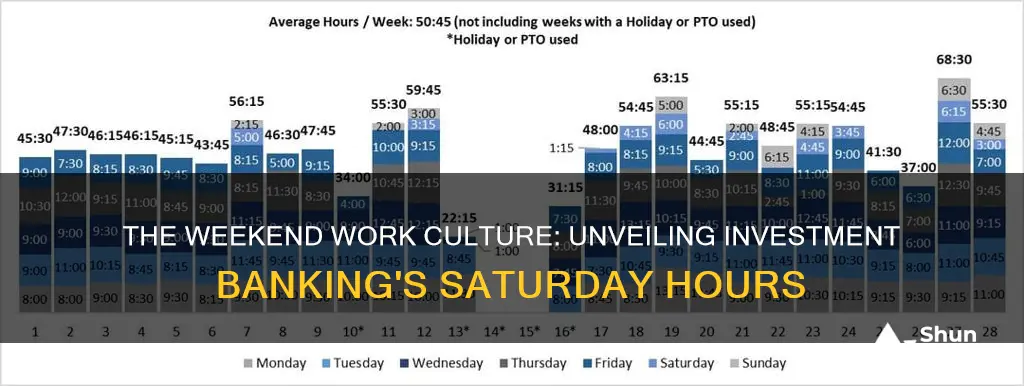

The question of whether investment bankers typically work on Saturdays is an intriguing one, especially given the high-pressure nature of the financial industry. While the industry is known for its demanding work culture, with long hours and tight deadlines being the norm, the specific practice of working weekends varies. Some investment bankers may find themselves working Saturdays due to the time-sensitive nature of certain deals or the need to meet client expectations. However, this is not a universal practice, and many firms have policies in place to ensure a healthy work-life balance for their employees. Understanding the reasons behind weekend work can provide insight into the challenges and rewards of a career in investment banking.

| Characteristics | Values |

|---|---|

| Work Culture | Investment banking is known for its demanding and high-pressure environment, often requiring long hours, including weekends. |

| Industry Norms | Working Saturdays is common in the industry, especially during busy periods like earnings seasons or M&A deals. |

| Client Expectations | Clients in the financial sector often require 24/7 access and immediate responses, leading to a culture of always being available. |

| Competitive Landscape | The industry is highly competitive, and professionals may feel pressured to work extra hours to stay ahead and secure business. |

| Compensation and Benefits | Some firms offer additional compensation or incentives for working weekends, recognizing the demands of the role. |

| Work-Life Balance | Achieving a healthy work-life balance can be challenging, as the job often demands a significant time commitment. |

| Personal Preferences | Individual preferences vary; some bankers may enjoy the flexibility and the opportunity to work on high-profile projects. |

| Regulatory Considerations | Certain regulations may require bankers to be available during specific hours, including weekends. |

| Technological Advancements | Technology enables remote work and instant communication, making it easier to collaborate across time zones. |

| Career Progression | Long hours and a willingness to work weekends can be seen as a sign of dedication and may contribute to career advancement. |

What You'll Learn

- Work Culture: Investment banking often demands long hours, including weekends, reflecting a culture of dedication and commitment

- Compensation and Benefits: High earnings and perks may justify weekend work, but they don't always ensure a balanced lifestyle

- Client Demands: Clients' urgent needs and global markets' 24/7 operation can lead to weekend work

- Project Deadlines: Tight deadlines and complex deals may require extended hours, including Saturdays, to meet targets

- Industry Norms: Weekend work is common in finance, driven by competitive pressures and the need for rapid decision-making

Work Culture: Investment banking often demands long hours, including weekends, reflecting a culture of dedication and commitment

The investment banking industry is renowned for its demanding work culture, often requiring employees to work long hours, including weekends. This culture is deeply ingrained and has become a defining characteristic of the profession. The expectation to be available and productive at all times, even on Saturdays, is a reflection of the industry's fast-paced nature and the high-stakes environment in which investment bankers operate.

This work culture is often associated with a strong sense of dedication and commitment to the job. Investment bankers are expected to be highly motivated, driven, and willing to go the extra mile to meet client needs and secure deals. The long hours are seen as a necessary trade-off for success and career advancement in this competitive field. Many professionals in this industry take pride in their ability to manage a heavy workload and maintain a high level of performance, even when it means working beyond the traditional 9-to-5 schedule.

The culture of long hours can be traced back to the industry's historical roots, where deals and transactions often required last-minute negotiations and quick decision-making. This has evolved into a tradition where investment bankers are expected to be readily available to handle urgent matters, regardless of the day or time. The pressure to deliver results and maintain a competitive edge in the market contributes to the demanding work schedule.

