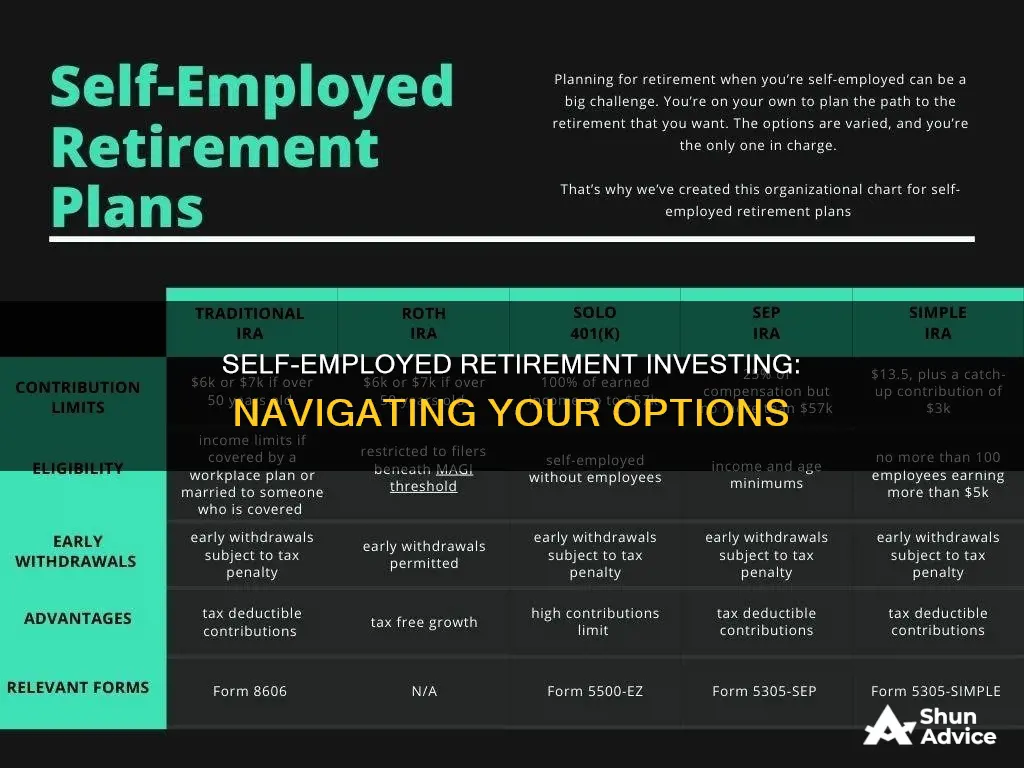

Being self-employed comes with a unique set of challenges when it comes to planning for retirement. Without access to employer-sponsored retirement plans like 401(k)s, self-employed individuals must take the initiative to set up their own retirement savings plans. Fortunately, several options are available, including traditional or Roth IRAs, solo 401(k)s, SEP IRAs, SIMPLE IRAs, and defined benefit plans. Each of these plans offers different contribution limits, tax advantages, and flexibility, catering to the diverse needs of the self-employed.

| Characteristics | Values |

|---|---|

| Number of plans | 5 |

| Plan names | Traditional or Roth IRA, Solo 401(k), SEP IRA, SIMPLE IRA, Defined benefit plan |

| Who is it for? | Self-employed people or small-business owners |

| Contribution limit | Varies depending on the plan |

| Tax advantage | Varies depending on the plan |

| Employee element | Varies depending on the plan |

What You'll Learn

Traditional or Roth IRA

The main difference between traditional and Roth IRAs is the way they are taxed. With a traditional IRA, you may be able to deduct your contributions from your taxes, lowering your taxable income. With a Roth IRA, you pay taxes on the money you put in, but when you withdraw the money in retirement, it is tax-free. There are also no required minimum distributions with a Roth IRA, and you can transfer the account to your heirs tax-free. However, there are income limits for eligibility for a Roth IRA, and those who earn above a certain amount cannot contribute.

