Private investments in businesses are a crucial aspect of the global economy, allowing individuals and institutions to support companies in their growth and development. This process involves a unique financial arrangement where investors provide capital to businesses in exchange for ownership stakes, often in the form of equity or debt. Understanding how these investments work is essential for anyone interested in the business world, as it can offer insights into the mechanisms that drive economic growth, innovation, and the creation of new industries. In this paragraph, we will explore the intricacies of private investments, shedding light on the various strategies, benefits, and potential risks associated with this powerful tool in the business landscape.

What You'll Learn

- Investment Vehicles: Private equity, venture capital, angel investing, and crowdfunding

- Due Diligence: Thorough analysis of business, market, and management

- Funding Rounds: Seed, Series A, B, and beyond

- Exit Strategies: IPOs, M&A, and buybacks

- Risk and Returns: High-risk, high-reward potential with potential for significant returns

Investment Vehicles: Private equity, venture capital, angel investing, and crowdfunding

Private investments in businesses are a crucial aspect of the global economy, providing capital for companies to grow, innovate, and expand. These investments are often facilitated through various investment vehicles that cater to different risk appetites, time horizons, and investment strategies. Here's an overview of some key investment vehicles in this domain:

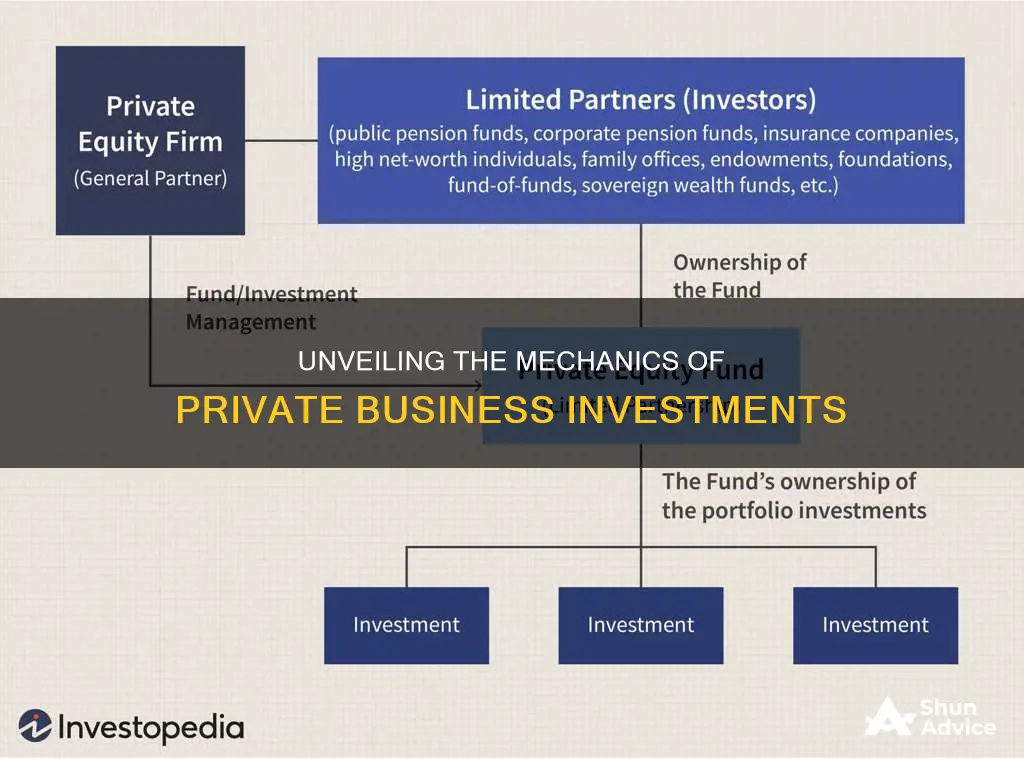

Private Equity: Private equity firms invest in privately held companies, often with the goal of improving their performance and then selling them at a higher value. These firms typically invest in mature businesses with established revenue streams and a strong market position. The process involves acquiring a significant stake in the company, sometimes alongside management, and implementing strategic changes to enhance profitability. Private equity firms may also provide operational expertise and resources to help companies reach their full potential. After a period of growth, the firm may sell its shares, realizing a profit, or take the company public, allowing investors to exit their investment.

Venture Capital: Venture capital (VC) firms focus on funding early-stage and emerging companies with high growth potential. These investments are often made in industries like technology, healthcare, and clean energy. VC firms provide not just capital but also mentorship, industry connections, and strategic guidance. Startups typically receive funding in exchange for a small equity stake, and the VC firm's goal is to help the company scale rapidly. This investment vehicle is high-risk, high-reward, as many startups fail, but successful ones can yield substantial returns. VC firms often invest in multiple companies simultaneously, diversifying their portfolio to manage risk.

Angel Investing: Angel investors are individuals who provide capital to startups and early-stage companies. They often invest their own funds or pool money from friends and family to support innovative ideas. Angel investors typically offer more than just financial support; they bring valuable industry experience, mentorship, and networks. These investors usually take a more active role in the company's operations, providing guidance and connections. Angel investing can be a good entry point for those who want to invest in startups but may not have the resources to become venture capitalists.

