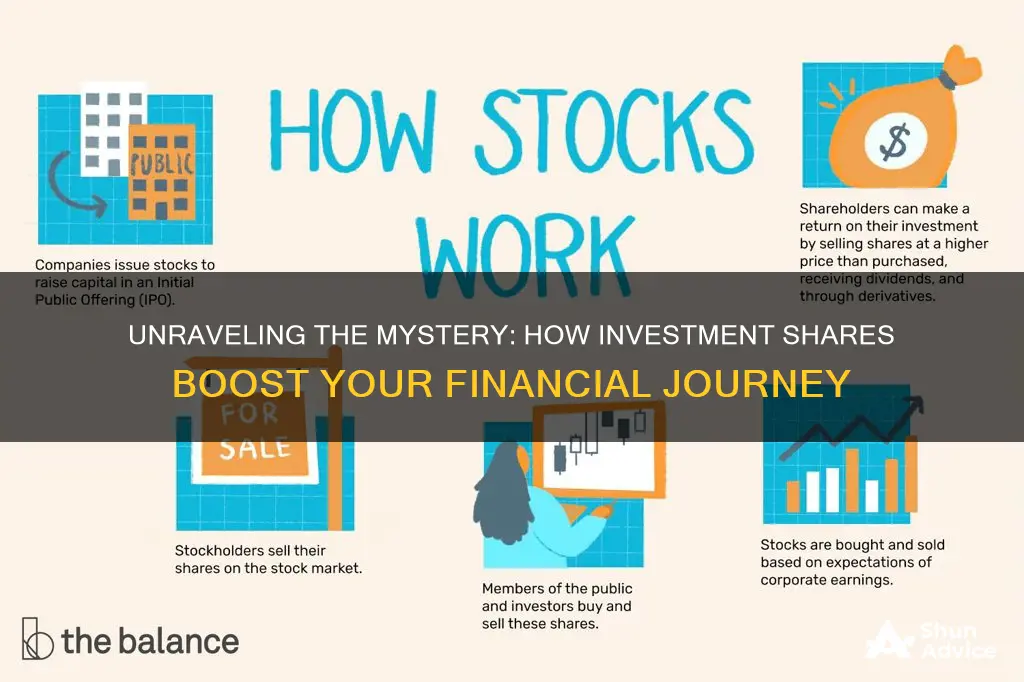

Investment shares, also known as stocks or equities, represent ownership in a company and offer investors a way to participate in its growth and success. When you buy shares, you become a shareholder, entitled to a portion of the company's profits and assets. Understanding how investment shares work is crucial for anyone looking to build wealth through the stock market. This involves learning about the different types of shares, how they are priced, and the various factors that influence their value. Additionally, investors need to grasp the concepts of dividends, voting rights, and the role of stock exchanges in facilitating the buying and selling of shares.

What You'll Learn

- Share Ownership: Investors own a fraction of a company when they buy shares

- Voting Rights: Shareholders can vote on key company decisions

- Dividend Distribution: Profits are distributed to shareholders as dividends

- Capital Appreciation: Share prices can rise, increasing the value of investments

- Risk and Volatility: Share prices can fluctuate, impacting investment returns

Share Ownership: Investors own a fraction of a company when they buy shares

When individuals invest in the stock market, they purchase shares of a company, which represents ownership in that business. This ownership is a fraction of the company's total shares, and it signifies that the investor has a claim to a portion of the company's assets and profits. The concept of share ownership is fundamental to understanding how the stock market operates and how investors can participate in the growth and success of companies.

When an investor buys shares, they become shareholders, and their ownership stake is determined by the number of shares they hold relative to the total number of shares issued by the company. For example, if a company has 1000 shares and an investor purchases 100 shares, they own 10% of the company. This ownership entitles the investor to certain rights, such as voting at shareholder meetings, receiving dividends (if the company decides to distribute profits), and potentially participating in the company's growth over time.

The value of an investor's share is influenced by various factors, including the company's performance, market conditions, and overall economic trends. Share prices fluctuate based on supply and demand dynamics in the market. When a company performs well, its shares may become more attractive to investors, leading to increased demand and potentially higher share prices. Conversely, if the company faces challenges or the market sentiment turns negative, share prices can decline.