However, this work culture has its critics and potential drawbacks. The constant availability and long hours can lead to burnout and fatigue, affecting the overall well-being of investment bankers. It may also impact personal lives and relationships, as the job often demands a significant amount of time and energy. Balancing the demands of the job with personal responsibilities can be challenging, and it requires a certain level of self-discipline and time management skills.

Despite the challenges, many investment bankers embrace this work culture as a necessary part of their profession. They understand the importance of being responsive and dedicated to their clients and the industry's unique demands. This dedication is often rewarded with opportunities for career growth and success in a highly competitive and lucrative field.

SoFi's Automated Investing: A Beginner's Guide to Hands-Off Wealth Building

You may want to see also

Compensation and Benefits: High earnings and perks may justify weekend work, but they don't always ensure a balanced lifestyle

The high-pressure nature of investment banking often leads to long hours, including weekends, as professionals strive to meet client demands and deadlines. While the industry is renowned for its lucrative compensation packages, the trade-off can be a significant impact on personal time and overall well-being. The question of whether the substantial earnings and benefits justify the weekend work is a complex one, as it involves weighing the financial rewards against the potential strain on an individual's health and personal life.

Compensation and benefits play a crucial role in this context. Investment bankers often enjoy competitive salaries, bonuses, and comprehensive benefits packages. These perks can include health insurance, retirement plans, and generous vacation allowances. For many, the financial incentives are substantial enough to motivate them to work weekends, as the potential for high earnings can significantly contribute to their overall financial goals and security. However, it is essential to recognize that financial compensation alone may not be sufficient to address the challenges associated with weekend work.

A balanced lifestyle is a critical aspect of overall job satisfaction and well-being. When investment bankers consistently work on weekends, it can lead to a sense of isolation from family and friends, disrupting social connections and personal relationships. The lack of a consistent work-life balance may result in increased stress, burnout, and even physical health issues. While high earnings can provide financial security, they do not guarantee a healthy or fulfilling personal life if the work demands continue to encroach on personal time.

To ensure a more balanced approach, it is advisable for investment bankers to prioritize self-care and set clear boundaries. This may involve learning to delegate tasks, utilizing technology to streamline processes, and effectively managing time to create a healthier work-life integration. Additionally, firms should consider implementing policies that promote a healthier work environment, such as flexible work arrangements and regular wellness initiatives, to support employees in maintaining a sustainable lifestyle despite the demanding nature of the industry.

In conclusion, while the high earnings and benefits in investment banking can be attractive, they should not be the sole determining factor in justifying weekend work. A comprehensive approach to employee well-being should be adopted, focusing on both financial incentives and the preservation of personal time and relationships. By recognizing the importance of a balanced lifestyle, investment bankers can strive for success while also prioritizing their health and happiness.

College Loans or Investments: Navigating the Financial Crossroads

You may want to see also

Client Demands: Clients' urgent needs and global markets' 24/7 operation can lead to weekend work

In the fast-paced world of investment banking, the demands of clients and the global markets can often lead to a 24/7 operation, including weekends. This is a reality that many investment bankers have come to accept and even embrace as part of their profession. The nature of their work, which involves facilitating complex financial transactions, providing strategic advice, and managing client portfolios, often requires a high level of responsiveness and availability.

Clients, especially in the corporate and institutional sectors, have urgent needs that may arise at any time. These needs can range from immediate financial advice during market volatility to last-minute deal-making and crisis management. For instance, a client might require rapid assistance to navigate a sudden market shift, secure a strategic investment, or address a liquidity crisis. Such situations often demand immediate attention, and investment bankers must be prepared to work beyond standard business hours to meet these demands.

The global markets, with their 24-hour trading sessions, further exacerbate the need for weekend availability. Financial markets operate across different time zones, and significant events or news can impact markets at any hour. Investment bankers must stay abreast of these developments, analyze market trends, and provide real-time insights to clients. This often involves monitoring news feeds, market data, and economic indicators around the clock, ensuring that clients receive timely and accurate information.

Moreover, the competitive landscape in investment banking is intense, with firms striving to provide the best service and maintain a competitive edge. This often translates to a culture of long hours and a willingness to work beyond the traditional 9-to-5 schedule. Investment bankers may find themselves responding to client requests or market opportunities that arise during the weekend, especially when dealing with time-sensitive matters.

While the weekend work can be demanding and may impact work-life balance, many investment bankers find it rewarding. The sense of urgency and the satisfaction of providing critical support during challenging times can be a driving force. Additionally, the ability to work flexibly and adapt to the dynamic nature of the financial markets is a valuable skill that can set investment bankers apart in their careers.