Crowdfunding: Crowdfunding platforms have revolutionized the way startups and small businesses access capital. This method involves raising funds from a large number of people, often via online platforms. There are various types of crowdfunding, including reward-based, where backers receive rewards for their investment, and equity-based, where investors receive a share of the company. Crowdfunding allows companies to validate their ideas, test the market, and gain early adopters. It also provides investors with an opportunity to diversify their portfolios and potentially earn returns on their investments. This investment vehicle has democratized access to capital, enabling a wider range of entrepreneurs to pursue their business ideas.

Target: Invest Now or Miss Out?

You may want to see also

Due Diligence: Thorough analysis of business, market, and management

Due diligence is a critical process in private investments, serving as a comprehensive evaluation to assess the viability, risks, and potential of a business before committing capital. It involves a meticulous examination of various aspects, including the business's operations, market position, financial health, and management capabilities. This process is essential for investors to make informed decisions and mitigate potential risks associated with private investments.

The first step in due diligence is a thorough analysis of the business itself. This includes studying the company's history, its products or services, competitive advantage, and growth strategies. Investors should scrutinize the business model, understanding its revenue streams, cost structure, and profitability. A detailed examination of the company's operations, including its supply chain, production processes, and customer base, is crucial to gauge its efficiency and sustainability. Additionally, assessing the intellectual property, patents, and any unique assets the business owns is vital to determine its long-term value.

Market analysis is another critical component. Investors must evaluate the industry trends, market dynamics, and competitive landscape. This involves studying the target market, customer demographics, and the company's market share. Understanding the industry's growth prospects, regulatory environment, and potential disruptions is essential. Investors should also identify the business's target audience and assess the effectiveness of its marketing and sales strategies. A comprehensive market analysis provides insights into the business's positioning and potential for growth or expansion.

Management due diligence is equally important. Investors need to assess the quality and experience of the business's leadership team. This includes evaluating their track record, industry expertise, and ability to execute the business plan. A thorough review of the management's financial and operational decisions, strategic vision, and problem-solving skills is necessary. Investors should also consider the organizational structure, corporate governance, and the effectiveness of internal controls. By examining the management's capabilities and integrity, investors can gauge the business's ability to navigate challenges and capitalize on opportunities.

Furthermore, due diligence should encompass a financial analysis to assess the business's financial health and performance. This involves reviewing financial statements, cash flow projections, and historical financial data. Investors should analyze key financial ratios, profitability metrics, and debt-to-equity ratios to identify potential risks and opportunities. A comprehensive financial review also includes evaluating the business's tax strategies, accounting practices, and compliance with regulations. By scrutinizing the financial aspects, investors can make informed decisions regarding the business's stability, growth potential, and overall financial viability.

In summary, due diligence is a comprehensive process that involves a detailed examination of the business, market, and management. It requires a thorough analysis of the company's operations, market position, and financial health. By conducting a rigorous due diligence process, investors can make well-informed decisions, identify potential risks, and assess the long-term prospects of private investments. This process is a cornerstone of responsible investing, ensuring that capital is allocated efficiently and effectively.

Foundation and Future: Navigating the Investment Potential of Buying Land and Building

You may want to see also

Funding Rounds: Seed, Series A, B, and beyond

The process of funding a business through private investments typically involves a series of funding rounds, each with its own unique characteristics and goals. These rounds are crucial for the growth and development of startups and early-stage companies, providing the necessary capital to fuel their progress. Here's an overview of the key funding rounds:

Seed Funding: This is often the initial stage of investment, where the business idea is still in its infancy. Seed funding rounds are typically aimed at developing a minimum viable product (MVP) and validating the market fit. Investors in this stage are usually angel investors or early-stage venture capitalists. They seek high-growth potential and are willing to take on higher risks. Seed funding can be crucial for a startup's survival, enabling them to refine their product, conduct market research, and build a team. This round often involves a smaller amount of capital and may include convertible notes or simple equity investments.

Series A and Beyond: As the business progresses and gains traction, it enters the Series A funding round. This is a critical phase where the company aims to scale its operations, expand its market reach, and solidify its position in the industry. Series A investors often include venture capital firms that have a proven track record of success in similar sectors. The focus here is on growth and expansion, and the investment amount can be significantly higher than in the seed round. Startups in this stage typically have a more mature business model and a clear path to profitability.

Series B and Subsequent Rounds: After a successful Series A, companies often seek further funding to continue their growth trajectory. Series B funding rounds are characterized by the company's increased visibility and a proven business model. Investors in this stage may include larger venture capital firms, institutional investors, or even private equity firms. The investment amount can be substantial, and the focus is on accelerating growth, expanding into new markets, or enhancing the company's product offerings. Subsequent funding rounds, such as Series C and beyond, are for more mature companies that have already demonstrated significant growth and market acceptance.