Investors can buy and sell shares through a brokerage account, which acts as an intermediary between the investor and the stock market. Brokers facilitate the execution of trades, allowing investors to buy shares when the market is open and sell them when they deem it appropriate. It's important for investors to research and understand the companies they invest in, as well as the risks and potential rewards associated with share ownership.

In summary, buying investment shares means becoming a partial owner of a company. Shareholders have rights and benefits tied to their ownership, and the value of their investment can fluctuate based on market conditions and company performance. Understanding the mechanics of share ownership is crucial for investors to make informed decisions and navigate the complexities of the stock market effectively.

Investing in People: Definition and Impact

You may want to see also

Voting Rights: Shareholders can vote on key company decisions

When you invest in a company by purchasing its shares, you become a shareholder and gain certain rights and privileges. One of the most significant rights is the ability to participate in the company's decision-making process through voting. Shareholders have the power to vote on crucial matters that can shape the future of the company.

Voting rights are a fundamental aspect of owning investment shares. Each share typically carries one vote, allowing shareholders to have a say in various corporate actions. These votes are crucial in determining the direction and governance of the company. Shareholders can vote on essential topics such as the election of board members, major corporate transactions, mergers, and acquisitions, and significant changes to the company's bylaws or articles of incorporation.

During a company's annual or special general meeting, shareholders are given the opportunity to exercise their voting rights. This meeting is a platform for shareholders to voice their opinions and make decisions on critical issues. Shareholders can attend the meeting in person or, in many cases, participate via proxy, where they appoint another person to vote on their behalf. The quorum, or the minimum number of shareholders required to make the meeting valid, must be met for the voting process to proceed.

Voting on key decisions ensures that the company's management is held accountable to the shareholders. It provides an avenue for shareholders to influence strategic choices, such as the appointment of executives, major investments, or changes in business direction. Shareholders can also propose resolutions or amendments to the company's policies, ensuring that their interests are represented.

Furthermore, voting rights empower shareholders to hold the board of directors and management accountable for their actions and performance. Shareholders can vote to re-elect or remove board members, express satisfaction or dissatisfaction with the company's performance, and even initiate a change in the company's leadership. This democratic process allows shareholders to have a say in the company's governance and encourages the board to act in the best interests of the shareholders.

Unit Trust: Why Invest?

You may want to see also

Dividend Distribution: Profits are distributed to shareholders as dividends

Dividend distribution is a fundamental aspect of the investment share system, allowing companies to share their profits with shareholders. When a company generates a profit, it has several options regarding how to utilize those funds. One common approach is to reinvest a portion of the profits back into the business for growth and expansion. However, a significant portion is often distributed to shareholders in the form of dividends.

Dividends are essentially a share of the company's profits, paid out to shareholders as a reward for their investment. The decision to pay dividends and the amount to be distributed is made by the company's board of directors, who consider various factors such as the company's financial health, growth prospects, and the overall market conditions. Shareholders, who own a portion of the company through their investment, are entitled to a portion of these profits based on the number of shares they hold.

The process of dividend distribution typically involves several steps. Firstly, the company announces its intention to pay dividends and discloses the amount per share. This information is usually provided in the company's financial statements or through a press release. Shareholders then receive a specified amount of money for each share they own, often on a quarterly or annual basis. The payment is made directly to the shareholders' bank accounts or in the form of additional shares, depending on the company's policies.

It's important to note that not all companies pay dividends. Some choose to reinvest all profits for business development, especially in growth-oriented industries. Additionally, companies may also retain a portion of the profits as retained earnings, which can be utilized for future expansion, research, or debt repayment. The decision to pay dividends or reinvest profits is crucial for a company's financial strategy and can significantly impact its overall performance and shareholder value.

Understanding dividend distribution is essential for investors as it provides insight into a company's financial health and its commitment to returning value to shareholders. Investors often seek companies with a consistent dividend history, as this indicates stability and a well-managed business. Dividend payments can also provide a regular income stream for investors, making it an attractive feature for those seeking a more passive investment approach.

Altcoin Investment: Best Picks

You may want to see also

Capital Appreciation: Share prices can rise, increasing the value of investments

When you invest in shares, one of the primary ways to grow your wealth is through capital appreciation. This concept is relatively straightforward: as a company's performance improves, its stock price tends to rise, and so does the value of your shares. This increase in value is a direct result of the company's success and the market's perception of its future prospects.

