managed and aligned with their risk preferences.

Vodafone Idea: Right Issue Investment Guide

You may want to see also

Communication and Education: Investment counselors provide clear and transparent communication, educating clients about market trends and investment decisions

Effective communication and education are fundamental aspects of an investment counselor's role, as they play a crucial role in building trust and ensuring clients make informed decisions. Investment counselors are responsible for providing clear and transparent information to their clients, which is essential for fostering a strong relationship and promoting long-term success.

One of the primary responsibilities of investment counselors is to educate their clients about market trends and investment strategies. This involves breaking down complex financial concepts and market dynamics into easily understandable language. Counselors should aim to simplify the decision-making process by offering clear explanations of various investment options, risks, and potential rewards. For instance, they can provide insights into different asset classes, such as stocks, bonds, or real estate, and how these can be incorporated into a client's portfolio. By doing so, counselors empower clients to make choices aligned with their financial goals and risk tolerance.

Regular communication is vital to maintaining a successful client relationship. Investment counselors should establish a consistent dialogue with their clients, providing updates on market performance, investment changes, and any relevant news that may impact their portfolio. This proactive approach ensures that clients stay informed and feel involved in the decision-making process. For example, counselors can send out periodic reports detailing the performance of the client's investments, market analysis, and any adjustments made to the portfolio. These reports should be concise yet comprehensive, allowing clients to quickly grasp the key insights.

Additionally, investment counselors should be prepared to answer their clients' questions and address any concerns promptly. This may involve scheduling regular meetings or phone calls to discuss specific investment matters or provide personalized advice. By actively listening to clients' needs and preferences, counselors can tailor their recommendations accordingly. It is also important to provide clear explanations of fees, charges, and the overall investment process to ensure clients fully understand the services they are receiving.

In summary, investment counselors must excel in communication and education to build a strong foundation of trust and understanding with their clients. By providing transparent information, simplifying complex concepts, and maintaining regular communication, counselors can ensure that clients are well-informed and confident in their investment decisions. This approach not only helps clients achieve their financial objectives but also fosters a long-lasting and mutually beneficial relationship between the counselor and the client.

US Retirement Investments: Exploring the Impact for Non-Citizens

You may want to see also

Frequently asked questions

Investment counselors are financial professionals who provide personalized guidance and strategies to help clients manage and grow their wealth. They offer expertise in various investment options, such as stocks, bonds, mutual funds, and real estate, to create tailored financial plans.

Investment counselors typically charge a fee based on a percentage of the assets they manage on behalf of the client. This fee structure is known as an asset-based fee, and it ensures that the counselor's interests are aligned with the client's goals, as they are compensated based on the performance of the investments.

These professionals provide a range of services, including portfolio management, investment research, risk assessment, tax planning, and financial planning. They analyze market trends, assess the client's risk tolerance, and offer recommendations to optimize investment returns while managing potential risks.

Finding a qualified investment counselor involves thorough research and due diligence. You can start by seeking referrals from trusted sources, such as friends or family who have had positive experiences. Additionally, you can check professional associations' websites, like the Financial Planning Association or the National Association of Personal Financial Advisors, for certified and accredited counselors in your area.