Each funding round is a strategic step towards the company's long-term success. Investors provide not only financial support but also valuable guidance, mentorship, and industry connections. The process involves rigorous due diligence, where investors assess the company's business plan, market potential, team capabilities, and financial projections. Startups must present a compelling narrative and demonstrate their ability to execute their vision to attract investors and secure the necessary funding.

Mortgage REITs: A Smart Investment Strategy?

You may want to see also

Exit Strategies: IPOs, M&A, and buybacks

Exit strategies are crucial components of private investments in businesses, as they outline the plans for the investors to realize their returns and exit their investments. There are several common exit strategies that private investors employ, each with its own advantages and considerations.

One of the most traditional and widely used exit strategies is the Initial Public Offering (IPO). An IPO involves taking a private company public by listing its shares on a stock exchange. This strategy allows investors to sell their shares to the public, providing liquidity and the potential for significant returns. During an IPO, the company offers its shares to the public for the first time, allowing existing shareholders to sell a portion of their stake. This process can be complex and costly, requiring extensive regulatory compliance and due diligence. However, it offers the advantage of a large and liquid market for the company's shares, attracting a wide range of investors.

Mergers and Acquisitions (M&A) is another popular exit strategy. In this approach, private investors may sell their stakes in a company to another company or a third-party buyer. M&A can take various forms, such as a share purchase, asset acquisition, or a merger. When a company is acquired, the investors can realize their returns by receiving a premium price for their shares. M&A transactions often involve strategic considerations, as the acquiring company may seek to expand its market presence, gain access to new technologies, or diversify its portfolio. Private investors can also participate in M&A by investing in funds or vehicles that specialize in acquiring and integrating companies.

Shareholder buybacks are a less common but increasingly relevant exit strategy. This strategy involves a company repurchasing its own shares from shareholders, typically from private investors. Buybacks can be executed through various methods, such as open-market purchases, private agreements, or tender offers. By buying back shares, a company can reduce the number of outstanding shares, increase earnings per share, and potentially boost its stock price. For private investors, buybacks provide an opportunity to exit their investments at a higher price, especially if the company has performed well and has excess cash.

The choice of exit strategy depends on various factors, including the company's stage of development, market conditions, investor preferences, and regulatory environment. Each strategy has its own timeline, tax implications, and potential risks and rewards. Private investors often engage in a combination of these strategies to optimize their returns and manage their investment portfolios effectively.

Smart Places to Invest $10K

You may want to see also

Risk and Returns: High-risk, high-reward potential with potential for significant returns

Private investments in businesses are a high-risk, high-reward venture, offering significant potential for substantial returns. This type of investment is an alternative to traditional public markets, where investors can acquire ownership stakes in privately held companies. These investments are often made by accredited investors, such as high-net-worth individuals or institutional investors, who have the financial sophistication and risk tolerance to navigate the complex and illiquid nature of private equity.

The high-risk aspect is inherent in the private investment landscape. Private companies, by their very nature, are not publicly traded, which means there is less transparency and access to information compared to publicly listed companies. Investors must rely on due diligence processes, including financial analysis, industry research, and an understanding of the company's management team and business model, to assess the potential risks and rewards. This process can be time-consuming and requires a deep understanding of the investment, often involving legal and financial experts.

Despite the risks, private investments offer the potential for substantial returns. The high-reward nature of these investments is primarily due to the growth potential of privately held companies. These businesses often have the opportunity to scale rapidly, disrupt established markets, or innovate in ways that can significantly impact their industry. Private investors can benefit from the upside of these companies' success, which may include significant capital appreciation and dividends if the company goes public or is acquired.

The key to managing risk and maximizing returns in private investments is diversification. Investors should aim to spread their capital across multiple companies and industries to mitigate the impact of any single investment's performance. Additionally, a long-term investment horizon is often recommended, as private investments can be illiquid and may take time to mature. This approach allows investors to weather short-term market fluctuations and benefit from the long-term growth potential of private companies.

In summary, private investments in businesses present a unique opportunity for investors seeking high-risk, high-reward prospects. While the process requires thorough due diligence and a long-term perspective, the potential for significant returns can be substantial, especially for those who can identify and support innovative and scalable companies in their early stages.

Invest Now: Where to Put Your Money

You may want to see also

Frequently asked questions

Private investment refers to the act of investing in privately held companies, which are businesses that are not listed on public stock exchanges. These investments are typically made by individuals, groups, or institutions that seek to support and grow these companies. Private investments can take various forms, such as venture capital, private equity, angel investments, or seed funding.

Private investments contrast with public investments, which involve buying shares of publicly traded companies on stock markets. In private investments, the investor becomes a part-owner of the company and often has a more hands-on approach, providing strategic guidance and support. Private investments are usually made in exchange for equity, and the investor may also participate in decision-making processes, board meetings, and company growth.

Private investments offer several advantages, including the potential for higher returns, as these companies often have high growth prospects. Investors can also gain a deeper understanding of the business and its industry. However, there are risks involved, such as illiquidity, as private investments may not be easily convertible into cash. Additionally, the lack of public disclosure means less transparency, and investors must rely on due diligence and their own research. Private investments are often more complex and may require a longer-term commitment compared to public investments.