The contribution limit for IRAs in 2024 is $7,000, or $8,000 if you are aged 50 or older.

Investing 101: Post-College Edition

You may want to see also

Simplified Employee Pension (SEP) IRA

A Simplified Employee Pension (SEP) IRA is a retirement savings plan that is ideal for self-employed individuals and small-business owners with few or no employees. It is a traditional IRA that allows self-employed people to save for retirement with tax benefits.

SEP IRAs are easy to set up and administer, with no start-up or operating costs. They are funded by employer contributions only, which are tax-deductible and can be up to 25% of each eligible employee's income or a maximum of $69,000 in 2024. Employers are not required to contribute every year and can change the contribution percentage annually. Employees own and control their accounts and can choose from various investment options, including stocks, bonds, mutual funds, and ETFs.

Who is eligible?

Eligible employees must be at least 21 years old, have worked for the employer for at least three of the past five years, and have earned a minimum of $750 in 2024. Employers can set less restrictive but not more restrictive participation requirements.

Withdrawals and contributions

Contributions and earnings can be withdrawn at any time but are subject to the limitations imposed on traditional IRAs. Withdrawals before the age of 59½ are generally subject to a 10% additional tax. SEP contributions and earnings must eventually be distributed following the IRA's required minimum distribution rules, which, beginning in 2023, must start at age 73.

Pros and cons

The high contribution limit of up to $69,000 in 2024, tax-deductible contributions, and flexibility in contributions are some of the advantages of SEP IRAs. However, there is no catch-up contribution for savers aged 50 or older, and there is no Roth version available. Additionally, if you contribute to your own SEP IRA, you must also contribute to each eligible employee's account.

Invest in Cars: Buyer's Guide

You may want to see also

Savings Incentive Match Plan for Employees (SIMPLE) IRA

A Savings Incentive Match Plan for Employees (SIMPLE) IRA is a type of tax-deferred retirement account that may be established by employers, including self-employed individuals. It is ideally suited as a start-up retirement savings plan for small employers who are not currently sponsoring a retirement plan. SIMPLE IRAs are easy to implement and have lower start-up and administrative costs than many other retirement plans. They also have lower contribution limits than most other employer-sponsored retirement plans.

Here's how SIMPLE IRAs work:

- Only employers who do not offer other retirement plans and have fewer than 100 employees can set up and offer a SIMPLE IRA.

- SIMPLE IRAs require employers to make a minimum contribution to the employee's account. The yearly contribution can be either a matching contribution of up to 3% of compensation or a 2% non-elective contribution for each eligible employee.

- Employees may elect to contribute to their SIMPLE IRA, but they are not required to.

- Contributions to SIMPLE IRAs are immediately 100% vested, and the IRA owner directs the investments.

- SIMPLE IRAs have the same rules on investments, distributions, and rollovers as traditional individual retirement accounts (IRAs).

- SIMPLE IRAs cannot be rolled over to a traditional IRA until a two-year waiting period has passed, starting from when the employee first participated in the plan.

- SIMPLE IRAs have lower contribution limits than other workplace retirement plans. For 2024, the contribution limit is $16,000, with people aged 50 and older allowed to make a catch-up contribution of an extra $3,500.

- There is no Roth version of the SIMPLE IRA.

- Participant loans are not allowed.

- There is a steep tax penalty for some early withdrawals. A 10% additional tax applies for withdrawals before the age of 59 1/2, and a 25% additional tax applies for withdrawals within the first two years of participation.

To set up a SIMPLE IRA plan, employers must:

- Sign an IRS Form 5304-SIMPLE, Form 5305-SIMPLE, or an IRS-approved prototype SIMPLE IRA plan offered by a qualified financial institution.

- Provide eligible employees with information about the SIMPLE IRA plan.

- Establish a SIMPLE IRA account for each eligible employee using either a custodial account or trust account.

