Pipe investments, also known as pipeline investments, are a unique and innovative approach to investing in the energy sector. This strategy involves investing in companies that are involved in the exploration, production, and transportation of oil, gas, and other natural resources through pipelines. Pipe investments offer investors a way to gain exposure to the energy industry while also benefiting from the stability and reliability of these essential infrastructure projects. By investing in these pipelines, individuals can contribute to the development and maintenance of critical energy infrastructure, ensuring a steady supply of resources for various industries and communities. Understanding how pipe investments work can provide valuable insights for investors seeking to diversify their portfolios and support the energy sector's long-term growth.

What You'll Learn

- Pipe Investment Structure: Understand the legal framework and how pipes are structured as investment vehicles

- Tax Advantages: Explore the tax benefits and how they can attract investors

- Income Generation: Learn how pipes generate income through various sources and distribution models

- Risk Assessment: Analyze the risks associated with pipe investments and strategies to mitigate them

- Regulatory Compliance: Study the regulatory environment and compliance requirements for pipe investment operations

Pipe Investment Structure: Understand the legal framework and how pipes are structured as investment vehicles

The term "pipe investment" is often used in the context of private equity and venture capital, referring to a structured investment approach that involves a series of steps and legal arrangements. This investment strategy is designed to provide a structured and organized way of investing in companies, particularly in the early stages of their growth. Here's an overview of the legal framework and structure of pipe investments:

Legal Structure: Pipe investments typically involve a master-feeder fund structure. This structure is a common approach in private equity, where a master fund, often a limited partnership, acts as the primary investment vehicle. This master fund then raises capital from investors, who become limited partners. The master fund then invests in a feeder fund, which is a separate legal entity. The feeder fund is a sub-fund within the master fund and is designed to invest in specific sectors, industries, or types of companies. This structure allows for a more flexible and tailored investment approach. Each feeder fund can have its own investment criteria, manager, and investment strategy, providing a diversified portfolio of investments.

Investment Process: The process begins with the master fund raising capital from investors, often institutional investors, family offices, or high-net-worth individuals. These investors commit a certain amount of capital, becoming limited partners in the master fund. The master fund then appoints a general partner or investment manager who oversees the investment strategy and decision-making. When an investment opportunity arises, the master fund's investment committee evaluates and decides on the investment. If approved, the master fund invests in the feeder fund, which then allocates capital to the specific investment. This structure ensures a streamlined process, allowing for quick decision-making and efficient capital allocation.

Benefits and Advantages: Pipe investments offer several advantages. Firstly, they provide a structured and organized approach, making it easier for investors to understand and manage their investments. The master-feeder structure allows for diversification, as investors can choose to invest in multiple feeder funds with different investment strategies. This also enables investors to align their investments with specific sectors or industries they are interested in. Additionally, the use of feeder funds allows for a more targeted and focused investment approach, catering to specific investment themes or opportunities.

Legal Considerations: Understanding the legal framework is crucial for investors. The master-feeder structure involves complex legal agreements and partnerships. Investors should carefully review the limited partnership agreements, which outline the rights, obligations, and distribution of profits and losses. The investment manager's role and decision-making authority should be clearly defined in the management agreements. Additionally, investors should be aware of the tax implications, as pipe investments may have different tax treatments compared to traditional investment vehicles. Seeking legal and financial advice is essential to ensure a comprehensive understanding of the investment structure.

In summary, pipe investments provide a structured and organized approach to investing in private equity and venture capital opportunities. The master-feeder fund structure offers flexibility, diversification, and a tailored investment strategy. Understanding the legal framework and the specific terms of the investment vehicle is crucial for investors to make informed decisions and ensure their investments are aligned with their financial goals.

SPACs: The New Investment Craze

You may want to see also

Tax Advantages: Explore the tax benefits and how they can attract investors

Pipe investments, also known as real estate investment trusts (REITs), offer a unique and attractive investment opportunity, particularly for those seeking tax advantages. These investments are structured to provide investors with a way to gain exposure to the real estate market while enjoying certain tax benefits. One of the key tax advantages of pipe investments is the ability to defer capital gains taxes. When an investor sells a property or asset, they typically have to pay capital gains tax on the profit made. However, with pipe investments, the process is designed to allow investors to defer these taxes. This is achieved through a mechanism called "tax-deferral" or "tax-sheltered" status. By reinvesting the proceeds from the sale into new properties or assets, investors can delay the payment of capital gains tax until a later date, often indefinitely. This deferral can be particularly beneficial for long-term investors who aim to build a diversified real estate portfolio over time.

