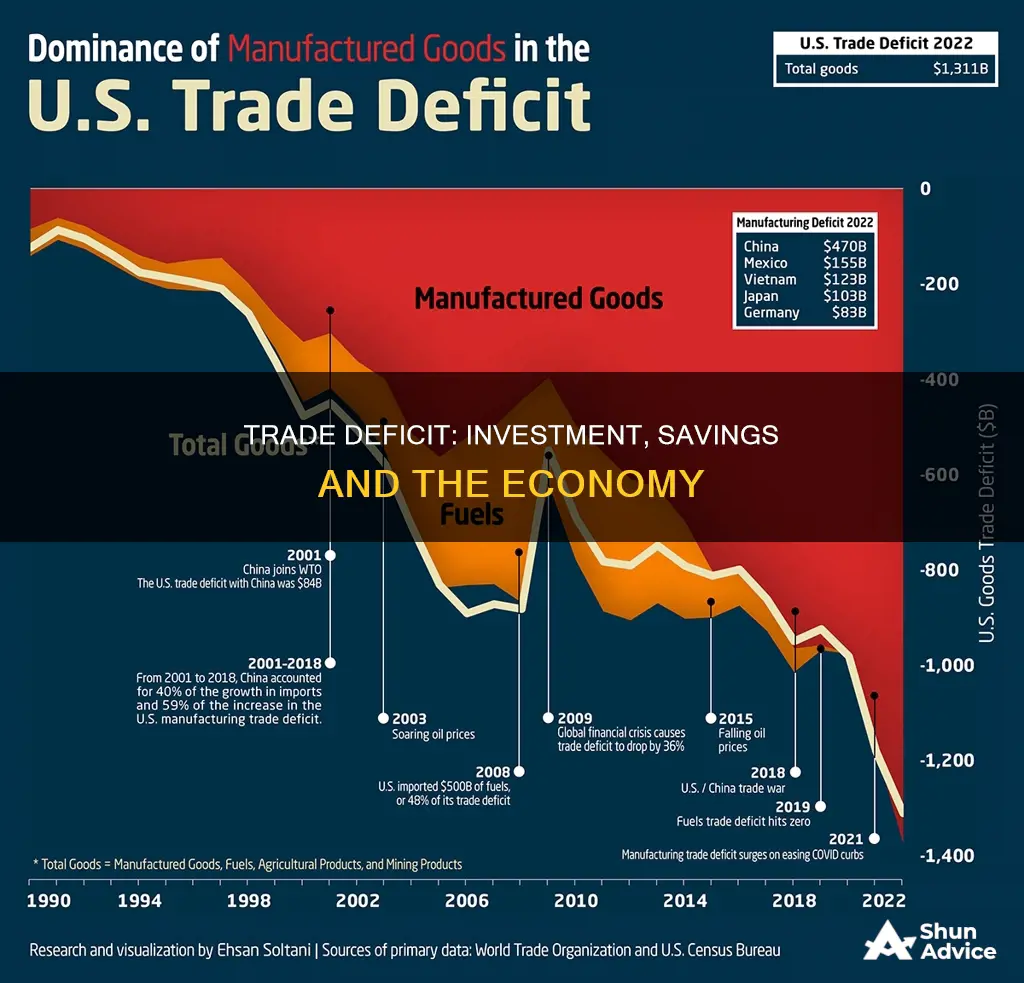

A trade deficit occurs when a country's imports exceed its exports. This can be caused by a range of factors, such as insufficient production of domestic goods and services, increased consumer purchasing power, or a strong economy. While a trade deficit can provide opportunities for domestic businesses and attract foreign investment, it can also lead to negative consequences in the long run, including job losses and decreased production.

The relationship between trade deficits and national savings is complex and subject to differing economic interpretations. Some economists argue that trade deficits are caused by low national savings rates relative to investment, resulting in a country consuming more than it produces. However, others disagree, stating that trade deficits are not inherently harmful and can be a result of various factors such as exchange rates, government spending, and income levels.

The impact of a trade deficit on investment and national savings depends on various factors, including the country's economic development, financial sector strength, and policy framework. While a trade deficit may provide opportunities for investment and growth, it is essential to consider the potential risks and long-term sustainability.

| Characteristics | Values |

|---|---|

| Trade deficit | Occurs when a country's imports exceed its exports |

| Trade deficit leads to investment exceeding national savings | A country's spending on imports is more than what it earns on exports. This shortfall is made up by borrowing from foreign lenders or allowing foreign investment in domestic assets. |

| Impact of trade deficit on investment and savings | A trade deficit can be beneficial in the short run as it indicates higher imports due to consumer consumption, which in turn brings down inflation. However, in the long run, it may not be beneficial as it can lead to a decrease in domestic production, job losses, and a further increase in imports, resulting in a vicious cycle. |

| Role of savings and investments | Savings refer to money left over after expenses, while investments are funds earmarked for conversion into capital. An increase in savings does not always lead to an increase in investments. During a trade deficit, capital generated by savings is crucial for economic growth. |

| Factors influencing trade deficit | Government spending, exchange rates, and economic growth can impact the trade deficit. |

What You'll Learn

Foreign capital inflows

When a country experiences a trade deficit, it indicates that domestic investment is higher than domestic savings. This implies that capital is flowing into the country from foreign sources to fund the additional investment. Foreign capital inflows can take the form of foreign lending or foreign investment in domestic assets and businesses.