Retirement Investment Strategies: Growing Your Nest Egg After Work

You may want to see also

One-participant 401(k)

A one-participant 401(k), also known as a solo 401(k), is a retirement plan for self-employed individuals or business owners with no employees other than their spouse. It is designed to mimic an employer-sponsored 401(k) plan and offers high contribution limits, flexible investment options, and relatively easy administration.

As a self-employed individual, you can contribute to a solo 401(k) in two ways: as the employee and as the employer. In 2024, you can contribute up to $23,000 as the employee (or up to $30,500 if you're 50 or older), and up to 25% of your compensation as the employer, for a total contribution limit of $69,000 ($76,500 if you're 50 or older). These contributions can be made to either a traditional pre-tax 401(k) or a Roth 401(k). With a traditional 401(k), contributions are made pre-tax, reducing your taxable income for the year, and distributions in retirement are taxed as ordinary income. On the other hand, contributions to a Roth 401(k) are made with after-tax dollars, and qualified distributions in retirement are tax-free.

Solo 401(k)s are relatively easy to set up and administer. You can open an account at many online brokers, and some institutions do not charge any setup or maintenance fees. When choosing a plan, consider factors such as investment options, fees, administrative support, and the ability to take out loans. Additionally, keep in mind that if your solo 401(k) balance exceeds $250,000, you may have to file an annual report with the IRS.

Solo 401(k)s offer self-employed individuals and business owners a powerful tool to save for retirement, with high contribution limits and flexible investment options. By contributing as both employee and employer, you can maximize your retirement savings and enjoy the tax advantages of traditional or Roth 401(k) plans.

Best Etoro Investments Today

You may want to see also

Defined benefit plan

A defined benefit plan is a pension plan for self-employed professionals, allowing for significantly larger contributions than other retirement plans. It is best for those with no employees who have a high, stable income and want to save a lot for retirement each year.

When setting up a defined benefit plan, you work with an actuary to determine your retirement payout. The actuary will calculate your monthly or annual contributions based on this desired retirement amount, as well as other factors such as your age and expected returns on plan investments.

Contributions are generally tax-deductible, and distributions in retirement are taxed as income. There are no individual accounts with defined benefit plans; instead, assets to pay individual benefits are pooled. Each year, an actuary determines a contribution range to ensure benefits are funded according to IRS guidelines.

While defined benefit plans allow for large contributions, they can be complicated to set up and costly to run. There are startup fees, annual actuarial calculations, administrative requirements, and filing fees for IRS Form 5500. You must also commit to funding your plan at a minimum level each year to meet payout requirements, regardless of your business's performance. If you have employees, you are required to offer them the plan, which can be expensive.

Why People Avoid Investing

You may want to see also

Frequently asked questions

Self-employed people can choose from a variety of retirement plans, including a traditional or Roth IRA, a Solo 401(k), a SEP IRA, a SIMPLE IRA, or a defined benefit plan.

A Solo 401(k), also known as a one-participant 401(k), allows self-employed individuals to contribute as both the employee and the employer, offering a higher contribution limit compared to other plans.

A SEP IRA, or Simplified Employee Pension IRA, is a retirement plan that allows self-employed individuals and small business owners to contribute up to 25% of their net earnings each year, with a maximum annual contribution limit. The business owner contributes to the plan, and all employees must receive the same percentage contribution.

A SIMPLE IRA, or Savings Incentive Match Plan for Employees IRA, is a retirement plan that combines features of a traditional IRA and a 401(k) plan. It is suitable for small businesses with up to 100 employees and allows both employers and employees to contribute. Employers must either match employee contributions up to 3% of their salary or contribute a fixed 2% to all eligible employees' salaries.

Yes, self-employed individuals can also consider a Health Savings Account (HSA) if they have a high-deductible health insurance plan. While HSAs are designed for medical expenses, they can also function as a retirement account, allowing tax-free withdrawals after the age of 65.