Unrealized gains are increases in the value of an asset that an investor has not yet sold. They are also known as paper gains because they only exist in theory and have not been converted into actual profits through a sale transaction. These gains are important in financial planning and investing as they represent potential profits, but they can fluctuate with market conditions and are not guaranteed until the asset is sold. The recording of unrealized gains depends on the type of security, whether they are held-for-trading, held-to-maturity, or available-for-sale. For example, for an equity security classified as trading, any unrealized gains or losses resulting from a change in fair value are recorded directly into the income statement. On the other hand, for available-for-sale securities, unrealized gains or losses are recorded in other comprehensive income (OCI), which is part of stockholders' equity on the balance sheet.

What You'll Learn

Unrealized gains are recorded on the balance sheet

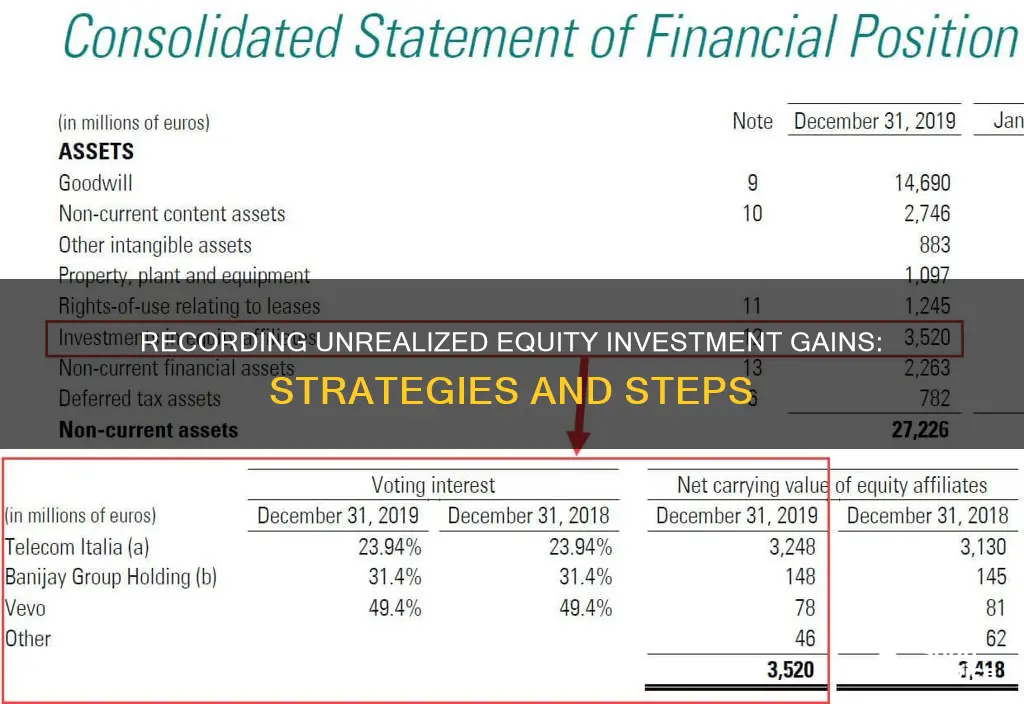

When an equity investment is made, the cost is recorded as an asset on the balance sheet. As the value of the investment changes, the difference between the original cost and the current market value is either an unrealized gain or loss. These fluctuations are recorded in OCI, which is a temporary holding account that is later closed out to the retained earnings statement.

The OCI section of the balance sheet includes items that are excluded from net income, such as unrealized gains and losses on available-for-sale securities. These are typically investments in debt or equity instruments that are not classified as held-to-maturity or trading securities. The OCI also includes foreign currency translation adjustments and gains/losses on derivative instruments used for hedging.

Recording unrealized gains in the OCI allows investors to see the overall performance of their investments, separate from the income generated by regular business operations. This distinction is important for financial statement users, providing a more comprehensive view of the company's financial health and stability.

It's important to note that the OCI is a transitional account. The accumulated balance is eventually transferred to the retained earnings statement when the investment is sold or at the end of each reporting period for any unrealized gains/losses. This process ensures that the OCI acts as a holding account, capturing interim changes in investment values for a more accurate financial position representation.

Waste Management: A Smart Investment for a Greener Future

You may want to see also

They are reflected in the equity section

When reflecting unrealised gains in the equity section of a balance sheet, several accounting practices and standards come into play. These will dictate the specific methods and locations for recording these gains. The equity section typically includes components such as common stock, preferred stock, revaluation surplus, and retained earnings.

Unrealised gains, or losses, on equity investments are often recorded in a separate component within equity. This is because these gains have not yet been realised, and so are treated differently from the company's own capital contributions and profits. The specific title of this component can vary, but it is often labelled as 'Other Comprehensive Income' or OCI. This section is used to report gains or losses that have yet to be recognised in the income statement.