The impact of foreign capital inflows on an economy is complex and depends on various factors. On the one hand, foreign capital inflows can be seen as a vote of confidence in the country's economy and can contribute to long-term economic growth if the capital is invested wisely. For example, in the 1800s, foreign investment in railroads and public infrastructure in the US helped its economic development.

On the other hand, there are risks associated with foreign capital inflows, particularly for smaller countries. If the foreign investment is not allocated efficiently, a sudden outflow of capital during an economic crisis can leave these countries vulnerable to global financial markets, as seen during the 1997-1998 Asian financial crisis.

The relationship between foreign capital inflows and domestic savings has been a subject of debate among economists. Some argue that there is a negative relationship between the two, while others suggest that the impact may be influenced by exogenous factors such as monetary and fiscal policies.

In summary, foreign capital inflows occur when a country's imports exceed its exports, leading to a trade deficit. This capital is then invested in the domestic market, potentially contributing to economic growth if managed effectively. However, it is essential to consider the risks and potential negative consequences of relying heavily on foreign capital inflows.

Savings-Investment Equilibrium: What's the Balancing Act?

You may want to see also

Foreign investment in domestic assets

Foreign direct investment (FDI) is a long-term, significant investment made by a foreign entity in a domestic company or asset. It often involves the transfer of technology, expertise, and management practices in addition to capital. FDI investors typically gain control over the foreign enterprise or have substantial influence over its decision-making. Examples of FDI include opening new operational facilities, acquiring foreign companies, or forming joint ventures.

Foreign portfolio investment (FPI), on the other hand, involves foreign investors buying financial assets such as stocks, bonds, or other securities in domestic companies. FPI is generally more liquid and shorter-term in nature, allowing for easier entry and exit. While FPI provides investors with diversification benefits, it is considered less favourable by the domestic country as the investment can be quickly sold off.

In the context of a trade deficit, foreign investment becomes crucial. A trade deficit occurs when a country's imports exceed its exports, resulting in a negative balance of trade. To make up for this shortfall, a country may need to borrow money from foreign lenders or allow foreign investment in domestic assets. Foreign investment can be seen as a vote of confidence in the country's economy and a source of long-term economic growth if the investment is used wisely.

Roth Accounts: Savings or Investment?

You may want to see also

National savings vs. national investments

The relationship between national savings, national investments, and trade deficits is complex and multifaceted. While some economists argue that a trade deficit occurs when a country's national savings are lower than its national investments, others suggest that it is caused by a variety of factors, including exchange rates, government spending, and income inequality. This article will explore the interplay between national savings, national investments, and trade deficits, highlighting the nuances and complexities of this economic relationship.

National Savings and National Investments

National savings refer to the money left over after accounting for expenses, while national investments refer to the money earmarked or intended for conversion into capital. In generic terms, savings are often interchangeable with investments. However, savings are risk-free, while investments are subject to a certain level of risk. According to the Keynes theory, an economy is in equilibrium when savings are equal to investments, and this balance is crucial for maintaining a healthy trade balance.

Trade Deficits and Their Causes

A trade deficit occurs when a country's imports exceed its exports, leading to a negative balance of trade. While a trade deficit can indicate a growing economy, it may not be beneficial in the long run. Various factors can contribute to a trade deficit, and economists disagree on the primary cause. Some argue that it is due to an imbalance between national savings and national investments, with low national savings leading to a trade deficit. However, others attribute it to factors such as exchange rates, government spending, and income inequality.

The Impact of National Savings and Investments on Trade Deficits

The relationship between national savings, national investments, and trade deficits is intricate. During a trade deficit, the balance between savings and investments becomes crucial. While a country with sufficient savings and investments can offset its deficit, this is not always the case. The dynamics of global trade and investment have evolved, and the old models that assumed a direct link between low national savings and trade deficits may no longer hold true.