Capital appreciation is a powerful tool for investors as it provides an opportunity to build significant wealth over time. For instance, if you purchase shares of a company at $100 per share and the company's performance leads to a 20% increase in its stock price, your investment is now worth $120 per share. This $20 increase in value is a result of the company's growth and market confidence in its future.

The key to maximizing capital appreciation is to invest in companies with strong growth potential. These are often businesses that are innovative, have a competitive edge, or operate in high-growth industries. By identifying such companies, investors can position themselves to benefit from substantial share price increases. It's important to note that while high-growth companies offer significant potential for capital appreciation, they also come with higher risks, as their stock prices can be more volatile.

Diversification is another strategy to consider when aiming for capital appreciation. Investing in a variety of shares across different sectors and industries can help mitigate risk. If one investment underperforms, the gains from other investments can offset these losses, ensuring a more stable overall return. Additionally, staying informed about market trends and economic factors can help investors make more informed decisions, allowing them to capitalize on emerging opportunities.

In summary, capital appreciation is a fundamental aspect of investing in shares, offering investors the potential to significantly increase their wealth. By understanding the factors that drive share price growth and implementing strategic investment approaches, investors can harness the power of capital appreciation to achieve their financial goals.

Coins to Invest in Now

You may want to see also

Risk and Volatility: Share prices can fluctuate, impacting investment returns

Understanding the concept of risk and volatility is crucial when it comes to investment shares. Share prices are inherently volatile and can fluctuate significantly over time, which directly impacts the returns on your investments. This volatility is primarily driven by market forces and various factors that influence the perceived value of a company's stock.

One of the key aspects of risk in share investments is the potential for price drops. When a company's stock is traded, its price is determined by the forces of supply and demand in the market. If there is a sudden increase in the number of shares being sold or a decrease in demand, the price can fall rapidly. This volatility can be influenced by various events, such as economic downturns, industry-specific crises, or even unexpected company news, like financial scandals or major management changes. For instance, during the 2008 financial crisis, many banks and financial institutions saw their share prices plummet as a result of the global economic turmoil.

Volatility also means that share prices can rise just as quickly as they fall. Positive news, such as strong earnings reports, innovative product launches, or successful expansion into new markets, can drive up the demand for a company's shares, leading to price increases. However, this very nature of volatility can be a double-edged sword. While investors may benefit from significant gains during upward trends, they also face the risk of substantial losses during market downturns.

Diversification is a common strategy to manage risk and volatility. By investing in a variety of shares across different sectors and industries, investors can reduce the impact of any single stock's performance on their overall portfolio. This approach helps to spread the risk, ensuring that the volatility of one investment is offset by the stability of others. Additionally, long-term investors often focus on the overall trend of share prices, believing that the market tends to reward patient investors who weather the short-term fluctuations.

In summary, the concept of risk and volatility is integral to understanding investment shares. Share prices are subject to rapid changes, influenced by numerous factors, and can significantly impact investment returns. While this volatility presents challenges, it also offers opportunities for investors who are well-informed, strategic, and prepared to manage their risk exposure through diversification and a long-term perspective.

Retirement Planning: Why Investing is a Must, Not a Maybe

You may want to see also

Frequently asked questions

Investment shares, also known as stocks or equities, represent ownership in a company. When you buy shares, you become a shareholder and are entitled to a portion of the company's assets and profits.

You can purchase shares through a brokerage account. This involves opening an account with a stockbroker or using an online trading platform, where you can place buy orders for shares of specific companies.

The stock market is a platform where shares of publicly traded companies are bought and sold. It provides a way for companies to raise capital by selling shares to investors and for investors to buy and sell these shares. The stock market's performance is often tracked by stock market indices like the S&P 500 or Dow Jones Industrial Average.

Investors can earn returns from shares in two main ways. Firstly, through dividend payments, where companies distribute a portion of their profits to shareholders. Secondly, by selling shares at a higher price than their purchase price, which is known as capital gains.

Investing in shares carries certain risks. Share prices can fluctuate due to various factors, including market trends, company performance, economic conditions, and investor sentiment. This volatility can lead to potential losses. Additionally, individual companies may face specific risks related to their industry, management, or financial health.