Additionally, pipe investments often provide tax credits and deductions, which can further enhance the overall tax efficiency. These credits and deductions may include expenses related to the acquisition, development, or improvement of properties. For example, investors can claim deductions for interest payments, property management fees, and other costs associated with the investment. These tax benefits can significantly reduce the overall tax liability for investors, making pipe investments an appealing choice for those looking to optimize their tax strategy.

The tax advantages of pipe investments extend beyond the individual investor. In many cases, these investments are structured as pass-through entities, such as partnerships or S corporations. This structure allows the tax benefits to flow through to the investors, who then report their share of the income or losses on their personal tax returns. This pass-through nature can be advantageous for high-income individuals or those in higher tax brackets, as it may enable them to take advantage of lower tax rates on their investment income.

Furthermore, the tax benefits of pipe investments can attract a wide range of investors, including high-net-worth individuals, institutional investors, and retirement plans. For high-net-worth individuals, the tax efficiency can provide an attractive alternative to traditional investment vehicles. Institutional investors, such as pension funds or endowments, may be drawn to the stability and tax advantages offered by pipe investments, especially when considering long-term investment strategies. Retirement plans, including 401(k)s and IRAs, can also benefit from the tax-deferral aspect, allowing investors to build a substantial real estate portfolio over time while deferring taxes until retirement.

In summary, pipe investments offer a compelling opportunity for investors to gain exposure to the real estate market while enjoying significant tax advantages. The ability to defer capital gains taxes, combined with tax credits and deductions, provides a powerful incentive for investors to consider this investment strategy. By understanding and utilizing these tax benefits, investors can potentially maximize their returns and build a robust real estate portfolio while optimizing their tax position.

What Your Peers are Investing In

You may want to see also

Income Generation: Learn how pipes generate income through various sources and distribution models