The OCI section is important as it provides a more comprehensive view of the company's financial performance and health. By including these unrealised gains, stakeholders can see the potential future impact of these investments. It also ensures that the balance sheet remains accurate and compliant with accounting standards, such as GAAP or IFRS. These standards dictate that unrealised gains must be recorded and reported separately from realised gains and losses.

The equity section of the balance sheet is, therefore, a critical location for understanding a company's financial position. It reflects the company's share capital, retained profits, and the impact of any equity investments. The inclusion of unrealised gains in this section provides a more complete picture of the company's financial health and potential future gains or losses. This information is vital for investors and creditors when assessing the company's financial stability and prospects.

Maximizing Cash Savings: Best Investment Options for You

You may want to see also

Unrealized gains are recorded differently depending on the type of security

For securities classified as "trading", any unrealized gains or losses resulting from a change in fair value are recorded directly into the income statement. For example, if the fair value of a security on December 31, Year 1, was $100 and on December 31, Year 2, was $200, then an unrealized gain of $100 would be recorded in the income statement. It is important to note that the gain is only "realized" when the security is sold.

For "available-for-sale" securities, unrealized gains or losses are recorded in OCI (Other Comprehensive Income), which is part of stockholders' equity on the balance sheet. This assumes that the change in fair value is temporary.

Securities that are "held-to-maturity" are not recorded in financial statements. However, companies may choose to disclose information about them in the footnotes of their financial statements.

It is worth noting that unrealized gains and losses are often referred to as "paper" profits or losses since they are not actualized until the position is closed. These gains and losses can fluctuate with market conditions and do not guarantee a profit until the asset is sold.

Metal Investment Guide for Indians: Getting Started

You may want to see also

They are recorded periodically

Unrealized gains are recorded differently depending on the type of security. They are recorded periodically.

Securities that are held to maturity are not recorded in financial statements. However, the company may decide to include a disclosure about them in the footnotes of its financial statements.

Securities that are held for trading are recorded on the balance sheet at their fair value, and the unrealized gains and losses are recorded on the income statement. The increase or decrease in the fair value of held-for-trading securities impacts the company's net income and its earnings per share (EPS).

Securities that are available for sale are also recorded on a company's balance sheet as an asset at fair value. However, the unrealized gains and losses are recorded in comprehensive income on the balance sheet.

Unrealized gains and losses are also called "paper" profits or losses since the actual gain or loss is not determined until the position is closed. A position with an unrealized gain may eventually turn into a position with an unrealized loss as the market fluctuates and vice versa.

For example, if an investor purchased 100 shares of stock in ABC Company at $10 per share, and the value of the shares subsequently rises to $12 per share, but they refrain from selling, the unrealized gain on the shares still in their possession would be $200 ($2 per share x 100 shares). If the investor eventually sells the shares when the trading price rises to $14, they will record a realized gain of $400 ($4 per share x 100 shares).

Purchasing a Condominium: Saving or Investing?

You may want to see also

They are sometimes called paper gains

Unrealized gains are sometimes referred to as "paper gains" because they exist only on paper or in theory and have not been converted into actual profits through a sale transaction. They are the increase in the value of an asset that an investor has not yet sold.

For example, if an investor buys a stock for $100 and its market value rises to $150, they have an unrealized gain of $50. This gain remains unrealized until the stock is sold and the profit is locked in. Paper gains are temporary fluctuations in the values of investments and can be tracked for accounting and tax purposes. They are important in financial planning and investing as they represent potential profit, but they can fluctuate with market conditions and are not guaranteed until the asset is sold.

Unrealized gains are recorded on financial statements differently depending on the type of security. Securities that are held to maturity are not recorded in financial statements, but the company may include a disclosure about them in the footnotes of its financial statements. Securities that are held for trading are recorded on the balance sheet at their fair value, and the unrealized gains and losses are recorded on the income statement. The increase or decrease in the fair value of these securities impacts the company's net income and earnings per share (EPS). Securities that are available for sale are also recorded on a company's balance sheet as an asset at fair value, but the unrealized gains and losses are recorded in comprehensive income on the balance sheet.

Savings and Investments: Two Sides of the Same Coin

You may want to see also

Frequently asked questions

An unrealized gain is the increase in the value of an asset that an investor has not yet sold. It is also known as a "paper" gain.

Unrealized gains are recorded on the balance sheet. They are reflected in an investment account and charged to "Current Assets – Investments" or a similar equity category. The frequency of recording is up to the investor.

Unrealized gains are not taxed until the investment is sold and the gain is realized. Once the position is sold and a profit is made, the gain is taxed as a capital gain.

An unrealized gain is calculated by subtracting the original purchase price or book value from the current market value of an asset.