In conclusion, the relationship between national savings, national investments, and trade deficits is complex and multifaceted. While a trade deficit can occur when national savings are lower than national investments, it is essential to consider other factors that influence this economic relationship. The dynamics of global trade and investment have evolved, and the interplay between these variables is not always straightforward. Therefore, a nuanced understanding of the underlying conditions and assumptions is necessary to grasp the full picture of how national savings and investments impact trade deficits.

Retirement Investments: Best Places for Your Savings

You may want to see also

The role of exchange rates

A country's exchange rate is a critical factor in its economic health and a key determinant of its trade balance. Exchange rates are relative values between two currencies, such as the US dollar and the British pound. They are influenced by several factors, including inflation rates, interest rates, and current account deficits.

A country with a trade deficit, where imports exceed exports, will experience reduced demand for its currency, leading to depreciation or loss of value. This occurs because the country needs to buy more foreign currency to pay for its imports, increasing the supply of its own currency in foreign exchange markets. Conversely, a country with a trade surplus, where exports exceed imports, will see increased demand and appreciation of its currency.

The exchange rate also impacts a country's trade balance. A higher exchange rate makes a country's imports cheaper and its exports more expensive, potentially worsening the trade deficit. Conversely, a lower exchange rate can improve the trade balance by making exports more competitive and reducing import costs.

Additionally, a country's exchange rate can affect foreign investment. A weaker currency may attract foreign investors as it makes the country's assets cheaper to buy. However, a weaker currency can also be a sign of economic instability, reducing investor confidence.

In summary, exchange rates play a crucial role in a country's trade balance and economic health. They are influenced by various factors and can impact demand for a country's currency, its trade balance, and foreign investment.

Savings Investment Strategies: Accessibility and Growth

You may want to see also

The impact on employment

The impact of trade deficits on employment is a complex issue that has sparked debate among economists. While some argue that trade deficits negatively affect employment, others highlight the potential for job growth in certain sectors.

The traditional view holds that a trade deficit, occurring when a country's imports exceed its exports, can hurt job creation in the deficit-running country. This perspective suggests that an increase in imports leads to a decline in domestic production, resulting in job losses for employees in manufacturing and other sectors. This argument has been particularly prominent in the context of the United States' trade relationship with China, with some attributing the loss of millions of American jobs to the surge in Chinese imports.

However, this simplistic understanding of trade deficits overlooks the dynamic nature of economies and the potential for job creation in other sectors. Economists who challenge the traditional view argue that trade deficits do not always lead to a net loss of jobs. They contend that while certain sectors may experience job losses, there can be offsetting job growth in other areas. This perspective recognises the complex interplay of various economic factors and acknowledges that trade deficits are not inherently detrimental.

The impact of trade deficits on employment is further nuanced by the relationship between savings, investment, and trade. Some economists argue that trade deficits are driven by a country's low savings rate relative to its investment rate. In this context, they suggest that policies aimed at increasing national savings can help reduce trade deficits and positively influence employment. However, critics refute this notion, claiming that such policies may not always yield the desired results. They argue that in a world characterised by excess savings, there might not be sufficient investment opportunities to absorb additional savings productively. Consequently, policies aimed at increasing savings could potentially lead to higher unemployment or increased household debt.

Moreover, the impact of trade deficits on employment is influenced by various factors, including exchange rates, government spending, economic growth, and the structure of the economy. A stronger domestic currency, for instance, can make exports more expensive for foreign buyers, potentially impacting employment in export-oriented sectors. Additionally, government spending and economic growth can affect the trade balance and, consequently, employment levels.

In conclusion, the relationship between trade deficits and employment is intricate and subject to varying interpretations. While some economists emphasise the negative impact on employment, particularly in specific sectors, others highlight the potential for job creation in different areas. The interplay of savings, investment, and trade further complicates this dynamic, and policies aimed at addressing trade deficits may have unintended consequences on employment. Ultimately, the impact of trade deficits on employment is context-specific and influenced by a multitude of economic factors.

The TSP: Where Your Money Is Invested

You may want to see also

Frequently asked questions

A trade deficit occurs when a country's imports exceed its exports. In other words, a trade deficit happens when a country buys more goods and services than it sells.

A trade deficit can be caused by a country's low national savings relative to investment. This is because a trade deficit can be viewed as the difference between national savings and investment.

The impact of a trade deficit on a country's economy is debated among economists. Some argue that it can lead to job losses and hurt economic growth, while others claim that it can attract foreign investment and lead to stronger economic growth in the future.

A country can address a trade deficit by increasing national savings, reducing investment, or a combination of both. However, it is important to note that protectionist policies may not be effective in improving the trade balance as they do not directly impact savings or investment.

A trade deficit can lead to an increase in foreign debt and a country's vulnerability to changes in foreign investment flows. If a country is unable to secure financing for its trade deficit, it may experience a sharp reversal, requiring abrupt adjustments in consumption, investment, and government spending.