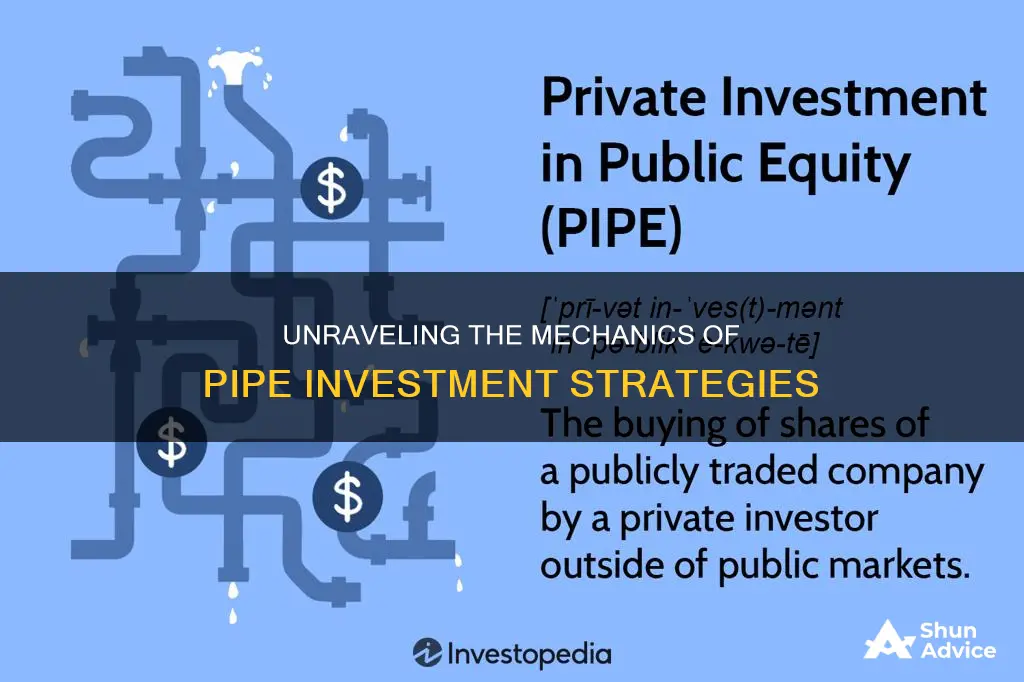

Pipe investments, often referred to as "PIPEs" (Private Investment in Public Equity), are a unique type of investment vehicle that allows private equity firms or investors to invest in public companies. This mechanism provides an alternative to traditional public offerings and initial public offerings (IPOs) for companies seeking to raise capital. The concept of PIPE investments revolves around the idea of providing a direct investment channel between private investors and public companies, offering several advantages and income generation opportunities.

One of the primary income sources for pipe investments is the investment itself. When a private investor or a private equity firm invests in a public company through a PIPE deal, they purchase a stake in the company's shares. This investment can generate income in several ways. Firstly, the investor can benefit from capital appreciation as the company's stock price increases over time. This is a common strategy for private equity firms, who often aim to build value in the companies they invest in and then exit with a profit. Secondly, investors can receive dividends if the company decides to distribute a portion of its profits to shareholders. This is especially attractive for income-seeking investors who value regular returns.

PIPE investments often come with various distribution models that determine how the income is generated and shared. One common model is the "locked-in" or "restricted" model, where the investment is held for a specific period, typically 12 to 24 months. During this time, the investor is restricted from selling the shares, ensuring a long-term commitment. This model often provides a higher rate of return as the company has the opportunity to execute its growth strategies without the pressure of an immediate exit. Another distribution model is the "unlocked" or "free-trading" model, where the shares are immediately tradable, allowing investors to buy or sell at their discretion. This model provides more flexibility but may result in lower returns due to the potential for frequent trading.

Additionally, pipe investments can generate income through strategic partnerships and value-added services. Private equity firms often bring expertise and resources to the table, helping the invested company improve its operations, expand its market reach, or develop new products. This can lead to increased profitability and, subsequently, higher dividend payments or capital gains for investors. Furthermore, PIPE deals may include special rights or preferences, such as the ability to participate in future financings or receive a higher dividend rate, providing additional income streams for investors.

In summary, pipe investments offer a structured way for private investors and equity firms to generate income by investing in public companies. Through various distribution models and strategic partnerships, investors can benefit from capital appreciation, dividends, and value-added services. Understanding these income generation aspects is crucial for investors looking to diversify their portfolios and explore alternative investment opportunities in the public market.

Smart Money: Where's It Going?

You may want to see also

Risk Assessment: Analyze the risks associated with pipe investments and strategies to mitigate them

Pipe investments, also known as pipeline investments, are a relatively new concept in the investment world, offering an alternative to traditional buy-and-hold strategies. These investments involve buying and selling securities in a short period, often within minutes or seconds, to capitalize on small price movements. While this approach can be lucrative, it also comes with several risks that investors should carefully assess.

One of the primary risks associated with pipe investments is the high-frequency trading (HFT) environment. HFT firms use advanced algorithms and technology to execute trades at lightning speeds, often outpacing human traders. This rapid trading can lead to increased market volatility, as small price fluctuations can trigger multiple buy and sell orders. As a result, the market may become more susceptible to flash crashes, where prices drop dramatically in a short time, causing significant losses for investors. To mitigate this risk, investors should consider implementing strict risk management protocols, such as setting stop-loss orders to limit potential losses and regularly monitoring market conditions to identify any unusual price movements.

Another critical aspect of risk assessment is understanding the impact of market liquidity. Pipe investments often rely on liquid markets, where assets can be bought or sold quickly without significantly affecting the market price. However, during times of high market volatility or economic uncertainty, liquidity can dry up, making it challenging to execute trades at favorable prices. This lack of liquidity can lead to slippage, where the actual trade price deviates from the desired price, resulting in potential losses. Investors should carefully analyze market conditions and consider using limit orders to ensure they get the desired price, even in illiquid markets.

Additionally, the complexity of pipe investments requires a deep understanding of market dynamics and technical analysis. These investments often involve sophisticated strategies, such as arbitrage, where investors exploit price differences between related securities. While this can be profitable, it also carries the risk of errors or miscalculations. Investors should continuously educate themselves about market trends, develop robust trading strategies, and consider backtesting their approaches to ensure they are effective in various market conditions.