Prosperity's Promise: Exploring the Potential of Will Prosper Investments

You may want to see also

Project Deadlines: Tight deadlines and complex deals may require extended hours, including Saturdays, to meet targets

In the fast-paced world of investment banking, managing project deadlines and handling intricate deals often demands a significant commitment from professionals. It is not uncommon for investment bankers to find themselves working beyond the standard 9-to-5 schedule, including weekends like Saturdays, to meet these demanding targets. This extended workweek is a critical aspect of the job, ensuring that clients receive timely and efficient services.

Tight deadlines are a prevalent challenge in investment banking, especially when dealing with mergers, acquisitions, or initial public offerings (IPOs). These processes often involve numerous stakeholders, complex legal and regulatory frameworks, and intricate financial modeling. To ensure timely completion, investment bankers may need to work late into the night, sometimes even on Saturdays, to gather and analyze data, draft documents, and coordinate with various teams. The pressure to meet these deadlines can be intense, requiring a dedicated and flexible approach to work.

Complex deals, on the other hand, demand a meticulous and thorough process. Investment bankers are tasked with conducting in-depth research, assessing market trends, and performing due diligence. This process can be time-consuming and may extend well into the evening or even require work on weekends. For instance, a deal involving international parties or multiple regulatory jurisdictions might necessitate real-time communication and collaboration across different time zones, making Saturday work a regular occurrence.

The culture of long work hours in investment banking is deeply ingrained and often seen as a sign of dedication and professionalism. However, it is essential to maintain a healthy work-life balance. Banks and financial institutions are increasingly implementing policies to support employee well-being, such as flexible work arrangements and mandatory time off. These measures aim to ensure that professionals can manage their personal and professional responsibilities effectively, even when extended work hours are required.

In summary, the nature of investment banking, with its tight deadlines and complex deals, often results in a need for extended work hours, including Saturdays. While this aspect of the job can be demanding, it is a testament to the industry's commitment to delivering exceptional services to clients. Balancing these requirements with employee well-being is an ongoing challenge, and organizations are adapting to create a more sustainable work environment.

Volatility: Friend or Foe?

You may want to see also

Industry Norms: Weekend work is common in finance, driven by competitive pressures and the need for rapid decision-making

Weekend work is a prevalent practice in the finance industry, particularly within investment banking. This norm is deeply ingrained in the culture and operations of these firms, often driven by intense competitive pressures and the need for swift, decisive actions. The fast-paced nature of financial markets demands that investment bankers are readily available to respond to market shifts, client demands, and regulatory changes, often requiring them to work beyond traditional 9-to-5 hours.

The competitive landscape in finance is fierce, with banks vying for market share, client relationships, and prestigious deals. In this high-stakes environment, the ability to act quickly and efficiently can be a significant differentiator. Weekend work allows investment bankers to be more responsive to opportunities and challenges that may arise outside regular business hours. For instance, a sudden market downturn or an unexpected acquisition offer might require immediate attention, and being available on weekends can provide a competitive edge.

Moreover, the nature of investment banking often involves dealing with time-sensitive matters. These can include executing large transactions, managing client portfolios, or providing real-time market analysis. Such tasks frequently demand a rapid response, and the weekend work culture ensures that bankers can deliver these services without delay. This is especially crucial in industries where timing can significantly impact the success of a deal or the performance of a client's portfolio.

The weekend work culture in investment banking is also influenced by the global nature of financial markets. With trading and market activities spanning multiple time zones, bankers often need to coordinate with colleagues and clients worldwide. This global connectivity means that being available on weekends is essential to ensure seamless communication and collaboration, especially when dealing with international clients and markets.

However, the prevalence of weekend work in investment banking has raised concerns about work-life balance and employee well-being. The long hours and frequent weekend commitments can lead to burnout and fatigue, impacting personal lives and overall health. As a result, many firms are now implementing policies to address these issues, such as flexible work arrangements, enhanced support for mental health, and regular reviews of workload and schedules to ensure a more sustainable work environment.

TBN Network's Retirement Fund Options: A Secure Investment Path?

You may want to see also

Frequently asked questions

While investment banking is a demanding profession, the work schedule can vary significantly. It is not uncommon for investment bankers to work on weekends, especially during busy periods or when dealing with time-sensitive deals. However, the frequency of Saturday work can depend on the individual firm's culture, the specific role, and the nature of the projects they are handling.

Saturdays can be crucial for deal-making, especially in the financial industry. Investment bankers often need to meet with clients, conduct research, finalize documents, or coordinate with various parties involved in a transaction. These tasks may require extended hours, including weekends, to ensure timely completion and successful deal execution.

Maintaining a healthy work-life balance can be challenging for investment bankers, especially those with Saturday work. The job often demands long hours, late nights, and occasional weekend commitments. To manage this, many bankers prioritize self-care, set clear boundaries, and ensure they take time off when possible. It's essential for individuals to find a sustainable routine that allows them to recharge and maintain their well-being.