To mitigate these risks, investors should adopt a comprehensive risk management approach. This includes diversifying their investment portfolio to spread risk, implementing robust transaction monitoring systems to detect and prevent unauthorized trades, and regularly reviewing and adjusting their investment strategies based on market performance. Furthermore, staying informed about regulatory changes and industry best practices is essential to ensure compliance and make informed investment decisions.

In summary, pipe investments offer an exciting opportunity to capitalize on short-term market movements, but they also present unique risks. By thoroughly assessing these risks, implementing robust risk management strategies, and staying informed, investors can navigate the complexities of pipe investments and potentially achieve their financial goals while minimizing potential losses.

The Franchise Bet: Will Roundtree's Investment Gamble

You may want to see also

Regulatory Compliance: Study the regulatory environment and compliance requirements for pipe investment operations

The regulatory landscape for pipe investments is complex and varies across different jurisdictions. It is crucial for investors to understand the specific rules and regulations governing this type of investment to ensure compliance and mitigate potential risks. Here's an overview of the key considerations:

Industry Regulations: Pipe investments, often associated with infrastructure projects, are subject to industry-specific regulations. These rules are designed to protect investors and ensure the integrity of the investment process. For instance, in the United States, the Securities and Exchange Commission (SEC) regulates the offering and sale of pipe investments, requiring companies to provide detailed disclosures and adhere to specific reporting standards. Investors should familiarize themselves with the relevant industry bodies and their guidelines, such as the regulations set by the SEC or similar financial authorities in their respective countries.

Compliance and Due Diligence: A comprehensive study of the regulatory environment is essential. This involves examining the legal and compliance requirements, including registration processes, licensing, and reporting obligations. Pipe investment operations often need to comply with environmental regulations, safety standards, and construction permits. Due diligence should include verifying the project's adherence to these regulations and assessing the potential risks associated with non-compliance. Investors should also consider the legal structure of the investment, such as whether it is structured as a limited partnership or a trust, as each has its own set of regulatory implications.

Transparency and Disclosure: Regulatory bodies often mandate strict disclosure requirements to ensure transparency. Pipe investment companies are typically obligated to provide investors with detailed information about the project, including financial statements, cash flow projections, and risk assessments. These disclosures should be accurate, timely, and presented in a manner accessible to investors. Understanding the specific disclosure obligations is vital to ensure that investors receive the necessary information to make informed decisions.

International Considerations: For cross-border pipe investments, investors must navigate the regulatory complexities of multiple jurisdictions. International projects may be subject to different tax laws, environmental standards, and investment regulations. It is essential to study the host country's regulations, including any specific permits or approvals required for foreign investment. Consulting legal and compliance experts familiar with international investment regulations can provide valuable guidance in this area.

Staying informed about regulatory changes is an ongoing process. Investors should regularly review and update their knowledge of the relevant laws and regulations to ensure their pipe investment operations remain compliant. This includes monitoring changes in tax laws, environmental policies, and any new industry-specific regulations that may impact their investments.

Coins to Catch: Navigating the Crypto Investment Landscape

You may want to see also

Frequently asked questions

Pipe investments, short for "private investment in public equity," are a type of investment vehicle that allows private investors to invest in public companies. It involves a private equity firm or a group of investors pooling their capital to invest in a public company, often with the goal of taking the company private or achieving specific financial objectives.

Pipe investments offer several advantages. Firstly, they provide an opportunity to invest in well-established companies with strong growth potential. Investors can benefit from the expertise of the private equity firm managing the investment, who may have a strategic plan to enhance the company's performance. Additionally, pipe investments often offer higher returns compared to traditional public investments due to the potential for value creation and the ability to negotiate favorable terms.

While pipe investments can be lucrative, they also carry certain risks. One significant risk is the potential for loss if the investment does not perform as expected. The success of the investment depends on the private equity firm's ability to identify undervalued companies and execute their strategic vision. Additionally, pipe investments may have longer investment horizons, and investors might need to commit a substantial amount of capital for an extended period. It is crucial to conduct thorough research and due diligence to assess the risks and ensure they align with the investor's financial goals and risk tolerance.